Author: 0xWeilan.eth, EMC Labs Source: @0xweilan

Which parts of the market are changing, which parts have not changed, which new factors have been added to affect market trends, and which existing factors still play a huge role... This is what investors who are trying to explore market trends and industry cycles need to know.

*The information, opinions and judgments on the market, projects, currencies, etc. mentioned in this report are for reference only and do not constitute any investment advice.

When the United States and Hong Kong approved BTC ETFs one after another, and we cheered for the integration of DeFi and TradFI, we had not yet realized the profound changes in the structure of the Crypto market.

Which parts of the market are changing, which parts have not changed, which new factors have been added to affect market trends, and which existing factors still play a huge role... This is what investors who are trying to explore market trends and industrial cycles need to understand.

In April, policy expectations were re-changed, and global financial markets fluctuated violently.

Macro Finance

For BTC with a market value of more than 1.2 trillion US dollars, its strong correlation with the Nasdaq trend has been widely known as the market value has expanded and the participating groups have changed, which makes macroeconomics, financial data and global central bank policies the most important factors affecting BTC price trends in many cases. April is the month when these data took over BTC trends.

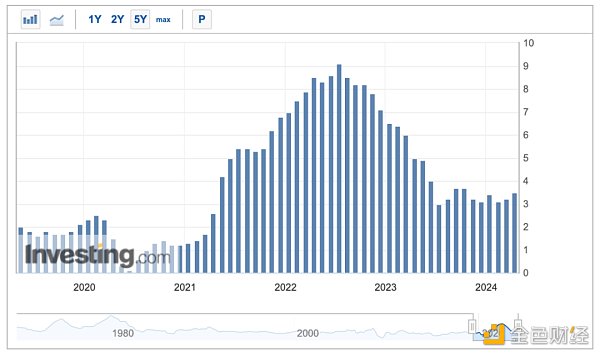

The US CPI data for March released in April was as high as 3.5%, exceeding 3.2% in February. The unexpected rebound of CPI has caused the market's expectations for the US interest rate cut in the first half of the year to fall to the freezing point. The market has previously paid much attention to the pressure on US government bond interest rates under a high interest rate environment. However, in the context of the Fed's current core task - to reduce CPI to below 2%, which is hopeless to achieve, no one doubts that the interest rate cut will be delayed again. There are even voices that believe that there is no hope for an interest rate cut this year, and there may be another interest rate hike - this is not impossible. If the CPI rebounds sharply, what else can the United States do besides raising interest rates?

The US CPI index rebounded for two consecutive months

At the same time, the Fed's balance sheet reduction plan is still being implemented firmly.

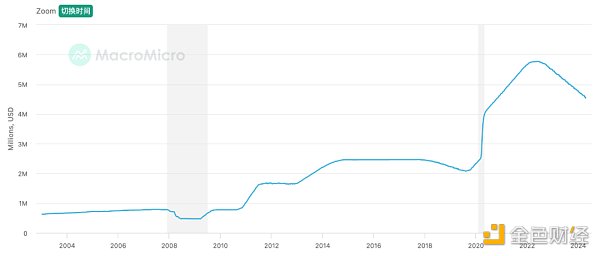

The scale of US debt held by the Federal Reserve

Since the launch of the balance sheet reduction operation in 2022, the Federal Reserve has sold more than $1.2 trillion in US debt. This is another powerful pump under the background of high interest rates. This pump removes up to $95 billion in liquidity from the market every month (60 billion in U.S. Treasury bonds and up to $35 billion in institutional bonds).

The pessimistic expectations and changes in response strategies caused by the above two points have pushed the U.S. dollar index to continue to strengthen, and ended the five-day winning streak of the Nasdaq and the Dow Jones this month. After hitting record highs in March, the two indexes fell by 4.41% and 5.00% respectively this month.

Correspondingly, BTC, which completed its production cut this month, also ended its seven-day winning streak, falling by $10,666.80 per month, a drop of 14.96%. After breaking the rising channel in March, the effort to build a shock box in April seems to have failed.

The storm is about to rise, and the tide seems to be turning?

Crypto Market

In April, BTC opened at US$71,291.50 and closed at US$60,622.91, down 14.96% for the month, with an amplitude of 19.27%, ending the consecutive rise in July. With the shrinking trading volume, it ushered in the largest single-month decline since January 2023 (that is, since the recovery period of this round of bull market).

BTC Monthly Trend

After the big sell-off in March, the buying power of BTC suffered a major setback and has been weak since then. In April, it has been running below the 7-day average price for most of the time since mid-to-late April, and hit an adjustment low of $59,573.32 on April 19.

BTC daily trend

Since February, BTC has established a bull market price rising channel in the daily dimension (the green background part in the above figure). After setting a record high price on March 13, it started to detect the lower track of the rising channel. Then, throughout April, it tried to establish an oscillation box between US$59,000 and US$73,000 (the purple background part in the above figure). With the shift in macro-financial expectations and the break of the US stock index, the action of building an oscillation box is difficult.

Sell and hold

In the March report, we mentioned that "December 3, 2023 was the highest point in the history of long-term holdings, when long-term holdings held a total of 14,916,832 BTC. Since then, with the gradual start of the bull market, long-term holdings have begun a four-year cyclical sell-off, with a total of 897,543 BTC sold as of March 31".

The biggest positive for the BTC narrative in January - the fulfillment of the approval of 11 spot ETFs, caused long-term holdings to sell at a record high, resulting in short-term saturation and cooling of enthusiasm for new short-term positions.

This behavior is a response to the phased rise of BTC, and it is also the reason why the price of BTC stopped rising in March and entered a period of continuous fluctuations. After entering April, the trend of "from long to short" in the bull market stage within the market was suspended.

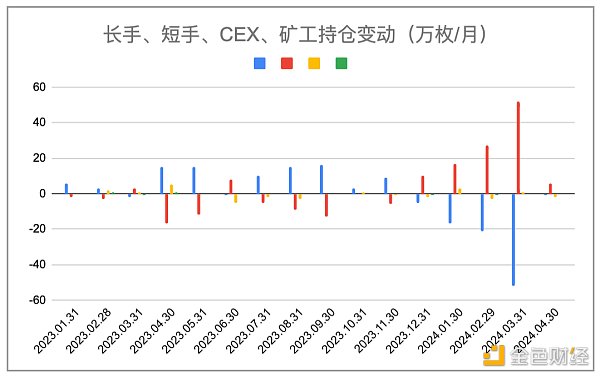

Changes in BTC positions of various parties in the market (monthly)

According to statistics, the selling volume of long hands in April decreased to 10,000 pieces (the selling volume in March was as high as 520,000 pieces). During the price decline, short hands increased their positions this month, not only swallowing the selling of long hands, but also withdrawing tens of thousands of pieces from the balance of centralized exchanges.

With the completion of BTC production cuts this month, the miner group still maintains the state of "holding coins without moving" (the overall position does not move, which means that the scale of market selling is approximately equal to the output). Although the downward price is approaching the cost price of some miners, a large sell-off has not occurred, and miners still hold about 1.81 million BTC stably.

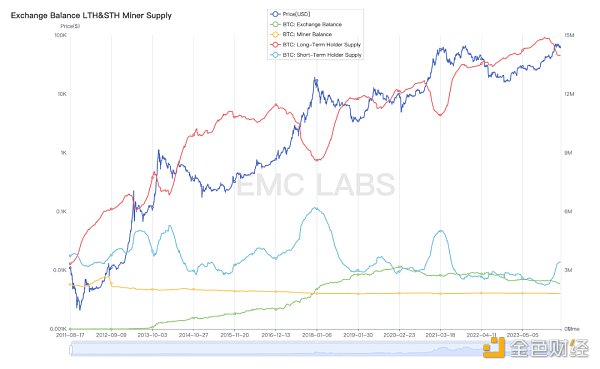

From the statistical chart of the holding scale of each party, we can clearly see the pause of the trend of "from long to short".

BTC holding scale

Looking at the data changes of the holdings of each party for 11 years, it can be found that the phenomenon of long-handed selling being suspended in the middle of the bull market in mid-2016 also occurred. This often means that with the sharp drop in prices, the long-handed group who believes that the bull market will continue chooses to stop, and restarts selling after the market restores the supply and demand balance and continues to rise.

The pessimistic expectations and changes in response strategies caused by the above two points have pushed the US dollar index to continue to strengthen, and ended the five consecutive rises of the Nasdaq and the Dow Jones Index this month. After hitting record highs in March, the two indexes fell by 4.41% and 5.00% respectively this month.

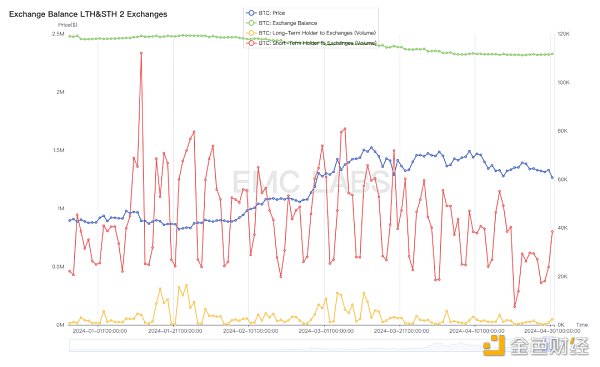

Long-short hand selling scale and CEX accumulation statistics (daily)

From the data of long-short hands transferring BTC to exchanges, the transfer scale in April continued to decline compared with March, and the stock of centralized exchanges did not change much and there was a small outflow.

Capital Flow

Capital is an important factor in determining market trends. After observing the internal structure of the market, we continue to examine the inflow and outflow of funds.

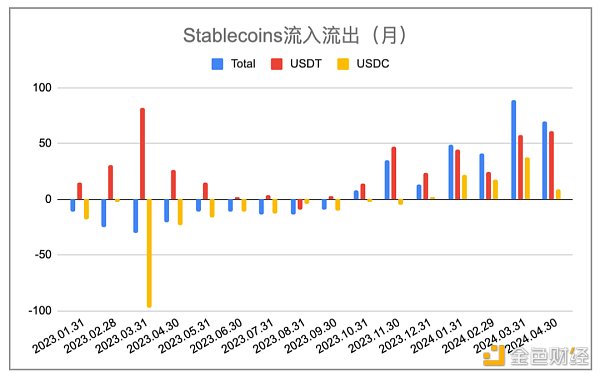

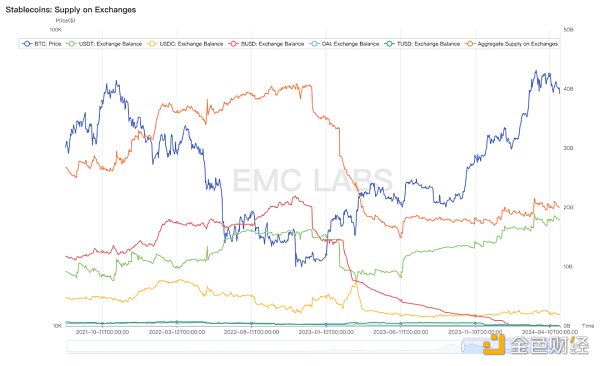

Changes in the Supply of Major Stablecoins (EMC Labs Chart)

Insighting into the stablecoin issuance data, EMC Labs found that the funds entering the market with the help of stablecoins in April reached 7 billion US dollars, including 6.1 billion USDT and 900 million USDC. According to eMerge Engine, BTC will enter the repair phase of this cycle in 2023, and then achieve net inflow for the first time in October. Since then, stablecoins have been in a state of additional issuance, and ranked second with an inflow of US$7 billion in April.

Main stablecoin issuance scale

As of April 30, the total issuance scale of stablecoins has increased to about 149.9 billion, an increase of about US$30 billion since the low point, and has not yet reached the peak of the previous cycle.

Furthermore, the stablecoin stocks of centralized exchanges are relatively maintained at a high level. However, these funds do not seem to be in a hurry to convert into purchasing power. It is worth noting that the main stablecoin newly accumulated in centralized exchanges is USDT, while USDC used in the US has basically no new accumulation.

On the BTC ETF channel side, the capital inflow and outflow showed a relatively obvious feature of chasing up and selling down. Since the price stopped rising in mid-March, it has continued to flow out.

11 BTC ETF inflow and outflow statistics (SosoValue chart)

Based on its fund characteristics and volume, we believe that the funds in the BTC ETF channel are neither the main reason for the decline in BTC prices, nor can they independently assume the responsibility of reversing the situation.

Supply pressure and cycle

All things prosper and decline, and the cycle continues.

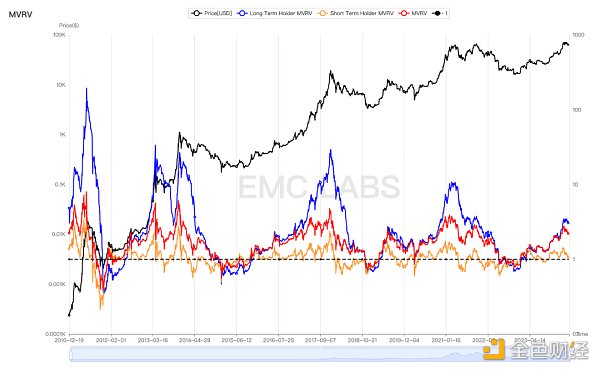

Long-short hand and the floating profit and loss ratio of the whole market

The bull market is always accompanied by drastic adjustments. This adjustment objectively plays the role of clearing floating chips.

An indicator worth paying attention to is the short-hand MVRV (floating profit and loss ratio). During the repair period and the rising period, with the rise in prices, the floating profits of the holders are increasing. At this time, the market needs to use the decline to clear the short-hand chips that have just boarded the train and the long-hand chips with sufficient profits. In history, this kind of clearing often requires the price to fall to the position where the MVRV value of the short-hand group is close to 1 before it can stop. Since last year, this kind of clearing has occurred twice, in June and August to October last year. In January, it fell to a minimum of 1.03. As of April 30, this cleanup had reached 1.02 (on May 1, MVRV fell to 0.98). It is worth noting that historically, after experiencing such severe tests, BTC prices often see a sharp rise.

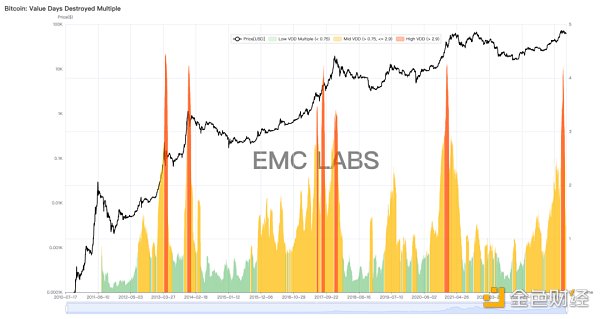

Another terrible guess is that this cycle is a front-runner, with a new high before the production cut, and the current bull market has passed the top. One of the evidences is the VDD destruction indicator.

BTC VDD destruction data

The VDD destruction indicator not only takes into account the realization of value, but also the holding factors of long and short hands in the realized value, so it has great reference value.

The peak speculation is closer to the last bull market (2021). Another speculation based on this data is that the bull market is halfway through, and if there is another large-scale VDD destruction (similar to 2013) or two (similar to 2017), the bull market will end.

A major interference factor in this round of VDD data is the redemption of Crayscale Trust holdings after conversion to GBTC. This interference data can also affect the judgment of the scale of long-term selling.

Conclusion

Combining the multi-dimensional judgment of fundamentals, capital, policy, market cycle and industrial cycle, EMC Labs believes that the decline of BTC in April is the result of the weak balance between buyers and sellers after its price surged in July and some investors sold off heavily. New entrants chose to wait and see cautiously, while traders who traded based on macro-financial data and technical indicators dominated the market. The adjustment range is comparable to the scale of the correction in the previous bull market.

From the inflow scale of stablecoins (the second highest since last year), the market's enthusiasm for long positions has not been extinguished. The current adjustment is due to the fact that macro-financial and economic data exceeded expectations, causing entrants to hold coins and wait and see. As such, macro-financial data, especially the Fed's statement on interest rate cuts and changes in core economic data such as non-agricultural employment, will dominate the attitude of funds in the market for some time to come, and thus determine the price trend of BTC.

At present, the activity on the Bitcoin chain has declined significantly and has fallen close to the bear market level. User activity has shifted to Solana and Etherum, making the user data of these two networks still in an upward state. What is worrying is that the market currently expects that the interest rate cut has been postponed to after September. So in the next four months, what information will the funds and short positions on the market use to make trading decisions? The current balance is very fragile, and the decisions of the two will break the balance and push the market up or down violently.

BTC price trend after each reduction

If it is upward, it is likely to start the second stage of the bull market and usher in the AltCoin Season.

If it goes down, the confidence of the coin holders will collapse, and then a series of stampedes will occur. The AltCoin that has been cut in half may break again.

This is the worst development direction with a very low probability.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Weiliang

Weiliang Bitcoinworld

Bitcoinworld Bitcoinworld

Bitcoinworld Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph