Foreword

The turmoil in the crypto market has never stopped, and the DeFi field has also continued to move forward in this turmoil. The expectation of interest rate cuts facing the global economy is quietly changing investors' risk preferences and return demands.

Facing the increasingly dry market narrative environment, the discussion about DeFi has increased again. After a complete round of bull and bear evolution, DeFi projects are no longer satisfied with simply copying the traditional financial model, but have begun to think deeply about how to better meet market demand.

From the rebranding of MakerDAO to the emergence of various novel income strategies, the entire ecosystem is undergoing a profound transformation. At the same time, Binance, as an industry giant, is also actively seeking change. The Meme craze on BNB Chain and the high frequency of projects in the ecosystem... This series of actions are sending positive signals to the market.

In the midst of the turbulent changes, BSC Ecosystem's OG DeFi protocol Tranchess stands out from the crowd of similar products with its unique structured fund architecture, providing investors with a unique DeFi experience by cleverly combining the concept of structured funds with DeFi innovation. As the market demand environment changes, Tranchess continues to advance product iterations and jointly match market demand with multiple projects.

This article will delve into Tranchess's multiple innovations and analyze how Tranchess, with its inherent advantages and mechanism innovation, has opened up a unique path for investors to make profits in the current market environment. Whether you are a DeFi veteran or a newcomer to this field, I believe this article can provide you with some new insights.

Why DeFi?

Faced with the diverse crypto ecosystem, not only external users, but even old crypto players will have some thoughts: with so many new ideas constantly emerging, why is DeFi still worthy of attention?

Andre Cronje provides some relevant insights in a recent article "Why DeFi is the key to the future?".

The article points out that DeFi is essentially a liquidity hub and a carrier of transaction needs. In each on-chain ecosystem, DeFi plays an indispensable role, providing the market with necessary liquidity support, while meeting diverse financial needs from simple token exchanges to complex derivatives transactions.

AC mentioned: "Anyone who is willing to try can participate, which is an important cornerstone of economic growth." DeFi's openness and composability make it an ideal testing ground for financial innovation. Whether it is a bull market or a bear market, DeFi is the core engine to maintain the vitality of the ecosystem.

Tranchess, a good DeFi chess piece that crosses bull and bear markets

Tranchess was born in the DeFi wave in 2021, which coincided with the peak of the bull market in the crypto market. However, Transess not only showed strong vitality in the long cycle, but also injected new vitality into itself through continuous iteration and innovation mechanisms, fully demonstrating its deep strength as an "old OG".

According to the latest data from DeFiLlama, as of September 2024, Transess's TVL on BNB Chain reached US$183 million, an increase of nearly 500% year-on-year.

Professional Team

The fact that Tranchess can survive the bear market and remain active is inseparable from the strength of its professional team. Tranchess is composed of a team with rich professional backgrounds in blockchain and finance. The core team members have rich traditional financial experience including investment banking, asset management and hedge funds.

Co-Founder Danny Chong graduated from Nanyang Technological University and has more than ten years of banking experience, including trading, sales and management in the Asia-Pacific region.

The technical team also has good experience in the network security of centralized exchanges and DeFi protocols. Team members come from technology giants such as Google, Meta and Microsoft.

DeFi protocol inspired by the concept of "Tranches"

Tranchess was inspired by the concept of "Tranches" (grading) in traditional finance. The protocol innovatively provides investors with different risk preferences with graded and multi-structured asset investment solutions.

Tranchess provides two core services:

Liquidity staking service: The liquidity staking service of Transess is mainly represented by BNB Chain's staking token nQUNEE and Ethereum mainnet's staking tokens qETH and . Taking qETH as an example, users can stake ETH on the Ethereum mainnet to obtain qETH. While enjoying the staking income within the protocol, qETH can also be used as collateral for external DeFi protocols to improve capital efficiency.

Graded return products: Transess also provides diversified risk-return solutions based on the main fund QUEEN, splitting QUEEN into two derivative tokens, BISHOP and ROOK, according to different risk returns, aiming to meet the needs of investors with different risk preferences. Today, Transess has further optimized its product structure and upgraded it to a more flexible Turbo & Stable architecture.

There is no fixed pattern for chess, from structured funds to Turbo & Stable

From the graded model to Turbo & Stable, the iteration of Transess is just like a wonderful chess game, and every move is a precise response to market changes.

Starting with a structured fund with hierarchical responses

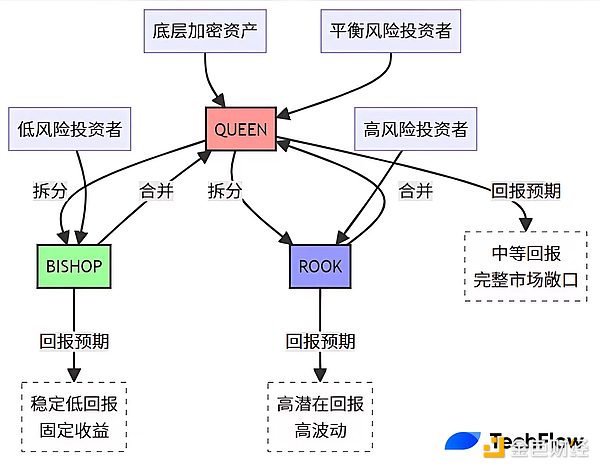

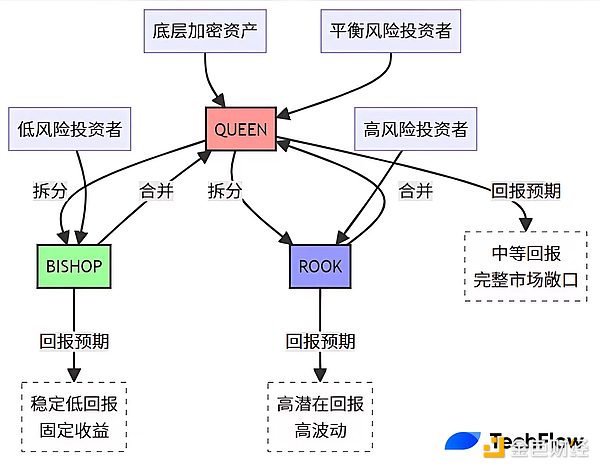

Structured design is the core innovation of Tranchess's design concept. It is to split a single asset into derivatives with different risk levels. This structure allows investors to choose the right investment strategy based on their risk preferences. Specifically, Tranchess divides assets into three levels:

Main Fund Token QUEEN

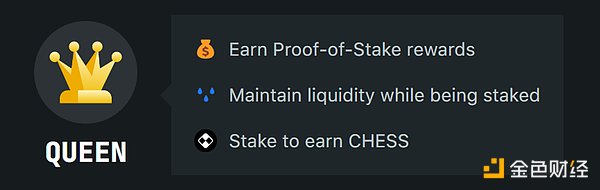

QUEEN is the underlying asset, pegged 1:1 to the underlying crypto asset. As the main fund unit in the entire structure, users can directly hold QUEEN to obtain full exposure to the underlying assets. QUEEN can be minted, redeemed, and split into BISHOP and ROOK. QUEEN's income sources include price changes of the underlying assets, staking rewards (if the underlying assets support staking), and protocol income distribution.

Take BTC as an example, QUEEN holders can not only enjoy the benefits brought by Bitcoin price changes, but also earn additional CHESS governance token rewards through staking. Investors can directly exchange BTC for QUEEN, or purchase it with USDC in Tranchess Swap.

Derivative Tokens: BISHOP and ROOK

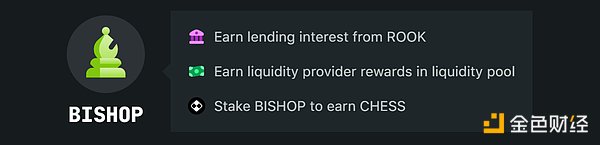

BISHOP and ROOK, two derivative tokens split from QUEEN, represent different risk and return characteristics.

BISHOP is a fixed-income token with low risk and stable returns, similar to fixed-income products. Its source of income is a fixed QUEEN yield, which is adjusted regularly by the protocol according to market conditions. BISHOP provides relatively stable returns when the market fluctuates, suitable for risk-averse investors.

ROOK is a leveraged token with higher risk, provides leveraged returns, and is more sensitive to changes in the price of underlying assets. ROOK's returns come from all the residual returns of QUEEN (that is, the total return minus the portion paid to BISHOP). When the market rises, ROOK can obtain excess returns, but also faces greater downside risks.

The structured fund design allows investors to flexibly adjust their positions according to their own risk preferences. Investors can switch between QUEEN, BISHOP and ROOK at any time to achieve personalized risk management strategies. For example, when the market is expected to rise, ROOK can be increased to obtain higher returns; when the market is expected to fall, BISHOP can be increased to obtain stable returns.

The flexible tiered architecture allows Tranchess to expand to more crypto assets in the future, providing investors with a wider range of market participation opportunities. Whether it is BTC, ETH or BNB, Tranchess has the potential to create corresponding structured products for it to meet the needs of different investors.

Turbo&Stable, tactical innovation in the chess game

With the launch of the liquidity pledge product qETH on the ETH mainnet by Tranchess, the concept of "Turbo&Stable" has also been introduced into the product ecosystem of Tranchess.

The Turbo & Stable model is essentially a subdivision upgrade of structured funds. The concepts of Turbo and Stable can also be understood as enhanced products of ROOK and BISHOP.

Like a rook that moves forward in a chess game, Turbo products offer higher leverage and potential returns, suitable for investors who are willing to take higher risks. It is like a bold attack in a chess game, which has the potential to bring significant returns, but also faces greater risks.

Similar to the flexible elephant (BISHOP), the Stable product provides more stable returns and becomes the defensive core of the investment portfolio. It provides an ideal choice for investors who seek stable returns and have a low risk appetite, just like building a solid defense line in a chess game.

Detailed explanation of Turbo&Stable, taking StakeStone's STONE fund as an example

Just talking about the concept is inevitably a bit abstract. Let's take the Turbo&Stable product STONE Fund, which is a collaboration between Tranchess and StakeStone, as an example to introduce how this architecture works.

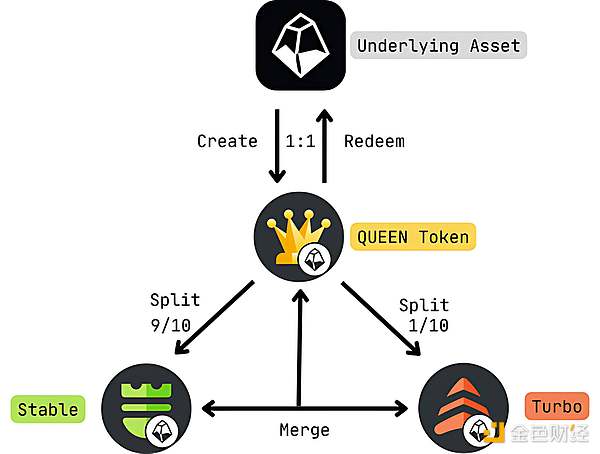

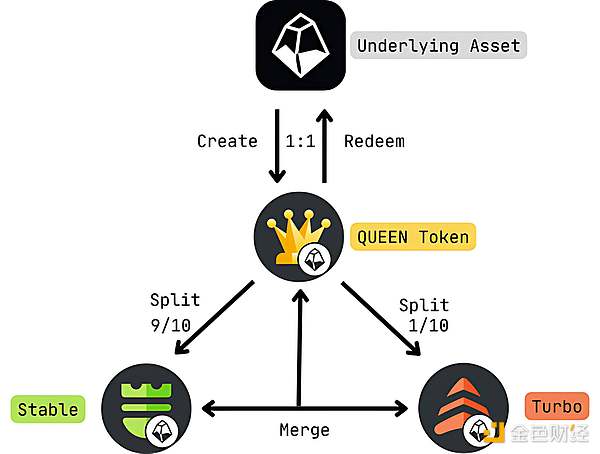

Simplifying the complex, two tokens can be flexibly split

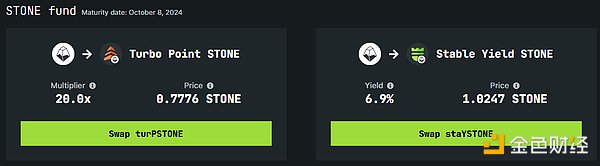

The core of the STONE fund is the token splitting mechanism based on the Turbo&Stable architecture. Users can exchange STONE for stoneQUEEN at a ratio of 1:1, and each stoneQUEEN can be split into 0.1 turPSTONE (Turbo Point STONE) and 0.9 staYSTONE (Stable Yield STONE). At the same time, this process is reversible, and users can merge 0.1 turPSTONE and 0.9 staYSTONE back into 1 stoneQUEEN.

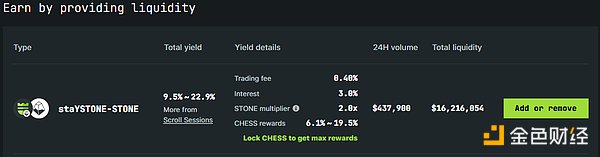

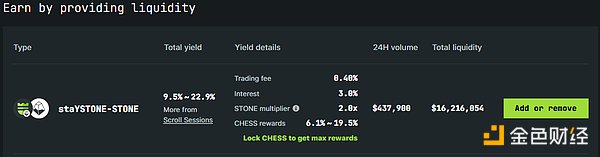

staYSTONE-STONE LP Diverse Income

Tranchess also introduced staYSTONE-STONE LP tokens to provide additional income opportunities for ecological users.

These LP token holders can not only obtain CHESS tokens and 0.05% transaction fee rewards, but also enjoy part of the staYSTONE interest and a 2x StakeStone points multiplier (for the STONE part of the LP). In addition, Tranchess provides an additional reward of 150,000 CHESS per week to the LP of the STONE Fund.

Different Points Rewards and Revenue Structures

The total staking period of the Tranchess STONE Fund is 6 months, which will end on October 8, 2024. At that time, different types of tokens can be exchanged back to STONE according to their fair value, and Tranchess allows STONE holders on Scroll to earn Scroll Marks points while earning StakeStone points.

stoneQUEEN can be exchanged with STONE 1:1, and holding stoneQUEEN can obtain the same multiple of StakeStone points as holding the same amount of STONE. However, splitting stoneQUEEN into staYSTONE and turPSTONE and holding both at the same time can obtain a 2x points multiplier without loss, and obtain Scroll Marks points based on the value of holding.

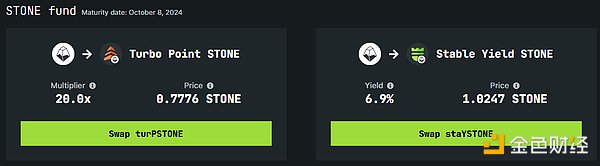

turPSTONE not only has a fixed leverage of 10x, but also obtains a 2x points multiplier of StakeStone, that is, it can obtain 20x StakeStone points in the end. Excluding the cost of paying a fixed interest rate to staYSTONE at the end of the fund, turPSTONE: STONE<1

staYSTONE provides investors who seek stable returns with a fixed annual interest of 6%, but there is no StakeStone points reward, and Scroll Marks points are obtained based on the holding value. At the end of the fund, staYSTONE: STONE>1

In addition, Transess will charge a 3% fee from the points obtained from Turbo & Stable fund products as additional income 100% distributed to veCHESS holders, increasing the yield of veCHESS holders.

PS: The exchange ratios of turPSTONE, staYSTONE and STONE shown in the article are all roughly estimated, and the exact ratio will be announced based on the specific fair value and when the fund is close to closing.

Good and fast, precise architecture that can be quickly replicated

Not limited to the STONE fund, the Turbo&Stable products currently launched include the weETH fund launched in cooperation with eth.fi, the Staked ETH fund in cooperation with LIDO, the SolvBTC fund in cooperation with SOLV, the slisBNB fund in cooperation with Lista DAO, and the recently launched SolvBTC.BBN fund.

Not only can it provide a variety of revenue gameplay, Turbo&Stable supports the rapid launch of any LST narrative chain, and can also flexibly cooperate with the income changes of the corresponding assets, such as the recently launched SolvBTC.BBN, which is the project with the most BTC pledged in the early stage of the Babylon ecosystem and is currently the LRT with the most Babylon points income. As another part of user income, this advantage will also be retained in the structure of Turbo&Stable, fully reflecting the flexible characteristics of this sophisticated architecture of "good and fast".

The key chess of Tranchess: CHESS&veCHESS

Recently, CHESS, which was launched on Binance contracts, has attracted attention again. As the governance currency of Tranchess, CHESS and veCHESS are not only the key link connecting the entire Tranchess system, but also their own value grows together with the project itself.

Governance Token CHESS

The total supply of CHESS is 300 million. In addition to direct purchase, users can also obtain CHESS in a variety of ways, mainly including participating in liquidity mining or staking QUEEN, BISHOP, ROOK tokens to obtain CHESS.

After the lock-up is converted to veCHESS, CHESS is able to unlock various use cases in the ecosystem: veCHESS has governance rights such as voting, weekly protocol dividends, and 3% Turbo & Stable points income.

In addition to liquidity and governance functions, CHESS currently also supports BNB Chain, Ethereum and Scroll three-chain cross-chain.

Lock-up transformation, veCHESS launched!

Lock CHESS for redemption

Users can choose to lock CHESS for a period ranging from 1 week to 4 years. The redemption ratio also increases linearly according to the lock-up time. The specific veCHESS amount is calculated by multiplying the CHESS amount by the lock-up time (in years) divided by 4.

For example, 100 CHESS locked for 4 years will get 100 veCHESS, while 100 CHESS locked for 2 years will get 50 veCHESS. At the same time, the amount of veCHESS will decrease linearly over time, but users can increase the veCHESS balance by increasing the lock-up time or amount.

Tranchess also supports locking CHESS in batches, and each lock will create a new lock position. For ease of management, users can merge multiple lock positions into one.

Layers of additional income

In addition to the 3% point income return of the Turbo&Stable fund product mentioned above, veCHESS holders will also receive 50% of the weekly income of the Tranchess platform as additional staking rewards, and the other 50% of the income will go to the Treasury.

Continuously enriched governance rights

Users holding veCHESS can participate in various important decisions of the Tranchess platform, and the voting weight is proportional to the number of veCHESS held, ensuring that users who have a long-term commitment to the platform have a greater voice in the decision-making process.

Recently, the governance proposal 9 passed by the Tranchess community proposed that the voting governance rights of veCHESS in the future can be extended to the decision-making layer of all new Turbo&Stable project launches. This proposal further expands veCHESS's use cases and demonstrates the future potential of Turbo&Stable architecture to be quickly replicated.

Value depression under the hot spot?

With the in-depth exploration of the Tranchess ecosystem, it can be seen that CHESS is not only a simple governance token, but also the core value carrier in the Tranchess ecosystem.

The veCHESS obtained by locking CHESS can not only bring rich revenue sharing, but also give holders the power to participate in major decisions of the platform. The dual attributes make CHESS an attractive value storage and value-added tool.

With the continuous growth of the platform's TVL, the official launch of perpetual contracts, and the upcoming expiration of several Turbo & Stable fund products, CHESS is likely to be at a value point. The profit potential of veCHESS may be enough to cover the current market's price perception of CHESS. The real potential value of CHESS is not limited to the market's hype expectations for the DeFi sector and the short-term "lottery mentality" for a single token to be listed, but long-term, value-supported product returns.

Innovation is the key to success

From structured funds to Turbo&Stable architecture, veteran player Tranchess has always maintained excellence and flexibility in the fiercely competitive DeFi track, providing more solutions for various ecosystems while ensuring diverse user benefits, and implementing a true DeFi Native style.

The development trajectory of Tranchess proves that only by innovating and always maintaining the key "half-piece" advantage can we be invincible in the game of encryption.

JinseFinance

JinseFinance