Author: CryptoVizArt, Glassnode; Compiler: Deng Tong, Golden Finance

Abstract

Bitcoin prices hit ATH again, surprising the market and rebounding strongly even before the widely expected halving event.

We saw a sudden spike in the average transaction size interacting with Coinbase, which highlights the scale of new institutional capital entering Bitcoin.

Long-term holders have begun to increase allocation pressure, reaching a monthly payout rate of 257,000 BTC, of which GBTC accounts for 57%.

The beginning of 2024 has already been etched in Bitcoin history, with the Bitcoin market already rising to ATH even before the April halving event.

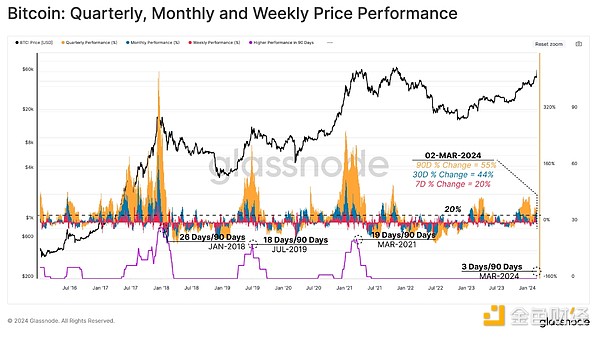

The chart below shows rolling performance on weekly (red), monthly (blue) and quarterly (orange) time frames, reaching +20% and +44 respectively at the time of writing. % and +55%. If we count the number of trading days last quarter when all three performance metrics exceeded +20%, we can see that last weekend's rally was the strongest since the 2021 bull run.

Spot ETF demand< /h2>

After the SEC approved a spot ETF in the U.S. market, many observers expected strong demand. At the same time, many are skeptical and believe that ETF news is already priced in and therefore expect a sell news correction. At the time of writing, Bitcoin is trading at $68,000, 58% higher than the $42,800 it was at when the ETF was approved, and the sell-off news camp finds itself overside.

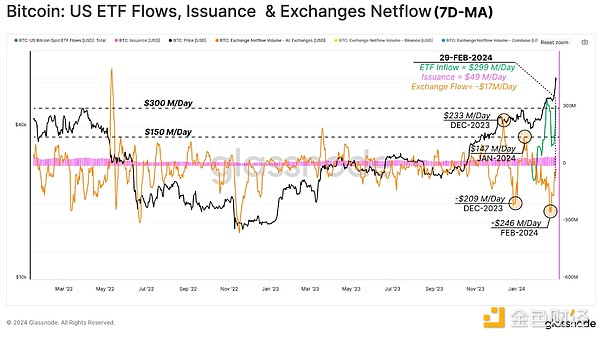

To better measure total demand inflows, the chart below shows the weekly average of dollar flows through the following areas:

Online distribution (blue): Daily network rewards for miners (assuming sellers) have increased from $22 million/day in September 2023 to $49 million/day today.

Net flows of all exchanges (orange): Focusing on the months leading up to the ETF approval date, centralized exchanges witnessed significant swings between positive (sell-side) and negative (buy-side) capital flow waves. The metric shows continued outflows or buying pressure as high as $246 million per day since the ETF began trading. As of the end of last week, total net outflows from the exchange were $17 million per day.

U.S. spot ETF net flow (green): Despite significant initial selling pressure from existing GBTC holders, total net flows into U.S. spot ETFs averaged $299 million/day.

Overall, this indicates net capital inflows into Bitcoin of approximately $267 million per day. This represents a meaningful phase shift in market dynamics and is a valid explanation for the market rally toward a new ATH.

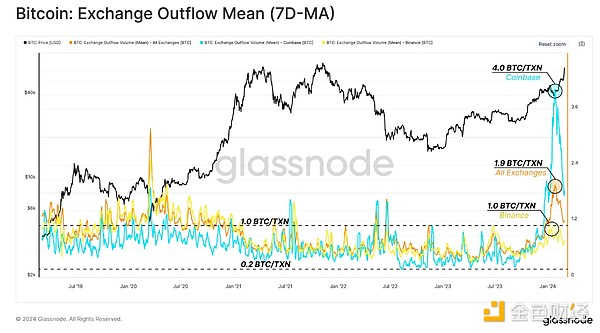

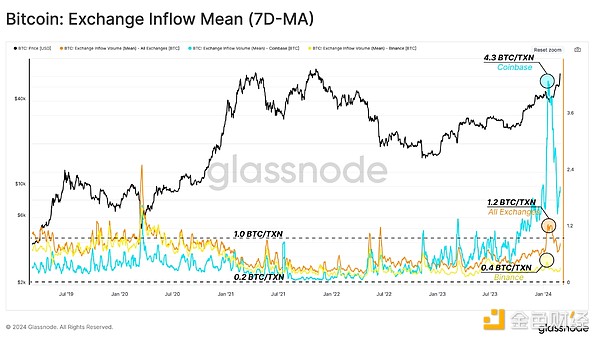

We can also isolate Fund flows associated with a specific exchange, such as Coinbase, to identify any changes in overall market dynamics. The chart below shows the average deposit volume in and out [BTC]:

The results show that in particular Coinbase’s average incoming and outgoing transactions have reaches quite high values. When the ETF was approved, the average trade size peaked at 4.3 BTC/Tx.

Compared with historical range Ratio, these values are worth noting as the historical range since 2019 has been between 0.2 BTC/Tx and 1.0 BTC/Tx.

Diamond hand profit

As the market approaches ATH, unrealized profits held by long-term investors and distribution pressure increase accordingly.

One way to measure the market profitability of any given group of investors is to leverage their on-chain cost base (or the average price at which each group gets the token) and compare it to the spot price.

Long-term holders (blue) = $207,000

Short-term holders (red) = $458,000

Market realized price (orange ) = $244,000

The transaction price is $68,000, and the average unrealized profit for long-term holders is approximately 228%.

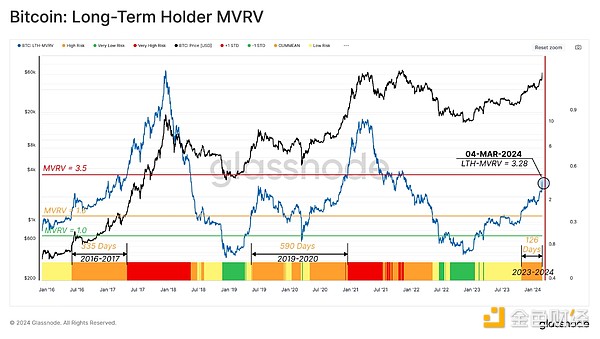

We can use LTH -The MVRV indicator plots the multiple of unrealized profits held by long-term holders, which is the ratio between price and its cost basis. The ratio currently stands at 3.28, between the two historically significant threshold levels that separate the stages below a typical cycle.

Bottom Found (Green) (LTH-MVRV < 1) : Means that, on average, these investors are losing money.

Bear-Bull Transition (yellow) (1 < LTH-MVRV < ; 1.5): Means that the profitability for long-term holders is between the break-even point and +50% profit.

Balanced (Orange) 1.5 < LTH-MVRV < 3.5) :Meaning that the average unrealized profit for long-term holders is +50% to +250%.

Euphoria (red) (3.5 < LTH-MVRV):Meaning that the average profit for long-term investors is over +250%.

Based on current values, these investors are approaching their euphoric state and have a higher incentive to spend and profit. Historically, as new market ATHs are reached, this group increases spending and accelerates allocations until they help form a cycle macro top.

Long-term players in Action

Now that we have established the size of unrealized profits for long-term holders, we must assess how these entities respond to this shift in profitability.

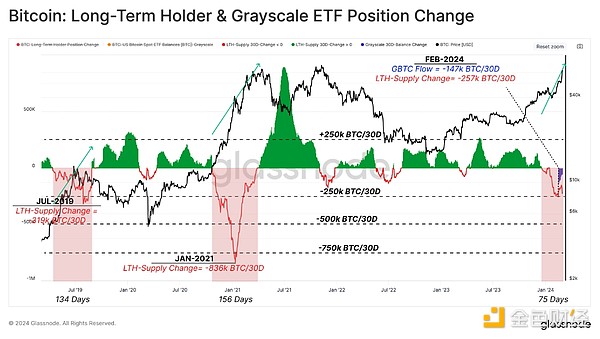

A quick and direct way is to look at the supply from long-term holders. As shown in the chart below, long-term investors have allocated approximately 480,000 BTC since December 2023, when LTH-MVRV was still in equilibrium. That means some of these investors are paying out, on average, 50% to 200% of their profits before the ETF even launches.

To evaluate a distribution system for long-term holders, we consider two factors: distribution rate and duration.

The chart below shows the monthly changes in long-term holder supply. Looking closely at the last two major market expansions in mid-2019 and early 2021, we can see that LTH allocation rates peaked at 319,000 BTC/month and 836,000 BTC/month respectively.

The distribution rate for this cycle has so far peaked at 257 BTC/month, with GBTC outflows accounting for approximately 57% of that.

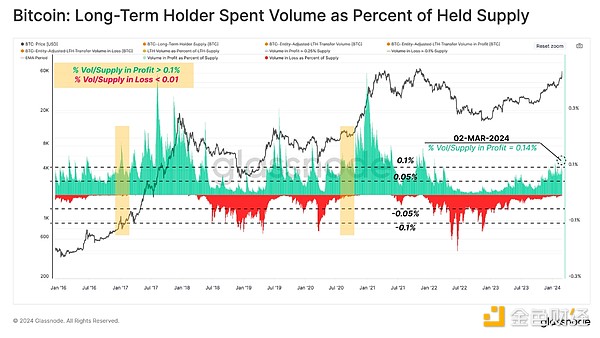

With LTH allocation As the amount increases, the size of the locked realized profit will also increase. To monitor this dynamic, we measure the proportion of LTH transfer volume in profit and loss relative to its overall balance.

As of this writing, the indicator shows that LTH is making profits at a rate equivalent to 0.14% of its total daily supply. The indicator is approaching levels consistent with early euphoric phases and previous breakouts of market ATH.

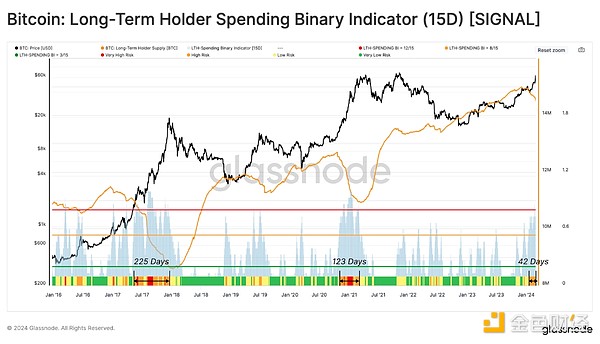

In this survey In the final section, we create a binary indicator that identifies periods when LTH spending is large enough to deplete its total balance within a 15-day duration. This spending represents the release of long-dormant supply back into the liquidity cycle, thereby acting as a balance to offset new demand.

In the figure below, we use several thresholds to classify spending regimes. Since late January 2024, the market has entered a phase where binary indicators have shown a long-term trend on at least 8 out of the past 15 days Holder supply decreases.

If we look at the cycle peaks in 2017 and 2021, we see a similar structure lasting from 123 to 225 days. The current phase has been in this state for 42 days so far, which may indicate that demand inflows may offset LTH spending in the coming months (If history is any guide).

Conclusion

Bitcoin surprised investors again, rallying to its last ATH before the halving event, the first time this has happened. New U.S. spot ETFs introduce a significant new source of demand to the market, partially offsetting daily issuance and recent increases in trading Seller pressure exerted.

Long-term holders are accelerating their distribution cycles,This is a trend we have seen in all previous cycles as ATH has been challenged. This allows us to compare these new demand vectors with allocation pressure from existing holders by ETF , and explainreasons for Bitcoin’s rapid return to all-time highs.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund Coindesk

Coindesk Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph