Source: Grayscale; Compiled by: Deng Tong, Golden Finance

Summary

Cryptocurrency is a unique high-volatility alternative asset class that may help improve risk-adjusted returns when added to a traditional portfolio.

When including cryptocurrencies in a portfolio, a little goes a long way:Traditional portfolio optimization techniques suggest that an allocation of about 5% can maximize expected risk-adjusted returns. However, allocating to cryptocurrencies may also increase portfolio risk.

Allocations to cryptocurrencies may replace other assets used to enhance returns or achieve diversification, including gold and other commodities, small-cap and international stocks, or technology stocks. The crypto asset class may also replace certain private investments because it can provide more liquidity.

Investors should consider their own circumstances and financial goals before investing in cryptocurrencies. The asset class should be considered high risk and may not be suitable for investors with short-term capital needs and/or high risk aversion.

Constructing a well-diversified portfolio has become increasingly difficult due to greater concentration of returns in traditional assets, changing correlations, and macro risks. At Grayscale, we believe the crypto asset class can be a way to help address these challenges. The crypto asset class includes a wide variety of technologies with many specific use cases. For example, Bitcoin is a monetary system, while Aave is a lending protocol and Bittensor is a platform for building open source AI. This diversity raises a question for asset allocators: When considering the allocation of a portfolio, should crypto assets be viewed as commodities, technology investments, or something else?

Grayscale Research believes that cryptocurrencies should be viewed as a unique, high-volatility alternative asset class that can help improve risk-adjusted returns when included in traditional portfolios. While individual assets vary, they are all based on the same underlying technology—public blockchains—and most can be considered early-stage investments. The key difference from other early-stage investment options, such as venture capital, is the market structure of cryptocurrencies: blockchain-based assets are liquid and traded around the clock around the world, including by many retail investors. These characteristics—early-stage investments that trade in liquid public markets and can be purchased by anyone—generate a set of statistical properties that can be used to guide portfolio construction.

Behavior of the Cryptoasset Class

Over its relatively short history, the returns of the cryptoasset class have exhibited four main statistical characteristics: (1) high volatility; (2) returns relative to the volatility of other major asset classes; (3) low correlation with traditional assets; and (4) relatively high momentum (statistical persistence). [1] Furthermore, these statistical characteristics tend to evolve over time, particularly for more mature digital assets such as Bitcoin.

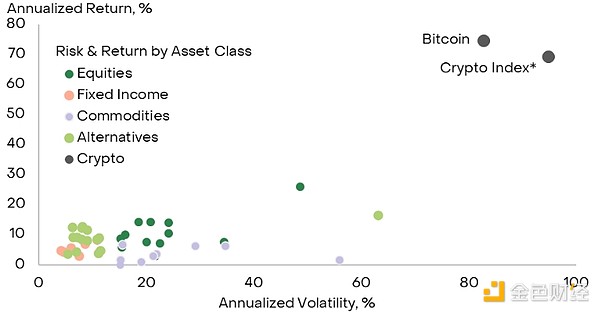

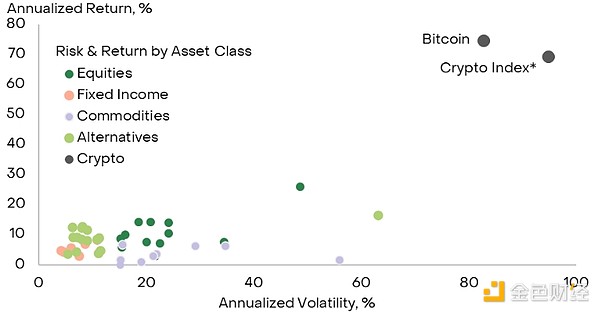

1. High Volatility. Cryptocurrencies are a unique major asset class with extremely high volatility. Since the beginning of 2017, the market-cap-weighted index of investable digital assets[2] has an annualized volatility of 95%; Bitcoin's volatility over the same period is 83%. In comparison, the S&P 500 has an annualized volatility of 16% and the Nasdaq 100 has an annualized volatility of 19%. The volatility of cryptocurrencies is closer to that of certain high-price volatile commodities such as natural gas or investment strategies that employ leverage (Figure 1). Therefore, the crypto asset class should be considered high risk, which is the first consideration that investors should keep in mind before adding crypto assets to their portfolios.

Figure 1: Cryptocurrency is a unique and volatile major asset class

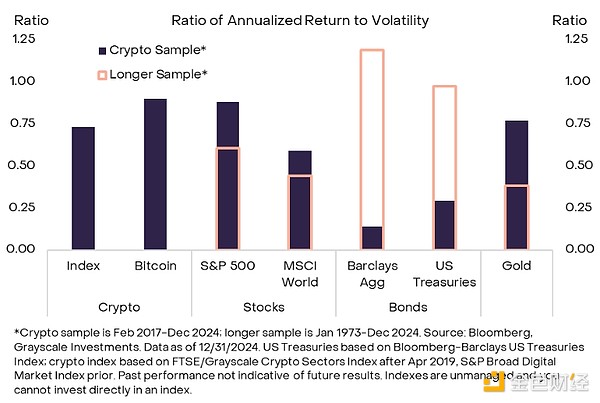

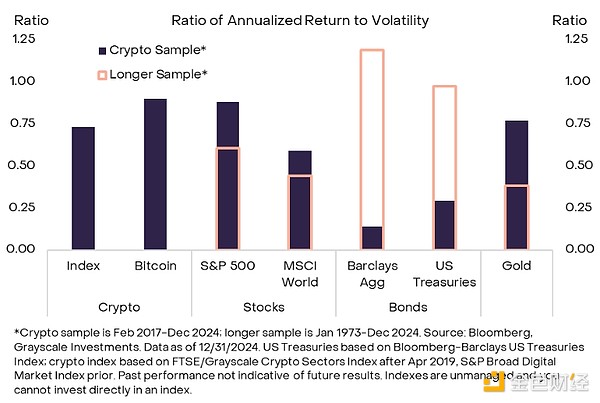

2. Returns are commensurate with volatility. Meanwhile, Bitcoin and digital assets as a whole (e.g. based on market cap weighted indices) have generated returns commensurate with their higher volatility. In other words, cryptoassets compensate investors for the higher risk they take with higher returns. For example, the same market cap weighted index of investable crypto assets has returned 69% annualized since the beginning of 2017. Given an annualized volatility of 95%, the return-to-volatility ratio is about 0.7. Over the same period, the S&P 500 had an annualized return of 14% and a volatility of 16%, for a return-to-volatility ratio of about 0.9. [3] Over periods of about 10 years or more, the return-to-volatility ratios of major asset classes tend to be in the 0.5-1.0 range, and cryptocurrency returns are also in this range (Exhibit 2). Thus, given their higher volatility, cryptocurrency returns are comparable to those we observe for other asset classes.

Figure 2: Cryptocurrencies have similar returns and volatility to other asset classes

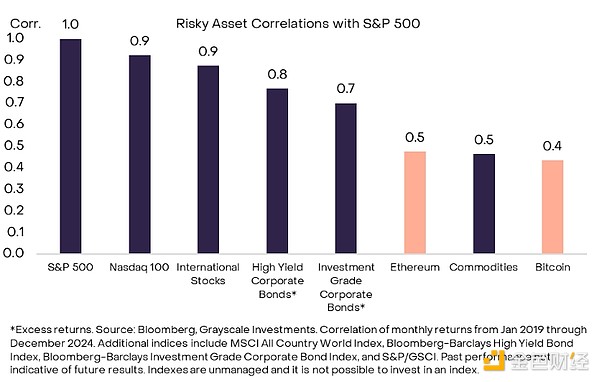

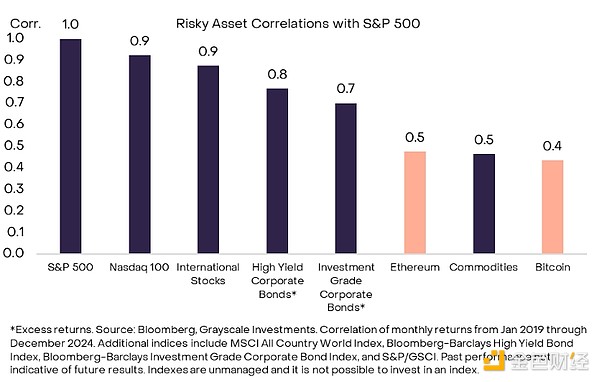

3. Low correlation with traditional assets.Higher volatility and higher returns can be achieved through leverage—investing more capital by borrowing money. However, adding leverage to traditional assets does not affect their correlation and therefore cannot be used to improve risk-adjusted returns. [4] The crypto asset class is unique in that it offers high risk and high potential returns while having a low correlation with traditional assets (Figure 3). Low correlation is the “secret sauce” for portfolio diversification and why data-driven portfolio optimization approaches often include crypto asset classes.

