Author: DFG Official Source: medium Translation: Shan Ouba, Golden Finance

What is DeFAI

Decentralized Finance (DeFi) has been a core pillar of the crypto ecosystem since its rapid expansion in 2020. While many new innovative protocols have been established, it has also led to increased complexity and fragmentation, making it difficult for even experienced users to navigate the large number of chains, assets, and protocols.

At the same time, artificial intelligence (AI) has evolved from a broad, foundational narrative in 2023 to a more specialized, agent-oriented focus in 2024. This shift has given rise to DeFi AI (DeFAI) - an emerging field in which AI enhances DeFi through automation, risk management, and capital optimization.

DeFAI spans multiple layers. Blockchain is the base layer, as AI agents must interact with a specific chain to perform transactions and execute smart contracts. On top of this, the data and compute layers provide the infrastructure needed to train AI models derived from historical price data, market sentiment, and on-chain analytics. The privacy and verifiability layers ensure that sensitive financial data remains secure while maintaining trustless execution. Finally, the agent framework allows developers to build specialized AI-driven applications such as autonomous trading bots, credit risk assessors, and on-chain governance optimizers. While this ecosystem map could be expanded upon, these are the top-level categories for projects built on DeFAI.

As the DeFAI ecosystem continues to expand, the most prominent projects can be divided into three main categories:

1. Abstraction layer

Protocols built on this category act as a ChatGPT-like user-friendly interface for DeFi, allowing users to enter prompts for on-chain execution. They typically integrate with multiple chains and dApps and execute user intent while eliminating manual steps in complex transactions.

Some of the functions these protocols can perform include:

Swapping, bridging, lending/withdrawing, executing trades across chains

Copy trading wallets or Twitter/X profiles

Automatically execute trades such as take profit/stop loss based on position size percentage

For example, instead of manually withdrawing ETH from Aave, bridging it to Solana, swapping SOL/Fartcoin, and providing liquidity on Raydium — the abstraction layer protocol can do it in a single step.

Main protocols:

@griffaindotcom — A network of agents that execute trades for users

@HeyAnonai — A protocol that handles user alerts for DeFi trades and real-time insights

@orbitcryptoai — An AI companion for DeFi interactions

2. Autonomous Trading Agents

Unlike traditional trading bots that follow preset rules, autonomous trading agents can learn and adapt to market conditions and adjust their strategies based on new information. These agents can: Analyze data to continuously improve strategies Predict market movements to make better long/short decisions Execute complex DeFi strategies such as fundamental trading Major protocols: @Almanak__ — A platform for training, optimizing, and deploying autonomous financial agents @Cod3xOrg — Launching AI agents that perform financial tasks on the blockchain @Spectral_Labs — Create a network of autonomous on-chain transaction agents

3. AI-driven DApps

DeFi dApps provide functions such as lending, exchange, and yield farming. AI and AI agents can enhance these services by: Optimizing liquidity provision by rebalancing LP positions to get better APY Scanning tokens for risk by detecting potential rugs or honeypots Major protocols: @gizatechxyz’s ARMA — AI agent for optimizing USDC yield in Mode and Base @SturdyFinance — AI-powered yield vault @derivexyz — Optimized options and perps using a smart AI co-pilot Platforms

Main Challenges

Top protocols built on these layers face several challenges:

These protocols rely on real-time data feeds to achieve optimal trade execution. Poor data quality can lead to inefficient routing, failed trades, or unprofitable trades

AI models rely on historical data, but the cryptocurrency market is highly volatile. Agents must be trained on diverse, high-quality datasets to remain effective

A comprehensive understanding of asset correlations, liquidity changes, and market sentiment is required to understand the overall market situation

Protocols based on these categories have been well received by the market. However, in order to provide better products and optimal results, they should consider integrating a variety of datasets of varying quality to take their products to the next level.

Data Layer - Powering DeFAI Intelligence

AI is only as good as the data it relies on. In order for AI agents to work effectively in DeFAI, they require real-time, structured, and verifiable data. For example, the abstraction layer needs to access on-chain data through RPC and social network APIs, while trading and yield optimization agents require data to further refine their trading strategies and reallocate resources.

High-quality datasets enable agents to better perform predictive analysis on future price behavior, providing trade recommendations to suit their preference for long or short positions on certain assets.

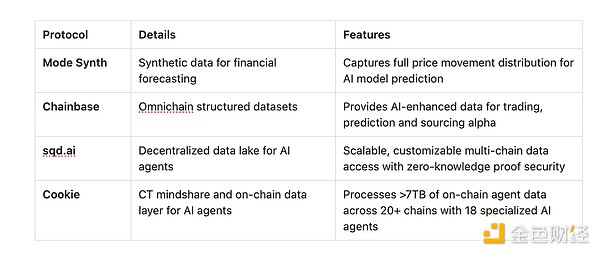

The main data provider of DeFAI

Pattern Synthesis Subnet

As Bittensor The 50th subnetwork of , Synth creates synthetic data for agents’ financial prediction capabilities. Compared to other traditional price prediction systems, Synth captures the full distribution of price movements and their associated probabilities, building the world’s most accurate synthetic data to power agents and LLMs.

Providing more high-quality datasets can enable AI agents to make better directional decisions in trading, while predicting APY fluctuations under different market conditions so that liquidity pools can reallocate or extract liquidity when needed. Since the mainnet launch, DeFi teams have been strongly requesting to integrate Synth’s data through their API.

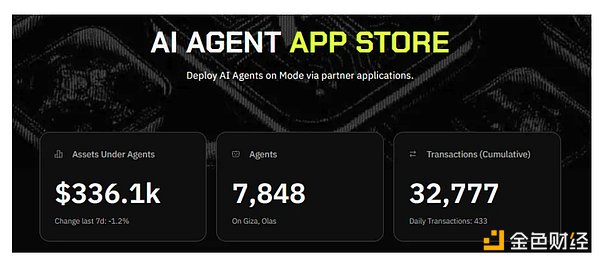

Most Watched AI Agent Blockchain

In addition to building a data layer for AI and agents, Mode is also positioning itself as the blockchain to build a full stack for the future of DeFAI. They recently deployed Mode Terminal, DeFAI’s co-pilot for executing on-chain transactions via user prompts, which will soon be open to $MODE stakers.

In addition, Mode also supports many AI- and agent-based teams. Mode has made great efforts to integrate protocols such as Autonolas, Giza, Sturdy into its ecosystem, and Mode has grown rapidly as more agents are developed and execute transactions.

These initiatives are all achieved at the same time as they upgrade the network with artificial intelligence, most notably equipping their blockchain with an AI-secured sorter. By using simulation and AI to analyze transactions before execution, high-risk transactions can be blocked and reviewed before processing to ensure on-chain security. As an L2 on the Optimism superchain, Mode stands in the middle ground, connecting human and agent users to the best of the DeFi ecosystem.

Comparison of the top blockchains AI agents are built on

Solana and Base are undoubtedly the two main chains where most AI agent frameworks and tokens are built and released. AI Agents leverage Solana's high throughput and low latency network and open source ElizaOS to deploy agent tokens, while Virtuals acts as a launchpad for deploying agents on Base. Although they both have hackathons and funding incentives, they have not yet reached the level that Mode has achieved in terms of their AI initiatives as a chain.

NEAR previously defined itself as an AI-centric L1 blockchain, with features including an AI task marketplace, the NEAR AI Research Center with an open source AI agent framework, and the NEAR AI Assistant. They recently announced a $20 million AI Agent Fund to scale fully autonomous and verifiable agents on NEAR.

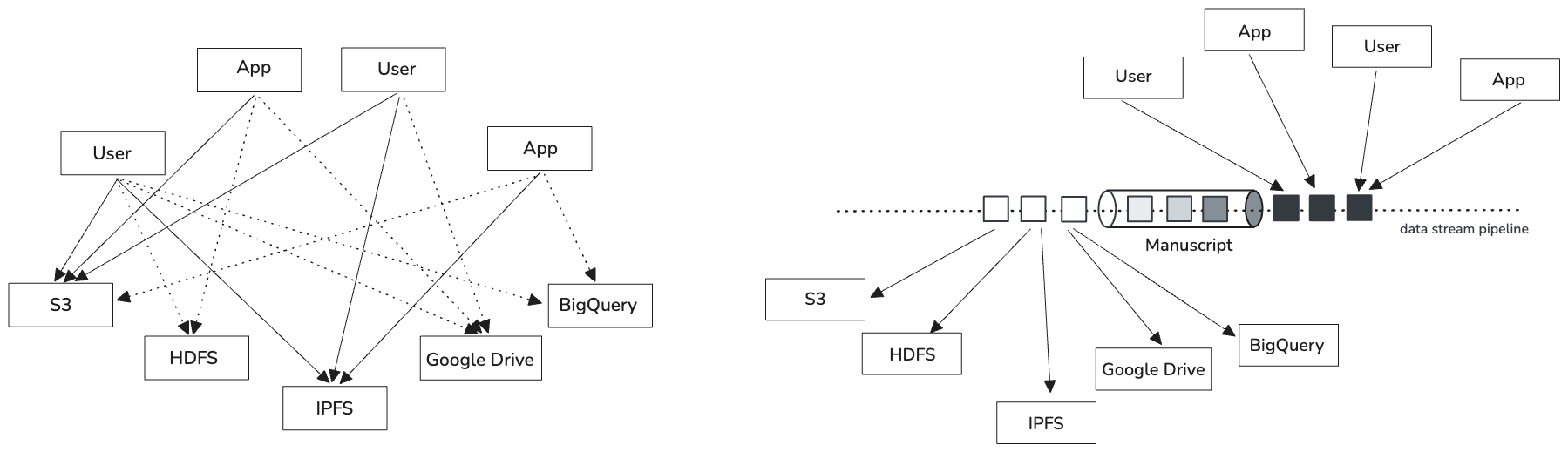

Chainbase

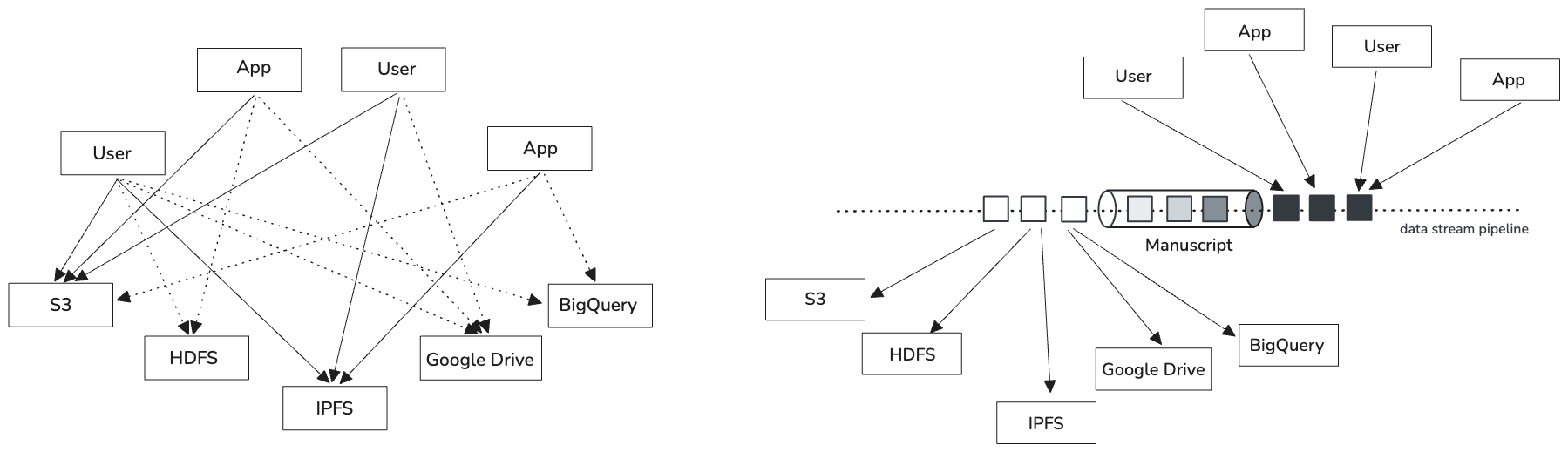

Chainbase provides fully verifiable on-chain structured datasets that enhance AI agents’ trading, insights, forecasting, alpha finding, and more. They launched manuscripts, a blockchain data flow framework for integrating on-chain and off-chain data into a target data store for unlimited querying and analysis.

This enables developers to customize data processing workflows to their specific needs. Standardizing and processing raw data into a clean, compatible format ensures that their datasets meet the stringent requirements of AI systems, thereby reducing preprocessing time while improving model accuracy and helping to create reliable AI agents.

Based on their extensive on-chain data, they also developed a model called Theia, which translates on-chain data into data analysis for users without any complex coding knowledge. The utility of Chainbase’s data is evident in their partnerships, where AI protocols are using their data to:

ElizaOS agent plugin for on-chain driven decision making

Building the Vana AI assistant

Flock.io social network intelligence for user behavior insights

Theoriq data analysis and predictions for DeFi

Also working with 0G, Aethir, and io.net

Compared to traditional data protocols

Data protocols such as The Graph, Chainlink, and Alchemy provide data but are not AI-centric. The Graph provides a platform for querying and indexing blockchain data, giving developers raw data access that is not built for trading or policy execution. Chainlink provides oracle data feeds but lacks AI-optimized datasets for prediction, while Alchemy primarily provides RPC services.

In contrast, Chainbase data is specially prepared blockchain data that can be easily consumed by AI applications or agents in a more structured and insightful form, making it easier for agents to obtain data related to on-chain markets, liquidity, and token data.

sqd.ai

sqd.ai (formerly Subsquid) is developing an open database network tailored for AI agents and Web3 services. Their decentralized data lake provides permissionless, cost-effective access to large amounts of real-time and historical blockchain data, enabling AI agents to operate more efficiently. sqd.ai provides real-time data indexing (including indexing of unfinished blocks) at up to 150,000+ blocks per second, faster than any other indexer. In the past 24 hours, they have served over 11TB of data, meeting the high throughput needs of billions of autonomous AI agents and developers. Their customizable data processing platform provides customized data based on the needs of AI agents, while DuckDB provides efficient data retrieval for local queries. Their comprehensive dataset supports more than 100 EVM and Substrate networks, including event logs and transaction details, which is very valuable for AI agents running across multiple blockchains. The addition of zero-knowledge proofs ensures that AI agents can access and process sensitive data without compromising privacy. In addition, sqd.ai can support the growing number of AI agents (estimated to be in the billions) by adding more processing nodes to handle the increasing data load.

Cookie

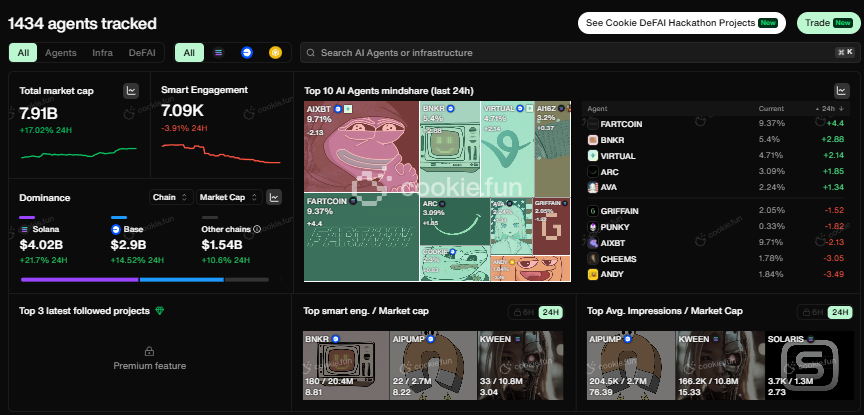

Cookie provides a modular data layer for AI agents and clusters, specifically designed to process social data. It features an AI agent dashboard that tracks top agent mindset on-chain and on social platforms, and recently launched a plug-and-play data clustering API for other AI agents to detect popular narratives and mindset shifts in CT.

Their data cluster covers more than 7TB of real-time on-chain and social data sources, powered by 20 data agents, providing insights into market sentiment and on-chain analysis. Their latest AI agent, @agentcookiefun, leverages their data swarm at 7% capacity, providing market forecasts and discovering new opportunities by leveraging various other agents running underneath it.

Next Steps for DeFAI

Currently, most AI agents in DeFi face significant limitations in achieving full autonomy. For example:

Abstract layers translate user intent into execution, but often lack predictive capabilities

AI agents may generate alpha through analytics, but lack independent trade execution

AI-driven dApps can handle vaults or trades, but are reactive rather than proactive

The next phase of DeFAI will likely focus on integrating useful data layers to develop an optimal agent platform or agent. This will require deep on-chain data on whale activity, liquidity changes, etc., while generating useful synthetic data for better predictive analysis, combined with sentiment analysis from the general market, whether it is token fluctuations in specific categories (such as AI agents, DeSci, etc.) or token fluctuations on social networks.

The ultimate goal is for AI agents to be able to seamlessly generate and execute trading strategies from a single interface. As these systems mature, we may see a future where DeFi traders rely on AI agents to autonomously evaluate, predict, and execute financial strategies with minimal human intervention.

Final Thoughts

Given the significant shrinkage of AI agent tokens and frameworks, some may think that DeFAI is just a flash in the pan. However, DeFAI is still in its early stages, and the potential for AI agents to enhance DeFi usability and performance is undeniable.

The key to unlocking this potential lies in access to high-quality, real-time data, which will improve AI-driven trade prediction and execution. More and more protocols are integrating different data layers, and data protocols are building plugins for frameworks, which highlights the importance of data to agent decision-making.

Going forward, verifiability and privacy will become key challenges that protocols must address. Currently, most AI agent operations remain a black box that users must trust with their funds. Therefore, the development of verifiable AI decisions will help ensure transparency and accountability of agent processes. Integrating protocols based on TEE, FHE, and even zk-proofs can enhance the verifiability of AI agent behavior, thereby enabling trust in autonomy.

Only by successfully combining high-quality data, robust models, and transparent decision-making processes can DeFAI agents gain widespread adoption.

Anais

Anais