Author: CryptoVizArt, UkuriaOC, Glassnode; Compiler: Wuzhu, Golden Finance

Summary

The hash rate remains slightly below its all-time high, and despite the decline in revenue, miners' continued investment shows that they have great confidence in the Bitcoin network.

Investor interaction with exchanges is decreasing, and trading volume is shrinking across the board, indicating a weakening interest from investors and trading.

Both Bitcoin and Ethereum ETFs have seen outflows, however, investor interest in Bitcoin ETFs remains significantly larger in scale and volume.

Miners

Miners remain the fundamental participants of the Bitcoin network and the main source of new coin production. Miners provide hash power for discovering the next valid block, and the network will autonomously reward them with newly issued coins and transaction fees.

This makes mining an extremely challenging industry as they have no control over either the input cost of energy or the output cost of BTC.

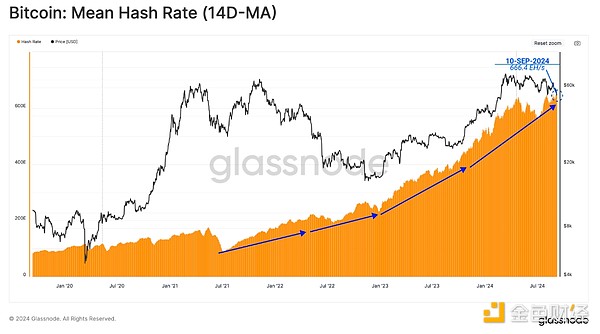

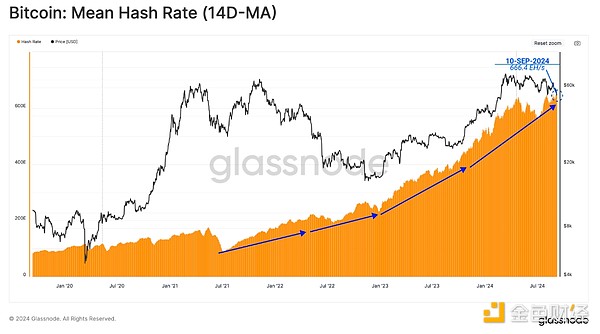

Despite volatile and uncertain market conditions, Bitcoin miners continue to install new ASIC hardware, driving the overall hash rate higher (14D-MA) to 666.4EH/s, just 1% below the ATH.

As the hash rate increases, the target difficulty for successfully mining a valid block also increases. The Bitcoin protocol automatically adjusts the difficulty to accommodate rising and falling hash rates on the network.

Currently, the average number of hashes required to mine a block is 338k exahash. This is the second most difficult in Bitcoin's lifetime, highlighting the increasingly competitive mining industry.

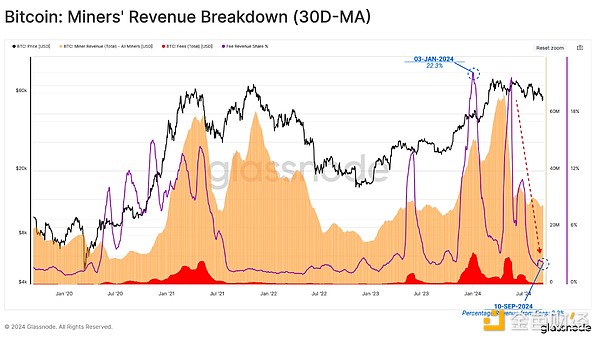

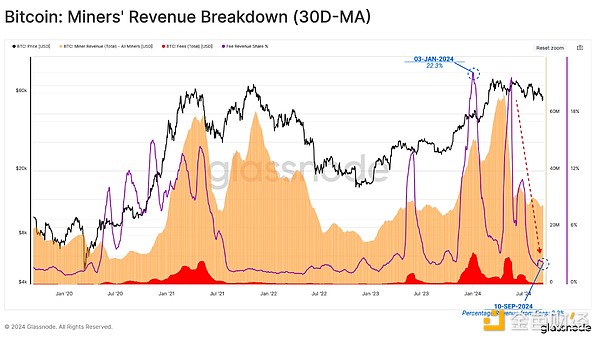

Nevertheless, miners have seen a significant drop in revenue since market prices hit a record high in March. A large part of the drop in revenue can be attributed to falling fee pressure. This is due to a drop in demand for currency transfers and a drop in fees generated by rune and inscription-related transactions.

With spot prices above $55k, miner revenues related to block subsidies remain relatively high, but are still around 22% below the previous high.

As revenues decline, we can infer that some level of revenue pressure may be starting to set in. We can estimate the percentage of mining supply that miners spend over a 30-day period to gauge whether this is indeed the case.

Due to the competitive and capital-intensive nature of the mining industry, miners have historically needed to allocate a large portion of mined coins to cover input costs. Interestingly, miners have shifted from net allocating mined supply to now retaining a portion of mined supply in their treasury reserves.

This highlights an interesting development as miners tend to be pro-cyclical, being sellers during declines and holders during uptrends. Rising hash rate and difficulty represent an increasingly expensive cost of producing BTC, which could adversely affect miner profitability in the near future.

Settlement Slowdown

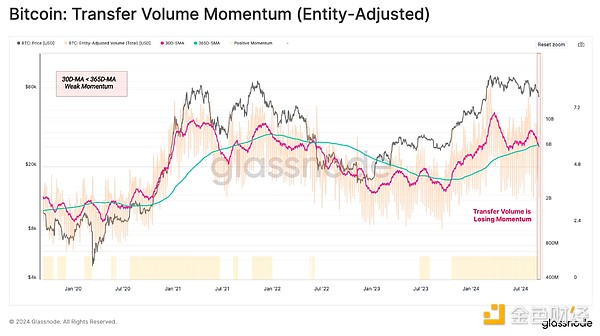

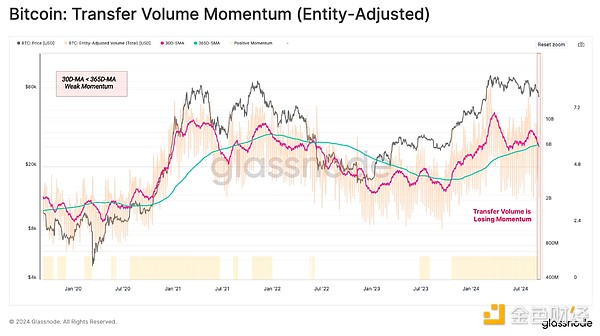

The volume of transactions settled on-chain can also reflect the level of adoption and health of the network. When filtering for entity-adjusted transaction volume, the network is currently processing and settling approximately $6.2 billion in transactions per day.

However, settlement volume is beginning to decline toward the annual average, indicating a clear decline in network usage and throughput.Generally speaking, this is a net negative observation.

Declining Trading Willingness

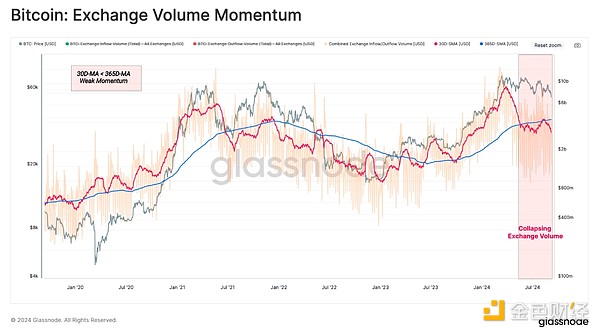

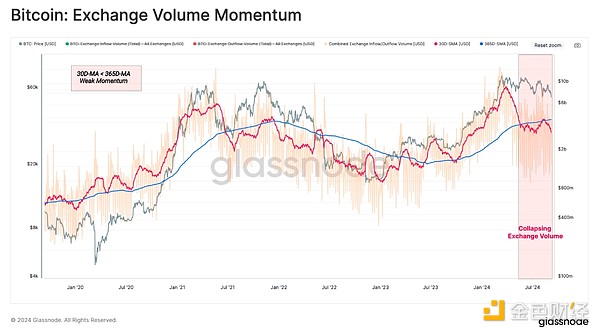

Centralized exchanges have been central venues for speculative activity and price discovery in a changing market landscape.As such, we can assess on-chain volume at these venues as an indicator of investor activity and speculative interest.

Performing a similar 30/365-day momentum crossover on exchange-related inflows and outflows, we can see that the monthly average volume is well below the annual average. This highlights a decline in investor demand and fewer speculators trading in the current price range.

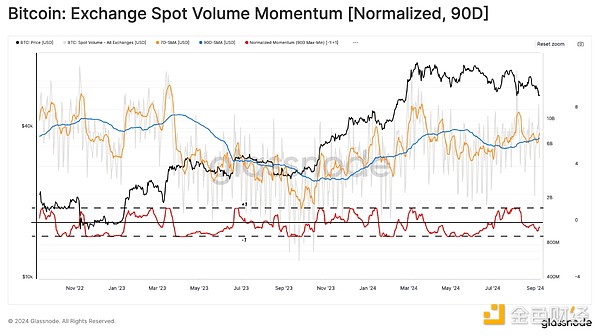

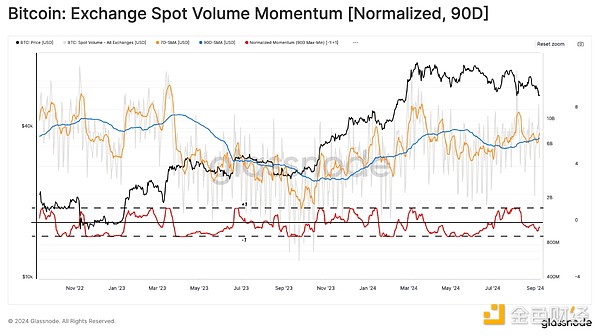

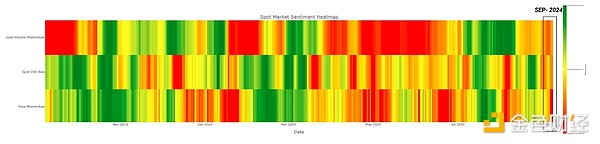

Next, we look at the spot volume on the exchange. Here, we apply the 90d MinMax scalar, which sets the value to a normalized value in the range of 1 to -1 relative to the maximum and minimum values of the selected period.

Similar observations can be identified from this, with spot volume momentum continuing to decay. This further supports the view that trading activity has clearly declined over the last quarter.

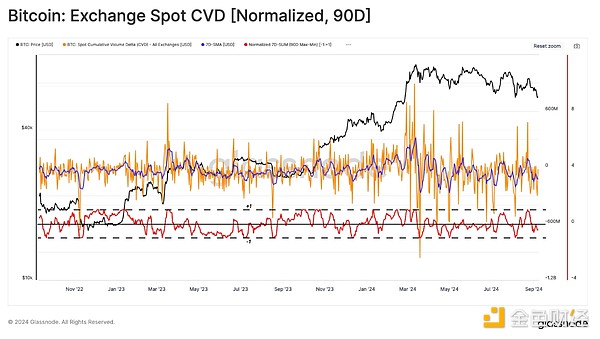

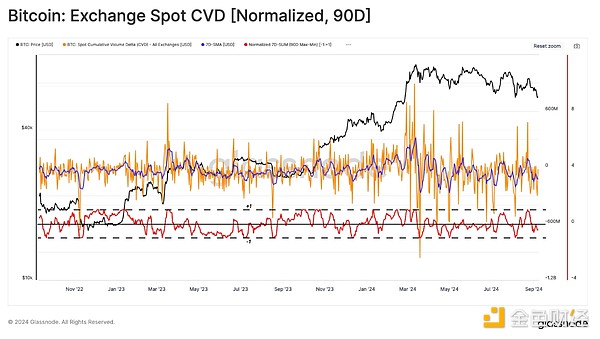

The CVD indicator can estimate the net balance between the current buying and selling pressure in the spot market. Using the same method, we noticed that investors' selling pressure has been increasing over the past 90 days, causing the price trend to tilt downward.

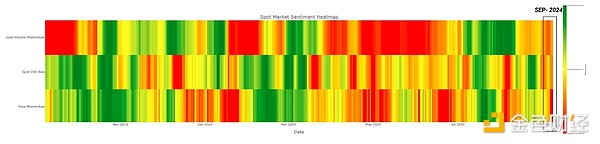

Finally, we can evaluate the momentum of Bitcoin's price. Here we can see a degree of indecision, with both positive and negative data points occurring in August. This is in stark contrast to the two indicators highlighted previously, both of which were clearly negative during the same period. Combining the MinMax transforms of volume, CVD, and price action separately, we are able to generate a sentiment heatmap of feature values between 1 and -1. We can think of this on the following framework:

A value of 1 indicates higher risk (green)

A value of 0 indicates medium risk (yellow)

A value of -1 indicates lower risk (red)

All three indicators suggest that the market is moving into low risk territory relative to the past 90 days of data points. This confluence between the spot indicators discussed can translate into decreasing (spot volume momentum) selling volume (CVD < 0) while price action is slowly declining. This structure could be vulnerable to external forces and could break out on either side if the situation changes.

ETFs

The Ethereum ETF has now been launched in August following the US Bitcoin ETF launched in January. The two events marked a "crossing the Rubicon" event for the digital asset ecosystem, providing the US traditional market with a convenient entry point for exposure to the leading two cryptocurrencies.

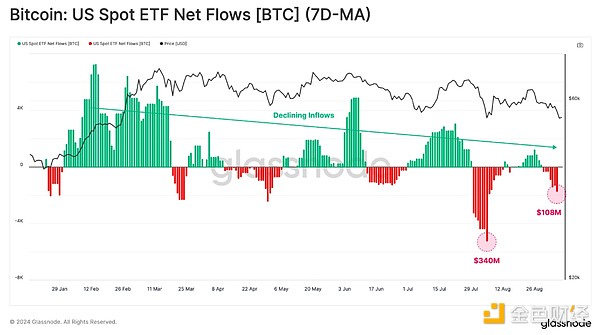

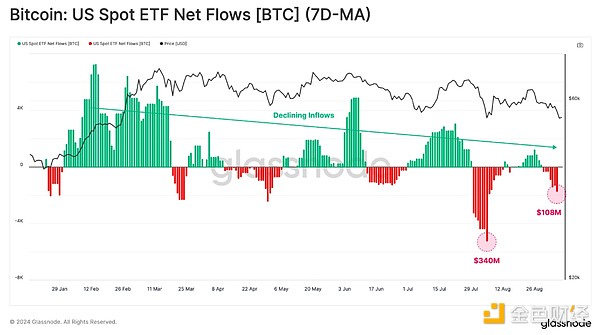

Starting with Bitcoin ETFs, we can see that net capital flows into the U.S. dollar have weakened since August 2024, with outflows currently reported at $107 million per week.

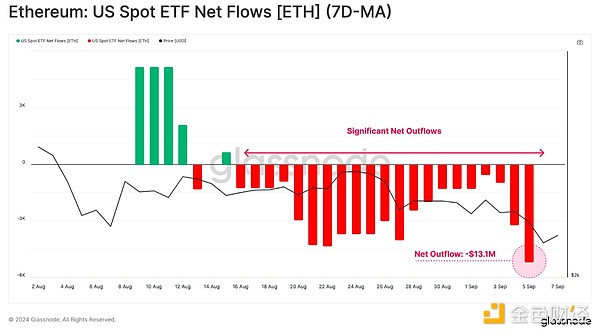

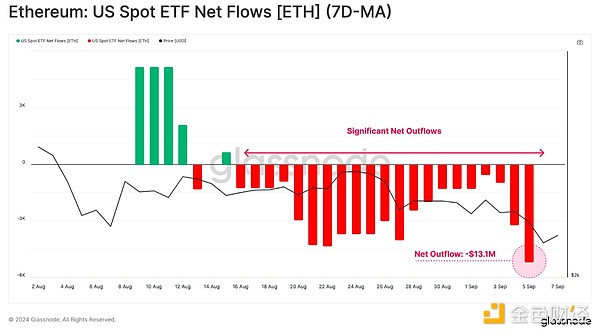

Demand for Ethereum ETFs has been relatively tepid recently, with net negative outflows. This has been driven primarily by redemptions into Grayscale’s ETHE product, which has not been offset by inflows from other instruments.

Overall, Ethereum ETFs saw total outflows of -$13.1 million. This highlights the difference in the scale of demand between BTC and ETH, at least under current market conditions.

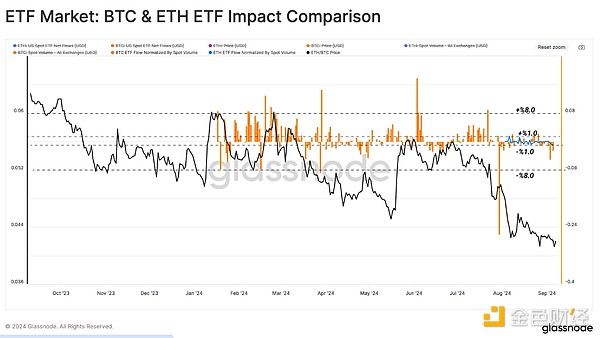

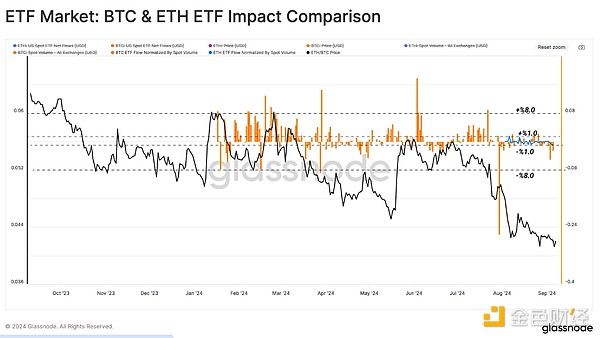

To approximate the impact of ETFs on the Bitcoin and Ethereum markets, we have normalized the ETF net flow deviations by the corresponding spot volume. This ratio allows us to directly compare the relative weights of the ETFs in each market.

As shown in the chart below, the relative impact of the ETF on the Ethereum market is equivalent to ±1% of spot volume, while the Bitcoin ETF is ±8%. This shows that despite normalization, interest in the Bitcoin ETF is still an order of magnitude greater than the Ethereum ETF.

Summary

Miners continue to show great confidence in the Bitcoin network, and despite a significant drop in revenue, the hash rate remains slightly below its all-time high. However, as miners tend to be pro-cyclical, being sellers during dips and holders during rallies, one can expect some degree of seller pressure if further declines occur.

Meanwhile, investor interaction with exchanges continued to decline, with volumes shrinking across the board, suggesting waning investor and trading interest. This was also evident in the institutional space, with both the Bitcoin and Ethereum ETFs seeing net outflows.

Edmund

Edmund