Figure 3: Correlation between crypto and stock market returns is historically low

4. High momentum.Compared to stocks and bonds, historical returns of crypto asset classes exhibit relatively high momentum: gains tend to follow gains, and losses tend to follow losses. In this way, digital asset returns are more similar to the returns of currencies and commodity assets, which also exhibit price momentum. The combination of high volatility and high momentum means that the cryptoasset class occasionally produces concentrated periods of large upside, as well as periods of large downside. Investors who include cryptocurrencies in a diversified portfolio may want to consider using trend-following strategies for risk management.

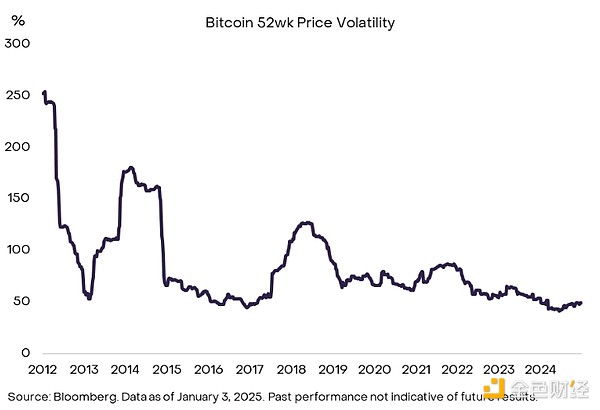

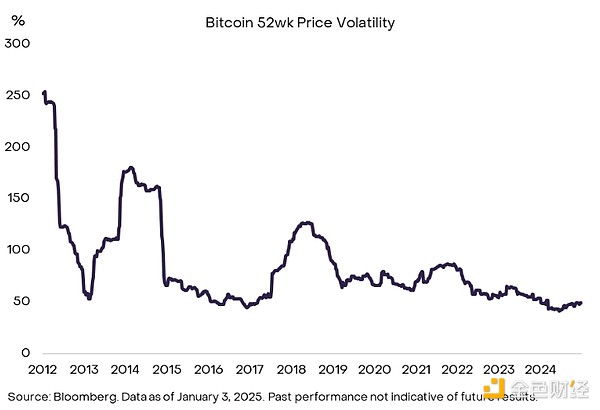

While the cryptoasset class has grown to considerable size, it is still relatively young and its statistical properties may change over time. This is already the case for some of the more mature assets, such as Bitcoin, which has seen its price volatility decline (Figure 4). Grayscale Research believes that public blockchains can be viewed as network technologies, and economic theory predicts that the value of the network will be non-linearly related to the size of the network. Therefore, investors should be prepared for changes in the statistical return behavior of blockchain-based assets as user adoption grows.

Figure 4: Bitcoin’s volatility has declined over time

Diversification Benefits

When constructing a diversified portfolio, investors typically consider the expected risk and expected return of each asset, as well as the expected correlations between assets, to arrive at a portfolio that maximizes risk-adjusted returns. [5] Inclusion in the cryptoasset class is no exception: investors should consider expected risk, return, and correlation based on historical performance and judgments about how future returns may change.

As a benchmark example, Grayscale Research considers the inclusion of Bitcoin in a traditional 60/40 stock and bond portfolio. [6] We simulated hypothetical portfolios containing different amounts of Bitcoin using a Monte Carlo approach. We then estimated the expected annualized return and annualized volatility of the portfolios and calculated the expected Sharpe ratio (see the Technical Appendix for details). [7] For the baseline example, we assumed that the distribution of Bitcoin’s future returns will match its actual returns since 2014. Bitcoin is used as a representative digital asset due to its long history; we consider portfolios with a wider range of digital assets in the next section.

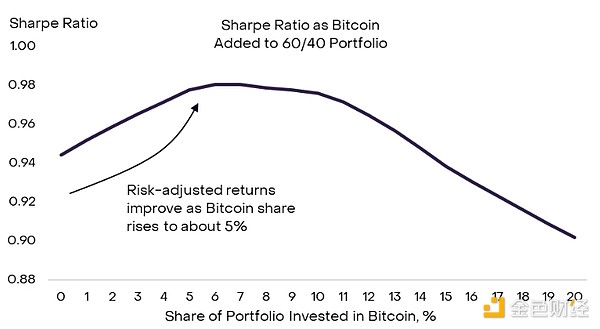

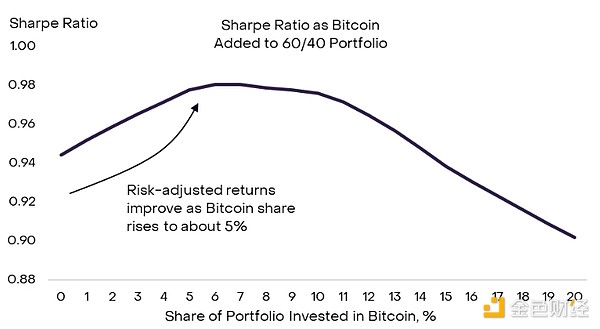

Figure 5 shows the results of our baseline simulation. As Bitcoin is added to the classic 60/40 portfolio in small increments, the expected Sharpe ratio initially rises. The reason is that, although Bitcoin is a volatile asset, it can offer high returns and has low correlations with traditional assets, thus providing diversification benefits. The Sharpe ratio continues to rise until Bitcoin accounts for approximately 5% of the total portfolio, and then begins to level off. After this point, adding Bitcoin allocations is no longer expected to improve risk-adjusted returns.

Figure 5: Adding Bitcoin to a Traditional Portfolio Could Boost Risk-Adjusted Returns

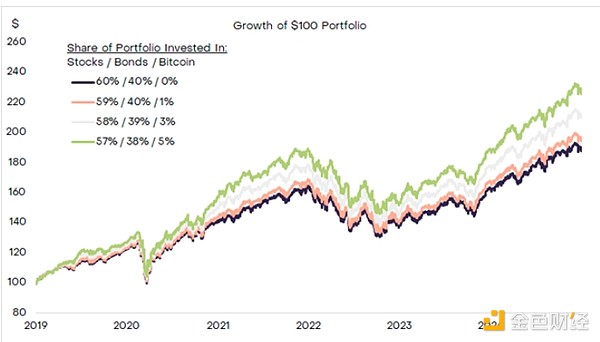

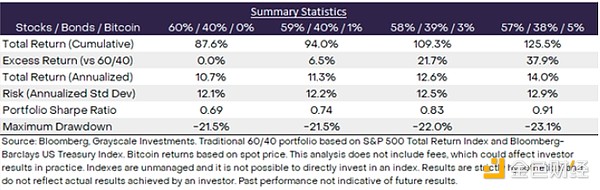

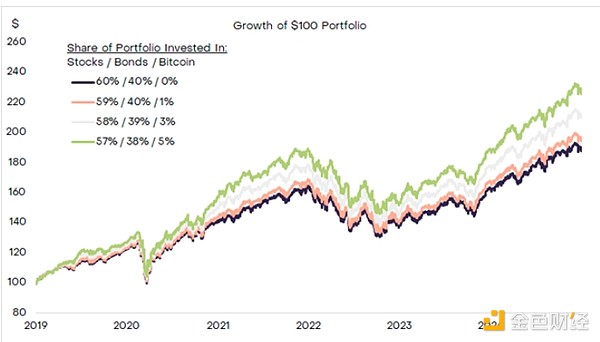

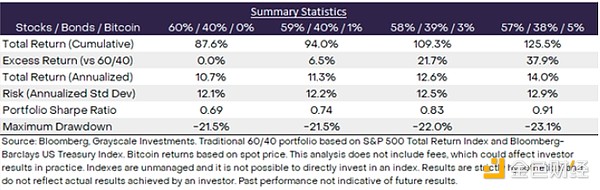

Because cryptocurrency is a volatile asset class, only a small investment can have a large impact: even a modest allocation to Bitcoin and other digital assets can significantly improve total and risk-adjusted returns. For example, Exhibit 6 shows the hypothetical ex-post impact of adding Bitcoin to a traditional 60/40 portfolio in increments of 1%, 3%, and 5%. These results are entirely hypothetical and do not reflect actual results achieved by investors. When Bitcoin is added to a 60/40 portfolio at these amounts, annualized returns increase by 0.6-3.3 percentage points (pp) and portfolio Sharpe ratio increases by 0.05-0.22pp over this period. While both total and risk-adjusted returns increase, it is important to emphasize that portfolio risk (including maximum drawdown) also increases.

