Author: [email protected] Data source: Token Dashboard

In the world of cryptocurrencies and digital assets, token analysis plays a vital role. Token analysis refers to the process of delving into data and market behavior related to a token.

Through token analysis, we can obtain investment decisions on market trends, risk factors, trading activities and capital flows.

In the rapidly evolving field of blockchain technology, Chainlink has become a key player, setting the industry standard for Web3 services. LINK is the native token of the Chainlink network and plays a core role in providing token price information services.

How to analyze LINK coin?

Token analysis is crucial. Generally speaking, what are the key indicators to consider?

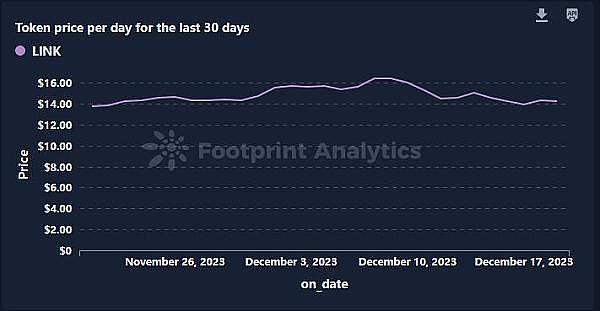

LINK coin price per day for the past 30 days

Token price, measured in both fiat and cryptocurrency forms, is an important way to assess the health of the token market Key indicators of condition and potential. As of December, the LINK coin was priced at $14.28, up slightly from $13.87 a month earlier.

In November, the coin hit a monthly low of $13.87 on the 21st, but since then, it has shown a steady upward trajectory, reaching 16.51 in early December The dollar reached monthly highs before experiencing a minor correction. It is currently stable at around $14.

From a technical perspective, LINK coin is currently sitting near support at the 50-day moving average. If a rebound occurs, there is about 20% bullish potential.

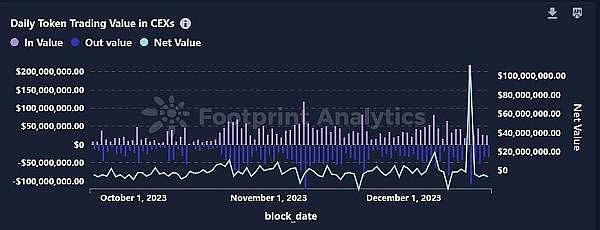

Daily token trading prices in CEX

From the end of November to the beginning of December, Chainlink's LINK coin daily trading volume and transaction volume increased significantly. It reached its peak on December 7, with transaction volume reaching 535 million and transaction value reaching US$8.2 billion. But then data showed continued declines, suggesting market enthusiasm was cooling.

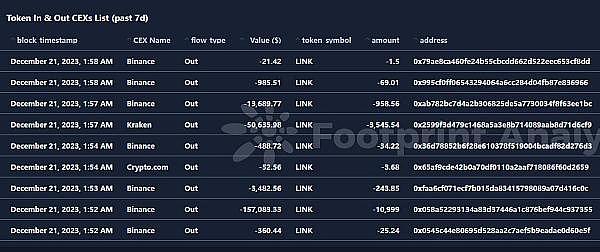

Tokens in and out of CEX list (past 7 days)

The recent sustained negative net flow indicates that tokens have been withdrawn from exchanges in large numbers, suggesting that Holders’ long-term confidence in the project continues to grow. This trend reflects the tendency of holders to maintain their positions rather than actively trade, highlighting LINK’s strong fundamentals.

In addition, the behavior of large holders withdrawing tokens shows their confidence in the project. Of particular note is that a new wallet named “0x8eAD” has withdrawn a total of 247,860 LINK coins, worth $3.5 million, from the Binance platform in the past two days. This action may suggest a strategic move to stake tokens or engage in other activities.

Use Footprint to track LINK token data

You All the data you need can be obtained in Footprint's Token Dashboard.

In addition, you can use Footprint's multi-functionality to conduct personalized and customized analysis. The following are its main advantages:

Rich reference data: The platform provides a wide range of reference data, Data that helps users gain a deeper understanding of various cryptocurrencies. Helps make informed investing and trading decisions.

Diverse data acquisition methods: Users can obtain data through multiple methods such as API, Dashboard and batch download. Can meet the different user needs and preferences of developers and non-technical users.

Multi-dimensional data: The platform provides multi-dimensional and multi-level data to facilitate users to conduct in-depth analysis. This layered data structure enables users to gain a comprehensive understanding of the cryptocurrency market.

Token analysis is crucial, it provides us with insights into market volatility and risks, helping investors and traders Make informed decisions. Here's our guide to finding opportunities and responding to threats in the volatile cryptocurrency space.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Catherine

Catherine Others

Others Catherine

Catherine Nulltx

Nulltx Coindesk

Coindesk Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph