Source: Grayscale; Compiled by: Deng Tong, Golden Finance

Spot bits Bitcoin ETFs made their debut on the U.S. market, with highlights including high trading volumes and net inflows totaling approximately $1.5 billion.

The valuations of Bitcoin and Ethereum were little changed in January, while the prices of many “altcoins” fell. Positioning measures suggest active traders reduced risk after the U.S. spot Bitcoin ETF began trading.

At the same time, the market value of stablecoins continues to rise, the market is paying attention to the synergy of cryptocurrency and artificial intelligence, and the Federal Reserve has stated that it is not yet ready to start cutting interest rates.

A spot Bitcoin exchange-traded fund (ETF) debuted in the United States in January 2024, more than a decade after it was first filed. Bitcoin’s journey to the center of the global financial system has seen many milestones, including the first exchange, the first derivatives product, and the first loan collateralized by Bitcoin. While these events may be overlooked in the daily focus on price and trading volume, we believe the launch ofthe new Bitcoin ETF is another significant step in the development of the emerging crypto asset class.

The trading volume of these ten new products demonstrates widespread investor interest in acquiring Bitcoin through ETF structures. Since its launch on January 11, the overall spot Bitcoin ETF has averaged $2.1 billion in daily trading volume. Compared to typical trading volumes for all U.S.-listed ETFs, the new Bitcoin product would rank eighth in volume since launch, along with products offering exposure to U.S. equity and bond markets (Exhibit 1). For more comparison, the largest non-crypto commodity ETF ($GLD) has average daily trading volume of about $1.1 billion since January 11, while the largest Bitcoin futures ETF ($BITO) has average daily trading volume of around $1.1 billion. to US$570 million. period. [1] While there are many ways to own Bitcoin, including self-custody, the successful launch of a spot Bitcoin ETF suggests that many investors and financial advisors may value the liquidity and convenience of this product structure.

Chart 1: Spot Bitcoin ETF trading volume ranks among large stock and bond products

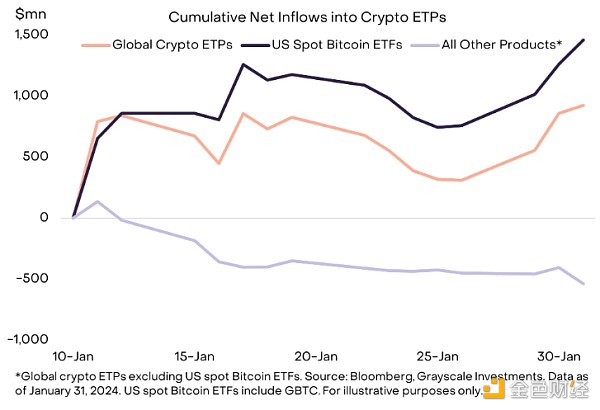

Net new product inflows surged at the start of trading and stabilized as the month progressed . Since January 11, net inflows into U.S.-listed spot Bitcoin ETFs have totaled approximately $1.46 billion (Chart 2). This was partially offset by net outflows from overseas cryptocurrency exchange-traded products (ETPs), particularly Canadian Bitcoin funds, with net inflows across all products totaling approximately $1.094 billion since January 11 (1 The net inflow for the whole year was US$1.285 billion).

Chart 2: Net inflows into U.S.-listed spot Bitcoin ETFs, outflows elsewhere

From a price return perspective, Bitcoin and Ethereum are almost There was no change, while many other coins (or “altcoins”) underperformed. [2] According to the FTSE Grayscale Crypto Industry Index Series, the consumer and cultural cryptocurrency industry was the worst performer among the five sectors, down approximately 12% in January. We believe the underperformance of low-cap tokens is consistent with declining risk appetite among some market participants.

Chart 3: "Altcoins" performed poorly in January

Although the new Bitcoin ETF saw healthy net inflows, active trader positions may have been ahead of the launch Overextended, leading to a correction later in January. For example, open interest in CME Group-listed Bitcoin futures reached local highs before January 11 but has since fallen back (Chart 4). Likewise, in the options market, the price of short-term (e.g., 2-week) call options increases relative to the price of short-term put options, which may indicate investor demand for a bullish leverage structure. But like futures open interest, call premiums fell in the second half of the month. [3] Indeed,some market participants seemed ready for a significant increase in Bitcoin prices once the ETF began trading; they may have subsequently reduced their risk after trading near unchanged on the first day.

Chart 4: Futures open interest increases before the launch of spot Bitcoin ETF

The utility and services cryptocurrency space included some of January's best and worst performers Token. For example, both UMA (+105%) and ENS (+81%) tokens saw significant gains. [4] The UMA token benefits from the launch of Oval, a project focused on protecting lending protocols from Maximum Extractable Value (MEV). [5] Meanwhile, Worldcoin (WLD), which is also part of the Utilities and Services cryptocurrency sector, was one of the worst-performing coins (-34%). [6] For Worldcoin, January’s weakness marks a reversal from a strong performance in December, with reports that it is in the process of a funding round. [7]

The synergy between cryptocurrencies and artificial intelligence (AI) technology became a prominent theme in 2023, with AI-related cryptoassets outperforming all cryptocurrencies industry. The topic remained in focus in January, with Ethereum co-founder Vitalik Buterin giving his opinion. Grayscale Research believes thatpublic blockchain technology can offer the potential to help alleviate social issues related to artificial intelligence, including the rise of deepfakes and concerns about data privacy. While the crossover between these fields is still in its infancy, early signs of progress can be seen in the decentralized GPU (graphics processing unit) market like Akash and Render. In January, the theme's asset performance varied widely, with assets such as Bittensor (+71%) and Akash (+20%) outperforming the market, while assets such as Render (-6%) and Fetch AI (-) Performance is in line with the market. 17%) and WorldCoin (-34%), which significantly underperformed the market. [8]

While artificial intelligence and other topics often steal the limelight,the steady resurgence of stablecoin adoption remains another key trend. Stablecoins provide a way to hold and transfer U.S. dollars (or other fiat currencies) on a public blockchain, sowe expect that rising adoption of stablecoins may provide a new platform for blockchain generation. Coins bring value. Total stablecoin market capitalization increased by $5 billion in January, primarily due to growth in Tether (Exhibit 5). In fact, Tether’s “dominance” (its share of the stablecoin market) rose to a new high of 71% this month. [9] Tether has multiple use cases, including as a cash asset held in trading applications and as a payment medium. Howard Lutnick, CEO of financial services firm Cantor Fitzgerald, said in mid-January that his company manages a significant portion of Tether’s assets, noting that the stablecoin retains reserve assets. [10] Separately, USDC stablecoin issuer Circle filed for an IPO. [11]

Exhibit 5: Tether drives growth in stablecoin adoption

With the launch of spot Bitcoin ETFs, the focus of the cryptocurrency market may shift back to macroeconomics, political conditions and technological developments. On Wednesday (January 31), the Federal Reserve said that although inflation risks have been "better balanced," it is not yet ready to start cutting interest rates. Any change in monetary policy that lowers real interest rates will have a positive impact on Bitcoin’s valuation. Cryptocurrency investors may also begin to look ahead to the U.S. presidential election, in which various issues important to voters intersect with cryptocurrency investment themes and the candidates’ views on the asset class remain dominant. Grayscale continues to track the role of cryptocurrencies in elections by partnering with The Harris Poll (for more information, see Elections 2024: The Role of Cryptocurrency). Finally,on the technical side, we expect continued focus on the Bitcoin halving and the debate over Ethereum scaling ahead of the ETH Denver conference at the end of February and Ethereum Improvement Proposal (EIP) 4844, which is set to be enacted in April. [12]

References:

[1] Source: Bloomberg, as of January 31, 2024.

[2] Source: Bloomberg. The return calculation period is from December 29, 2023 to January 31, 2024.

[3] Source: Glassnode data as of January 31, 2024.

[4] Source: CoinGecko, as of January 31, 2024.

[5] Source: The Block.

[6] Source: CoinGecko, as of January 31, 2024.

[7] Source: Reuters.

[8] Source: CoinGecko, as of January 31, 2024.

[9] Source: DeFi Llama, Grayscale Investments. Ends January 31, 2024.

[10] Source: The Block.

[11] Source: CNBC.

[12] Source: Consensys.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Bernice

Bernice Huang Bo

Huang Bo Catherine

Catherine Beincrypto

Beincrypto Beincrypto

Beincrypto Bitcoinist

Bitcoinist Nulltx

Nulltx Cointelegraph

Cointelegraph