Figure 6: Hypothetical impact of a 1%-5% Bitcoin allocation on a 60/40 portfolio

Of course, this is just a simulation under specific assumptions, and there is no guarantee that future returns will match past returns. Investors should consider a range of possible outcomes for cryptoasset returns before allocating capital. While an allocation of approximately 5% is likely to maximize risk-adjusted returns based on historical results, a lower amount may be appropriate if Bitcoin's returns decline in the future or its correlation with other asset classes increases.

FAQ

While traditional portfolio optimization techniques can be a useful starting point, investors often need to address a variety of practical implementation issues when allocating to cryptoasset classes. The following are some of the most common questions we receive from investors regarding the inclusion of cryptocurrencies in a diversified portfolio:

1. How do portfolio outcomes change when cryptoassets other than Bitcoin are considered?Cryptoassets with a market capitalization lower than Bitcoin (traditionally referred to as "altcoins") generally have higher price volatility and should be considered riskier. Furthermore, the universe of assets is highly diversified in terms of use case, market capitalization, and correlation with traditional assets. During the period in which broad indices of crypto market performance are available[8], altcoins as a class have had slightly lower total and risk-adjusted returns than Bitcoin, although this may not be the case in the future. [9] At a minimum, investors considering an allocation to altcoins should take a diversified approach that reflects the higher idiosyncratic risk and may want to consider methods for evaluating token-specific fundamentals. That said, taking historical data at face value, our Monte Carlo simulations suggest that an allocation of approximately 5% would also maximize the expected risk-adjusted return of a market-cap-weighted basket of crypto assets that includes Bitcoin and altcoins. 2. Which parts of my existing portfolio should I divest from when adding cryptocurrencies? Within a diversified portfolio, the crypto asset class can provide return enhancement, diversification, or both. As such, it may displace existing allocations designed to provide these attributes, including gold and other commodities, small-cap and international equities, or technology stocks. Cryptocurrency may also displace certain private investments (e.g., private equity, venture capital, or infrastructure) where it would also provide additional portfolio liquidity. The crypto asset class may offer higher risk and higher potential returns than other asset classes, potentially helping to improve capital efficiency across the portfolio.

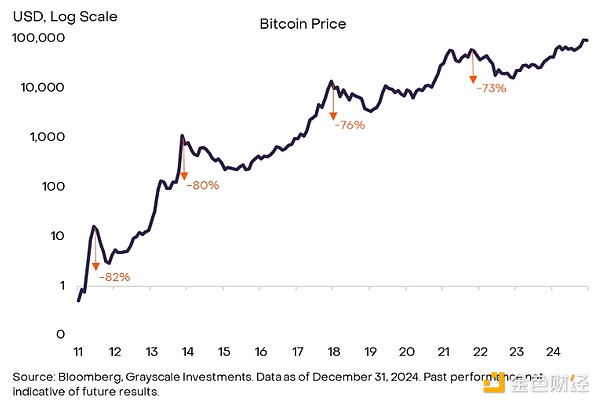

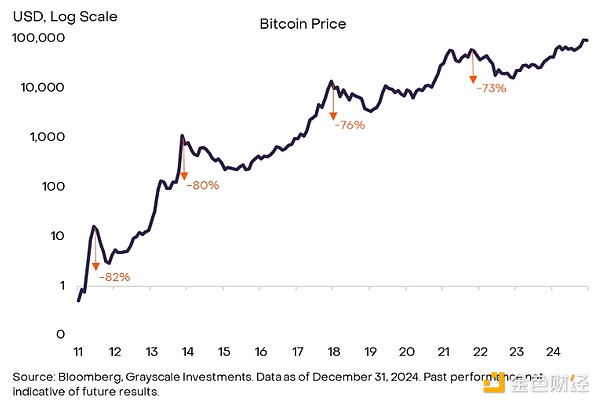

3. What was the magnitude and frequency of past drawdowns? Bitcoin has experienced four long drawdowns in its history (Exhibit 7). Using monthly data, the average peak-to-trough decline during these periods was 77%. As discussed above, trend-following strategies may be used to manage downside risk. There are many more examples of smaller drawdowns. For example, during the most recent appreciation phase of the crypto market cycle (from December 2018 to November 2021), the price of Bitcoin increased approximately 21 times. However, during this period, the price of Bitcoin fell by at least 10% a total of 11 times. During the previous appreciation phase of the crypto market cycle (from January 2015 to December 2017), the price of Bitcoin fell by at least 20% a total of 11 times. [10]

Figure 7: Bitcoin has experienced four major declines in its 16-year history

4. Should I consider Bitcoin a defensive asset?Grayscale Research believes that Bitcoin can be considered a store of value: we expect it to maintain its value in real terms (i.e., taking inflation into account) over the long term because it is scarce and not dependent on any particular institution.Today, Bitcoin should not be considered a defensive asset that can dampen portfolio volatility during a recession or other period of heightened risk aversion. Bitcoin is a high-volatility asset that is positively correlated with the stock market and typically falls when risk aversion increases. In addition, at least for now, gold and short-term U.S. Treasuries tend to outperform Bitcoin when geopolitical risks increase.

The Role of Cryptocurrencies

It is important to emphasize that investing in digital assets may not be suitable for everyone. In this analysis, we considered a representative investor who holds a classic 60/40 portfolio. However, in practice, there are many types of portfolios that can meet different financial needs. For example, some investors hold a portfolio of low-volatility assets because their capital is earmarked for upcoming expenses (such as buying a house or college tuition). Cryptocurrency is a high-volatility asset class that may generate strong returns over time, but it may also depreciate significantly in the short term. In addition, some investors favor income-producing assets such as fixed-income securities or dividend-paying stocks. While some crypto assets generate income, in most cases the returns will be low compared to the volatility of the asset - cryptocurrency is an asset class that is primarily used for capital appreciation.

While there are some exceptions, Grayscale Research’s analysis suggests that a traditional balanced portfolio could achieve higher risk-adjusted returns with a modest allocation to cryptocurrencies (perhaps around 5% of total financial assets). Because cryptocurrencies are a high-risk/high-return potential asset class with low correlation to equities, crypto assets may help investors overcome some of the portfolio construction challenges they currently face. Allocating to cryptocurrencies does not change other traditional thinking about portfolio construction, including reducing portfolio volatility as retirement approaches, using tax-advantaged accounts when possible, and avoiding attempts to time the market.

Notes

[1] Bitcoin also exhibited positive skewness in its early history. We do not consider the impact of positive skewness in this report, but do discuss it in a previous report on cryptocurrencies in portfolios.

[2] In this report, we use a composite of two market-cap-weighted cryptocurrency price indices, with the starting date chosen based on data availability. The FTSE/Grayscale Crypto Sector Index Series began in April 2019. Prior to that, the only other available broad market-cap weighted index of cryptocurrency price returns was the S&P Crypto Broad Digital Market Index, which began in February 2017. In this report, our measurement of crypto asset class returns is based on the S&P Broad Digital Market Index as of March 2019 and the FTSE/Grayscale Crypto Sector Index Series thereafter.

[3] Source: Bloomberg, Grayscale Investments. Data as of December 31, 2024.

[4] Risk parity strategies typically apply leverage to low volatility asset classes such as Treasuries, theoretically to improve risk-adjusted returns.

[5] These are fundamental concepts of Modern Portfolio Theory, a common approach to portfolio construction.

[6] This is a simplification, as many modern portfolios may include some alternative asset classes.

[7] When calculating the Sharpe ratio, cash returns are assumed to be zero.

[8] As noted in footnote #2, this is data from February 2017 to date.

[9] Source: Bloomberg, Grayscale Investments. Based on the FTSE/Grayscale Crypto Sectors Index Series and the S&P Crypto Broad Digital Market Index.

[10] Source: Coin Metrics, Grayscale Investments. Data as of December 31, 2024.

Catherine

Catherine