Author: Sankalp Shangari Compiler: Vernacular Blockchain

1. From boring bonds to the wonderful counterattack of Bitcoin

If you think traditional finance is boring, you are not alone. However, cryptocurrency is different. It is destined to change the way financial markets and legal currency systems operate.

Sometimes, there is always a character who does not play by the rules, breaking the rules and bringing new changes. Michael Saylor is such a person - he turned a seemingly ordinary financial instrument - convertible bonds, into a powerful Bitcoin acquisition machine. Think of this as the "Ocean's Eleven" in the financial world. However, instead of robbing a bank, Saylor combined market volatility, debt and Bitcoin to successfully "rob" the entire market.

1) What are convertible bonds (and why should you care)?

Convertible bonds sound like something boring like a tax lecture, but they’re actually a very interesting tool in the world of finance.

Imagine if bonds and stocks were combined, and you have a convertible bond. It’s part loan, part stock option. Companies issue these bonds to raise money, and investors buy them because they’re flexible: You can hold them like a bond and earn a steady interest payment, or you can convert them into stock if the stock price rises sharply.

Here’s the kicker: Convertible bonds have a “conversion option,” meaning they can be converted into company stock at some point in the future under certain conditions. This gives investors more options and allows companies like MicroStrategy to get creative.

Four factors affect the price of convertible bonds:

1) Interest rates: If interest rates are high, bonds are expensive.

2) Corporate credit: The riskier the company, the higher the return bondholders demand.

3) Stock price: Since bonds can be converted into stocks, stock price changes are important.

4) Volatility: The more volatile the stock, the more valuable the conversion option.

Of these, volatility is the most interesting part - and Michael Saylor's strategy is to seize this point and quickly take advantage of volatility like a roller coaster.

2) Saylor's secret weapon: the "black technology" of convertible bonds and how to turn volatility into wealth

If convertible bonds are a hybrid car, then Saylor has found a way to turn it into an F1 car. Here are four "simple" steps to how it works (assuming, of course, that you've been in the financial world for 20 years):

A. Issue zero-interest convertible bonds

Seller's latest move: Convince investors to lend him money, and it's zero interest! How did he do it? He promised that investors could convert the bonds into MicroStrategy shares in the future, and the conversion price was much higher than the current stock price. Investors found this "conversion option" particularly attractive and were willing to borrow money at zero interest.

B. Earn a huge premium

The "conversion price" of these bonds is set much higher than the current stock price, sometimes as much as 50%. In other words, investors have to wait for the stock price to soar before they can convert the bonds into stocks. This also gives Saylor a buffer period to avoid equity dilution until the stock price shoots up like a rocket.

C. Get cash and buy Bitcoin

Seller's core strategy is to use the cash from selling bonds to buy Bitcoin. In other words, he is exchanging debt for digital gold. This is not only a bet on the future of Bitcoin, but also using stock price fluctuations as leverage to get more Bitcoin. If this sounds like a financial version of judo, it is.

D. Achieve long-term profits through "value-added dilution"

Usually, issuing more shares will dilute the shares of existing shareholders. But Saylor uses a different approach: by buying and holding Bitcoin, he has increased MicroStrategy's net asset value (NAV) while increasing the content of Bitcoin per share. It's like buying a pizza and cutting it into more slices, but you end up with more pizza.

Here is a concise breakdown of the "magic" steps:

Assume the initial state of MSTR:

Market value = $1 million

Bitcoin holdings = $300,000

Bitcoin to stock ratio = $300,000 / $1 million = 0.3

Stock issuance:

MSTR issues another $2 million in stock, bringing the total market value to $3 million (1 million + 2 million).

Use this $2 million to buy the same amount of Bitcoin.

New Bitcoin holdings = $300,000 + $2 million = $2.3 million

New Bitcoin to stock ratio = $2.3 million / $3 million = 0.7667 (about 0.77).

This is the core of "financial engineering". By issuing shares, increasing the company's market value, and then using these funds to buy more Bitcoin, MicroStrategy increases the proportion of Bitcoin per share without directly diluting the shares of existing shareholders. Doing so can make the company's stock price more attractive when the price of Bitcoin rises.

This mechanism can continue to work, provided that the market is willing to give MSTR a premium based on its Bitcoin holdings. If market confidence declines, this premium may disappear (or even reverse), causing the stock price to plummet.

In simple terms, it’s like trading “cheap paper” (stocks) for “hard currency” (bitcoin). This strategy works until the market no longer values the “paper.”

“Magic, isn’t it?” Of course – but only if the market continues to cooperate.

Wait, who buys this stuff? (Hint: not grandma)

You’re right – this is a classic hedge fund move. Let’s take a closer look at how this works, for those who don’t know much about it.

2. Who buys these zero-coupon convertible bonds?

The answer is: hedge funds, not your grandma’s retirement fund.

Why? Because hedge funds don’t care about interest payments. They care about something more lucrative: volatility.

These zero-coupon bonds (paying no interest) come with an option to buy a stock (like MSTR stock) attached. Hedge funds buy these bonds not to hold them for a long time like traditional fixed-income investors, but to take advantage of the volatility of the stock market using complex strategies like “delta hedging” and “gamma scalping.”

Delta hedging: Adjusting sensitivity to stock price changes. If MSTR stock price goes up 10%, they need to adjust their position to maintain a “neutral” position (e.g. short/sell some stocks to maintain market neutrality).

Gamma scalping: Profiting from the speed of stock price fluctuations. When the stock price fluctuates wildly, the gamma strategy can help them profit from these fluctuations, and there will be gains every time the hedge is adjusted.

Simply put, these hedge funds do not care about the "up or down direction" of MSTR stock, they are more concerned about the volatility of the stock price.

3. How do hedge funds make money from these bonds?

Buy at a low price: When Michael Saylor issues these convertible bonds, he usually "leaves some value", that is, the initial price of the bond is lower than its actual value (this ensures that the bond can be issued smoothly). For example, if the "implied volatility" (IV) is set at 60, but the market later trades it to 70, the hedge fund will make 10 points (this is a big profit in the bond market).

Volatility arbitrage: Hedge funds buy bonds (long volatility) and then short MSTR stock to hedge. As MSTR stock fluctuates, they constantly adjust, buying and selling shares as needed. The greater the volatility, the more adjustments there are, and the greater the potential profit. If implied volatility (IV) rises, the price of the bond will also rise. The hedge fund can sell the bond and make a quick profit.

First day gains: These bonds usually increase in price on the first day after issuance. This is because they are initially priced low (to ensure market demand) and will reprice once the market realizes the "true" value of the bond. The hedge fund can resell the bond at a higher price in a short period of time, making a quick return.

4. Why did Michael Saylor do this?

The answer is simple: he needs cash to buy Bitcoin. By issuing convertible bonds, he was able to raise cash without issuing shares, thus avoiding shareholder dilution (at least for now). These bonds will only convert into shares if MSTR's stock price rises significantly. This means that he can raise funds at a low cost and will only dilute equity if the stock price rises.

Hedge funds are very fond of this operation. They buy convertible bonds at a low price, profit from the initial pricing difference (which is equivalent to making "free money"), and make money from stock market fluctuations. This is basically a "win-win" situation for hedge funds and MSTR (at least for now).

1) Why is this "free money"?

Hedge funds are basically harvesting "mispricing" in the market.

They buy the bonds at a low price,

see the bond price go up on the first day,

then hedge against the volatility with MSTR stock, making a little money every time the stock price moves.

If MSTR's stock price goes up, they still make money through the options on the bonds.

Hedge funds like this because they can take huge positions (hundreds of millions) with relatively low risk. For Saylor, it's a way to raise billions of dollars without directly diluting shareholders. Everyone benefits...until the market stops cooperating.

It's called "free money" - but only if you are a well-funded hedge fund with a Bloomberg terminal and a coffee addiction.

2) Is MicroStrategy a Bitcoin ETF? (Short answer: No)

Some critics have argued that MicroStrategy is just a “deluxe Bitcoin ETF.” But that’s like calling Batman “just another rich guy in a suit.” While both ETFs and MicroStrategy give you exposure to Bitcoin, there’s one big difference: ETFs charge fees, while Saylor gives you more Bitcoin for each share of stock you own each year.

Why? Unlike ETFs, which charge management fees, MicroStrategy’s Bitcoin holdings grow with each convertible bond operation Saylor completes. So if you own MicroStrategy stock, you’re actually getting more Bitcoin every year. It’s like getting a free medium pizza and suddenly getting a large pizza because the manager was in a good mood.

3) Why does this strategy work, and when does the music stop?

Michael Saylor’s strategy has great potential, but it also comes with considerable risks. Let’s take it apart step by step to see how he walks the tightrope and when he may face major challenges.

MSTR Balance Sheet - Debt to Bitcoin Ratio

Bitcoin Holdings: ~$45 billion

Convertible Debt: ~$7.5 billion

Other Debt (interest-bearing debt): ~$2.5 billion (presumably interest-bearing debt)

Total Debt: ~$10 billion

Debt Maturity: ~$1 billion of debt will mature in 2027-2028.

On paper, MicroStrategy is in good financial shape, with its Bitcoin assets ($45 billion) greater than its debt ($10 billion). But the risk behind this is volatility risk.

Assuming that the price of Bitcoin falls by 80%, from the current $25,000 to $20,000, MicroStrategy's $45 billion in Bitcoin will shrink to about $10 billion, making the $10 billion debt burden particularly heavy.

But for Saylor to really face a "margin call", the price of Bitcoin would have to fall to about $20,000. If that happens, MicroStrategy will be in a liquidity crisis and Saylor will have to make some difficult decisions.

What happens if Bitcoin falls by 80%?

If Bitcoin crashes, the situation could deteriorate quickly, mainly because there is a feedback loop between the convertible bond, stock prices, and the price of Bitcoin.

Stock price decline: MSTR stock and Bitcoin prices are closely correlated. If Bitcoin falls, MSTR stock will also fall sharply.

Convertible bondholders' options: At this point, bondholders have the right to demand cash instead of converting their bonds into stock (because the stock is worthless compared to the face value of the debt).

Forced selling: If bondholders don't want the stock, Saylor will have to sell Bitcoin to repay the debt.

Market spiral downward: If Saylor sells Bitcoin, this will further depress the price of Bitcoin, leading to more selling, forming a vicious cycle.

This is the equivalent of entering "margin call hell", and Saylor may have to sell Bitcoin at a low price to maintain the company's solvency.

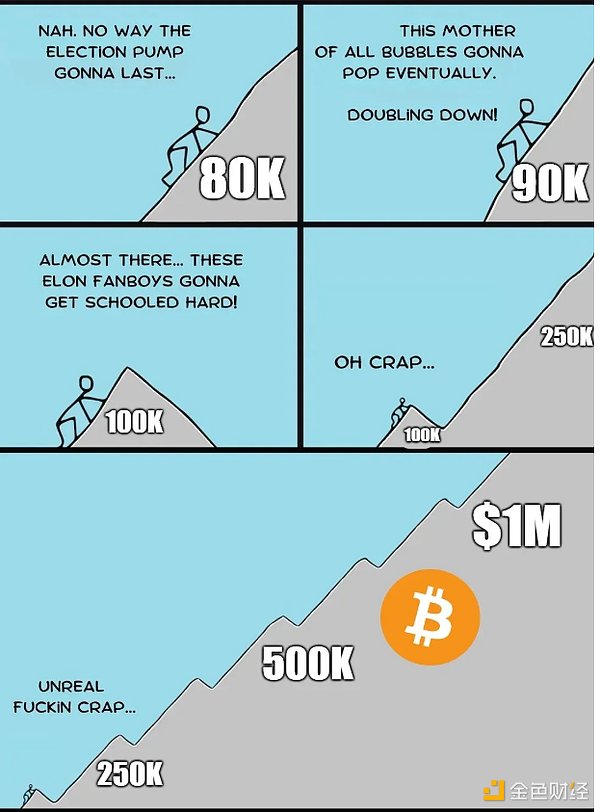

Key point: Saylor is basically betting that Bitcoin will not fall below $20,000. If it falls below this price, he will enter "life and death" mode, and MicroStrategy may be forced to sell Bitcoin to repay its debts.

How does Saylor reduce risk?

Saylor is obviously not a fool, and he has developed several "lifelines" just in case. Here are some of the strategies he has employed:

MicroStrategy still operates a profitable and cash-flowing software business.

This business generates enough cash to pay its relatively small debt interest payments (about $50 million per year) without having to sell Bitcoin.

This acts as a “safety net” for the company, allowing it to stay afloat without selling Bitcoin.

MicroStrategy quietly releases shares into the market through ATM stock sales.

This approach allows the company to generate cash while avoiding a large one-time sale of stock.

If MicroStrategy's stock price reaches a certain level, Saylor can enable the "soft put" option.

This means that he can force bondholders to convert their bonds into stocks instead of asking for cash repayment.

In simple terms, he can convert debt into equity at his will.

Currently, MicroStrategy holds about $45 billion in Bitcoin.

He has enough room to sell some of his Bitcoin without having to liquidate all his holdings.

This option is a last resort, but it still provides the company with a buffer space for emergencies.

5. Conclusion: "Master of Vulnerabilities" in the Financial Field

Whether you like him or hate him, Michael Saylor is playing a whole new game. He doesn't just hold Bitcoin, but has built a complete strategy around Bitcoin. By using convertible bonds, he cleverly combines debt, stocks, and volatility into an almost unstoppable financial flywheel.

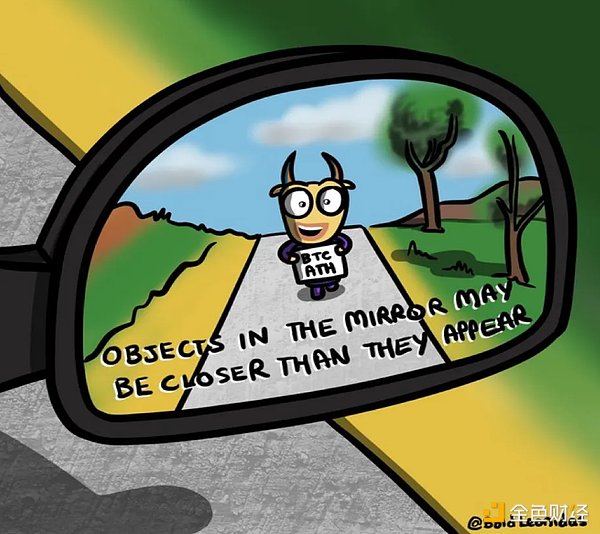

Every Bitcoin acquired by MicroStrategy is, in a sense, a "benefit" of the company. This shift in mindset may make analysts suddenly realize one day that the true value of MicroStrategy is far greater than they expected. If that’s the case, the company’s stock price could rise significantly.

In short, Michael Saylor has found a way to play four-dimensional chess in a two-dimensional market. He issues zero-coupon bonds and uses the funds raised to buy Bitcoin, thereby increasing the number of Bitcoins held per share. While this strategy is risky, if Bitcoin continues to rise, it could be the smartest move in financial history.

More and more companies are also beginning to think about how to combine debt, equity, and Bitcoin. As this strategy becomes more popular, we may be witnessing the advent of a new era of corporate finance.

So the next time someone says convertible bonds are boring, tell them the story of Michael Saylor. Watch their eyes widen and realize that this is not just about bonds, but about a revolution that redefines the entire rules of finance.

Olive

Olive