Author: Daniel Kuhn Source: coinbase Translation: Shan Oppa, Golden Finance

< p style="text-align: left;">For years, the Lightning Network has been hailed as the savior of Bitcoin. It is an off-chain solution that can make the "peer-to-peer digital cash" proposed by Satoshi Nakamoto truly a functional Payment network. Now, however, the Lightning Network seems to be losing people’s trust.

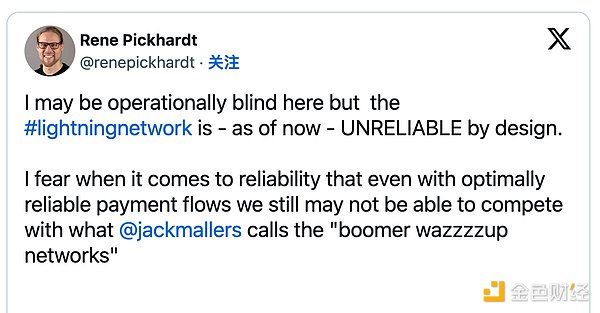

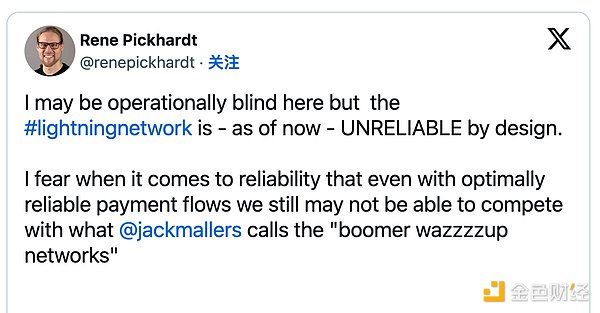

Industry publication Protos recently published an article stating thatmany Lightning Network developers have withdrawn from the project, and there are increasing vulnerabilities and issues that need to be resolved. More and more, and liquidity is slowly drying up. Taken together, people seem to be more willing to point out the flaws of Bitcoin, the leading scaling solution.

These statements are partially true. Back in 2019, one of the network's co-creators, Tadge Dryja, was willing to discuss the "limitations" of the scaling solution, and was criticized that year for the way he scaled Bitcoin with Lightning Network experiments. After disagreements with major Lightning Network developers, including Lightning Labs, they stopped direct contributions to the project (just months after Lightning Network went live and almost four years after the concept was first proposed).

Similarly, Joseph Poon, another co-author of the Lightning Network white paper, appears to have concerns about blockchain scaling on other chains, such as Ethereum’s Plasma. Program is more interesting. He is currently developing a new type of decentralized exchange.

Over the years,vulnerabilities affecting the Lightning Network and some of its implementations have been discovered. For example, in 2022, buggy code in LND, the preferred implementation of Lightning Network Labs, prevented users from transferring funds to mainnet for several hours. (Though, to be fair, vulnerabilities are usually fixed before they are exploited.)

Other Bitcoin supporters have also criticized many of the Lightning Network’s Concerns were raised about privacy issues and the fact that the scaling solution can sometimes be surprisingly expensive to use. In particular, they take issue with the design of "inbound capacity" in the Lightning Network, which limits the amount of Bitcoin you can receive, so users sometimes have to pay a fee to receive funds (or the fee is subsidized by the startup).

< /p>

< /p>

The latest round of discussion about Bitcoin’s Lightning Network appears to have been sparked by long-time Bitcoin supporter John Carvalho, a former Lightning One of the web's "biggest fans" until he tried building software solutions on top of it. Carvalho recently attracted widespread attention when he mocked the "complexity and fragility" of the agreement in an interview with Vlad Costea.

We tried our best to keep it running, but all the narratives that formed around [Lightning Network] in the first few years were greatly exaggerated. ”

Indeed, there appears to be a shift in opinionaround Bitcoin’s Lightning Network. The Lightning Network had been touted as a potential alternative to the Visa payment system and It will bring about a wave of “Bitcoin hyper-issuance”.

Inspired by Carvalho’s interview, Bitcoin developer Paul Stock ( Paul Sztorc posted a long list of "negatives" for the Lightning Network, including doubts about its ability to scale to more than 8 billion people around the world, "channel risks" with who it interacts with, payment failure rates and the amount of Bitcoin invested in it. The amount accounts for only "a paltry 0.025%" of Bitcoins in circulation.

Protos further pointed out that the total number of Bitcoins on the Lightning Network has been slowly decreasing, From under 5,500 BTC in December 2023 to around 4,750 BTC today. This may be a sign that people are abandoning the Lightning Network, although it is worth noting that the value put into the Lightning Network has doubled this year in USD terms to approximately $320 million, compared to $158 million in the same period last year.

Looking at the data alone makes the picture confusing: Lightning Network node count has also declined from its 2022 peak , the same goes for the number of connections between nodes, however the total number of transactions has reportedly been rising.

Stoker has been advocating for scaling Bitcoin through "sidechains," The subjective and anecdotal accounts he marshaled paint a grimmer picture. Just in the past year, respected Bitcoin Core developer BlueMatt called the Lightning Network a “joke.” Lightning Network security researcher Antoine Riard left the project (and published a scathing blog post). FiatJaf, the creator of the popular social network Nostr, also expressed his feelings of declining confidence.

CoinDesk is not here to speculate on the final outcome, but it can be seen that the growth of Lightning Network has been somewhat stagnant at best. But to say that the public perception of Lightning Network has changed seems to be an exaggeration; Lightning Network has been criticized for years for being over-hyped. Its fanatical followers set unrealistic expectations.

In fact, Lightning Network co-creators Joseph Poon and Tadhg Draja started from It was stated at the outset thatit does not solve all of Bitcoin’s scalability issues. There’s a reason the memes surrounding Lightning Network always say it’s “18 months away.”

While it’s hard to argue with critics that commitments to the Lightning Network were too frivolous (especially during the last bull market mania), it’s important to consider these It’s important to put the conversation in its proper context. When the network officially launched in 2019 after years of testing, Bitcoin supporters frequently warned it was an “experimental” solution.

Testing the Lightning Network at scale (the "Lightning Torch" is passed around the world to indict random bits after Craig "Fake Satoshi" Wright sues Around the time Coin backer Hodlonaut raised funds), a popular hashtag appeared warning users that using the Lightning Network was "reckless" and should only send amounts they were willing to lose.

There are legitimate complaints about the Lightning Network. They existed in the past and exist now, and they should be voiced if improvements are to be made. Opening and closing channels is difficult and expensive. There are many security and scalability issues. Often making the Lightning Network suitable for day-to-day custodial solutions reintroduces the very third-party problems that Bitcoin was designed to solve.

If there's any saving grace, it's this: Bitcoin's most ardent supporters are often its harshest critics.

JinseFinance

JinseFinance

< /p>

< /p>