In the world of blockchain, liquidity is king. Recently, Nervos DAO’s staking tool NervDAO completed its integration with the iCKB protocol. This milestone not only enables Nervos DAO’s depositors to get rid of the minimum 30-day deposit cycle limit, effectively solving the liquidity problem, but also opens the door for users to achieve higher returns through "BTCFi Lego".

This article will provide a detailed introduction to the working principle of the iCKB protocol and its importance in the market.

CKB economic model, Nervos DAO and NervDAO

Before we take a deeper look at the iCKB protocol, let’s briefly review the basics of CKB’s economic model, Nervos DAO and its staking tool NervDAO.

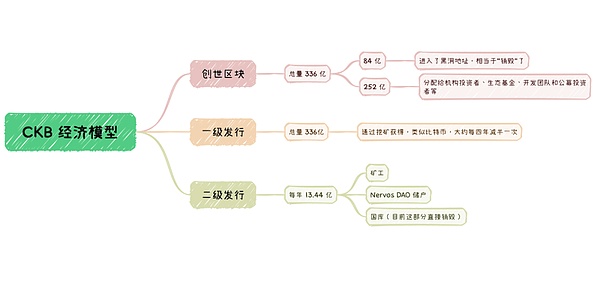

As of December 8, 2024, the total issuance of CKB has reached 46.202 billion, of which 8.133 billion CKB are locked in Nervos DAO. These CKBs mainly come from three channels:

Genesis block: a total of 33.6 billion, of which 8.4 billion entered the black hole address at the beginning of issuance (equivalent to "destruction"), and the remaining 25.2 billion CKBs were mainly distributed to institutional investors, ecological funds, development teams and public investors, etc. These CKBs have time locks, but they have all been unlocked.

Primary issuance (basic issuance): a total of 33.6 billion, all awarded to miners, and its issuance mechanism is similar to Bitcoin, which is halved approximately every four years until all issuance is completed.

Secondary issuance: a fixed issuance of 1.344 billion per year, which is distributed to miners, Nervos DAO depositors, and the treasury in proportion (currently this part is directly destroyed).

For a more detailed introduction to the CKB economic model, please read Understand CKB's economic model and its ingenious design in one article.

Nervos DAO is a smart contract written at the bottom of the system that can automatically allocate CKB's secondary issuance to Nervos DAO's depositors. In other words, if the holder is willing to sacrifice the liquidity of the token and lock CKB in the Nervos DAO contract, he can get compensation from the system, thereby avoiding asset dilution caused by secondary issuance.

NervDAO is the staking tool of Nervos DAO, which aims to provide users with convenient staking and withdrawal services. Compared with other tools that support Nervos DAO staking, such as Neuron Wallet and CKBull Wallet, NervDAO's advantages are mainly reflected in the following two aspects:

Lower operation threshold: Users can operate directly on the web page without downloading additional apps or wallet software, and without synchronizing block data.

Support multi-chain wallet login: Currently, JoyID, MetaMask, OKX Wallet, UniSat, UTXO Global Wallet are supported, and other major ecological wallets including SOL, DOGE and Nostr will be supported in the future.

With NervDAO integrating the iCKB protocol, users can choose the "traditional" Nervos DAO staking method, as well as staking through the iCKB protocol.

Detailed explanation of iCKB protocol

The iCKB protocol was proposed and developed by Phroi, a developer in the Nervos community, to solve the liquidity problem of Nervos DAO deposits: it allows users to deposit and quickly withdraw any amount of CKB at any time.

So, how does the iCKB protocol work?

From the user's perspective, depositing CKB to Nervos DAO through the iCKB protocol only requires one step: convert CKB to iCKB. When withdrawing, you only need to convert iCKB back to CKB. Therefore, we can regard iCKB as a deposit certificate for users who deposit CKB in Nervos DAO.

Currently, 1 CKB can be exchanged for approximately 0.86287995 iCKB, and 1 iCKB can be exchanged for approximately 1.15890975 CKB. CKB deposited in Nervos DAO enjoys compensation for secondary issuance (the current annualized rate of return is approximately 2.26%), so the iCKB representing the deposit certificate will also increase in value over time, that is, the number of CKB exchanged for iCKB will gradually increase over time.

iCKB protocol will decompose users' CKB deposits into two parts: large deposits and small deposits. Each large deposit is equivalent to 100,000 iCKB, and introduce the Market Maker mechanism to solve the liquidity problem of small deposits.

Below, we use an example to illustrate the working principle of iCKB (to simplify the calculation, assume that the exchange rate is 1 CKB = 0.8 iCKB, 1 iCKB = 1.25 CKB):

Suppose Alice has 300,000 CKB in her hand, and she deposits it into Nervos DAO through the iCKB protocol. The iCKB protocol will decompose these 300,000 CKB into: 125,000 CKB + 125,000 CKB + 50,000 CKB. Among them, 125,000 CKB is exactly equivalent to 100,000 iCKB. This part of CKB will be deposited in Nervos DAO (that is, 2 copies of 125,000 CKB each) and the remaining 50,000 CKB will be placed and taken by Maket Maker. Finally, Alice will receive 240,000 iCKB.

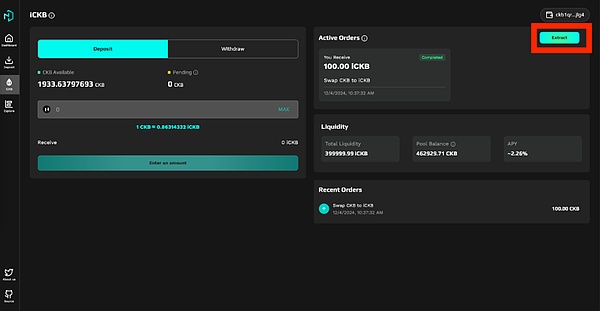

It should be noted here that the 240,000 iCKB will be temporarily in the state of on-chain contract custody. If you want to return it to Alice's wallet immediately, Alice needs to initiate an "Extract" operation; if you do not initiate the "Extract" operation, the next time Alice deposits CKB in exchange for iCKB or uses iCKB to exchange CKB, the 240,000 iCKB will also be automatically released from custody and returned to Alice's wallet. iCKB in custody cannot be directly exchanged for CKB, nor can it be directly transferred to other wallets or participate in BTCFi.

A few days later, Alice decided to exchange back to CKB. For the convenience of calculation, we assume that the exchange rate remains unchanged. After the iCKB protocol receives Alice's 240,000 iCKB, it will be decomposed into: 100,000 iCKB + 100,000 iCKB + 40,000 iCKB. Among them, the two 100,000 iCKB will be destroyed, and iCKB will select 2 deposits from Nervos DAO that can be withdrawn the fastest and withdraw them. After the remaining 40,000 iCKB is placed, it will be taken by Maket Maker. Finally, Alice will receive 300,000 CKB (same as above, these CKB are also in the on-chain contract custody state, and can be returned to the wallet immediately through the "Extract" operation, or automatically released and returned to the wallet at the next exchange).

Through this example, we can clearly see how iCKB effectively solves the liquidity problem of Nervos DAO deposits: The liquidity of large deposits is achieved by aggregating deposits from other users, while the liquidity of small deposits is guaranteed by Market Maker. It should be noted here that anyone can become a Market Maker under the iCKB protocol, and its main income comes from the service fees paid by users.

The far-reaching impact of the iCKB protocol

The "traditional" Nervos DAO staking method has two major limitations:

Amount limit: minimum deposit of 102 CKB (excluding mining fees).

Time limit (liquidity issue): There is a minimum deposit period of about 30 days, and withdrawals are also affected by the compensation cycle (that is, after initiating a withdrawal transaction, it may not be possible to withdraw immediately).

The iCKB protocol, through its clever design, allows users to deposit and quickly withdraw any amount of CKB at any time, successfully resolving the amount and time limits of the "traditional" Nervos DAO staking method, and greatly improving the liquidity of Nervos DAO deposits.

In addition, iCKB tokens are also RGB++ assets, which means that iCKB holders can not only obtain interest from Nervos DAO, but also participate in various BTCFi applications to gain more benefits. For example, iCKB holders can build a pool on UTXOSwap and become a liquidity provider (LP) to earn transaction fees. The next step for the RGB++ protocol is to expand to DOGE, and in the future it will expand to other UTXO chains. Through RGB++'s Leap bridgeless cross-chain technology, iCKB can be safely transferred to UTXO chains such as DOGE and participate in the ecosystem on these chains.

Not only that, after CKB's lightning network Fiber Network mainnet is launched, iCKB can also enter the lightning network and enjoy the low cost, high privacy, and instant confirmation transaction advantages brought by the lightning network.

Operation Guide

The NervDAO website provides 2 staking methods: one is the "traditional" staking method, which is operated on the Deposit page of the NervDAO website; the other is staking through iCKB, which is operated on the iCKB page of the website. These two staking methods are independent of each other.

As mentioned above, to deposit CKB into Nervos DAO through the iCKB protocol, users only need to do one simple step: convert CKB to iCKB. To withdraw the corresponding CKB, just convert iCKB to CKB. The specific steps are as follows:

Deposit

1. Open the NervDAO website (https://www.nervdao.com/) and connect your wallet (JoyID, MetaMask, OKX Wallet, UniSat, UTXO Global Wallet are currently supported).

2. Click iCKB in the left navigation bar, select "Deposit", enter the amount of CKB you want to deposit, then click the "Swap" button and sign in your wallet to confirm.

3. Wait for about 90 seconds for confirmation. When the order in "Active Orders" is displayed as "Completed", it means that the on-chain operation has been completed.

4. At this time, your iCKB will be in the on-chain contract custody state. If you need to withdraw, click "Extract" and sign and confirm in the wallet; if you do not withdraw, the next time you deposit CKB in exchange for iCKB or exchange iCKB for CKB, this part of iCKB will also be automatically released from custody and returned to your wallet. Whether or not to perform the "Extract" operation will not affect the interest of Nervos DAO. The only difference is that these iCKBs in custody cannot be directly exchanged back to CKB, nor can they be directly transferred to other wallets or participate in BTCFi.

Withdraw

1. Open the NervDAO website and connect your wallet.

2. On the iCKB page, select "Withdraw", enter the number of iCKBs you want to exchange, then click the "Withdraw" button and sign in the wallet to confirm (if you need to exchange all iCKBs, and there are iCKBs in the "Active Orders" that are managed by the on-chain contract, you must first retrieve all iCKBs through the "Extract" operation).

3. Wait for the transaction confirmation on the chain. When the order in "Active Orders" is displayed as "Completed", it means that the on-chain operation has been completed. As above, these CKBs are also in the on-chain contract custody state. They can be returned to the wallet immediately through the "Extract" operation, or they can be automatically released from custody and returned to the wallet at the next exchange.

Conclusion

The launch of the iCKB protocol marks a major advancement in the Nervos DAO staking tool, which not only solves the liquidity problem for users, but also provides them with more flexible investment options and income methods. Through iCKB, users can fully enjoy the opportunities and value brought by Nervos DAO and the entire BTCFi ecosystem.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cointelegraph

Cointelegraph Future

Future Cointelegraph

Cointelegraph