Author: Andrey Sergeenkov, CoinTelegraph; Compiler: Deng Tong, Golden Finance

1. Understand the bond curve in DeFi

In decentralized finance (DeFi), bonds Curve utilizes smart contracts and mathematical formulas to dynamically adjust the price of a token based on its supply.

Bond Curve is a smart contract that algorithmically determines the price of a token based on its circulating supply. As more coins are purchased, the price adjusts upward, and as coins are sold or removed from circulation, the price decreases.

This automated pricing mechanism ensures liquidity for new tokens without the need for traditional order books or external liquidity providers. It does this by embedding liquidity directly into the token’s smart contracts.

Specifically,the bond curve utilizes the economic principles of supply and demand. When demand for a coin increases (reflected by increased purchases), the smart contract increases the price accordingly. When selling activity indicates a drop in demand, the smart contract lowers the price.

This dynamic adjustment is based on a predefined curve that models the relationship between price and supply. As a result, Bond Curve allows for automated, decentralized liquidity that responds to real-time market conditions.

2. Price determination in the bond curve

The bond curve in DeFi adjusts token prices based on supply, supporting various economic strategies and market dynamics.

Through mathematical modeling, projects can customize bond curve economics by defining a unique curve that determines how a token’s price changes based on its supply. Theoretically, there are no restrictions on the type of curve, but the most common forms include:

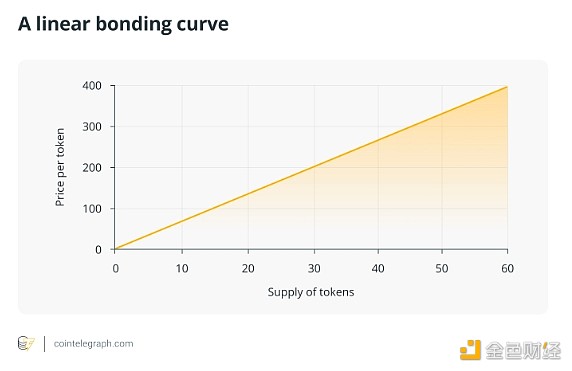

Linear Curve

The linear bond curve is a simple mathematical model, The price of a token increases proportionally to the number of tokens sold. In this model, each additional coin minted or sold increases the price by a fixed, predetermined amount.

Below is a simple graphical representation of a linear curve, where the X-axis (horizontal) represents the supply of a coin and the Y-axis (vertical) shows the price of each coin at that supply level.

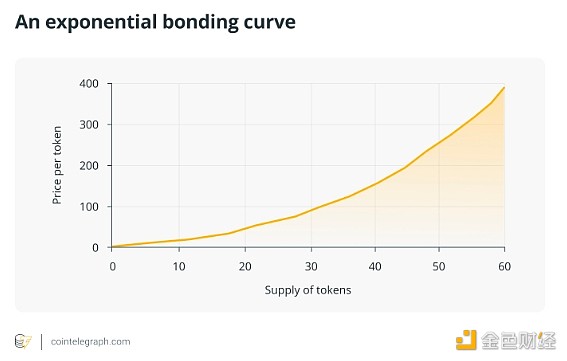

Index Curve

The exponential curve makes the price of a token exponentially dependent on supply. This means that if the supply doubles, the price will more than double. Adding even a few coins can lead to a significant increase in price. This makes the token’s price rise faster.

These curves maximize rewards for early buyers. When demand later increases, the initial users will likely sell their tokens at a higher price. Therefore, the exponential curve is ideal for projects that want to encourage early participation. The initial users bear the greatest risk, but if the project succeeds, they stand to gain the greatest profit.

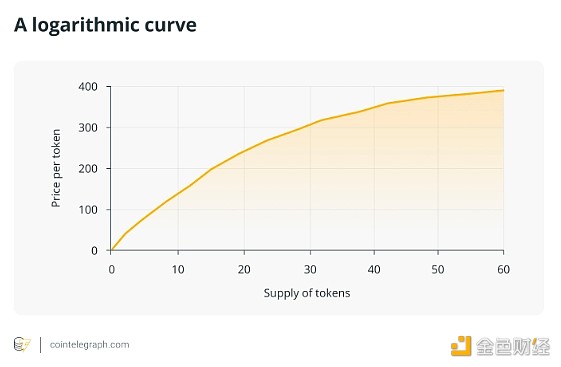

Yes Logarithmic Curve

The logarithmic curve causes the price of a token to rise rapidly as more tokens are added. However, as supply continues to expand, price growth gradually slows down. As a result, prices will rise sharply at the beginning but then stabilize over time. This benefits early investors the most as their tokens quickly increase in value in the early stages. The potential for quick early profits can attract the first buyers to provide liquidity.

In DeFi, In addition to linear, exponential, and logarithmic models, there are a variety of bond curve types to choose from. For example, there are S-curves for staged growth and stabilization, Step curves for milestone-based price growth, and reverse curves for lower prices as supply grows, each of which is specific to the bond curve of the economy. Results and project goals are customized.

3. Application of bond curve in cryptocurrency

The bond curve provides automated token liquidity and dynamic pricing for projects, transactions, stablecoins, communities and governance.

The bond curve serves as the basic mechanism for automatic liquidity initiation in initial decentralized exchange offerings (IDOs), enabling projects to launch new tokens by dynamically adjusting liquidity pool reserves. This model differs from traditional order books and ensures continuous and algorithmic adjustments to liquidity based on real-time demand. The flexibility of dynamic pricing in blockchain, enabled by bond curves, opens up new possibilities for token distribution and trading.

Platforms like Uniswap and Curve use bond curves as autonomous market makers, enhancing liquidity and providing more efficiency for various tokens, especially tokens that may be affected by low liquidity. transaction.

The bond curve plays a key role in stablecoin protocols, ensuring the stability of these digital currencies in a fully decentralized manner through algorithmic supply adjustments to build currency reserves and maintain fixed prices. However, this approach is risky, as algorithmic stablecoins rely entirely on bond curves and programmed supply changes to maintain their fixed prices.

For example, the algorithmic stablecoin TerraUSD (UST) lost its 1:1 fixed price against the US dollar after experiencing a dramatic run in May 2022. This shows that decentralized algorithmic stablecoins still have stability challenges compared to asset-backed models.

When demand drops sharply, algorithmic stablecoins may not be able to adjust supply quickly enough to maintain their fixed price. So while bond curves allow for decentralized stabilization mechanisms, they have not yet fully proven to be sufficiently resilient to runs compared to staking alternatives.

The Bond Curve facilitates a continuous token model in DeFi that allows for automated liquidity initiation, autonomous market makers, and dynamic pricing that adjusts to real-time demand.

They play a key role in decentralized autonomous organization (DAO) governance, purchasing voting tokens through the bond curve, aligning investments with governance participation, and ensuring pricing reflects the level of commitment to the DAO.

4. Decentralized Exchanges (DEX) and Bond Curves

Bond Curves provide customized, automated decentralization for various decentralized exchanges (DEXs) Liquidity and Pricing.

Uniswap

Uniswap uses a constant product formula, a specific type of bond curve, for its automated market maker (AMM) protocol . This formula ensures liquidity by maintaining constant the product of the quantities of two assets in any given liquidity pool. For example, if a pool contains Ethereum (ETH) and another token, the product of their quantities remains constant, dynamically determining the price based on supply and demand. This approach provides continuous liquidity and price discovery without the use of traditional order books.

Curve Finance

Curve Finance in DeFi focuses on stablecoins and uses a bond curve specifically for assets expected to be of equal value. Its bond curve is designed to reduce slippage and maintain stable prices for closely pegged assets (such as different stablecoins pegged to the US dollar). For asset pairs of similar value, the curve is flatter, which reduces the impact of transactions on price changes, making it more efficient for exchanges between stablecoins.

Balancer

Balancer uses a generalized version of the constant product formula, allowing for custom liquidity pools of up to eight assets in any weighted ratio composition. This flexibility allows users to create their own automatically balanced portfolios and liquidity pools, and define the relationship between the pool's asset prices and volumes using custom bond curves. Balancer's approach extends the utility of the bond curve beyond two asset pools, accommodating a wider range of trading strategies and portfolio management practices.

5. Challenges faced in implementing the bond curve

Challenges facing the bond curve include modeling, security and legal issues, requiring extensive testing, auditing and compliance analysis , to properly design, deploy, and regulate automated token pricing systems.

Designing the appropriate curve shape that is consistent with incentives and encourages desired market behavior requires extensive modeling and testing. For example, a curve that is too steep or flat can lead to price manipulation.

The security of smart contracts executing bond curves must be audited to guard against exploits that could affect price integrity. Additionally, smart contracts need to be optimized to minimize gas costs for automated transactions.

Ensuring the security of the smart contracts governing the bond curve is critical, as vulnerabilities could lead to arbitrage or manipulation. Formal verification, bug bounties, and audits can help reduce this risk. Ongoing research is focused on implementing dynamic curves that can be algorithmically adjusted based on market conditions.

The issue of legal regulation of the bond curve remains an open question. Most jurisdictions have yet to provide clear guidance on whether automated market makers, such as Bond Curve, constitute regulated trading venues or securities offerings.

Projects must carefully analyze the rights conferred by tokens sold through the bond curve according to different jurisdictions. Local regulations related to crypto-assets and securities vary across regions.

For example, if a token gives the holder rights such as profits, governance rights, etc., it may be regarded as a security in some jurisdictions and needs to comply with relevant securities regulations.

However, other jurisdictions may be more flexible in classifying utility tokens, even if these tokens have accompanying profit or governance rights. Therefore, projects should review the regulations of their target markets.

Many projects adopt a utility token model, where the token only provides access to the project's products or services, and the holder has no profit rights or governance capabilities. In many cases, such restricted token designs avoid meeting the legal definition of securities.

However, even purely utility tokens may still be subject to know-your-customer (KYC) and anti-money laundering (AML) regulations. These regulations require verification of user identity and source of funds.

Projects must seek legal advice to navigate this complex legal environment. The legal regulatory issues surrounding crypto tokens continue to evolve in various jurisdictions. Ongoing legal developments may provide a clearer framework for designing regulatory-compliant token implementations and bond curve systems.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Max Ng

Max Ng JinseFinance

JinseFinance JinseFinance

JinseFinance Cointelegraph

Cointelegraph