Author: Eric SJ, Researcher Source: X, @SJ95E

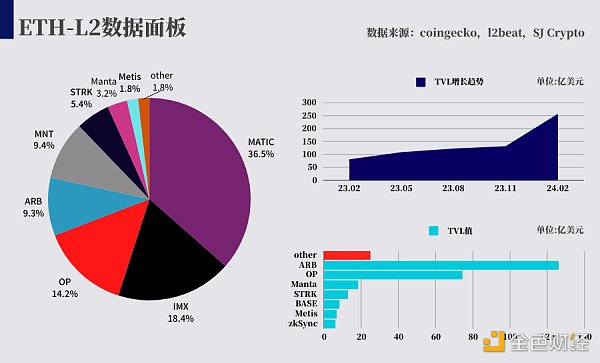

Let me talk about the conclusion first: the financial attention of the sector is constantly diluted, the financial consensus is disordered, and it is difficult to capture high-quality price chips under market sentiment According to public information on the data website, the current market value of ETH L2 is 200 More than 100 million, and this growth trend is believed to remain stable with some future upgrades and adjustments to Ethereum But this growth may not necessarily bring enough Alpha benefits

STRK has recently entered the secondary market. From the perspective of market consensus, views on it are relatively fragmented. Judging from the current #Binance market, the trend is not very in line with emotional expectations. Although I think its long-term The development will have high growth potential, but judging from the sector transition trend from the primary market to the secondary market, there will be enough star L2 logins in the future. Overall, although the total market value will further increase, there is a consensus among the funds within the sector will also be divided.

The phenomenon of "more meat, more wolves" is too vivid to describe the L2 track. Currently, there are 8 well-known L2 tracks on the entire track. Occupying 98% of the share, the remaining part is divided with some L2 coins. One super and many strong ones are not enough to describe this track.

The gradual entry of star L2s later will not only cause a certain diversion of existing projects, but also further squeeze these L2s that have not been paid attention to by the market. Survival space From the user's perspective, if I want to invest in an L2 project in the future, how should I choose to achieve better beta returns? Currently we can only put question marks, and this is the problem: 1. Under normal logic, choosing a small market capitalization does have the potential for high growth, but as I said above, the first few L2s are all strong. The world is terrible. What can I use to fight the small coins in the current sector? And after beating one, there will be another... 2. As for betting on the ones with larger market capitalization, the gap between them is not particularly large, and the market shares are also almost the same, and they can be tied up with a wave of market prices. , how to choose this? 3. Even looking at the growth trend of TVL (a total of more than three times in one year), it is difficult for us to choose now~

Last year , you will not make any mistakes when choosing the leading ARB or OP without thinking. At that time, there were many second-tier options available in the market. Now, from my personal point of view: because I hold OP myself, it is the main choice. One of the positions, plus the price is relatively good, so this part is not moved. The other small positions, some scattered second-tier coins obtained from this and that, will find opportunities to clear them out and collect them. Funding Many friends have asked me to look at various second-tiers before. The recommended fundamentals are all good, but good targets ≠ suitable for buying. Judging from this wave of STRK being launched, the second-tier narratives come one after another. It is difficult for us to be like before. I have picked up high-quality chips at a high price in the secondary market, even if the odds have just been online, this is the first principle for me to bet on the target. L2 in small market capitalization is too difficult to choose, and the Alpha income of star L2 is constantly decreasing as new stars come online and overall expectations decrease

= Just like DEX The track is the same. Due to the homogenization of business models and the competitive environment of the sector, it is difficult for us to really say which DEX is really worth holding for a long time = the current L2 and the L2 sector in the future are in this pattern.

"If it’s hard to choose, don’t choose it, just try another track" (Community @4ceLabs )

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Joy

Joy JinseFinance

JinseFinance Bitcoinist

Bitcoinist cryptopotato

cryptopotato Beincrypto

Beincrypto Ftftx

Ftftx