Author: Revc

Foreword

"I watched him build a red building, I watched him entertain guests, and I watched his building collapse."

Friendtech was previously launched on Base and quickly gained attention in the Web3 field. At its peak around September 14, 2023, daily fee income reached $2 million. The team sold 19,477 ETH from December 2, 2023 to June 11, 2024, with a total value of approximately $52 million, but the price of its Friend token has plummeted 95% since its launch, and the current daily trading volume is only $180,000.

I will not elaborate on Friendtech here. Unlike the “sharers”, the author of this article wants to use the perspective of a “celebrator” and use an inappropriate expression, “Those who carry firewood for the public should not be allowed to freeze to death in the wind and snow” to highlight the heroism of the Friendtech team, even though the team has received tens of millions of dollars in fees.

In the crypto industry where Ethereum decentralized infrastructure is orthodoxy, Friendtech once wanted to break away from L2 - Basechain and turn to Solana, which is more friendly to the application layer. However, history will not give Friendtech a second chance to choose. However, without the DeFi atmosphere of Ethereum, the team may not have come up with such a small and beautiful asset issuance protocol, and even Pumpfun would not have appeared so early. Perhaps this is the significance of our exploration of its impact on the Web 3 social track. After all, the economic model of unilaterally launching liquidity, most people do not understand its innovative significance today.

Friendtechand its imitations

When Friendtechwas building, it was crowded with people and traffic. Various public chain foundations, top project parties, and well-known VCs all came to incubate its imitations, and it was in the limelight for a while. The crypto industry has such a "tradition", because this industry is full of speculative and short-sighted "smart people". After the "sharers" chewed the essence, the track began to decline. Perhaps it is more difficult to protect innovation in the decentralized world, and VCs also play a role in fueling the flames.

Back to the product itself, KOL is the first stop for current Web3 project parties to contact users, and to a large extent it is also the first channel for users to reach cutting-edge projects. Products that tokenize KOL influence or social relationships cater to the most direct needs of the mainstream crypto community. At least, projects that allow KOLs to make profits at zero cost can basically cover every corner of the crypto community without marketing and promotion. However, this is also the problem with FT's design. Let KOLs open the market and users pay the bills. Many of the big Vs who have supported Bro have suffered losses.

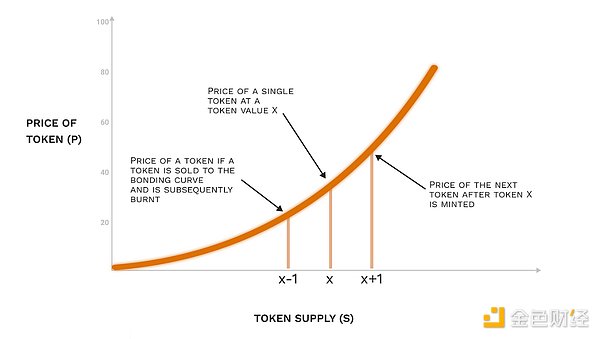

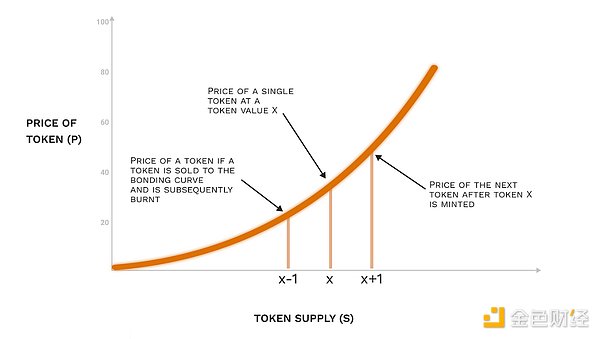

Let's first briefly review the FT formula, P = K²/C+ D (C and D are both constants), and break down the formula parameters:

K's square and constant C: affect the price curve (tangent slope), corresponding to the price difference between P(X) and P(X-1) in the figure below. If the square becomes cube (limited by Ethereum smart contracts, non-integer exponential power operations are not supported), or the constant C decreases, then the P value will change more steeply as users buy in (easily generating Fomo emotions), which is reflected in the purchase game strategy. The steeper the curve, the better the return expectations of users, but it is also easy for robots to preempt transactions, and the costs are borne by latecomers. As the purchase price increases and the number of takeovers is limited, the expected rate of return decreases, affecting user entry and the model is unsustainable.

If a higher capacity is needed to make the curve flatter, the index can be reduced, the coefficient less than 0 can be increased, or C can be enlarged.

Constant D: Enlarging will raise the base price of P, increase the user threshold, and also lead to a decrease in the wealth effect.

Friendtech will also face the "MEV problem" of robots. Robots have the advantage of contract monitoring and can buy newly issued keys at extremely low prices. Although there are many solutions to manage robots on the market, such as increasing D to raise the purchase threshold, setting up a slowing price curve on the left, and pre-sales, there are still limitations.

Friendtech has more than 10 imitations with product landing and strong background. Among them, SA and TOMO, the two main imitations, have made some adjustments to the price curve formula in order to reduce the purchase cost while maintaining attractiveness. Secondly, the native governance tokens of the public chain are different, and the exchange rate of the "C" parameter in the formula is converted with ETH:

l SA adjustment: SA adds linear terms and constant terms on the basis of quadratic terms, and reduces the coefficient of linear terms. This adjustment makes the price curve flatter, and the initial price rises slightly, but the overall change is not obvious.

l TOMO adjustment: TOMO's adjustment is relatively simple, just reducing the coefficient of the quadratic term, which directly leads to a slower growth rate of the curve.

Due to the slowing curve, SA and TOMO have lower prices than FT with the same Key supply. On the one hand, lower prices can help attract more users and expand market share. On the other hand, a lower growth rate may weaken the enthusiasm of users to participate and affect the long-term development of the platform. PumpFun also relies on Bonding Curve (BC). The core of the BC curve is that the trading market can obtain unilateral liquidity support, and users interact with smart contracts. Although the trading experience is relatively rigid and the real-time trading price deviates from the market value, unilateral liquidity builds a runway for the takeoff of all assets. DeFi is configured as a trading pair, which requires bilateral liquidity.

From the tokenization of social relationships to the issuance of social assets

The above-mentioned imitations are all from the perspective of curve parameter adjustment, supplemented by a rate-friendly mechanism. The main business is still the tokenization of social relationships. There are currently two problems with tokenization.First, social relationships will not generate expected and visible cash flows, so the Key has no value support.The second problem is that the post-transaction scenario still returns to the Web2 platform, although Friendtech has also done some exploration on information flow.The author learned that the DeTikTok project uses Bonding Curve to explore the issuance of social assets. There are some interesting designs. With permission, some designs are shared in the article.

1. First of all, the product is issued for social assets. Although it is not as easy to operate and marketable as the tokenization of social relationships, it has been endowed with the attributes of Key from the beginning, and its vitality may be longer than the existing Key.

2. Due to the diversity of KOL's own community, especially in terms of purchasing power, DTT supports KOL to customize parameters such as exponent and denominator when launching BondingCurve.KOL can decide the steepness of the curve by themselves to match the purchasing power of their own community, while balancing the potential value of social assets.

3. Friendtech's social relationship tokenization, in theory, is a permanent transaction curve, while DeTikTok's social asset issuance will have a contract liquidation point, which can be automatically triggered, such as when the transaction fee reaches the initial setting value.

DeTikTok's specific operation process is as follows:

1. KOL customizes the curve parameters for social asset issuance and sets the contract termination conditions, such as when the fee income token reaches the corresponding value of 2W USDT.

2. The contract opens the transaction according to the customized parameters. Before the contract is terminated, Key's transaction refers to the existing FT products, and players can arbitrage and buy and sell.

3. When the handling fee income reaches the preset amount, the contract terminates the transaction, takes a snapshot of the Key holding address, and executes social asset allocation.

4. Then, according to the last-in-first-out principle, users can exit in reverse order according to the order in which the Key was purchased, which ensures that those who enter at a high price can exit at a high price, avoiding the serious exit stampede behavior that is common in existing FT products.

In addition,becauseKey holders have expectations of social asset allocation,even if they sell for arbitrage in the early stage,ifthe attractiveness of social assets is strong enough,they will eventually buy back the Key to obtain the social asset allocation qualification,promote transactions,social assets can be NFT,white orders, or even token shares.

Users can eventually retrieve the assets in the contract according to the order in which they purchased the Key,which is equivalent to the social asset allocation qualification being a second-order function of the transaction fee,which increases the attractiveness of the game and provides protection for its assets.

But in my opinion, DeTikTok lacks a lot of permissionless and trustless designs, and its products are not in a hurry to be launched on the market due to the industry downturn and other reasons. The reason for taking DeTikTok as an example is that it represents a new exploration of the social track, but with the current developed infrastructure, influencers such as KOLs have a lot of automated platforms or tools for asset issuance, and the social track currently has no new conditions for outbreak.

Conclusion

The current market view of Friendtech is that it has failed to attract new users and maintain the participation and satisfaction of early users. Social platforms should focus on building long-term sustainable products and strategies rather than pursuing short-term interests. Prioritize lasting solutions rather than extracting market liquidity through fee mechanisms. If there is a lack of sustainable value proposition, hype alone will lead to rapid user loss and huge disappointment.

Understand SocialFi from the perspective of production relations and productivity. The development of production relations depends on the development of productivity. This sentence is specific to the crypto industry. Don't think about using production relations to transform Web2, but use Web3 production relations to empower new productivity. This is also the reason why many TwitterFI, TikTokFi and YoutubeFi have not been successful. There is no new innovation at the productivity level to meet the needs of users and creators, and production relations cannot be established.

In the market environment where the crypto industry has not yet been widely popularized and a small number of high-net-worth users are concentrated, the short-term social products with wealth utility such as Friendtech have attracted user attention. This situation is expected to continue for several years. Social media is a way of social interaction, self-cognition and information acquisition. It meets the needs of users for a sense of belonging, self-expression, information acquisition, emotional support, entertainment and career development. It requires a certain scale of users to form positive feedback before it can be created. At present, the user base of Web3 is small, and it is difficult to gather a large number of user needs to form a composite product.

FT has its epoch-making positive significance.The rise of the product is supported by multiple conditions.It has successfully formed a threat and challenge to the Web2 social media platform.When a whale falls, all things come to life.FT has also accelerated the arrival of Pumpfun.New Web3 social products will continue to emerge.The industry and builders need patience and perseverance.Finally, I wish you all a happy holiday.

Anais

Anais