Author: Charles Yu, Galaxy; Translator: Tao Zhu, Golden Finance

Abstract

Avalanche is a high-performance blockchain heterogeneous network. Avalanche's outstanding feature is its platform architecture, which adopts a horizontal expansion approach to build a multi-chain architecture with a highly customizable, interoperable blockchain called "L1" (formerly known as "subnet"). Customizability enables Avalanche to support a wide range of builders and use cases, especially across enterprise and institutional DeFi, for teams that need privacy and access control, as well as gaming and consumer verticals. Avalanche's mission is to "tokenize all the world's assets", and strong BD efforts have supported many well-known companies/organizations in their efforts to move to the chain and explore innovative and influential crypto use cases on Avalanche.

Background

The Avalanche mainnet, developed by Ava Labs, launched in September 2020 using a high-performance EVM L1 (called “C-Chain”, short for Contract Chain), driven by an innovative consensus mechanism that enables fast transaction finality (typically <2 seconds). C-Chain’s adoption has grown rapidly, becoming one of the leading “EVM Alt-L1s” for DeFi activity, attracting over $10B in TVL at its peak in 2021-22.

Since then, Ava Labs has been working to differentiate Avalanche from Ethereum and other EVM chains as a more interoperable layer by focusing on the development of “subnets”, which are customizable chains that run in parallel to the mainnet. With the launch of subnets in mid-2022, Avalanche provides developers with the tools and capabilities to easily configure the blockchain to best meet the needs of its users across a wide range of use cases - subnet builders on Avalanche can define execution logic, choose their own gas tokens, adjust fee structures, and manage the set of validators that secure the chain. The platform also enables native interoperability between blockchains and shared liquidity hubs through Avalanche Warp Messaging/Teleporter.

Avalanche9000:A planned major network upgrade (via the Etna upgrade) will replace the current subnet model with a new concept called "L1s", which will significantly reduce the cost of launching a blockchain on Avalanche. Specifically, Etna removes the requirement for L1 validators to stake at least 1,000 AVAX (which had been reduced from 2,000 AVAX in a previous upgrade), and also removes the requirement to validate the main network (including the C chain). The new framework is designed to inspire accelerated development of subnets and provide self-regulatory security for enterprise L1s to meet regulatory compliance requirements (especially for RWA issuers who are prohibited from validating permissionless networks such as C-Chain). The Etna upgrade is scheduled to be deployed by the end of 2024.

Ecosystem Highlights

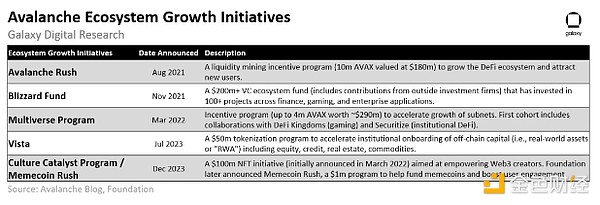

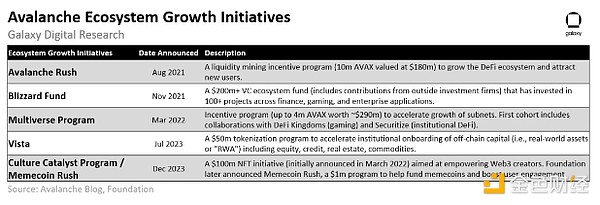

Avalanche ecosystem growth plans/marketing initiatives have targeted projects in the DeFi, RWA/Tokenization, Gaming, and Art/Culture end markets:

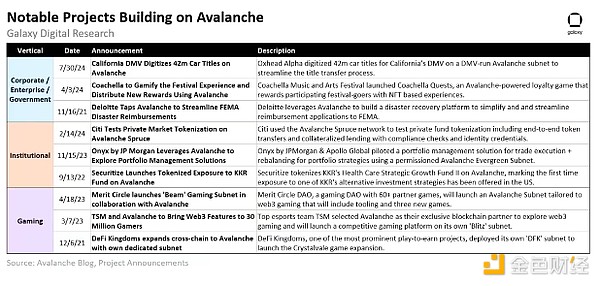

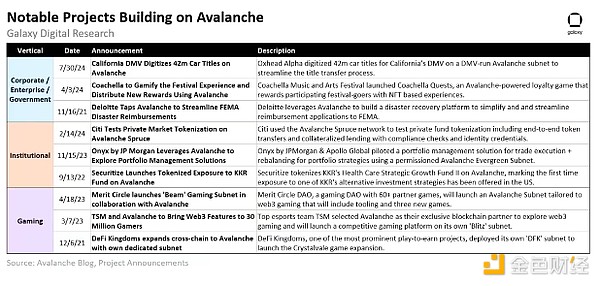

Notable Avalanche-related partnerships/project announcements by end market include:

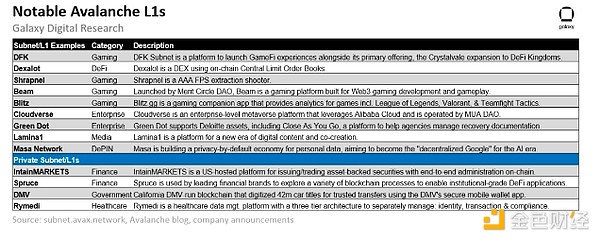

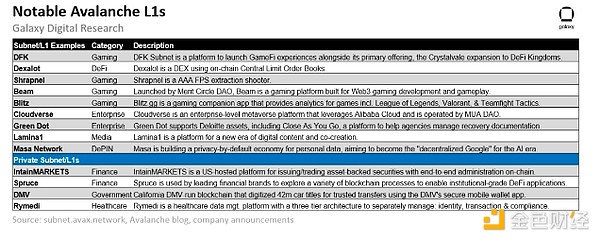

Subnets can be configured as public or private (i.e. blockchain data is only available to a managed set of validators). Some examples of public and private subnets are listed below:

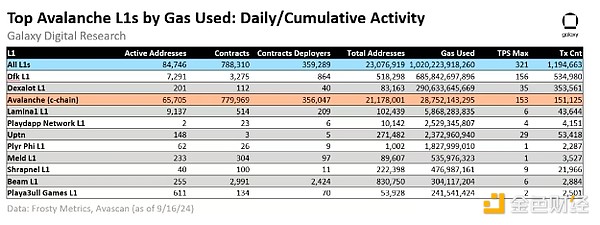

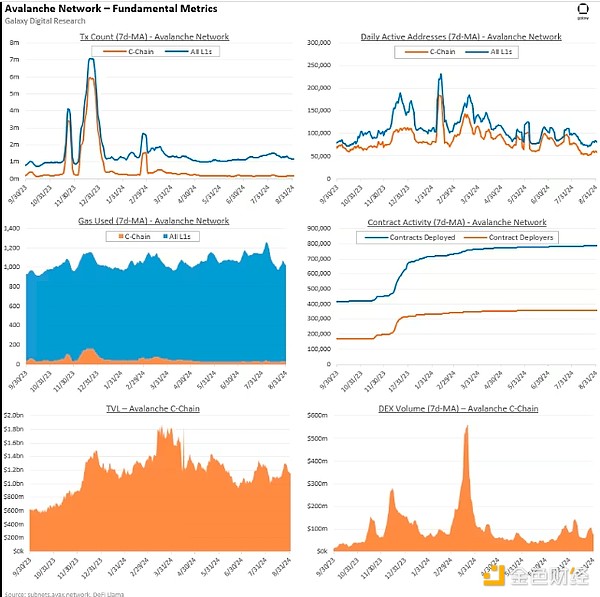

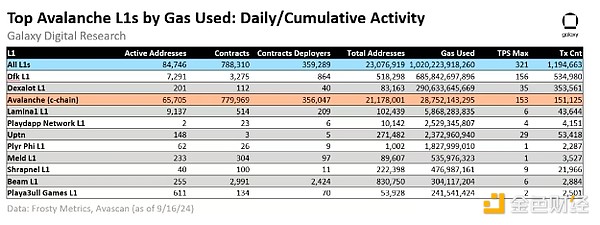

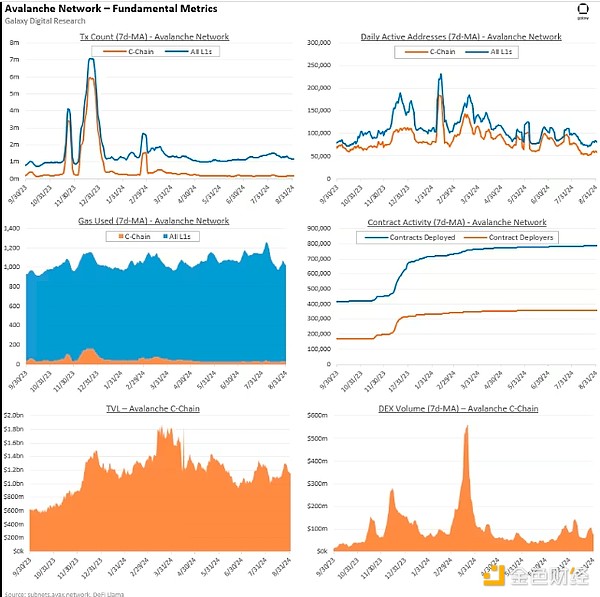

Of all the L1s on the Avalanche network, two L1s (DeFi Kingdoms and Dexalot) have surpassed C-chain in terms of total gas consumption and number of transactions, demonstrating Avalanche's scaling advantages. However, in terms of active addresses, C-Chain is still ahead of other L1s:

Basic Metrics

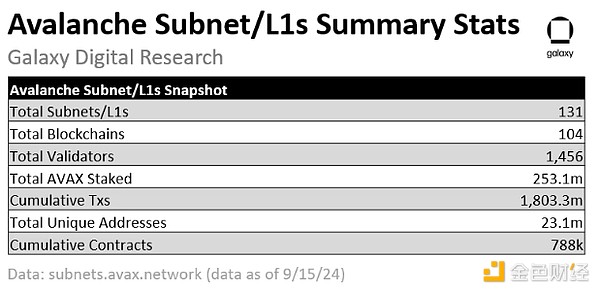

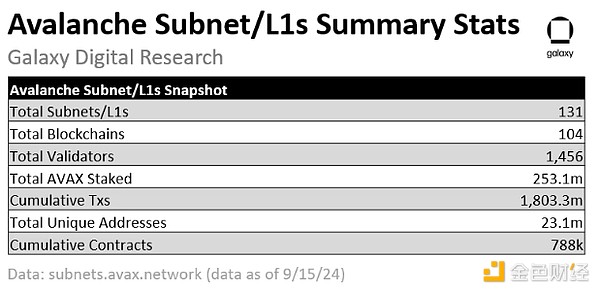

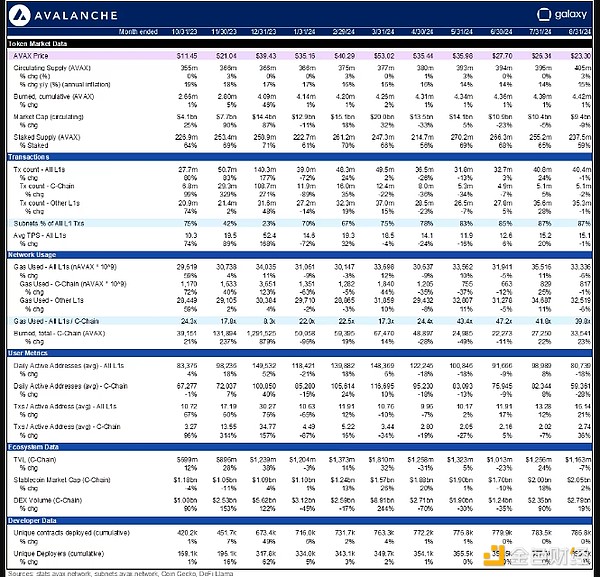

Given the focus on serving builders with custom subnets/L1s, KPIs for assessing the health of the Avalanche platform should include the mainnet and all L1s, such as: number of L1s, total addresses and transactions, total number of deployed contracts and contract deployers, max TPS, and total gas used by L1s.

Avalanche Subnet / L1 Market Statistics:

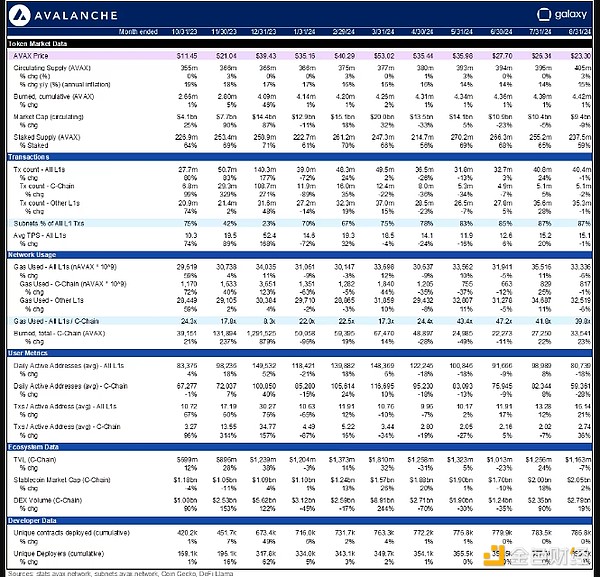

AVAX Token / Token Economics

Fee Model: Avalanche C-chain fees (paid in AVAX) are based on Ethereum’s EIP-1559, including base and priority fees. However, transaction fees on the Avalanche C chain are all burned, including priority fees (unlike Ethereum, where priority fees are paid to validators and only base fees are burned).

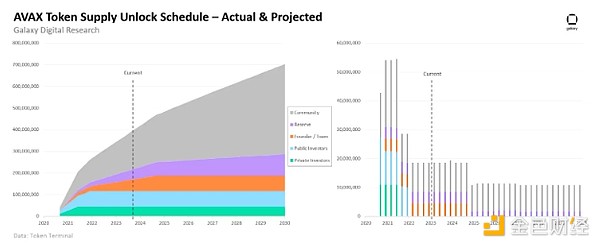

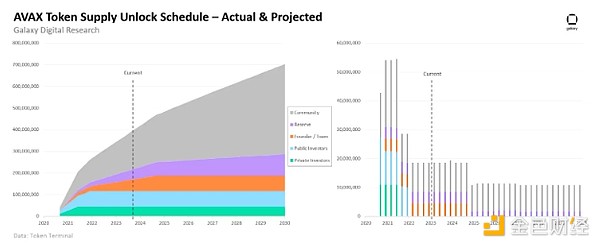

Staking:~56% of the circulating supply of AVAX is staked. Validators on the mainnet receive staking rewards through issuance (current staking rewards are ~7.9% APY). Validators on subnets/L1 may receive other forms of staking rewards.

Vesting and Unlocking: Over the next year (September 9, 2024), 43M AVAX (+10.6% of circulating supply) are scheduled to be unlocked. Aside from the planned unlocking of 1.7M AVAX every three months until 7/19/30, there will be no cliff unlocks for any other allocations going forward (i.e. vesting is complete for all groups other than the Foundation (including the team and investors) as of 8/20/24). Staking rewards will continue to unlock linearly until 2030.

Competitive Positioning

Competitors: The most relevant competitors for the Avalanche platform and its subnets/L1 networks include: Ethereum and L2, Rollup ecosystems (such as Arbitrum Orbit, Optimism Superchain), Polygon Supernets and AggLayer, and interoperability platforms (such as Cosmos and Polkadot). These platforms aim to provide builders with customizable features to launch application-specific blockchains, but they each have their own unique network design:

Future Challenges/Opportunities:

Expand the subnet/L1 ecosystem.Past network upgrades and the upcoming Avalanche9000 program are designed to spark growth for Avalanche L1 by reducing setup/operation costs and introducing more customizable features for builders. Avalanche needs to attract quality projects and builders to its ecosystem while facing stiff competition from Ethereum L2, which comes with a robust set of development tools, including Rollup-as-a-Service (“RaaS”) providers that help projects easily deploy appchains on the L2 platform.

Advance institutional/enterprise adoption through permissioned private subnets/L1s. Permissioned subnets have been positioned as a potential solution for regulated entities that need to meet certain compliance requirements (e.g., maintaining a managed validator set vs. permissionless validation). The Evergreen subnet solution is designed to serve TradFi entities for certain RWA/tokenized applications and is private by default. Currently, Ethereum leads other networks in regulatory acceptance, but as regulatory guidelines evolve around privacy/control settings on blockchains, Avalanche may gain recognition for its deep customization and managed deployments in these areas.

Translate featured partner announcements into actual ongoing use. Avalanche has been involved in several promising proofs of concept with notable partners, such as Deloitte x FEMA for disaster recovery payouts, California DMV for tokenized car titles, and JPMorgan or Citi for tokenized financial applications. Moving these from POC to production will be key to validating these use cases.

Showcasing other core technical features of the platform. Ava Labs has introduced tooling for custom VM development for developers, including the HyperSDK toolkit, which has yet to launch its public development network. Most major public subnets/L1s in existence today leverage a slightly modified EVM (we have yet to see Avalanche L1 using Solana’s SVM or MoveVM in production), but having the HyperSDK and demonstrating a more powerful custom VM could be a differentiator for Avalanche, distinct from Ethereum and its L2 ecosystem.

Important Upcoming Events

Some important upcoming events and estimated times:

Avalanche Summit LATAM 2024 (October 16-18, 2024)

Etna upgrade to Avalanche9000 (expected November/end of the year)

Shrapnel Game early access/public release (expected Q4 2024/H1 2025)

Avalanche Summary Data

JinseFinance

JinseFinance