Author: Mu Mu; Vernacular Blockchain

Recently, Harris, the US Vice President and next presidential candidate, officially stated that she would support digital assets. As the main competitor of another high-support presidential candidate Trump, her attitude towards crypto assets is obviously very important. Although a number of crypto KOLs have expressed the positive effects of Harris's move, it is too early to think that Bitcoin and crypto assets will have a smooth road in the future. So how does the mainstream society view Bitcoin and other crypto assets?

01 What does the next US president think?

The US presidential election "finals" are imminent. If nothing unexpected happens, one of Trump and Harris will become the next US president in a few months. Before Harris once kept silent about crypto assets, Trump did not hide his support for crypto assets.

As mentioned in the previous article "How credible is Trump's Bitcoin Conference promise? ", Trump and Harris represent the very different political views of the Republican Party and the Democratic Party respectively. The Republican Party tends to support and participate in technological innovation and market freedom, while the Democratic Party's propositions, including environmental impact and sustainability, financial inequality and social justice, and stronger supervision, reflect its values of weakening individual freedom and power and emphasizing public and collective interests. The environmental impact of Bitcoin mining in the past and the seemingly unequal wealth acquisition of a large number of individuals have made the Democratic Party full of prejudice against crypto assets.

However, Democrats do not mean always leaning to the left, and the ultimate goals of the two parties are the same. Harris has expressed support for crypto assets more than once in public recently. In a speech at the Pittsburgh Economic Club on Wednesday, Harris said that under her leadership, the United States will "recommit" to maintaining global leadership in key areas that "shape the next hundred years": "maintaining dominance in artificial intelligence and quantum computing, blockchain and other emerging technologies."

Previously, some analysts believed that Trump's coming to power was good for Bitcoin and the crypto market, but Harris might be the opposite. Now some analysts have put forward different views. VanEck analysts said that Harris' presidency may be more beneficial to Bitcoin because it will "accelerate many structural issues that drive Bitcoin adoption."

So far, Harris's commitment and statement means that whoever takes office as the next US president will be more friendly than the current Biden administration (which is relatively less friendly), at least on the surface.

02 What do you think of regulation?

It is well known that the US regulators under the leadership of Biden have brought many troubles and challenges to the crypto market, especially the US SEC, which is always "finding trouble" and suing at every turn, and its anti-crypto chairman Gary Gensler (pictured below), who constantly releases unfriendly remarks and warnings.

Recently, the US Securities and Exchange Commission (SEC) Investor Education and Advocacy Office issued a notice on Monday stating that investors should understand that Bitcoin and Ethereum are highly speculative investments due to their huge volatility.The US SEC warned that spot Bitcoin and Ethereum ETPs are subject to risks such as price volatility and possible fraud in unregulated markets. The securities watchdog emphasized that "spot Bitcoin and Ethereum ETPs are not registered as investment companies under the Investment Company Act of 1940". Therefore, they lack the asset custody and valuation protections applicable to ETFs and mutual funds.

In general, regulators are always vigilant. Perhaps it is their duty, or perhaps it is because of Gary's anti-crypto plot and prejudice that the next leadership team has called for him to be replaced. It would be better to replace him with someone else. But the SEC will still be vigilant about the volatile crypto market and warn investors to pay attention to risks. After all, in essence, these decentralized assets are always a force that they cannot control. Even if crypto assets contribute to innovation and technology, they will not be at ease with the conflicts behind them.

03 What do institutions think?

Institutional funds usually vote with their feet. The inflow of funds from Bitcoin ETFs can show how institutions view it. Recently, Bloomberg analyst Eric Balchunas posted on the X platform that the capital flow of US Bitcoin ETFs has reached US$17.8 billion since the beginning of the year, setting a new high. The goal of owning 1 million Bitcoins has been achieved by 92%, and the holdings of Bitcoin ETFs are close to the holdings of Satoshi Nakamoto. Data shows that Satoshi Nakamoto holds 1.1 million BTC, and the holdings of Bitcoin ETF exceed 916,000.

Currently, most of the world's largest fund management companies have already started crypto asset business. The Bitcoin ETF launched by BlackRock has even exceeded the holdings of Grayscale Fund, becoming one of the institutions with the largest Bitcoin holdings.

Unlike the SEC's view that Bitcoin is a risky asset, institutions have gradually improved their understanding of crypto assets in recent years. Crypto assets such as Bitcoin have gradually transitioned from pure risk assets to alternative assets that play a hedging role in special circumstances in the eyes of institutions. They have special significance and role, and can hedge some fiscal, monetary and geopolitical risks that other assets in the portfolio may face.

04 What do the general public think?

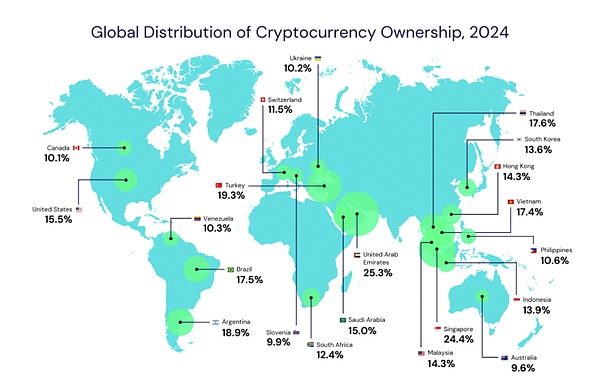

Since the general public does not have the professionalism of institutions, the general public's attitude towards crypto assets is still uneven, which is related to the friendliness of different countries and regions to crypto assets.

Image source: B2Broker

Image source: B2Broker

Qatar, Egypt, Bangladesh, Morocco and other countries and regions that explicitly prohibit or do not support the circulation of crypto assets are crypto-unfriendly regions, and their attitude is self-evident. In crypto-friendly countries such as Malta, Singapore, the United Arab Emirates, Germany, Portugal, and Switzerland, clear regulations and regulatory frameworks are usually provided, and funds are established to invest, support and promote the establishment and development of innovative crypto companies. Through these top-down support for innovation, ordinary people are generally more aware of crypto assets.

Due to the limited understanding of the public, the comments on crypto assets on social networks in some crypto-unfriendly countries and regions are mostly negative. Friendly countries and regions are just the opposite.Even in the relatively neutral United States, we currently see that the group of crypto asset enthusiasts is not small, and has become one of the important targets for the presidential election.

05 Summary

As Hayden Adams, founder of Uniswap, commented on Harris' crypto overtures, this is a positive signal. Biden has performed poorly on the cryptocurrency and technology industries over the past four years, and Harris is hinting that her government will handle it differently in the future and be more supportive of innovation.

Next, I believe that no matter who comes to power, the crypto industry will receive friendlier support than it does now. Under the leadership of new crypto-friendly leaders, supervision will be more open and inclusive, and institutions will dare to actively participate in investment and construction, and ordinary people will further deepen their understanding of crypto assets that have entered the mainstream.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cointelegraph

Cointelegraph Future

Future Cointelegraph

Cointelegraph