Author: Kogmo; Source: Running Finance

On Tuesday, Bitcoin hit a new high and the price rose Reaching an all-time high of $73,000.

In the news, the British Financial Conduct Authority (FCA) publicly stated that it will allow recognized investment exchanges to launch cryptocurrency-backed ETNs. The London Stock Exchange also announced on the same day that it will begin accepting applications for Bitcoin and Ethereum ETNs in the second quarter of this year, and the specific opening date will be announced "in due course."

Behind this major move, is it further innovative exploration of the traditional financial market as investors' demand for digital assets increases, or is it the search for new channels for cryptocurrency investment under supervision?

What is ETN?

ETN (Exchange Traded Note ), which refers to exchange-traded notes, is an unsecured bond financial product and is essentially a means of debt financing. Generally speaking, the issuing institution borrows debt from investors to raise funds, and repays investors a certain amount to the holders when the bond expires. The maturity date is usually more than 10 years. Different from ordinary bonds, investors hold a commitment to redeem funds according to the rise and fall of the investment target price index within a period of time. The income is based on this minus the necessary management fees, and no interest is paid during the duration.

The world's first ETN was BOXES issued by Morgan Stanley in March 2002, and its investment target was the trend of a biotechnology index. Taking BOXES as an example, set its face value to US$10,000 and the bond period to 30 years (that is, Morgan Stanley needs to pay bondholders exactly the same remuneration as the biotechnology index after 30 years). Thirty years later, if the biotechnology index has risen by 310%, Morgan Stanley will need to pay investors $41,000 (before management fees are deducted).

ETN’s investment targets are usually indices with higher investment thresholds, such as commodity indexes, exchange rate indexes, volatility indexes, etc.

From the perspective of financial products, ETN provides investors with more diverse investment options, and they are some products that are difficult to access. From a risk perspective, since ETN is a financial product guaranteed by the issuer and is not supported by other assets, investors may face certain risk exposure. Therefore, regulatory authorities usually set certain thresholds for ETN issuers.

The difference between ETN and ETF

Impact on the crypto world

Bitcoin ETN is not a brand new cryptocurrency derivative.

As early as 2015, Bitcoin ETN had been approved for listing by Swiss regulators. In 2018, when there was no hope of approval of a Bitcoin ETF, a Bitcoin ETN named Bitcoin Tracker One was listed on the US market. For the first time, U.S. dollar holders can invest in Bitcoin without owning it.

However, due to differences in the characteristics of financial products. Bitcoin ETN is more regarded by investors as a "soft substitute" for Bitcoin ETF and has not exerted great traction on the market. Now that the Bitcoin ETF has been approved, it may be more difficult for new Bitcoin ETN products to trigger new market narratives.

From the perspective of product features. For the crypto world, although ETN provides new options for investors who are unable to directly purchase cryptocurrency assets, its essence does not involve holding related assets. It only allows users to participate in investments by tracking price trends, and cannot be used as ETFs generally attract capital inflows without affecting supply and demand. For Ethereum ETN products, although regulatory agencies have delayed the approval time and the market's investment demand for cryptocurrency products is also increasing day by day, since the Ethereum ETF itself is already in the state of being ready and market expectations have been piling up for a long time, Ethereum ETN products may be It will not trigger strong market sentiment, only some expectations.

Looking at the essence through the phenomenon, the price of cryptocurrency itself fluctuates frequently, which is more consistent with the market size and liquidity of ETFs. ETNs are small in size and lack market appeal, and investors will face dual risks from the market and the issuer.

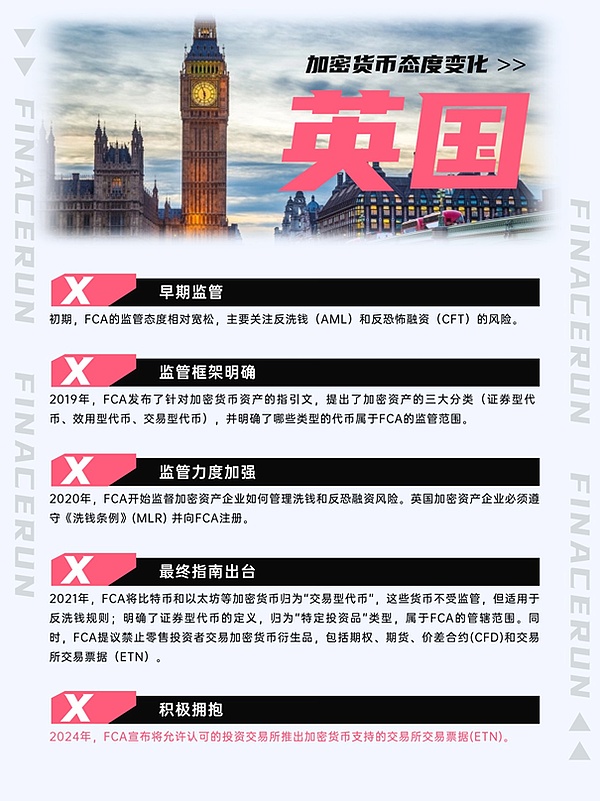

From a regulatory perspective, the British financial regulator allows recognized investment exchanges to launch cryptocurrency ETNs, which is a big step forward for the regulation of the British cryptocurrency field. After the EU passed the MiCA (Markets in Crypto Assets Regulation bill) regulations, the UK has been working to incorporate cryptocurrencies into its existing regulatory framework. In April 2022, the British government released a vision to build the UK into a global center for cryptocurrency investment and promised to create suitable conditions for the development of the crypto world. However, the implementation of this goal is difficult and requires active exploration of how to strike a balance between financial innovation and supervision.

As one of the world’s financial centres, the UK faces challenges posed by the decentralization, anonymity and cross-border nature of cryptocurrencies, which pose challenges to traditional The financial system has a disruptive effect. In this case, ETN, as an innovative form of cryptocurrency financial products, can provide practical case reference for the construction of complete regulatory measures. At the same time, ETN will not directly affect the encryption market, thereby avoiding the risk of causing major shocks.

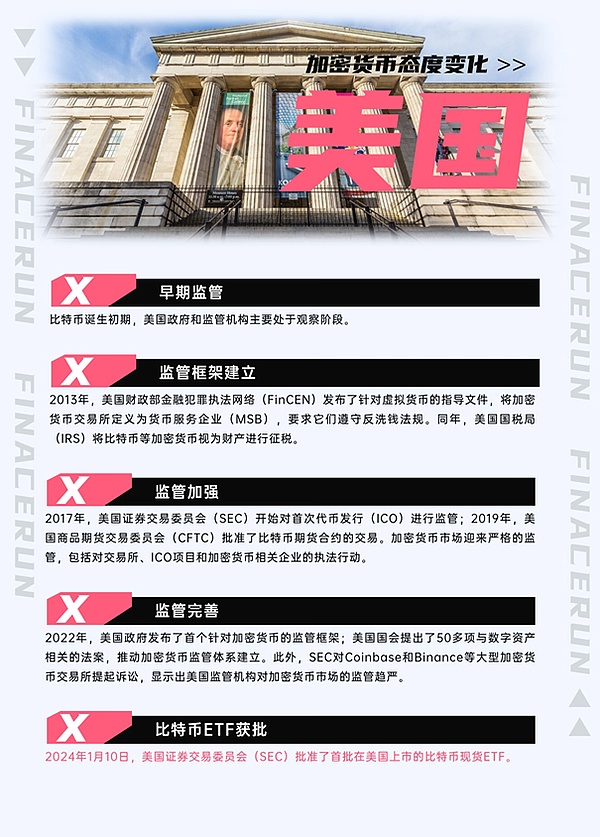

The regulatory environment has a crucial impact on the development of the maturing cryptocurrency market. From a global perspective, countries around the world have different attitudes towards cryptocurrencies, but it is not difficult to find that in recent years, the attitudes of various countries and regions towards cryptocurrencies are gradually turning positive.

After the Bitcoin ETF was approved in the United States, the mainstream financial market’s recognition of cryptocurrencies such as Bitcoin has further increased, and the global The regulatory attitudes of other countries must also have an impact. This time the British Financial Conduct Authority (FCA) allowed the launch of cryptocurrency-backed ETNs, once again releasing a positive signal for the overall upward development of the global crypto world.

The future of the encryption market is not only about high prices, but also requires progress in regulatory policies. It is believed that through the experience of ETN financial innovative products, the UK is expected to achieve further development in the field of cryptocurrency, thereby driving the continued development of the global crypto world.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Sanya

Sanya Alex

Alex JinseFinance

JinseFinance Nell

Nell Bitcoinist

Bitcoinist