Author: hamster Source: ChainFeeds Research

The USDe developed by the Ethena team is a synthetic dollar based on Ethereum that uses a Delta Hedging strategy to hedge against market volatility risks and achieve effective use of funds.

The inspiration for the Ethena project came from an article written by BitMEX co-founder Arthur Hayes, which explored the potential and innovative applications of stablecoins in the cryptocurrency market. Arthur Hayes proposed that by combining blockchain technology with complex financial instruments, a new and unique stablecoin could be created that would not only maintain its value but also generate returns for holders. This thinking inspired the Ethena team to develop USDe: a synthetic dollar based on Ethereum that uses a Delta Hedging strategy to hedge against market volatility risks and achieve effective use of funds.

The team and members of Ethena Labs have worked in well-known institutions such as Goldman Sachs, Aave, and Lido, and have the ability to handle complex financial instruments and blockchain technology. In terms of financing, Ethena has successfully raised $20.5 million in funds from major crypto investment funds including DragonFly Capital, Binance Labs, Delphi Digital, and OKX Ventures. The support of these funds and resources has enabled Ethena to grow rapidly and attract a large number of users. It was officially launched in February 2024, but as of now, its market value has exceeded $1.7 billion.

Mechanism Analysis

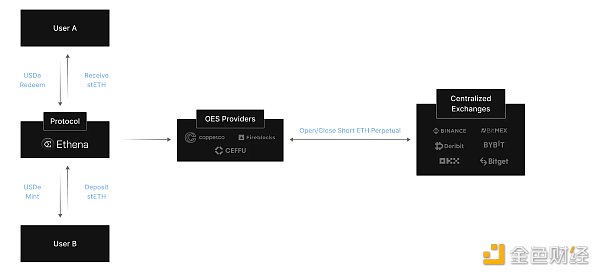

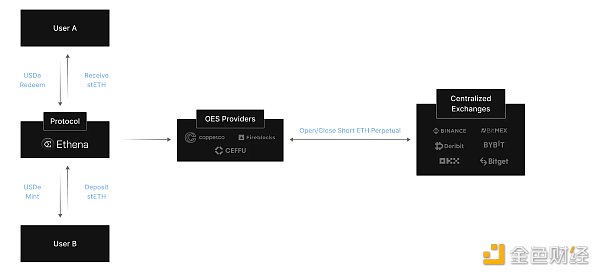

USDe, as a unique financial mechanism product, aims to provide a stable, crypto-native, dollar-denominated capital preservation tool, with the core product being "Internet bonds". This synthetic dollar, USDe, is backed by Ethereum as collateral, ensuring its scalability, decentralization, and resistance to censorship in the traditional financial system. Specifically, if the price of Ethereum falls, USDe's short-term short positions will generate profits, thereby helping to offset the impact of the fall in Ethereum prices on the value of USDe.

Delta Hedging Mechanism: USDe ensures stability through a delta-neutral hedging strategy that involves taking a hedging position in the derivatives market equal to the Ethereum collateral. This strategy helps stabilize the value of USDe and resist the impact of ETH price market fluctuations.

Yield Generation: USDe generates income through two main sources:

Staking Rewards: Rewards derived from staking Ethereum, including consensus layer inflation rewards, execution layer fees, and MEV. These rewards vary with network activity and the amount of ETH staked.

Funding and Basis: Achieved through delta-hedged derivative positions established when USDe is established. Positive funding rates and basis arise from an imbalance in demand for digital asset exposure, which provides additional yield to those holding short positions.

Risk Management: Ethena employs diversified hedging strategies and multiple custody solutions to address operational, market, and smart contract risks.The protocol uses over-the-counter settlement to reduce counterparty risk and improves security and transparency by maintaining on-chain evidence of collateral assets and hedge positions.

Issuance and Redemption: Through direct interaction with Ethena Labs,USDe can be minted or redeemed by users who have passed KYC/KYB audits. This controlled process helps maintain USDe's close peg to the US dollar and adjust the supply when necessary.

USDe is designed with a clear focus on stability and yield generation without relying on traditional banking infrastructure, providing an alternative to the DeFi space. This setup not only promotes the stability of digital currencies, but also provides potential lucrative opportunities for its holders.

In addition, Ethena has introduced the governance token ENA, which aims to further integrate user participation and protocol governance within its DeFi ecosystem. ENA token holders can participate in the governance decisions of the Ethena protocol, such as voting on protocol updates and parameter adjustments. The introduction of ENA not only promotes community participation, but also enhances the decentralization and transparency of the protocol.

Comparison with Luna's mechanism:

The mechanisms of Luna and Ethena are significantly different, and these differences are mainly reflected in the support methods of stablecoins, risk management strategies, and overall design concepts.

Stablecoin Support Mechanism:

Luna: As an algorithmic stablecoin, UST price stability relies on a dynamic exchange mechanism with Luna tokens. When the market price of UST is below $1, users can use Luna to mint UST at a cost below the market price, thereby pushing up the price of UST; conversely, UST is destroyed to obtain Luna to maintain its peg to the US dollar.

Ethena: Unlike UST, USDe is a synthetic dollar backed by physical assets (Ethereum) collateral, using traditional Delta hedging strategies to stabilize value. This means that USDe's stability does not rely on algorithmic adjustments to supply, but is achieved by hedging Ethereum's price fluctuations in the derivatives market.

Risk Management:

Luna: Luna carries a higher risk due to its reliance on algorithms to adjust the stablecoin supply. In the last cycle, this model led to a sharp deterioration in market confidence, which ultimately triggered a "death spiral" in which UST lost its peg and caused Luna's value to plummet.

Ethena: Ethena's USDe uses a Delta hedging strategy to manage risk, hedging against asset price fluctuations by opening an inverse position equal to the collateral asset in the derivatives market. In addition, Ethena also reduces counterparty risk through over-the-counter settlement services, focusing more on physical collateral and regulatory compliance.

Design concept:

Luna: The design pursues complete decentralization and algorithmic autonomous regulation, and attaches importance to the incentive mechanism of network effects and token economy.

Ethena: The design focuses more on stability and security, adopts the hedging strategy in traditional finance, combines the advantages of decentralization and the robustness of traditional finance, and strives to provide a stable and reliable monetary tool in DeFi.

In general, the mechanisms of Luna and Ethena reflect different stablecoin design philosophies and market positioning. Luna emphasizes the role of algorithms and market mechanisms, while Ethena combines the stability management methods of traditional finance to ensure the stability and security of stablecoins through physical collateral and hedging strategies.

Risk Analysis

Although the Ethena project has adopted some innovative stabilization mechanisms in its design, there are still several potential risks:

Market risk and liquidity risk: Ethena depends on the market performance of Ethereum and other crypto assets, which may be subject to price fluctuations. In addition, the effectiveness of financial derivatives and hedging strategies may also be affected by market liquidity, especially when the market fluctuates violently, hedging operations may not be effectively executed.

Technical and operational risks: Although the use of complex financial derivatives and strategies can improve stability, it also increases the complexity of the system. Technical failures, vulnerabilities in smart contracts, or operational errors may lead to losses. In addition, relying on centralized exchanges for certain operations may increase centralization risks, such as security issues or liquidity crises of the exchanges themselves.

Legal and Compliance Risks:As a cryptocurrency project involving financial derivatives, Ethena needs to operate in multiple jurisdictions around the world and needs to comply with the regulatory laws and regulations on cryptocurrencies and financial derivatives in these regions. Changes in legal policies may affect the legality of the project or increase compliance costs.

Reliance on a specific economic model: Ethena's stability depends to a certain extent on the assumptions of its economic model, such as market behavior and user participation. If these assumptions fail to materialize, or if the behavior of market participants does not match expectations, it may affect the performance and value of its stablecoin USDe.

Trust and Acceptance:As an emerging stablecoin project, it is crucial to establish and maintain the trust of users and investors. Any negative reports on the project's reputation or a decline in market confidence may lead to user loss, thereby affecting its market performance and stability.

Summary

Although Ethena's USDe mechanism is designed to provide a more robust stablecoin solution that can avoid the lessons learned from Lnua to a certain extent, it is impossible to completely eliminate risks. For Ethena, the road ahead will be a continuous test of its innovative mechanisms, and it needs to continuously optimize and adjust risk management strategies while remaining flexible to market changes.

In the world of cryptocurrency, no matter how carefully designed the system is, it must be prepared to face unforeseen market turmoil.

JinseFinance

JinseFinance