Author: Tom Mitchelhill, CoinTelegraph; Compiler: Wuzhu, Golden Finance

A former Grayscale executive said that traditional financial institutions are more enthusiastic than ever to tokenize assets on public chains.

Celisa Morin, who served as vice president of platform distribution at Grayscale until mid-2023, said in an interview that the new narrative led by BlackRock among TradFi institutions may see more companies seeking to tokenize assets on public chains rather than private chains.

“I think we’re seeing a preference for private chains like JPMorgan’s Onyx. But I do think that was a narrative a few years ago. Now, I think a lot of the attention is on public chains.”

Morin, who now heads the cryptocurrency department at international law firm Reed Smith, explained that it would make sense for large traditional financial institutions to follow the lead of BlackRock, which launched a $100 million tokenized “BUIDL” fund on the Ethereum network on March 18.

The BUIDL fund currently holds $288 million in assets, according to Dune Analytics data.

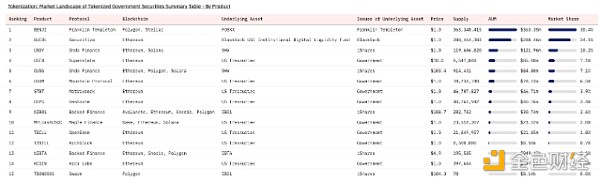

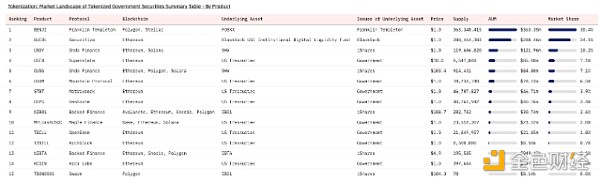

Top tokenized funds for government securities. Source: Dune Analytics

BlackRock’s move to launch a fund on Ethereum was not without controversy, with the asset manager’s on-chain wallet quickly becoming the target of various spoofs from crypto enthusiasts.

Deposits in BlackRock’s public wallet include legally dubious transactions from Tornado Cash, a now OFAC-approved mixer, as well as various cryptocurrencies from the Real World Asset (RWA) tokenization project and Memecoin.

Morin said that despite the potential legal issues that come with choosing to tokenize assets on a public blockchain, rather than using a private network that is more KYC- and AML-friendly, many companies may follow BlackRock’s lead.

Morin also noted thatFranklin Templeton had already taken the “forward-thinking” step of launching a tokenized money market fund on Ethereum Layer 2 network Polygon last October.

Franklin Templeton’s 11-month-old Franklin On Chain U.S. Government Money Fund (FOBXX) currently owns a total of $360.2 million in U.S. Treasuries. A total of $1.08 billion in U.S. Treasuries have now been tokenized across 17 products.

Ethereum ETF May Launch Unlikely

Morin was less enthusiastic about spot Ethereum exchange-traded funds (ETFs), saying they are unlikely to be approved in May.

Morin, who previously worked with the legal team at Grayscale in preparation for launching a bitcoin ETF, agreed with recent sentiment that the lack of communication between potential fund issuers at the SEC is a bad sign.

Echoing the sentiments of Bloomberg senior ETF analyst Eric Balchunas, Morin said VanEck’s chances of getting approved by the May 23 deadline are fading as the SEC refrains from making public comments.

Miyuki

Miyuki