Stablecoins are a hot topic right now, not only in the tech, finance, and economics sectors, but also in major social news, communities, and social media platforms, with related content making headlines. There's a wealth of popular science content, interpretations, and perspectives on stablecoins, and the buzz is diverse and lively. This article will provide you with knowledge and perspectives on stablecoins from a different perspective.

1. International experts, celebrities and executives’ comments on stablecoins

The following are the latest remarks or opinions on stablecoins by some international experts, celebrities and executives:

1. On the growth and potential of the stablecoin market

• Gautam Chhugani (Bernstein analyst): “We expect major global financial and consumer platforms to issue co-branded stablecoins to enable value exchange on their platforms.” According to a Bernstein research report, the stablecoin market is expected to grow from the current US$125 billion to US$2.8 trillion in the next five years. • Noelle Acheson (corresponding author of Crypto Is Macro Now): “The demand growth trend is upward, which is bullish for crypto assets as it indicates increasing investor interest.” She also pointed out that although the total market capitalization of stablecoins is still lower than the level earlier this year, the growth trend indicates that the market is recovering. 2. Regulatory challenges and compliance of stablecoins • Lael Brainard (Federal Reserve Governor): “The widespread adoption of stablecoins may pose risks to financial stability, and regulators need to ensure that the issuance and use of stablecoins are consistent with the existing financial regulatory framework.” She emphasized the importance of proper regulation of stablecoins to prevent them from being used for illicit financial activities. • Anneke Kosse (BIS Economist): “The regulatory framework for stablecoins needs to be coordinated globally to avoid regulatory arbitrage and financial instability.” She pointed out that the cross-border use of stablecoins requires regulators in various countries to strengthen cooperation and jointly develop regulatory standards. 3. About the Technology and Innovation of Stablecoins • Nick Cafaro (CEO of Polymesh): “The development of stablecoins will promote the widespread application of blockchain technology in the financial field, especially in cross-border payments and supply chain finance.” He believes that the combination of the stablecoin’s stabilization mechanism and the decentralized nature of blockchain will bring greater efficiency and transparency to the global financial market.

• Mark Connors (CEO of 3iQ): “The innovation of algorithmic stablecoins provides new ideas for addressing the limitations of traditional stablecoins, but it also brings new risks and challenges.” He emphasized the need for in-depth research and testing of algorithmic stablecoins to ensure their stability in market fluctuations.

4. On the market dynamics and competition of stablecoins

• Garth Baughman (Federal Reserve economist): “The competitive landscape of the stablecoin market is changing. The market share of some large stablecoins such as USDT has increased, while some other stablecoins are facing challenges.” He pointed out that competition in the stablecoin market will affect its future development and market acceptance.

• Krisztian Sandor (CoinDesk market reporter): "The supply of Tether (USDT) continued to grow in 2023, showing an increase in market demand for it. However, the market share of other stablecoins such as USDC and BUSD has declined, which shows that the stablecoin market is still evolving."

5. On the international impact and cooperation of stablecoins

• Facklmann, Juliana (Professor at the University of São Paulo, Brazil): "The emergence of stablecoins provides emerging market countries with a new cross-border payment solution, which helps to reduce transaction costs and improve the efficiency of capital flow." She also pointed out that the international use of stablecoins requires countries to strengthen monetary policy coordination and regulatory cooperation.

• Camila Villard Duran (Professor at the University of São Paulo, Brazil): “The development of stablecoins will have a profound impact on the global financial system, especially in cross-border payments and international settlements. Central banks and regulators need to work together to explore how to use stablecoins to promote financial stability and economic development.”

6. On the risks and challenges of stablecoins

• Briola, Antonio (Professor at University College London): “The failure of stablecoins, such as the Terra-Luna incident, reminds us that the design and operation of stablecoins need to carefully consider risk control and market stability.” He emphasized the importance of stress testing and risk assessment of stablecoins to prevent similar incidents from happening again.

• Jacob Gerszten (Federal Reserve economist): "The widespread use of stablecoins may pose competitive pressure on the traditional banking system, and regulators need to pay close attention to their impact on financial stability." He also pointed out that the decentralized nature of stablecoins may bring new regulatory challenges and corresponding regulatory policies need to be formulated.

II. Three Major Theories of Stablecoins

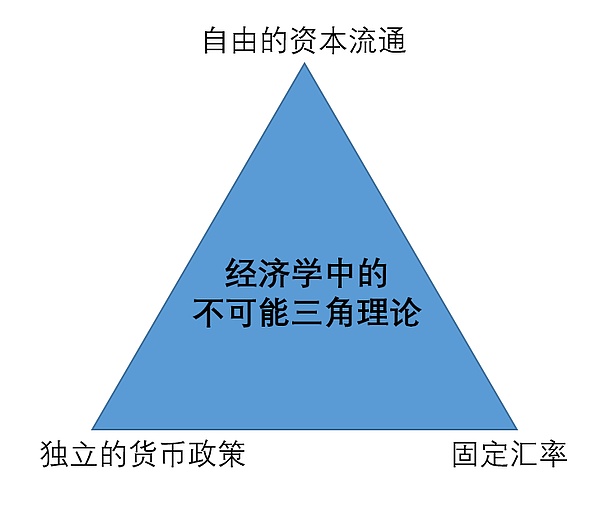

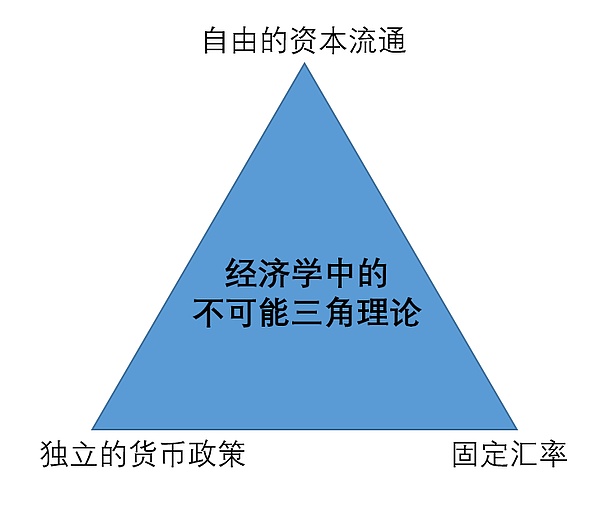

1. The "Impossible Trinity" Theory in Economics

Nobel Prize winner in Economics and renowned American Jewish economist Paul Robin Krugman proposed the "Impossible Trinity" theory, which states that a country cannot simultaneously achieve free capital flows, independent monetary policy, and exchange rate stability. In other words, a country can only have two of these, not all three. If a country wants to allow capital flows and maintain an independent monetary policy, it will find it difficult to maintain a stable exchange rate. If exchange rate stability and capital mobility are required, independent monetary policy must be abandoned. A crucial question is whether stablecoins (cryptocurrencies) can form a useful monetary/capital market, a monetary/capital tool, or a monetary/capital application for governments. If stablecoins (cryptocurrencies) can overcome this impossible triangle or prove useful to sovereign states, they may be accepted.

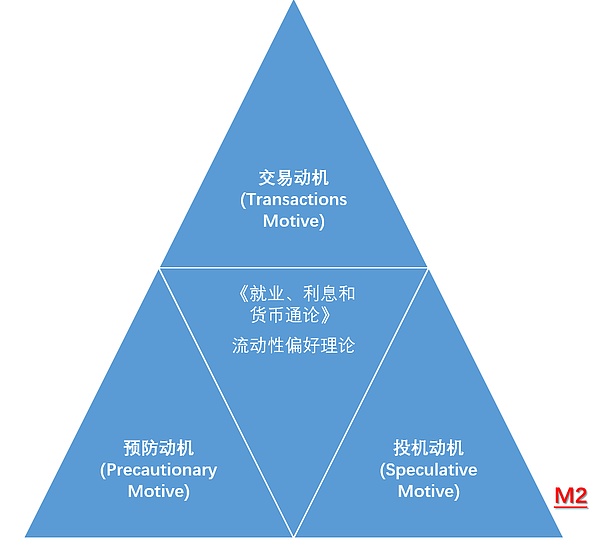

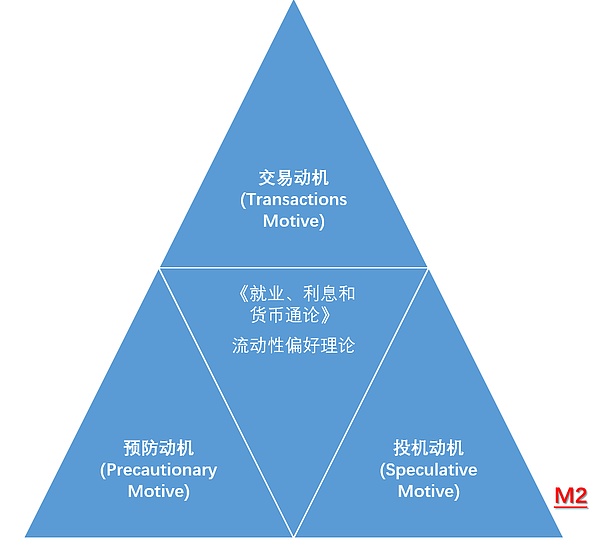

2. Keynes's theory of money demand

Keynes believed that the total society's money demand (M) is the sum of the money demand to satisfy the three motives on the right, that is, M=M1+M2=L1(Y)+L2(R)This formula clearly shows that money demand is not only a function of income, but also a function of interest rate. In particular, interest rate regulates total money demand by affecting speculative demand.

It can be seen that stablecoins, in addition to transactional motives, are now (or already have) speculative and precautionary motives.

3. Stablecoins—The First Killer App of Cryptocurrency Has Finally Been

Originally intended to facilitate buying and selling in the crypto world, stablecoins have grown into the "preferred" tool and means for cross-border payments.

The high volatility of cryptocurrencies makes their everyday applications for "payments and transactions" difficult to implement—merchants accepting Bitcoin may wake up to find a 10% decrease in payment; and investors seeking short-term risk hedging also lack a "safe haven." Stablecoins emerged as a response to this need. The crypto world now has a "stable unit of account," facilitating transactions and transfers, and allowing crypto finance to take its first step toward practical application. Stablecoins have now triggered a "catfish effect," which central banks around the world must confront and seek innovation. III. Five Common Sense About Stablecoins Most articles about stablecoins explain USDT and USDC. I originally didn't want to introduce them, but since this might be your first time exploring stablecoins, we'll just provide a brief introduction. USDT was launched by Tether in 2014 to provide a stable store of value and medium of exchange in the cryptocurrency market, addressing the excessive price volatility of cryptocurrencies like Bitcoin. As one of the earliest stablecoins, it quickly became the most commonly used stablecoin in cryptocurrency trading thanks to its first-mover advantage and widespread market acceptance. USDC was jointly launched by Circle and Coinbase in 2018 to provide a more transparent and compliant stablecoin to address USDT's reserve transparency issues. Circle has made extensive efforts in compliance, including obtaining relevant licenses in multiple countries and regions. USDC also became the first stablecoin issuer in Europe to meet MiCA standards. 1. Birth: Designed to Address Cryptocurrency Pain Points Cryptocurrencies' high volatility hinders their practical application for everyday transactions and payments. Merchants accepting Bitcoin might find their payments down 10% in the blink of an eye. Investors seeking short-term risk havens lack a safe haven. Stablecoins emerged to address this need. These stablecoins are anchored to fiat currencies (such as the US dollar and euro) or other assets (gold and cryptocurrencies), using algorithms and collateral to keep price fluctuations within manageable limits. For example, USDT and USDC were initially designed to provide a stable unit of account in the crypto world, facilitating transactions and transfers and enabling crypto finance to take its first step toward practical application. 2. Definition of Stablecoins: A stablecoin is a digital currency designed to maintain a stable value. Unlike cryptocurrencies like Bitcoin, the value of a stablecoin is typically pegged to a fiat currency (such as the US dollar) or other stable assets. This peg reduces price volatility, making it more suitable for everyday transactions and payments. 3. Core Uses of Stablecoins: More Than Just a Safe Haven: Stablecoins initially served a simple purpose of facilitating cryptocurrency transactions. However, today, their applications have expanded significantly. "Stable Anchor" for Crypto Trading Pairs: The base currency pair of a trading venue (BTC/USDT, ETH/USDC). Volatility Avoidance: A safe haven during market fluctuations. DeFi Cornerstone: Collateral/debt unit for lending protocols, the basis for trading pairs on decentralized exchanges, and the primary target asset for yield farming. Cross-border Payments and Remittances: Fast and with lower fees than traditional channels. Daily settlement/payroll: Applications in supporting the crypto payment ecosystem (but unclear regulation is an obstacle). Serving as a “bridge”/“transfer station” for fiat currency to and from the crypto world: A key entry and exit point for exchanges. 4. Classification of Stablecoins A. Fiat-Collateralized: The mainstream choice, transparency is key Mechanism: The issuer holds sufficient fiat currency reserves (such as US dollars, euros) or highly liquid cash equivalents (such as short-term US Treasury bonds) to support the value of the stablecoin in circulation (1:1 anchoring). Representatives: USDT (Tether), USDC (Circle), BUSD (Paxos/Binance), TUSD (TrustToken). · Core Advantages: o Easy to Understand: The principles are clear and the anchoring is intuitive. o High Theoretical Stability: With sufficient collateral, the value proposition is strongly supported. · Core Challenges and Controversies: o Audit and Transparency: Of paramount importance! Investors rely on the issuer's audit report (or on-chain proof) to verify the authenticity, adequacy, and security of the reserve assets (e.g., whether they include risky assets like commercial paper). USDT has been criticized for its lack of transparency. USDC has a good reputation for reserve transparency and its asset allocation primarily based on US Treasuries and cash. o Centralization Risk: The issuer controls a large reserve asset, acting as a centralized trust node. This can lead to asset freezes, account suspensions, and operational risks. Regulatory pressure is concentrated on this type of stablecoin. o Banking System Risk: Fiat currency reserves rely on the traditional banking system and custodians. B. Crypto-Collateralized: Decentralized Belief, Complex but Innovative · Mechanism: Users deposit excess digital assets (primarily ETH, WBTC, etc.) as collateral (the collateralization ratio is usually >150%), and the system mints stablecoins (such as DAI) based on this collateral. · Representative: DAI (MakerDAO) (the most successful representative). · Core Advantages: o Decentralization: Rules for staking, minting, and liquidation are determined by smart contracts and decentralized organizations (DAOs), freeing them from the control of a single entity and offering greater censorship resistance. o Transparency: Collateral assets are typically locked in public smart contracts and traceable on the blockchain. o No traditional bank account required: More suitable for a purely on-chain environment. · Core Challenges: o Complexity: Multiple factors, including collateralization ratios, liquidation thresholds, stability fees, governance token voting, and oracle price feeds, create a high barrier to entry for user experience. o Volatility Risk: Collateral assets are inherently volatile. If the price of ETH plummets too quickly, the value of collateral may be insufficient (below the liquidation threshold), triggering large-scale liquidations and exacerbating market declines (requiring a robust liquidation mechanism and oracle support). o Collateralization Efficiency: Requires a large amount of locked-up, high-value crypto assets as backing, resulting in lower capital efficiency than fiat-collateralized currencies. Decoupling pressure may persist in extreme market conditions. C. Algorithmic Stablecoins: Once the "holy grail," they present both risks and opportunities. · Mechanism: No physical collateral. Relying on algorithms (on-chain smart contracts) and market supply and demand mechanisms (often combined with a "dual-currency model") to regulate money supply and anchor prices. · Representatives: Terra's UST (collapsed), the existing Frax (partially algorithmic), and USDD (fractional reserve + partially algorithmic). Purely algorithmic stablecoins are relatively rare. Ideal Goals: o Complete decentralization: No reliance on fiat currency, physical assets, or crypto assets for collateral. o Higher capital efficiency: Theoretically, no large capital deposits are required. · Harsh Reality and Significant Risks: o Death Spiral Risk: The most fatal weakness! When the price falls below the anchor (e.g., $1), the algorithmic design often requires the destruction of stablecoins (shrinking the supply) to boost the price. This is often achieved by incentivizing users to burn stablecoins in exchange for higher-value governance tokens (e.g., UST for LUNA). Once market confidence collapses and stablecoins are sold off en masse, the price of governance tokens may plummet due to the issuance of new governance tokens (users burning stablecoins receive more newly minted governance tokens). The plummeting value of governance tokens, in turn, completely destroys the value support of the stablecoin, creating a "death spiral." The collapse of UST is a textbook example of this risk. o Over-reliance on market psychology: Price stability is entirely premised on participants' sustained confidence in the mechanism and their willingness to engage in arbitrage. When confidence collapses, the mechanism is easily ineffective. o Design Complexity: The model is difficult to perfectly design and maintain over the long term. Current Trend: Purely algorithmic stablecoins have largely lost market trust following the collapse of UST. The mainstream is a hybrid model combining partial collateralization with partial algorithmic support (such as Frax) to increase underlying credit support. D. Commodity-collateralized: Niche but unique Mechanism: Anchored to the value of physical commodities such as gold, silver, and oil.

· Representative: PAX Gold (PAXG) (pegged to 1 troy ounce of physical gold).

· Value: Providing the crypto market with access to real asset prices, an alternative to combating fiat currency inflation.

· Challenges: Physical assets present significant challenges in terms of custody, auditing, and liquidity, and their market size is far smaller than that of fiat-collateralized assets. E. Innovative Stablecoins: Combining with CBDCs · Mechanism: In the future, they may be integrated with CBDCs to serve as a "complement" to central bank digital currencies. · Representative: None at this time. · Principle: Central banks around the world are developing CBDCs (digital RMB, digital dollar, etc.). Stablecoins may work in tandem with CBDCs—for example, using stablecoins as a "cross-border settlement layer" and CBDCs as a "domestic legal tender layer." Alternatively, CBDCs and stablecoins may be integrated. This, of course, requires careful consideration of many details. 5. Risks and Controversies: Hidden Concerns The center of the regulatory storm: This is the primary focus of global regulators. Concerns include threats to fiat currency sovereignty, potential financial stability risks (especially at large scale, such as USDT), inadequate investor protection, anti-money laundering (AML)/counter-terrorist financing (CFT) compliance, and insufficient reserve asset quality and transparency. Anti-Money Laundering/Counter-Terrorist Financing (AML/CFT): Anonymity may be abused. User Protection: Risk of issuer bankruptcy or absconding. Monetary Policy Challenges:

Massive adoption could weaken central banks' regulatory capabilities (e.g., digital dollars replacing national currencies).

Financial Stability:

Potential impact on payment systems and capital markets. Countries are accelerating legislation (e.g., the EU's MiCA framework, US legislative proposals).

Operational Risks (primarily for fiat-collateralized):

Issuer bankruptcy, fraud, hacker attacks on reserve accounts/custodian banks, compliance failures leading to service interruptions or asset freezes.

Unpegging Risk (Core Challenge):

Any type of risk could occur! Fiat-based (insufficient reserves/bank runs), crypto-asset-based (collateral price collapse/liquidation failures), and algorithmic (death spirals/collapse of confidence) risks can all temporarily or permanently deviate from the $1 peg (e.g., the collapse of UST and the brief drop of USDC to $0.87 due to the Silicon Valley Bank incident). Systemic Risk: A collapse or serious issue with a major stablecoin (such as USDT) would have a catastrophic knock-on effect on the entire cryptocurrency market (especially DeFi, which relies heavily on it). Transparency Gap (especially for fiat-collateralized stablecoins): The authenticity, frequency, and depth of proof of reserves remain key pain points. Investors should pay close attention to the transparency reports of leading stablecoin issuers.

Four. Nine core viewpoints

The following are nine in-depth viewpoints based on the latest development trends, regulatory dynamics and technological evolution of global stablecoins, which are comprehensively refined based on policy documents, market data and academic research. Each viewpoint is accompanied by core evidence and forward-looking analysis:

1. Stablecoins have become the "digital weapons" of financial games among major powers

Viewpoint: US dollar stablecoins (such as USDT and USDC) are essentially an on-chain extension of the US dollar hegemony, binding global liquidity through forced US debt reserves. Evidence: The US GENIUS Act requires payment stablecoins to be 100% allocated to cash, deposits, or short-term US Treasury bonds, forming a closed loop of "global currency purchases → capital repatriation to US Treasury bonds"; Citigroup predicts that the scale of stablecoins will reach US$3.7 trillion in 2030. If all of them are anchored to US Treasury bonds, it will become the largest holder of US Treasury bonds. 2. Offshore RMB stablecoins will reshape the cross-border payment system. Viewpoint: Hong Kong's pilot RMB stablecoin (CNH) is China's core strategy to break through the SWIFT blockade and open up a new path for RMB internationalization.

Evidence: The Hong Kong Stablecoin Ordinance has come into effect, allowing licensed institutions to issue offshore RMB stablecoins. Standard Chartered and JD.com have entered the HKMA's sandbox testing;

If the CNH stablecoin is implemented, it can build a cross-border payment channel independent of SWIFT, supplement the CIPS system, and reduce the exchange costs of "Belt and Road" countries by 90%.

3. The "stablecoinization" of emerging markets accelerates the contradiction of de-dollarization

Viewpoint: People in countries with high inflation spontaneously adopt stablecoins as "digital dollars", but this exacerbates the local currency sovereignty crisis. Evidence: Argentina's annual inflation rate exceeded 200%, and 40% of savings were converted to USDT; Nigeria received over $59 billion in cryptocurrency annually, and 43% of African on-chain transactions involved stablecoins; Although central banks in countries such as Turkey and Lebanon have banned stablecoins, their over-the-counter (OTC) P2P trading volume has increased by 300% annually. 4. RWA (real-world assets) have become a new anchoring paradigm for stablecoins. Viewpoint: As a carrier of value, stablecoins are accelerating the tokenization of traditional assets (such as US bonds and funds). For example, BlackRock has launched a tokenized U.S. Treasury bond fund, and Circle's USDC is used for on-chain asset settlement, promoting the "programmability" of financial markets. Supporting documentation: Global tokenized assets are expected to exceed $1 trillion by 2025, with stablecoins accounting for over 70%. Hong Kong's Stablecoin Ordinance allows commercial banks to issue stablecoins, supporting the use of tokenized assets in cross-border payments. BlackRock and Fidelity have launched tokenized funds (such as BUIDL) using U.S. Treasury bonds as underlying assets and allowing stablecoins as a medium for subscription and redemption. MakerDAO has allocated over $3 billion in reserves to U.S. Treasury bonds and corporate bonds, and its DAI has become the benchmark for stablecoin asset settlement. 5. Regulatory arbitrage fuels competition among offshore stablecoin hubs. Viewpoint: Hong Kong, Singapore, and the UAE are competing for stablecoin issuers with differentiated licensing systems, creating a new landscape of regulatory competition and collaboration in Asia. Evidence: Hong Kong requires issuers to have a paid-in capital of HK$25 million and 100% segregated reserves, while Singapore's sandbox allows for flexible capital for trial runs. JD.com plans to issue a HKD/USD stablecoin in Hong Kong, aiming to reduce cross-border payment costs by 90%, while Singapore has attracted Circle to establish its Asian headquarters. 6. Algorithmic Stablecoins Enter the "Fractional Reserve + Enhanced Token Economics" 2.0 Era Viewpoint: After the collapse of UST, a new generation of algorithmic stablecoins integrates over-collateralization and gaming mechanisms to avoid a death spiral. Evidence: Ethena Labs' USDe uses a dual model of "ETH staking income + perpetual contract hedging," and its market capitalization has grown from 146 million to 6.2 billion US dollars in one year (according to online data); Frax Finance v3 introduces a fractional fiat reserve + protocol-controlled value (PCV) mechanism, reducing decoupling risk by 80% compared to UST. 7. CBDC and stablecoins move from confrontation to "regulatory complementarity" Viewpoint: Sovereign digital currencies (such as the digital RMB) will be interconnected with compliant stablecoins to form a dual-track payment network. Evidence: The People's Bank of China has established a digital RMB international operations center to explore cross-chain exchange with Hong Kong stablecoins; The EU MiCA framework requires stablecoin issuers to deposit deposits with the central bank, reserving a channel for CBDC access. 8. Enterprise-grade stablecoins reshape global supply chain finance Viewpoint: Multinational corporations use stablecoins to replace traditional letters of credit for settlement, achieving instantaneous payment and a cost revolution. Evidence: Global manufacturing leaders use stablecoins to pay suppliers, reducing settlement time from 3 days to 5 minutes and saving 1.2% in fees per transaction; Amazon and Shopify support merchants accepting USDC payments, and PayPal's PYUSD covers 2 million merchants. 9. Compliant Stablecoin Licenses Become the "Lifeline" of Fintech Companies Viewpoint: Whether or not a company can obtain a license in a major jurisdiction determines whether it can participate in the trillion-dollar stablecoin ecosystem. Evidence: Only five institutions (including ZhongAn Bank and Standard Chartered) were selected for the first batch of Hong Kong's sandbox, while JD.com, Xiao Commodity City, and others are vying for licenses in the second batch; The US GENIUS Act requires stablecoin issuers to hold a national banking license, prompting Goldman Sachs and JPMorgan Chase to accelerate their deployment. V. Six Potential Future Development Trends 1. Stablecoins are Reshaping the Global Payment System and Becoming Core Infrastructure for the Digital Economy Stablecoins leverage blockchain technology to enable real-time cross-border payments (within minutes) and dramatically reduce costs (with fees as low as 1/10 to 1/100 of traditional wire transfers). They have become a core bridge connecting traditional finance and the crypto world. For example, USDT is widely used for import payments and savings in countries with high inflation, such as Argentina and Nigeria. JD.com's Hong Kong dollar stablecoin has been integrated into Southeast Asian e-commerce platforms, boosting regional trade efficiency. 2. Under the wave of regulatory compliance, stablecoins will enter a new era of competition among sovereign currencies. Countries are strengthening regulation of stablecoins through legislation to safeguard monetary sovereignty and financial stability. For example, the US GENIUS Act requires stablecoins to be 100% backed by highly liquid US dollar assets and prohibits the unauthorized circulation of offshore stablecoins. The EU has implemented the MiCA framework to limit the scale of non-euro stablecoin transactions. Hong Kong, China, is balancing innovation and risk through a licensing system and exploring pilot programs for offshore RMB stablecoins. 3. Stablecoins will become a key tool for inclusive finance, bridging the global financial divide. In regions like Africa and Southeast Asia where traditional financial services are underserved, stablecoins, with their low barriers to entry and low costs, have become an alternative for cross-border remittances and savings. For example, Nigeria receives over $59 billion in cryptocurrency annually, and 43% of African on-chain transactions involve stablecoins. 4. The geopolitical game of stablecoins will reshape the international monetary power structure. The dominance of US dollar-denominated stablecoins (85% of the market) reinforces the dollar's hegemony. However, China, the EU, and other countries are exploring the path to currency internationalization through stablecoin pilots. For example, Hong Kong's offshore RMB stablecoin could become a new tool for trade settlement within the Belt and Road Initiative, challenging the dollar's monopoly. 5. Integration with CBDC: Complementing Central Bank Digital Currency Central banks around the world are developing CBDCs (digital RMB, digital dollar, etc.). Stablecoins may work in synergy with CBDCs—for example, using stablecoins as a "cross-border settlement layer" and CBDCs as a "domestic legal tender layer," complementing each other's strengths. While China is exploring the digital RMB, it is also studying a "stablecoin regulatory sandbox," which may lead to the formation of a "legal digital currency + compliant stablecoin" ecosystem in the future. 6. Decentralization: Purer “Crypto-Native Stablecoins” The crypto community pursues decentralization. In the future, there may be more sophisticated algorithmic stablecoins and over-collateralized stablecoins to address vulnerabilities in the existing model. For example, they could introduce multi-asset collateralization, dynamically adjust the collateralization ratio, and even combine AI algorithms to predict market fluctuations, making stablecoins truly “decentralized and stable.” VI. Conclusion Stablecoins are a remarkable attempt at "value stability" in the crypto world. They bridge the volatile crypto assets with real-world finance, fueling the boom of DeFi. However, they also expose the risks and regulatory challenges of crypto finance. As digital currencies designed to maintain stable value, stablecoins have broad application prospects and hold significant value in areas such as cross-border payments, supply chain finance, and decentralized finance. However, the development of stablecoins also faces regulatory challenges in areas such as anti-money laundering, consumer protection, and financial stability. Will they become a "new tool" for compliant finance, or continue to "innovate" on the fringes of regulation? Regardless, every step forward in the development of stablecoins is reshaping our understanding of "money and finance"—perhaps this is the most fascinating aspect of the crypto world: the constant search for "stability" amidst the unknown, the building of order amidst chaos. As a crucial bridge connecting the crypto world and traditional finance, stablecoins possess undeniable value and potential. They have fostered efficient global payments and open financial innovation (DeFi), demonstrating the power of technology to reshape finance. However, the resulting trust crisis, regulatory challenges, and potential systemic risks hang like a sword of Damocles. The future of stablecoins will inevitably involve striking a difficult balance between innovative vitality and financial stability. Only through transparent operations, solid reserves, and effective oversight can this "stabilizing force" truly safeguard the digital economy's long-term prospects, rather than becoming the source of the next storm. For ordinary users, understanding their mechanisms and recognizing their risks are prerequisites for participating in this transformation. Gao Zelong is a visiting scholar at Waseda University, Vice President of the Beijing Consensus Blockchain Research Institute, Co-Secretary-General of the WE3.0 Committee of the China Association of Private Technology Entrepreneurs, Senior Researcher of the International Blockchain and Cryptocurrency Association, and an invited expert at the Harvard University HCSSA Blockchain Summit.

JinseFinance

JinseFinance