In June, airdrops came one after another. After LayerZero, another star project, ZkSync, took over the airdrop baton.

However, unlike LayerZero, the ZkSync airdrop did not adopt extremely strict witch screening, which was quite a universal state. However, the irrefutable fund setting, the suspicious rat warehouse, and the rules that overly emphasized the project's discourse power made it usher in stronger community criticism and resistance.

Despite facing community disputes and various controversies, exchanges such as Binance and Bitget have successively announced the launch of ZK, and the weakening of prices has also involved ZK in a larger whirlpool of public opinion.

It seems that ZkSync, known as the last hope of L2, seems to have disappointed users the most.

Compared to the previously airdropped LayerZero, ZkSync, as the Ethereum L2 star "F4" on par with Arbitrum, Optimism and Starknet, has a higher profile and longer history.

zkSync originated from EthCC in 2019. The team is committed to developing and deploying Rollup with zkSNARK. At the beginning of 2020, with the outbreak of Defi, the Ethereum ecosystem flourished, and the scalability problem became more prominent. At that time, the Rollup solution was the industry consensus on the expansion technology path of Ethereum, but the fraud proof adopted by OP had its natural defects of waiting time and centralized verification. Therefore, ZK Rollup, which has more cryptographic characteristics and uses zero-knowledge proof, became the research object of technical workers, and zkSync came into being.

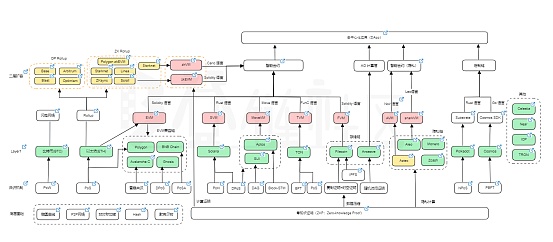

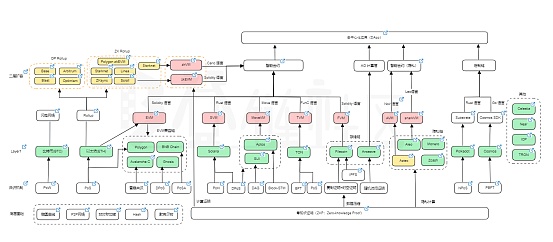

Web3 technology map, source: Dengchain Community

In June 2020, zkSync's parent company Matter Labs officially released zkSync v1.0 on the Ethereum mainnet. By introducing ZK Rollup, the process of generating proofs is output using zero-knowledge proof circuits. zkSync validators have no right to perform any operations on user assets, thereby eliminating some risks brought by centralized validators, improving data availability, and bringing more efficient and scalable technical solutions. zkSync has therefore become one of the most promising projects of Ethereum founder Vitalik Buterin.

From a technical point of view, zkSyn has significant advantages over OP Rollup in terms of security and efficiency, but it also has core problems - complex algorithms, high engineering difficulty, and poorer compatibility. In this context, zkSync is not developing rapidly.

In June 2021, the zkSync 2.0 testnet Era was released, and it was not until two years later, in March 2023, that the ZkSync mainnet was officially launched. However, ZkSync became an instant hit by becoming the first open source mainnet zkEVM deployed in the Ethereum Rollup ecosystem. Just two months after its launch, the TVL of the ZkSync Era mainnet reached US$480 million, with a weekly growth rate of nearly 20%. The number of independent addresses has reached 920,000, exceeding other Layer 2 networks such as Arbitrum, Optimism and Starknet at the time.

For such projects, capital will naturally not miss it. In fact, the team behind zkSync, Matter Labs, comes from the world's top companies and is closely connected with capital. According to public data, the project has raised $258 million through five rounds of financing since 2018, with endorsements from well-known capitals such as a16z, Dragonfly and Blockchain Capital.

