Author: Riyue Xiaochu Source: medium

One boring afternoon, your friend Goudan suddenly sent a message: XXX, hurry up. Nakamoto returned to the arena to create MeMe, Musk, CZ, Trump, and XJP have become the four major protectors in cx, starting from 10,000 times.

So, you skillfully opened uniswap, entered ca, and after countless failures, you finally bought at the highest point. Then you opened your circle of friends and saw Goudan thanking the blockchain for 1 million US dollars in half an hour.

You finally couldn't help asking: Mr. Wang, how did you buy it? He gave you five English passwords: TG Bot.

After Binance launched Banana, the TG Bot track attracted attention from funds again. It not only has the added layer of TG concept, but also has super strong money-making ability and a large number of real users. In the current anti-concept and anti-VC era, it seems that people will look up to it. Today I will analyze the current situation of the TG Bot track from a data perspective.

1 Advantages of TG Bot

1) Fast transaction. Especially when the on-chain transaction is hot, the native dex will be more stuck. TG Bot can trade very quickly. Those who have participated in the Solana Dog Season in the past few months should have a deep understanding of this.

2) Prevent MEV clamps. In this way, you don't need to set too high slippage to realize transactions. TG Bot basically charges a 1% handling fee, and the slippage saved can exceed the handling fee.

3) Fast trading. This is mainly suitable for people who rush in at the first opening.

4) Simple to use. TG Bot can be used directly on TG, without going to another website.

2 BOT track transaction volume and users

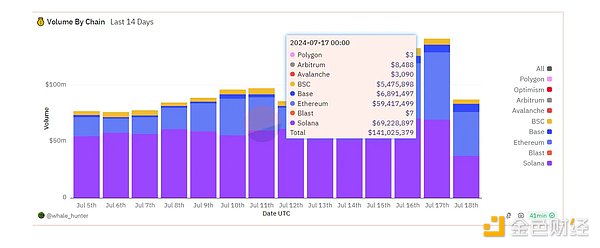

From the transaction volume, TG BOT's daily transaction volume is 140 million US dollars. Mainly from two public chains, Solana 69M, Eth 59M. Followed by BSC and Base, the daily transaction volume is basically 1/10 of the first two. At the same time, we found that some Layer2s are not on the list.

In terms of the number of users, Solana has 150,000 daily users, Ethereum has 37,000 users, and Base has 12,000 users. It can be clearly seen that the average transaction amount per user of Solana is relatively small at $460, while the average transaction amount per user on Ethereum is $1,594, which is three times that of Solana. The average transaction amount per user of Base is $574, which is basically the same as Solana.

In terms of future potential, at the same time, the total transaction volume of ETH is $1.6 billion, and Bot transactions account for 3.6%. Solana's daily transaction volume is $1.75 billion, and Bot transactions account for 3.9%.

In terms of the number of users, at the same time, Ethereum has 364,000 active users, Bot accounts for 10.1%, and Solana has 1.8 million active users, and Bot accounts for 8.3%. Base has 718,000 active users, and Bot accounts for 1.6%.

From various data, TG Bot still has a lot of room for growth, and in the future, it can also add to the growth of bull market trading volume and active users. From the perspective of public chains, Solana and Base account for a smaller proportion, indicating that there is more room for growth.

3 Main members of the track

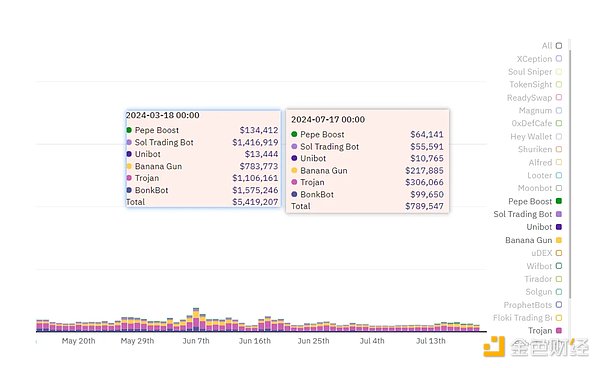

According to the dune statistics of whale_hunter, the main rankings of TG Bot based on historical cumulative trading volume are BonkBot, Maestro, Banana Gun, Trojan, Sol Trading Bot, Sigma, Unibot, Shuriken, PePe Boost, and ReadySwap.

From the perspective of the time of protocol launch, Maestro, Banana Gun and Unibot support Ethereum. They all have more than one year. In addition to these three, BonkBot, Trojan, and Sol Trading Bot were launched earlier than the previous ones, but they all have one feature, which is that they only support the Solana chain. This shows that these three bots later caught up with the latecomers through the Solana chain, and BonkBot achieved overtaking, which is also directly related to Solana's MeMe explosion this year.

At the same time, we also noticed Trojan, which is a TG bot made by the Unibot team. It has been online for only 200 days, and its cumulative trading volume has ranked fourth. And the trading volume in 7 days has ranked first.

4 Bot's income

From the perspective of protocol income, the top TGbots can be said to be making a fortune every day. Taking July 17 as an example, Trojan had the highest income, with a profit of 300,000 US dollars, followed by Banana Gun with a daily income of 210,000 US dollars, and BonkBot unibot and others with a daily income of 50,000 US dollars. The income of bots is also closely related to the overall market. Now is a cold time for trading. When on-chain trading was hot, for example, on March 18, SolTradingBot, Trojan, and BonkBot all had daily incomes of more than 1 million US dollars, and Banana Gun's daily income was as high as 780,000 US dollars. The daily income of the top protocols was as high as 5.41 million US dollars.

In contrast, the highest protocol fee of Uniswap in March was 6 to 8 million US dollars. But this is the fee, most of which is distributed to LP liquidity providers. Because LP providers have the risk of impermanent loss, this part cannot be counted as the income of the protocol. Only in some of the protocol switches that are turned on, 10% to 25% of the fee will be allocated to the Uniswap protocol itself. So the actual income of TG Bot may exceed that of Uniswap.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  dailyhodl

dailyhodl Coindesk

Coindesk Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph