Against the backdrop of the US election, with the unexpected passing of the Ethereum spot ETF as a turning point, the German government's sell-off ended, the election market was positive, and the market rebounded.

CryptoMarket Summary

1. From July 1 to the first two weeks of July 15, BTC rose by 1.91%, with the largest drop during the period reaching 16% (July 5). On July 13, the balance of the German government's Bitcoin wallet was reduced to 0, which was considered to be sold in full. Based on the market reaction to the German government's sell-off, we analyze the Mt Gox sell-off and believe that its impact will be much smaller than the German government's sell-off.

2. BlackRock submitted Form 8-A12B for the Ethereum spot ETF securities registration application to the U.S. SEC on July 9. According to the analysis and prediction of Bloomberg and the president of The ETF Store, the Ethereum spot ETF may be approved this week (7/15-7/19). (As of the time of this article, according to media reports, U.S. regulators have informed at least three companies that have applied to launch Ethereum spot ETFs that they may finally approve the listing and trading of new products next Tuesday, July 23.)

3. On July 5, the U.S. Bureau of Labor Statistics announced that non-agricultural employment increased by 206,000 in June, a sharp drop from the previous value of 272,000. On July 11, the U.S. Consumer Price Index (CPI) fell by 0.1% month-on-month in June. This is the second consecutive month that the U.S. CPI data has been mild, and it is one step closer to the Fed's interest rate cut. The London Stock Exchange said that after the report was released, the probability of the Federal Reserve cutting interest rates in September immediately rose to 92%.

4. In terms of regulation, the Republican National Committee of the United States expressed support for a number of policy measures that are favorable to cryptocurrencies in its official party platform for the 2024 US election. On July 14, Republican presidential candidate Trump was attacked, and data and public opinion speculated that the incident would help his election. At the same time, JD Vance is also a cryptocurrency-friendly person. It is expected that JD Vance will promote the development of the cryptocurrency industry in terms of policy support, market confidence, and regulatory attitudes. Republican leaders have clearly shown a friendly attitude towards the cryptocurrency industry. As the possibility of the Republican Party's election increases, the market expects that this year's election market will provide a better environment for the development of the crypto market.

I. Market Overview

1.1 FutureMoney Group DePIN Index

FutureMoney Group DePIN Index is a DePIN high-quality portfolio token index built by FutureMoney, which selects the most representative 26 DePIN projects. The initial value of the index is 10, with January 5, 2024 as the base period. As of July 15, the net value of the index is 11.52, up 15.2% from the beginning of the period and down 3.44% from July 1.

1.2 Crypto Market Data

From July 1 to July 13, the market value of stablecoins increased by $1.41 billion, an increase of 0.95%. Bitcoin's share of the total crypto market value remained flat at 53.19%.

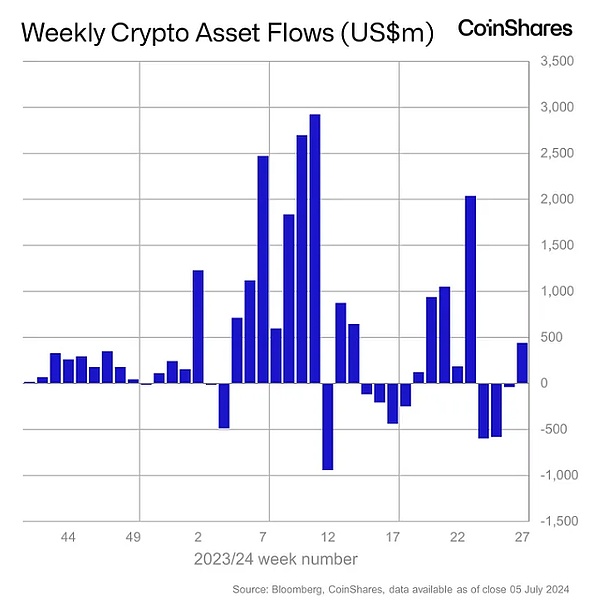

The recent price drop caused by the selling pressure from the German government and Mt Gox may be seen by institutions as a buying opportunity. The total inflow of crypto asset investment products in the first week of July reached $441 million, of which Bitcoin's inflow amounted to $398 million. In addition, the net inflow of Bitcoin spot ETFs turned from negative to positive.

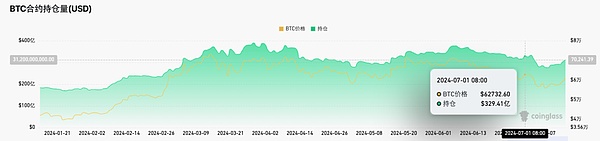

From the trend of contract positions, the bearish sentiment has eased. In June, the total open interest of Bitcoin contracts fell to US$32.9 billion, a decrease of about 4.3%. From July 1 to July 9, it continued to fall to US$27.6 billion, a decrease of 16%, and then rebounded to US$31.2 billion (July 15). The total open interest of Ethereum contracts fell from US$14.9 billion on July 1 to a minimum of US$11.973 billion (July 8), and then rebounded to US$13.4 billion. (Coinglass)

1.3 Analysis of MT.Gox repayment selling pressure through German government selling

As of July 12, the balance of the German government's Bitcoin address has dropped to 0, which is considered to be sold in full. The German government has been selling its 50,000 BTC through centralized exchanges since June 19, and the selling lasted for 23 days. During the same period, BTC retreated from $64,600 to $53,000, with a maximum decline of 16.6%. On July 15, the BTC price basically returned to the price level when the German government started selling, which was $62,700.

Mt.Gox will distribute a total of 142,000 BTC. On July 5, Mt.Gox distributed 3,000 BTC for the first time, and there are still 139,000 BTC to be distributed. In the previous biweekly observation, we predicted that the number of one-time distributions would be about 75,000. Considering the high dispersion of BTC distributed by Mt.Gox, most early investors are long-term holders. According to the selling ratio of 50% (37,500) and the selling time of 3 months, an average of 12,500 coins are sold each month. Therefore, although the total amount of Mt.Gox repayments is huge, it is expected that its market impact will be much smaller than the German government's sale, and according to the price trend of the German government's sale, the market can withstand such a large-scale sale.

2. Hot spots and narratives in the crypto market

2.1 DOGS, a popular zero-cost project in the TON ecosystem

DOGS has more than 1.8 million users in two days after its launch, and the price of off-site points is nearly 2 cents. Users only need to enter the DOGS BOT channel in Telegram, and the system will rate the user's Telegram account registration time and activity, and distribute points accordingly.

The black and white dog image of the DOGS project is inspired by Pavel Durov, the founder of Telegram. According to official Telegram information, DOGS is not an ordinary commemorative coin. It is the most Telegram-featured commemorative coin, reflecting the vibrant community spirit and culture.

2.2 Inventory of the most active applications

Pump.fun protocol revenue has reached 392,077 SOL, and set a new daily revenue record on June 30.

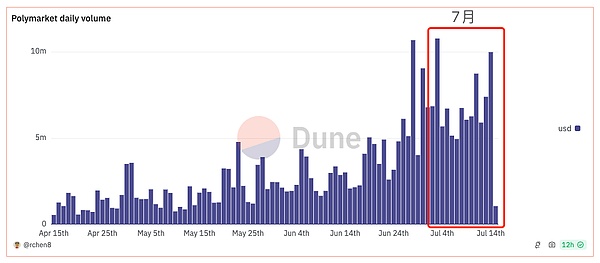

The transaction volume of the prediction market platform Polymarket reached 111 million US dollars in June, a record high, and the platform's monthly active users reached 29,400, also setting a historical record. July is expected to break the previous high again.

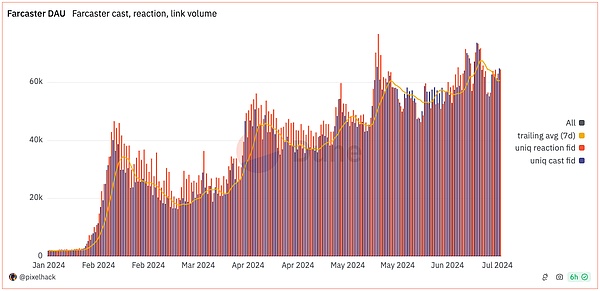

The decentralized social protocol Farcaster protocol revenue reached 2.12 million US dollars (7/15), and the total number of users reached 614,000. Judging from the number of Cast (tweets) independent IDs, the activity has further increased compared to June.

From the current most active applications, it can be seen that social and Meme are the main trends, with public chain platforms Ethereum and Solana as the main ones. The games in the Ton ecosystem are based on low barriers and community participation.

Three, Regulatory Environment

On July 9, the Republican National Committee of the United States expressed support for a number of policy measures that are favorable to cryptocurrencies in its official party platform for the 2024 US election. According to official documents released by the campaign team of Republican presidential candidate Trump, the Republican Party platform vowed to end the "illegal and un-American crackdown" on the US crypto industry. The platform promises to defend the right to mine Bitcoin, allow cryptocurrency holders to keep their tokens themselves, and defend the right to trade without government supervision and control.

On July 10, Rostin Behnam, chairman of the Commodity Futures Trading Commission (CFTC), said that the Illinois court had confirmed that BTC and ETH were digital commodities under the Commodity Exchange Act, and this ruling only applies to Illinois. So far, U.S. district courts have clearly classified Bitcoin (BTC) and Ethereum (ETH) as commodities in multiple cases, including the Eastern District of New York, the Southern District of New York, and Massachusetts.

On July 15, JD Vance was nominated as the Republican Party's vice presidential candidate. He is a cryptocurrency-friendly person. JD Vance was born in a poor town in the "Rust Belt" of the United States and his family background is ordinary working class. JD Vance is expected to promote the development of the cryptocurrency industry in terms of policy support, market confidence, and regulatory attitude.

Fourth, JD Vance's origins in cryptocurrency

As of 2022, JD Vance owns between $100,000 and $250,000 worth of Bitcoin on Coinbase. He has repeatedly spoken in support of cryptocurrency, believing that cryptocurrency can provide financial freedom and a means to resist excessive government intervention. He opposes SEC Chairman Gary Gensler's regulation of cryptocurrency, believing it is too political. JD Vance supports the Cantillon Effect, believing that printing money makes the rich richer and the poor poorer, and cryptocurrency may be a solution. He believes that cryptocurrency can help the lower class get out of economic difficulties and provide a financial tool that is not controlled by the government.

JD Vance may have the following potential impacts on the crypto market

1. Policy support: As a cryptocurrency-friendly person, J.D. Vance may support the development of cryptocurrency at the policy level and promote the establishment of relevant legislation and regulatory frameworks to make it more conducive to the innovation and application of cryptocurrency.

2. Market confidence: Vance's personal investment and public support may enhance market confidence in cryptocurrency, especially Bitcoin. His status as a vice presidential candidate may attract more investors to pay attention to and invest in cryptocurrency.

3. Regulatory attitude: Vance has criticized SEC Chairman Gary Gensler for being too political in regulating cryptocurrency. If Trump and Vance's team make a difference in policy, it may affect the way the U.S. Securities and Exchange Commission (SEC) and other regulatory agencies regulate cryptocurrency.

Since the beginning of this year, with the unexpected approval of the Ethereum spot ETF as a turning point in the context of the US election, the cryptocurrency regulatory policies have been frequently favorable, and the crypto market may move out of the election this year.

The data comes from: Coinmarketcap, Coinshare, Sosovalue, Bloomberg, Coinglass, Pixelhack

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Jasper

Jasper Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist