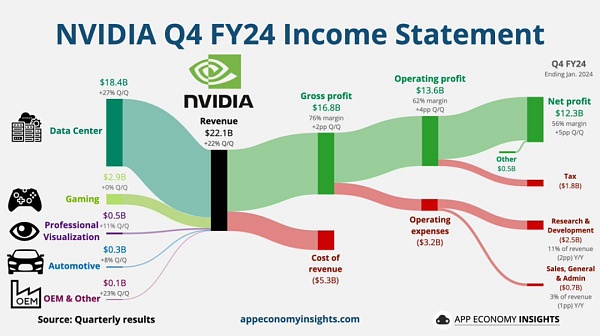

Recently, Nvidia released its fourth-quarter 2023 earnings report, which exceeded Wall Street expectations and performed well in delayed trading in the U.S. stock market. By analyzing Nvidia's financial reports, Ouke Cloud Chain Research Institute found that its main source of profit is the data center business (US$18.4 billion), which achieved more than 400% growth in the fourth quarter of fiscal year 2024, accounting for as much as 83.3%. However, we may sometimes be limited to looking at Nvidia's business from a single perspective, which cannot fully demonstrate Nvidia's core business logic and the ambitions of its founder Jensen Huang. For NVIDIA, what is a data center? What inspiration does NVIDIA's light asset and extreme pursuit of data have for Web 3.0, where "data is an asset"? Through this article, we find out.

Figure 1 Schematic diagram of NVIDIA's fourth quarter financial report for fiscal year 2024*

Source: Quarterly results, apeconomyinsights.com

Note: Each company's fiscal year regulations are different

What is the data center that brings huge revenue to NVIDIA?

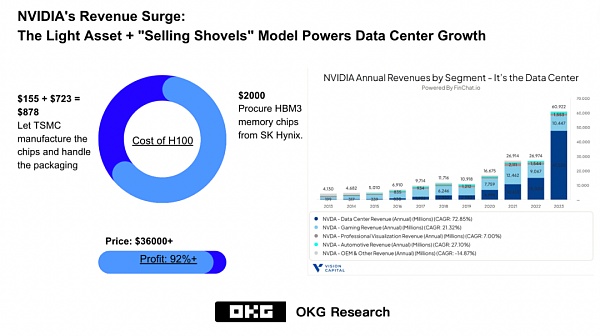

Huang Renxun mentioned in an exclusive interview with Lauren Goode last week: "We are building a new type of data center. We call it an artificial intelligence factory. According to The way data centers are built today, a lot of people share a group of computers and put their files in this big data center." According to Nvidia's latest financial report, Nvidia's data center business includes AI chips, and more than half of its revenue comes from the cloud. service provider, and its operating profit margin hit a record high (61.6%). This growth is due to NVIDIA’s adoption of a light asset + “shovel selling” model (Figure 2).

Figure 2 Taking H100 as an example, NVIDIA adopts the light asset + "shovel selling" model

Source: OKG Research, Vision Capital

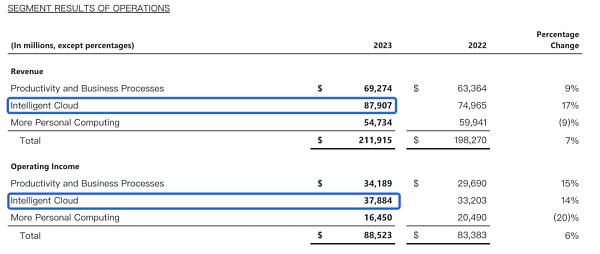

It’s not just Nvidia that is surrounding data. According to Microsoft’s latest annual report (Figure 3), its profit center is not their star product Office, but the Intelligence Cloud business, which is mainly used for data storage and processing.

Figure 3 Microsoft's 2023 fiscal year financial statement

Source: Public information on Microsoft's official website

Looking at Web3.0 from the perspective of AI, the data will also It is the coreprofitpoint of Web3.0

When we upgraded from Web2 to Web3.0, the core logic did not change. In Web3.0, when all data is open source, anyone can query the transactions and data on the chain through a blockchain browser, especially when innovative applications like GameFi, DeFi, DeSci and DePIN appear , a large number of users will focus on new applications. Andevery interaction between these applications will generate on-chain data, and on-chain data has become readily available. Therefore, the business models and potential profits related to on-chain data will be ignored by us. Just like we will focus on Microsoft’s Office products, we ignore that it is the data-related Intelligence Cloud that has achieved the greatest revenue for Microsoft.

The businesses of these two technology companies in the data sector are also worthy of consideration in Web3.0. The largest revenue segments of Microsoft and NVIDIA do not directly produce data but are related to data. In the upstream and downstream of the AI industry chain, Nvidia’s most profitable business is also the data/algorithm layer rather than the application layer, or in Huang Renxun’s words, “We try not to serve as much as possible. in a certain industry, but we are very good at the artificial intelligence computing part." It is this characteristic of "weak industry and low-level" that allows NVIDIA to serve many industries.

Current AI applications require a large amount of computing resources and storage space for high-performance data processing and analysis. NVIDIA's data centers can provide powerful computing power and large-scale storage facilities.

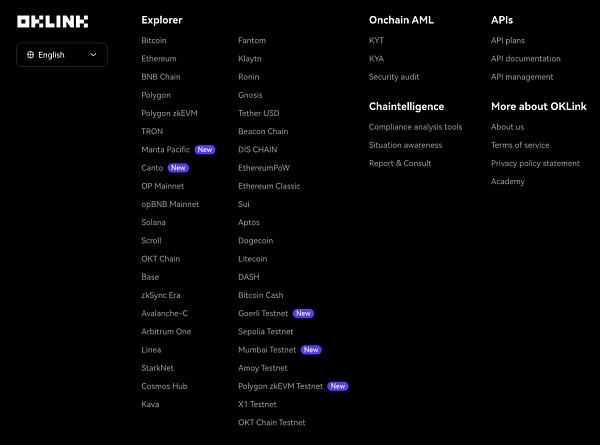

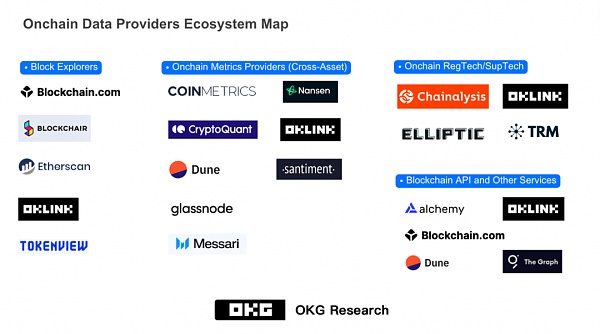

In Web3.0, Chainalysis, OKLink, etc. in the field of on-chain data are expanding their business territories based on on-chain data (Figure 4). The business model of directly entering the on-chain data track is just like Nvidia’s “trying not to serve a certain industry”. In other words, it can provide value for all public chain ecology. The more public chains connected, the greater its commercial value is, which also reflects the company’s stronger data processing capabilities.

Figure 4 OKLink on-chain data business layout

Source: oklink.com

Different from Web2, Web3.0 Data is no longer mastered and controlled by a centralized platform, and users have more opportunities to effectively manage their data. Web 3.0 gives individuals sovereignty and control over their data. In Web 3.0, data is no longer just used in a passive way, but has become an important asset for users to participate in innovation, value exchange, and co-construction and sharing. This change has given rise to a series of new data processing, verification, privacy protection and analysis methods, bringing new opportunities and possibilities to users.

Whoever builds the Web3.0 data system first will establish his or her leading position

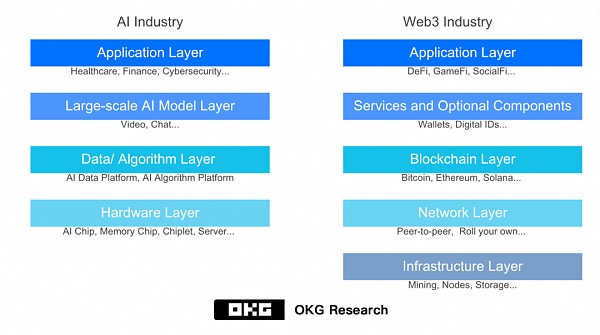

< p style="text-align: left;">In addition to business exploration in individual tracks such as on-chain data analysis and data privacy protection, from the system perspective of the AI industry chain, it can be roughly divided into hardware layer, data/ Algorithm layer, large model layer and application layer. For Nvidia, its data center focuses on the theme of AI computing, and the hardware layer, data/algorithm layer and large model layer are all involved. Therefore, it has gradually built a platform that is difficult for competitors to match. leading position.

Similar to AI, the Web3.0 industry chain can also be seen as being divided into blockchain layer, service layer, application layer, etc. (Figure 5). For example, at the blockchain layer, the blockchain browser is the basic tool for querying data on the chain, supporting data analysis, research reports, consulting services, etc. In addition, solving data expansion problems has become a hot topic, and Layer 2 solutions provide higher transaction throughput and lower transaction fees. This is critical for building scalable Web 3.0 applications and processing large-scale data. At the service layer, digital identities, wallets, etc. are also inseparable from the verification, tracking and path visualization of data on the chain. At the application layer, customized data services and solutions are provided according to the needs of different industries and fields, such as RWA and on-chain data analysis tools combined with the financial industry. Businesses surrounding on-chain data can run through the entire industry chain.

Figure 5 AI and Web3 industry technology stack

Source: OKG Research

However, on-chain data Also special: decentralized and open source. Therefore,Compared with NVIDIA's "data center", in Web3.0, there is no concept of "center". However, those companies that can build their own on-chain data systems, or in Web3.0 terms, establish their own "ecosystem", will have an absolute advantage in the industry. Currently, there are two main business models in the industry.

The first one is to build your own ecosystem around a public chain, which is relatively well-known in the industry. Successful examples of this model include the Ethereum ecosystem, which has many Ethereum-based decentralized applications (DApps) and smart contract platforms, attracting a wide range of developers and users.

The other mode is currently ignored, which is "directly cutting into the data on the chain and building a data system". Because on-chain data is open source, its commercial value is often overlooked. However, some companies have already laid out the on-chain data track in the industry a few years ago. For example, OKLink uses a multi-chain browser as the data query entrance, and continues to launch on-chain data tools suitable for B-side institutions along the compliance direction required by the current industry to meet the needs of users at different ports for on-chain data. need.

This model focuses on providing high-quality, reliable on-chain data services and meeting the needs of different industries and users through the continuous development and innovation of data tools. . Especially after the tone of the industry changed from barbaric growth to compliant development, the previous requirements of financial institutions for assets were reflected in on-chain data. In Web3.0, on-chain data is equivalent to assets. Therefore, systematically building an on-chain data system will become more important for this track (Figure 6).

Figure 6 Web3.0 on-chain data track industry layout

Source: OKG Research

And for open source Regarding this feature, several cases in the big data industry will also give us inspiration: Hadoop's troika companies Cloudera, Hortonworks, and MapR, three American big data companies, have found new business models by commercializing Hadoop. And achieved huge commercial value. It is worth mentioning that Cloudera and Hortonworks have been listed on the New York Stock Exchange and have been recognized by the market.

There are still expectations of a hundredfold difference

Currently, NVIDIA Its stock market value has exceeded US$2 trillion, and its data center can reach a corresponding valuation of about US$1.6 trillion; Microsoft's preliminary estimate of data is also as high as US$1.2 trillion. Players in the on-chain data track are also growing with the new industry of Web 3.0. Currently, according to public information, the highest valuation of companies in the on-chain data track is US$8.6 billion, which is still far from the valuation of the data business of the Web2 technology giant. There is a difference of more than a hundred times.

In the Web2 era, companies that tightly grasp data and focus on a certain aspect of data, such as computing and storage, have ushered in a trillion-level market. recognized. In the era of Web3.0, this experience can provide us with reference. Those companies that can take the lead in building a data system around on-chain data will be able to occupy a leading position in the industry in this decentralized Web3.0 world.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Wilfred

Wilfred Wilfred

Wilfred JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance