Author: CapitalismLab Source: X, @NintendoDoomed

TIA breaks $20B, and the airdrop expectations for ETH's enhanced version of TIA - Eigenlayer are also very high. The LRT track based on Eigen can achieve double points. This is an opportunity with high certainty. . Here we will bring you the most comprehensive guide to Eigenlayer + LRT airdrops, comprehensively analyzing multiple projects and their high-yield gameplay from liquidity, income, and background. This Tread will be updated for a long time

Too long and don’t want to read? Let’s summarize first:

Principle:

- You can save ETH or LST to Eigenlayer Get points

- LRT means that you deposit ETH or LST into these projects, and they then deposit Eigenlayer, which not only gives you Eigen points, but also their own airdrops It will also be distributed to you to achieve dual mining

- The LRT project will also send LRT tokens to you, so that you can sell and exit at any time like stETH. However, this is currently only supported by some projects

There are currently four main participants, and more are still under development. We will continue to add to this Thread in the future

1. ether_fi

- Moderate scale, good liquidity, low exit loss, already supported unstake, easy entry and exit of large funds

- Good background, Arthur Hayes has invested

- If you participate now, you can receive EigenLayer points and etherfi's own loyalty points, and there are airdrop expectations

- There are advanced ways to expand your income, see below for details

< p style="text-align: left;">- Link: https://app.ether.fi/eeth?address=0x307225Bc52ef0fEDAa67b626996c0E74cEA924Ee

2. ;swellnetworkio

- The largest scale, moderate liquidity, can be exited through swap, exit loss is uncertain

- Good background, some well-known VC investments

- Currently, you can only get swell pearl points by participating. After Eigenlayer opens deposits on January 29, deposit Enter swETH and eigenlayer to get Eigenlayer points

- swell will soon launch LRT's rswETH. You can also participate directly after the launch and double mine. The launch time is uncertain

- There are advanced ways to expand profits, see below for details

- Link: https://app.swellnetwork .io/?ref=0x307225bc52ef0fedaa67b626996c0e74cea924ee

3. KelpDAO

- Moderately sized, LRT has not been released yet and cannot be withdrawn at the moment

- A new project launched by the old project Stader. Stader has been in operation for two years

- Currently, you can only get KelpDAO points by participating. After Eigenlaye opens deposits on January 29, the currently deposited coins will be transferred to Eigenlayer and you will get double points. You can also participate again at that time

- Link: https://kelpdao.xyz/retake/?utm_source=capitalismlab

4. RenzoProtocol

- It is small in scale and cannot be withdrawn at present. It is not suitable for large funds with liquidity needs. You can observe it for a period of time.

- The background is unknown, if anyone knows, please add it in the comments

- Link: https://app.renzoprotocol.com/?ref=0x307225bc52ef0fedaa67b626996c0e74cea924ee

Overall

- In terms of flexibility, etherfi and swell are better. Those who want to get familiar with it are recommended to play ether fi first

- In terms of income, etherfi and renzo can currently be dual mined. , others have to wait until January 29th

- From a background perspective, etherfi, swell and kelpdao are all pretty good

ether_fi

The liquidity, income and background are good. It is suitable for both large funds and people who want to test the waters. After all, if you want to exit, you can have relatively low losses. of exit. Link: https://app.ether.fi/eeth?address=0x307225Bc52ef0fEDAa67b626996c0E74cEA924Ee

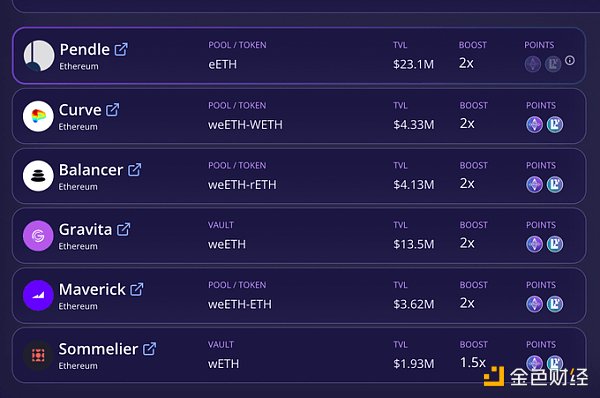

etherfi can earn points by depositing ETH and holding eETH, and the advanced gameplay is currently expanded. There are two ways of income. One is that it gives DeFi LP double the income of loyalty points. It currently supports multiple protocols, has the largest capital capacity, and the one with the highest income should be @pendle_fi

In addition, since Pendle is supported, you can further expand your income by purchasing Pendle's YT. How to play it specifically? To put it simply, if you feel that before June 27, EtherFi's double points income is higher than the implied APY/24.03%, you buy YT You can make money, and 1 eETH points will be given to users who hold 1YT

For the Pendle principle, see: https://twitter.com/NintendoDoomed/status/1637025920102940672

Also recommend @ViNc2453 's tweets https://twitter.com/ViNc2453/status/1745073168220618799

swellnetworkio

Large scale, moderate liquidity, you can swap out, good background, but you can save swell into Eigen on January 29th Double dig. Link:

https://app.swellnetwork.io

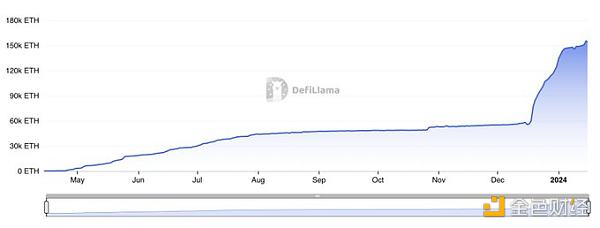

swell was originally doing LST , has grown rapidly after recently joining Eigenlayer, and the team also announced that it will launch LRT-rswETH. Since swETH is already very large, the community has relatively high expectations.

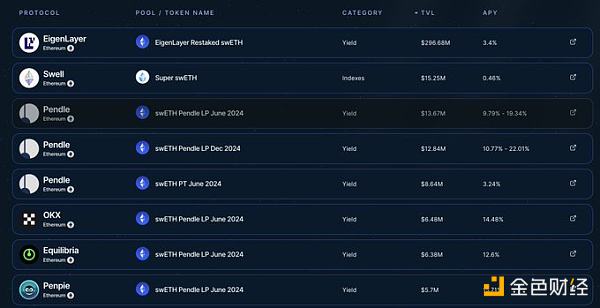

Currently, you can earn points by staking ETH as swETH or holding swETH, but it also supports DeFi to earn higher returns while earning swell points. At present, Eigenlayer and Pendle systems are the mainstream< /p>

Since swell actively participates in the Pendle-based Bribe, it has relatively high volume and income. You can also earn swell points through the Pendle-based bribe. It is recommended to watch the tweets of @ViNc2453 : https://twitter.com/ViNc2453/status/1740281408592228787

swell Here you can consider going to Pendle to mine first, and then withdraw it and deposit it on January 29th Enter Eigenlayer, or wait for January 29th or rswETH

KelpDAO

Background is still there Yes, but you cannot withdraw for the time being, and you can get double points after Eigenlayer opens deposits on January 29th. Link: https://kelpdao.xyz/retake/?utm_source=capitalismlab

KelpDAO currently has not issued LRT tokens, and there is no DeFi to play with. If you really want to earn KelpDAO points, you can first deposit stETH or ETHx and start accumulating KelpDAO points. On January 29, it will be automatically deposited into Eigenlayer to start dual mining.

RenzoProtocol

Small in scale, it is currently impossible to exit, and large funds with liquidity needs cannot It's very suitable. You can observe it for a while. The background is unknown. If anyone knows, please add it in the comments. Link: https://app.renzoprotocol.com/

The advantage is that there are double ezpoints in the early stage. This project requires more dysor. In addition, regarding the background of the project team, I suggest you check the official Twitter to help obtain certain information

General In terms of:

- In terms of flexibility, etherfi and swell are better

- In terms of income Etherfi and renzo are currently available for dual mining, others will have to wait until January 29th

- From a background perspective, etherfi, swell and kelpdao are all pretty good

< p style="text-align: left;">For subsequent updates and new projects, we will continue to update this Thread, and will also consider launching independent Threads for key projects

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Tristan

Tristan Tristan

Tristan Nell

Nell Cointelegraph

Cointelegraph