Source: SevenUp DAO

1. Matrixport report on January 2: Optimistic view

ETF passes faster, 24-500 Billions of capital inflows

Matrix on Target wrote on December 21, 2023, "Bitcoin will explode to $50,000 in January." After a typical mid- to late-December consolidation, Bitcoin is poised for a strong wave of early-year buying power that could see it break through resistance.

A year ago, most market participants were bearish and therefore under-positioned. However, things were different, with stocks and cryptocurrencies rising sharply. Institutional investors cannot afford to miss out on any potential rally again and must buy as soon as the market opens in 2024. We expect that the coming rally will once again catch investors off guard.

Potential approval of a Bitcoin spot ETF could be announced today or tomorrow, ahead of the January 8, 9 or 10 approval that most traders expect. If this happens, we expect Bitcoin prices to rise significantly. This is unlikely to be a “sell-off news” event, as approval would legitimize Bitcoin as an asset class in institutional portfolios that can be used as collateral for purchases of other assets.

Conversely, risk may rise as $5-10 billion in fiat may not find enough Bitcoin on exchanges to gain exposure to a Bitcoin ETF. Following the 2022 bankruptcy and collapse of the FTX cryptocurrency exchange, many Bitcoin holders have moved their BTC off exchanges and become more familiar with cold storage options. As a result, 70% of Bitcoins in circulation have remained “static” over the past 12 months.

In October 2023, we estimate that U.S.-listed Bitcoin spot ETFs could see $24-50 billion in inflows. We also estimate the potential rise in Bitcoin price based on its relationship to changes in Tether’s market capitalization. This keeps us bullish throughout the end of the year, especially after Fed Chairman Powell appeared to turn dovish in October 2023.

The halving effect will make the trend exceed most people’s expectations

Bitcoin mining companies often limit supply before and after the halving cycle. It's expected to take place in April 2024; this could be another reason for supply shortages. Oxtimes, this is a price development seen in commodity markets, when market participants are forced to buy and sellers refuse to sell at those price levels. The result has been a sharp increase in prices. The direction of Bitcoin’s price this year may surprise everyone.

As we noted, Bitcoin tends to rebound strongly during halving cycles, which coincide with the U.S. election cycle. Bitcoin’s average return in 2020, 2016, and 2012 was +192%. This could lift Bitcoin to the $125,000 target we set in July 2023 based on the “one-year high” indicator. Likewise, U.S. stocks tend to perform strongly in U.S. election years, with the only two declines since 1960 (-60 years ago) being in 2008 (-37%) and 2000 (-9.1%).

Altcoat Season is Coming

Surprisingly, Bitcoin financing rates remained high during the holidays, suggesting that crypto traders are still Very optimistic and expecting the Bitcoin ETF to be approved soon.

With the Bitcoin dominance metric falling to 50.3%, we are about to enter altcoin season, which will see the cryptocurrency market enter a beta rocket phase.

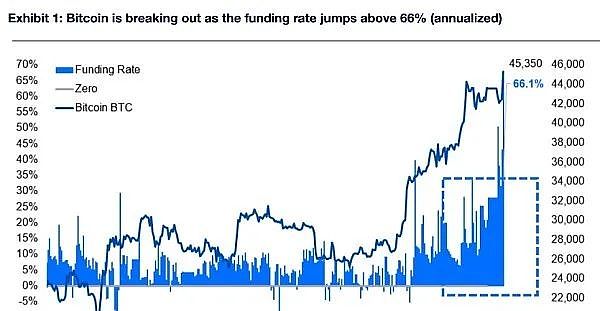

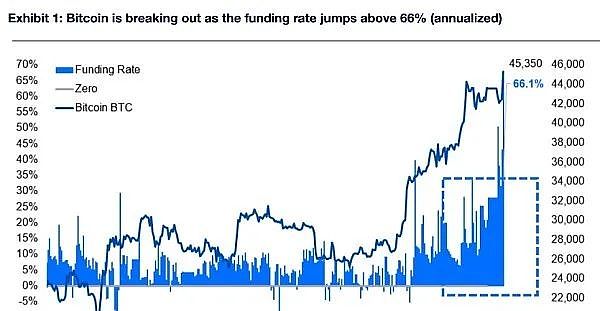

Bitcoin prices skyrocketed, and the funding rate exceeded 66% (annualized)

Although We are not seeing an increase in Tether minting activity, which would indicate an inflow of fiat into the cryptocurrency, but the fact that the price is rising could indicate that there are no sellers in the market and prices are heading higher. This morning, funding rates hit a new high of +66%. This means longs pay shorts 66% per year to remain long.

This is how the futures market squeezes the spot market and could push Bitcoin above the January 2024 $50,000 target level, which seems reasonably achievable. We could be trading over $50,000 by the end of the week.

2. Matrixport January 3: Pessimistic to Neutral

ETF has not yet reached SEC standards, but it will be achieved in the second quarter

Matrix on Target is bullish on consensus expectations for 2023 and predicts Bitcoin could reach $45,000 by Christmas. We even predict that Bitcoin could rise to $50,000 by the end of January 2024 if all SEC requirements for a Bitcoin spot exchange-traded fund (ETF) are met. Although we have seen frequent meetings between ETF applicants and SEC staff, resulting in applicants resubmitting their applications,we believe that none of the applications met key requirements that must be met before SEC approval. That could happen in the second quarter of 2024, but we expect the SEC to reject all proposals in January.

It is difficult to approve ETFs under Democratic leadership

Currently, Democrats dominate the SEC’s five voting committee leaders. SEC Chairman Gensler does not endorse cryptocurrencies,it is even remotely possible that he would vote to approve a Bitcoin spot trading fund. ETFs will definitely boost the overall cryptocurrency industry, and according to Gensler’s comments in December 2023, he still believes that the industry needs stricter compliance. From a political perspective, there is no reason to approve a Bitcoin spot trading fund, as this would officially make Bitcoin an alternative store of value.

Since traders began betting on the ETF’s approval in September 2023, at least $14 billion in additional fiat currency and leverage has been poured into the cryptocurrency market. Some of these flows may be related to accommodative macro conditions, as the Fed has turned dovish. However, of that $14 billion in additional long positions, $10 billion may be related to ETF approval expectations.

Even with chain liquidations, 24 years is still positive

If the SEC denies the application, we may see chain liquidations because We expect $51 billion of additional perpetual long Bitcoin futures to be unwound. We could see a quick 20% drop in Bitcoin price back to the $36,000/$38,000 range.

If market participants do not hear any news of approval before Friday, January 5, 2024, Matrix on Target recommends traders to short Bitcoin by purchasing $40,000 exercise put options at the end of January or directly through options coins to hedge their long positions.

Even if the SEC vetoes the ETF, we still expect Bitcoin prices to be higher at the end of 2024 than at the beginning ($42,000), as US election years and Bitcoin mining years tend to be positive.

3. Wu Jihan’s view, rapid iteration is a kind of ability

This unexpected incident slightly disrupted my vacation and woke me up After reading it, I discovered that Matrixport’s analyst report was actually responsible for the market crash. The pot is too heavy to carry. Please avoid believing in oversimplified rumors or generalizations based on X’s news.

Matrixport analyst Markus did not express conflicting views on the same day. He tweeted one view on Tuesday and the opposite on Wednesday.

Our analyst did adjust his view. In this ever-changing market, being able to calmly do "what is today and what was wrong yesterday" and adjust one's views in a state of "turning a page faster than turning a book" should be regarded as an ability and advantage. If you're a trader, you don't want to work with an analyst who's stuck with what he saw yesterday. It is possible that he has realized that he was wrong yesterday, but is embarrassed to admit and tell you. Matrixport works with a number of outstanding analysts, whose ability to quickly change their views continues to be highly appreciated by Matrixport clients.

Investors can evaluate the effectiveness of Matixport analysts from several time dimensions:

Short-term The key question is,Did Marcus make money by buying put options on Bitcoin immediately after the report was released? This has happened, and this advice has proven to be correct.

In the medium term, we will continue to observe whether the U.S. Securities and Exchange Commission (SEC) will indeed postpone the spot announcement on January 15 or 31, 2024. ETF decisions. Even after the well-known financial media ZeroHedge forwarded more positive news about spot ETFs and made fun of Markus, Markus still insisted on his opinion. Smart investors will ignore irrelevant whims, evaluate the forecast solely on the merits of the analyst's published analysis, and closely track any further changes.

In addition, Matrixport analysts also predict thatspot ETFs may finally meet key conditions in the second quarter of 2024. We'll see if his prediction is correct. Please also pay further attention to whether Matrixport analysts' views will be adjusted.

In the long term, smart investors will watch to see if Bitcoin trades above its starting price of $42,000 in 2024, as reported. Markus, an analyst working with Matrixport, recommends buying at potential lows. By this time in 2025, we will be able to determine whether this advice is correct.

JinseFinance

JinseFinance