Author: Stacy Muur, crypto researcher; Translation: Golden Finance xiaozou

In this article, I will bring Delphi Digital 20 key insights about DeFi 2024 in the coming year, which can help you better welcome the new year year.

About Liquidity Staking

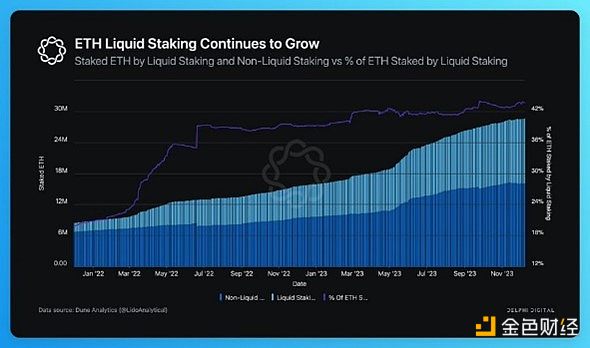

(1) The pledge rate of ETH is currently 23.7%, and the total supply is 120.2 million ETH. The amount of staked ETH is approaching the target of 33.5 million ETH (27% of the total ETH supply). This goal is considered the best option to ensure network security and reliability.

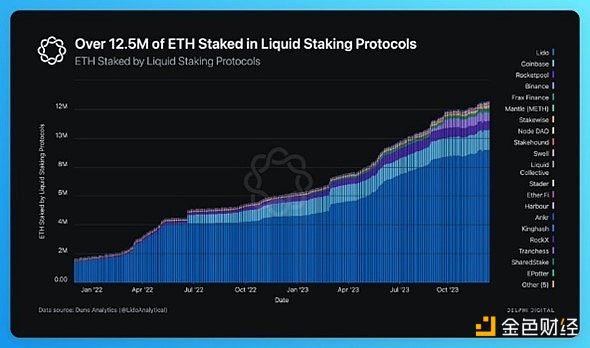

(2) LSD Adoption has also shown significant growth, with approximately 44% of staked ETH currently being stored in these protocols. The special utility of Lido stETH provides a substantial competitive advantage compared to other LSDs.

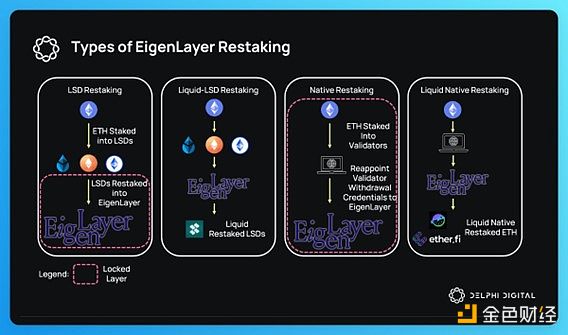

2023 LST field Highlights:

Frax Finance shows steady growth, with the amount of ETH pledged increasing from 3800 to 2023 233,000 per year. Frax stands out for its innovative sfrxETH design and integration within the ecosystem, especially Fraxlend.

Mantle uses the ETH owned by its protocol to launch mETH. The purpose of mETH is to generate revenue for Mantle and enhance the liquidity of the DEX.

ether.fi and Renzo conducted liquidity-native re-staking on EigenLayer.

(3) The LSD industry on Ethereum is operating well, and competition is fierce and saturated.

(4) Many LSDfi projects have lost their appeal because their incentive-driven high returns have been compressed.

(5) Restaking will be the biggest event in the staking field in 2024.

About DEX(Decentralized Exchange)

(6) Uniswap v4, Uniswap X and other intent-based DEX will become a major theme in 2024. It is recommended to pay attention to the following projects: Rage Trade, IntentX, aori, Uniswap Labs, CoW Dao, 1inch Network, SYMMIO.

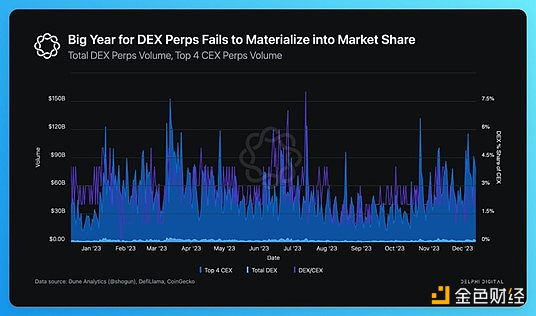

(7) Perp DEX has experienced a year of development, but its market share has not increased. dYdX v4 moved to the Cosmos application chain, Aevo took the lead in landing on the OP stack, Vertex made the DEX user experience soar, and RabbitX became a booster for Starkware.

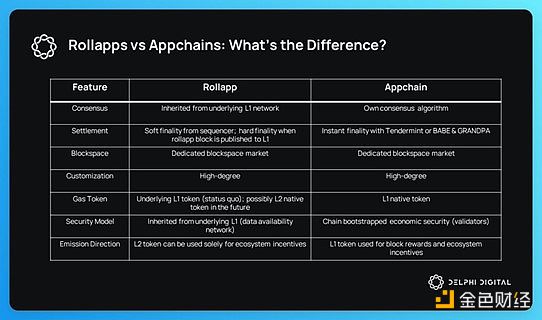

About specific applications< strong>rollup(Rollapp)

(8) Aevo paved the way for rolllapp (forked Optimism and deployed DEX on it to extend its Usage support). Most DEXs, especially derivatives, would benefit from having their own execution environment.

(9) Required Projects of concern include: Aevo, lyra (the matching process is less centralized than Aevo and Vertex), Caldera, Conduit and other tools for simplifying rollup deployment, Astria, Espresso Systems (shared sorting network).

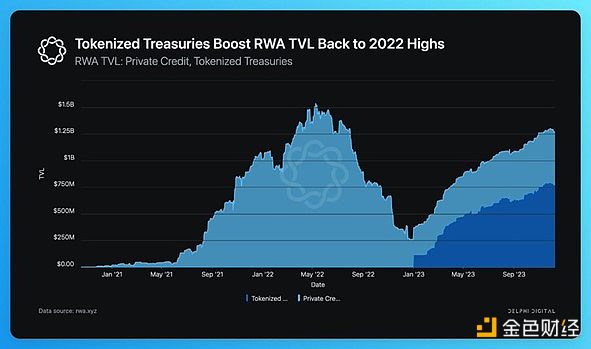

About RWA (Real World Assets)

(10) Real world assets are one of the most successful areas in the crypto industry in 2023. Projects that need attention include Backed and Superstate.

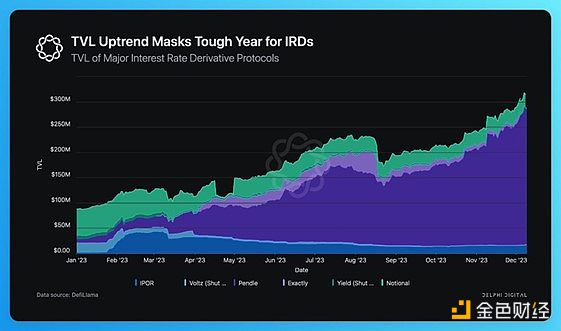

About IRD(Interest rate derivatives)

(11) Atm, Pendle, Notional (fixed interest rate lending) and IPOR Labs are the only sustainable IRD protocols. IRD is expected to become one of the most talked about narratives in the cryptocurrency space in the coming years.

About decentralization Stablecoins

(12) Decentralized stablecoins account for only a small part of the entire stablecoin market value.

(13) The derivatives market is becoming a key area with untapped potential for decentralized stablecoins (such as Synthetix’s sUSD).

About the wallet

(14) User experience and in-wallet experience are priorities for most wallet developers.

(15) Projects to pay attention to include: MetaMask (leader in the wallet market), Phantom (great features, such as trading simulation), Rabby Wallet (arguably the best EVM wallet), Brahma (based on Institution-centric smart wallet).

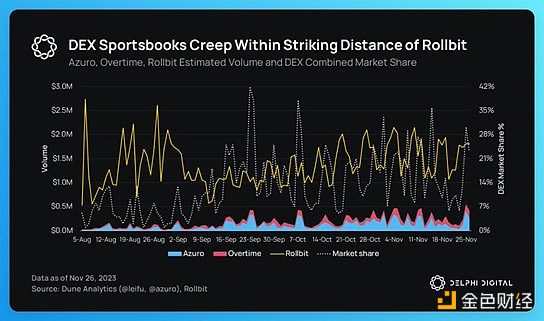

About on-chain betting

(16) For users and bettors, the DEX sports betting platform still has a lot of work to do before it enters the golden stage.

(17) Despite this, the DEX sports betting market share is still considerable, about 20% of Rollbit.

(18)Unibot Telegram bots such as , BookieBet and Boxbet provide some form of mobile experience, and daily transaction volume has reached a peak of 35% of Azure's daily transaction volume. The data has since stabilized at around 15%.

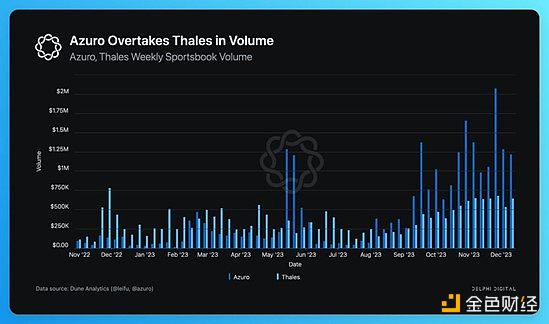

(19) Thales has a first-mover advantage and is deployed on Optimism, Arbitrum and Base.

(20) Deployed on the Polygon and Gnosis chains, Azuro has overcome its slow start and recently surpassed Thales to become the DEX sports betting platform with the highest trading volume.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Kikyo

Kikyo JinseFinance

JinseFinance JinseFinance

JinseFinance Others

Others Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph