By Alex O’Donnell, CoinTelegraph; Compiled by Deng Tong, Golden Finance

On August 5, cryptocurrencies had their worst day in years. Few saw it coming, but traders’ addiction to leverage had quietly been amplifying market risk for months. If leveraged trading was the fuse, the sudden rise in the yen was the match. Fortunately, the fire may soon be extinguished.

A surge in the cost of borrowing yen caused the crash. Now, as traders finally cut leverage and yen exposure, the market is set for a healthy rebound. If the broader market stabilizes—and it likely will—cryptocurrencies may soon make a comeback.

Cheap Borrowing

It’s no secret that cryptocurrency trading isn’t based on fundamentals. Prices are driven primarily by short-term institutional traders who profit from the volatility of cryptocurrencies. To boost returns, traders use leverage or borrow money to double their positions—often in staggering amounts. Shortly before the crash, open interest, a measure of net borrowing, was close to $40 billion.

All that borrowed money had to come from somewhere. Lately, that place was Japan. In 2022, U.S. Treasury rates rose above zero for the first time in years and have continued to climb. In Japan, rates remain rock-bottom. Trading firms profited—borrowing huge Japanese loans to finance trades in other markets at low cost.

It seemed like a good time. By 2023, the crypto bull run was in full swing. Leveraged trades—trading that can magnify gains or losses by 2x or more—brought rich rewards. Meanwhile, traders were getting yen-denominated funding for next to nothing.

This is the essence of the so-called yen carry trade, and it’s not unique to crypto. According to a report from ING Bank, yen-denominated loans to foreign borrowers could reach about $2 trillion by 2024, up more than 50% from two years ago.

The End of 17 Years of Policy in Japan

Everything changed on July 31, when the Bank of Japan raised its short-term government bond rate to 0.25% from 0%. (Previously, the Bank of Japan had raised rates from -0.1% in March for the first time in 17 years.) The seemingly innocuous move set off a chain of events that culminated in a Bitcoin crash.

Even traditional markets were hit hard, with the S&P 500 (an index of U.S. stocks) falling more than 5% on the day.

The catalyst wasn’t Japan’s rate hikes but what happened afterwards: a surge in the yen in foreign exchange markets. (When domestic interest rates rise, currencies typically appreciate.) From July 31, the dollar-yen exchange rate fell from around 153 to the dollar to 145 yen. Suddenly, borrowing in yen became very expensive.

Whether because of margin calls from lenders or out of caution, traders began selling billions of dollars in positions. Jump Trading’s dump of over $370M worth of ETH between July 24 and August 4 caused a stir but did not spark a market downturn. At best, Jump exacerbated what was destined to be a historic sell-off.

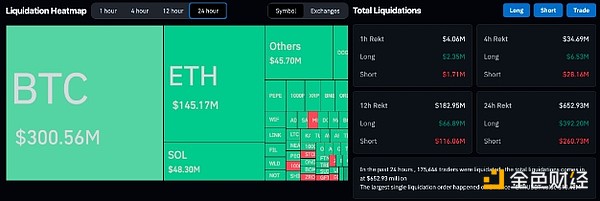

Liquidation data for 24 hours on the night of August 4-5, 2024. Source: CoinGlass

In fact, more than $1 billion in leveraged trading positions, representing hundreds of thousands of trades, were liquidated between August 4 and 5, according to CoinGlass.

Strong return?

For some diseases, the fever is the cure. Hopefully, that’s what’s happening in the market. Traders are being shaken out of risky leveraged positions and finally cutting their massive yen-denominated loan debt.

On the crypto side, net open interest now stands at $27 billion — nearly $13 billion less than before the crash.

Meanwhile, ING says USD/JPY may have run out of room to fall.

If all else fails, there’s always a rate cut. Japanese stocks fell about 12% on Aug. 5 — their biggest one-day drop since 1987. That could force the Bank of Japan to intervene and soften the blow for borrowers. The situation in the U.S. could also get some relief after a July report showed a sharp rise in unemployment.

In Japan, “if intervention works — now is the time,” said David Aspellh, senior portfolio manager at Mount Lucas Management. “Given recent U.S. data, it looks like the Fed will be more aggressive in cutting rates than was thought a few months ago.”

If that happens, cryptocurrencies could rebound in late summer. Of course, cryptocurrency markets are unpredictable. If there’s any lesson in all this, it’s to think twice before making another leveraged trade.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo JinseFinance

JinseFinance JinseFinance

JinseFinance Bernice

Bernice Bernice

Bernice Cointelegraph

Cointelegraph Ftftx

Ftftx