Top capital, potential tracks and star projects, such a superposition naturally makes users full of hope for its token airdrops, not to mention that OP, ARB and STARK have already built their own token systems, with a total of more than $3.4 billion in tokens airdropped. Under this expectation, despite the weak ZK ecosystem, a large number of users naturally poured into zkSync, and the project repeatedly played the wolf, and some users even joked that it was the "king of airdrop pua."

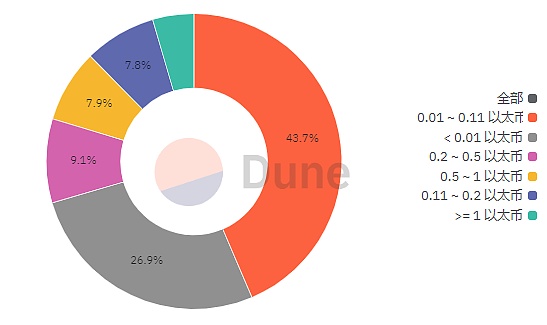

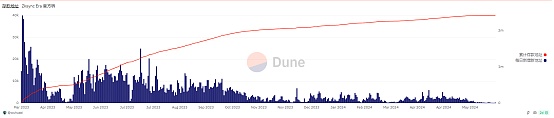

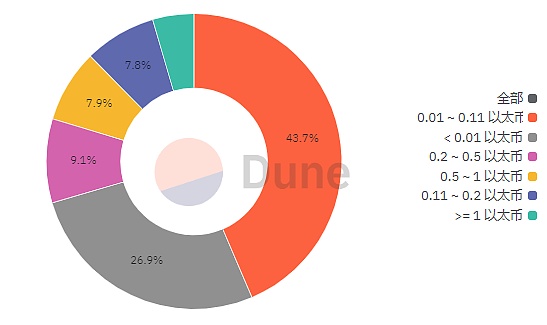

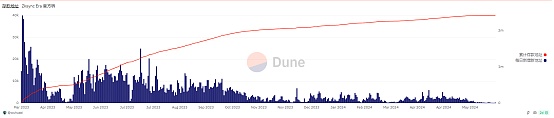

The data is exactly the same. According to Dune data, the average number of ETH bridged by users is only 1.37, and more than 80% of users have less than 1ETH bridged. Only 1.3% of the address balance exceeds 10 ETH. It can be seen that the main users of zkSync are still rushing for airdrops, rather than large capital users.

ZKsync bridge fund usage range distribution, source: Dune

This year, the airdrop finally came. On June 11, ZKsync announced that it would conduct a one-time airdrop of 3.6 billion ZK tokens to early users and adopters of zkSync on June 17, with 695,232 eligible wallets. The snapshot time is March 24, and community members can check the airdrop eligibility on the Claim.zknation.io website and claim the airdrop from the 17th until January 3, 2025. A single eligible address can get a minimum of 450 ZK, with a cap of 100,000 ZK.

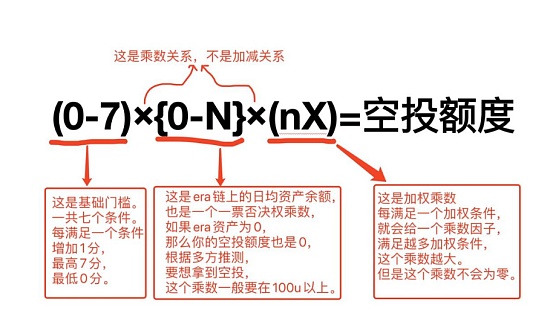

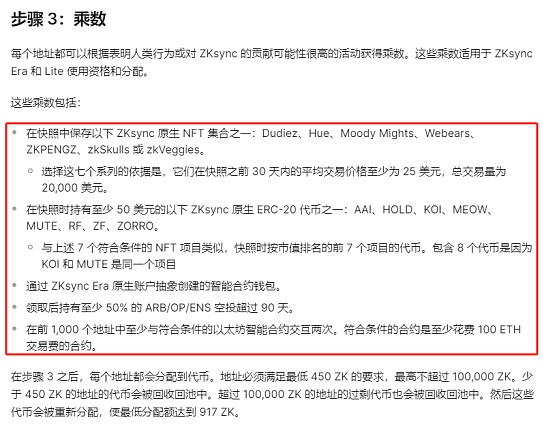

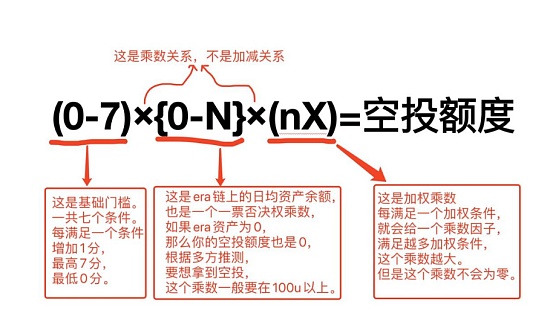

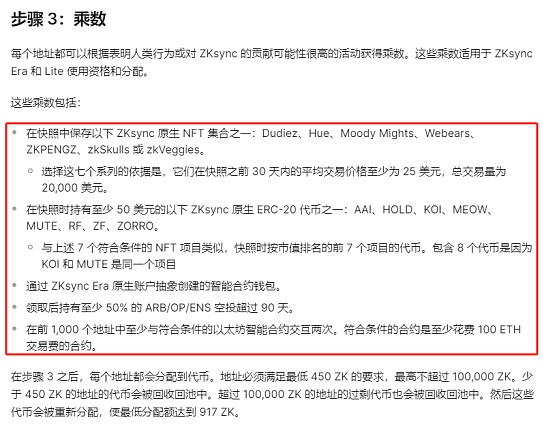

It should have been a good thing, but the airdrop details and subsequent events gave users a blow. From the perspective of the entire quota composition, the airdrop has three parts: qualification review, basic allocation, and multiplier effect.

ZKsync airdrop formula, source: Bale

From the perspective of qualification review, airdrop qualifications are not strict. Although the thresholds of owning NFT and having interacted are complicated, they are mostly basic operations. But from the perspective of allocation, there is a lot of knowledge. ZKsync innovatively added the threshold of fund retention, no longer using the common cross-chain standards such as monthly activity, transaction volume, and tx number, but more like a pledge project requirement. Fund retention means that large funds can naturally get more allocations, because from the formula point of view, accounts with more airdrop quotas either have a long retention time or a large fund balance, and both are better. In the multiplier item, the 5 multipliers are more stringent and difficult to figure out, almost tailor-made for rat warehouses.

It can be seen that it is extremely difficult to get the ZKsync airdrop even without a witch, which directly led to the wool party who thought they had won the game and instantly turned into a large-scale anti-looting defense war. According to Seanzhao1105 of the X platform, he used 6,000 accounts, including 400 manual accounts and 5,600 program accounts, with a total investment of 200,000 US dollars, and finally only 35 addresses received the airdrop. This is true. From the address point of view, only 690,000 addresses received the airdrop, accounting for only 10% of the total addresses. Before the airdrop, TrustGo, Nansen and other institutions predicted that as many as 1.6-2 million addresses could receive the airdrop. What's even more ridiculous is that even multiple projects in the zkSync ecosystem said that they did not receive any airdrops.

On the other hand, a sentence in ZKsync's airdrop claim interface also provoked a conflict that was about to explode. "Meeting one or more of the above airdrop standards does not mean a legal right or requirement to obtain an airdrop. All decisions related to airdrop allocation are made by the ZKsync Association at its sole discretion." Simply translated, the final right of interpretation belongs to the project party. This kind of behavior that is very un-Web3 is hard not to touch the user's reverse scale. For a time, the community began to denounce ZKsync in various ways.

What's more terrifying is that the broad witch standard boomerang has once again stabbed ZKsync. Due to not using Layerzero's witch library, the number of ZKsync airdrop witch addresses has skyrocketed. Witch hunter Artemis analyzed in the statistical table that witch users who made a profit of $4.2 million in the Arbitrum airdrop still have airdrop qualifications; some witch accounts marked on the LayerZero witch list also received more than 2 million ZK tokens by depositing the same amount of Ethereum funds on the same day. Each wallet received an average of 15,000 ZK tokens, while the average number of ordinary users was only 5,286, far lower than the witch addresses. Further analysis of the addresses that received airdrops will find that the accounts are quite concentrated. According to community statistics, 9,203 addresses received 23.9% of the total airdrops.

Faced with various doubts, the project party responded to the airdrop details and witches, updated the FAQ document, and added feedback mailboxes accordingly. But in this context, community criticism still reached its peak. The community stated that it would boycott the token and strongly called on exchanges not to list ZK tokens.

However, the final result was counterproductive.

On June 17, the ZKsync (ZK) airdrop was officially opened for claiming at 15:00. As of 5:00 pm, according to data released by ZKNation, more than 225,000 addresses received more than 45% of the airdropped ZK tokens in less than 2 hours.

Following closely, Binance announced that it would launch ZKsync (ZK) at 16:00 and open spot trading pairs of ZK/BTC, ZK/USDT, ZK/FDUSD, and ZK/TRY. At the same time, ZK withdrawals are expected to be opened at 16:00 on June 18. After Binance, Bithumb and Bitget announced that they would launch ZK tokens.

Data shows that the opening price of ZK on the chain reached a high of $0.4236, and it has fallen back by $0.29 after the launch, a drop of 30% after the launch. Perhaps affected by this, Binance and Bitget later announced the postponement of the launch of ZK. At present, ZK has been launched on both Bitget and Binance. Bitge opened at $0.34 and is now quoted at $0.26, while Binance opened at $0.295 and is now quoted at $0.26, which is much lower than previous market expectations. Although the community has some complaints about this, from the perspective of the exchange, it is understandable to launch a large-scale token. The exchange needs traffic and needs to be the first to list the token to occupy the market. No matter how controversial ZK is, its star status cannot be denied. Judging from the total amount of tokens alone, ZK's 3.6 billion token airdrops are actually much larger than OP, ARB and STARK.

On the other hand, there are also some people who have received large-scale airdrops and started to celebrate. This benefit, the final result is the same as before, with both joy and sorrow.

Reviewing this airdrop war, although ZKsync has problems such as transparency, its fund retention has left a far-reaching impact on subsequent airdrops. On the basis of the original transaction frequency, transaction volume, monthly activity, number of contracts, and balance, the subsequent retention time and balance are expected to be further added to the airdrop standard. In the long run, the reduction of airdrop odds, the increase in complexity, and the increase in investment will become an inevitable trend. Whether admitted or not, the change in the threshold of personal airdrops is already foreseeable. AndFor the problems of rat warehouses and witches that have long been operated in the industry, ZKsync has torn off the fig leaf this time, and the consequences have also given other projects a typical negative case. On the other hand, for ZKsync, the airdrop is just the beginning, and ecological issues and profitability are the focus of its attention. From the point of view of time, zkSync has run out of tricks in issuing tokens this year. Although it seems that TVL has made a lot of money and GAS revenue is also full, its profit capture ability is facing a sharp decline. Compared with OP, ARB and other projects with better network effects, zkSync has an obvious ecological dilemma. Although there are more than 243 projects, there is a lack of head DAPP, and the field is highly concentrated in DEX and lending. Only 4 zkSync projects have a TVL of more than 10 million US dollars, accounting for nearly 66% of the total locked volume. Gas, the absolute revenue leader, has also shown a continuous downward trend this year. The fees captured in April fell by about 88.9% compared with January. After the airdrop, the number of new addresses added daily by zkSync is also decreasing rapidly. In addition, as the gas price of Ethereum has dropped after the upgrade, the transaction cost of zkSync has also dropped. The official revealed that the price has dropped by about 10-20 times, which means that the profitability will be tested again.

The airdrop has been launched, and users have been hurt, but the time left for ZKsync may not be as abundant as it imagined.

JinseFinance

JinseFinance