Author: Michael Nadeau, The DeFi Report; Compiler: Wuzhu, Golden Finance

We have said it many times: If you don't understand macroeconomic trends, you don't understand cryptocurrency. Of course, the same is true for on-chain data.

This week, We will explore how macroeconomic trends will affect the cryptocurrency market in 2025.

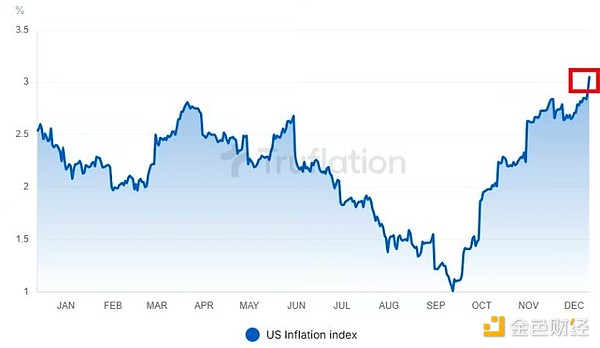

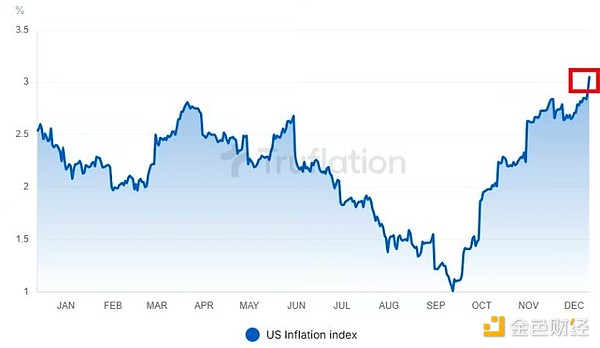

Inflation

Inflation data is rising. After bottoming out at 1% in September, we have accelerated back to more than 3% calculated by Truflation.

Data: Truflation

We like Truflation's data because it uses real-time web-scraped data from a variety of online sources. In addition, it is updated more frequently than traditional government indicators such as PCE.

However. The Fed's focus is on PCE. Therefore, we use PCE as a way to predict Fed policy and Truflation for a more real-time view of economic conditions.

Here is personal consumption expenditure:

Data: FRED database

Currently 2.3% (October data). Also rising - which is hard to see in the chart (September was 2.1%). We will get November data on December 20th.

Views on Inflation

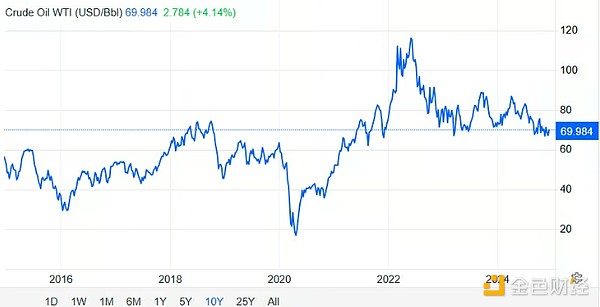

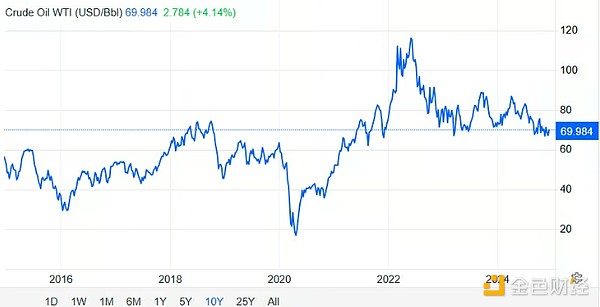

Energy costs and housing costs are the main drivers of growth. However, crude oil prices are at cycle lows.

Data: Trading Economics

The question is whether they are here to stay, or could fall further.

Given seasonal effects + Trump's plans to increase supply through US deregulation, it's hard to see why oil prices would surge anytime soon.

On the other hand, geopolitical conflicts, unforeseen natural disasters or OPEC production cuts (in anticipation of increased US supply) could lead to higher oil prices.

We have not seen these events unfold yet.

Also, our position is that inflation in the 2000s has been primarily caused by supply shocks + fiscal spending and stimulus checks - we do not see this as a threat today.

Therefore, we expect oil prices to be range-bound and inflation/growth to decline.

Dollar

Data: Trading View

Since October 1, Bitcoin has risen 58%. At the same time, the US dollar index has risen from 100 to nearly 108. Today's ranking is 107.

This is a special behavior. Typically, a stronger USD is bad for risk assets like Bitcoin (see 2022). But we are now seeing a strong correlation between the two.

So what is going on? Should we be worried?

We believe that the USD is showing strength as global markets are pricing in a Trump win. Trump’s policies are good for business. That means they are good for markets.

We saw the same dynamic after Trump’s win in 2016. The USD rose. Why? We believe that foreigners are pricing in the impact of the “Trump pump” and buying USD-denominated assets as a result.

USD View

We believe growth is slowing/normalizing. This is reducing inflation, albeit with a delay. Rates are likely to fall.

As a result, we expect USD to be range-bound in the medium term, possibly falling back towards 100.

ISM Data (Business Cycle)

Data: MacroMicro

Looking at the business cycle, we can see that the blue line (manufacturing) appears to be bottoming out. Historically, readings below 50 indicate an economy in contraction. Sustained readings below 50 indicate an economic slowdown.

This is where we are now - services (red line) are doing slightly better.

These levels tend to coincide with rising unemployment. This typically leads to an accommodative monetary policy by the Fed.

Again. That is exactly what we are seeing today.

View on the Economic Cycle

We see slower growth, leading to higher unemployment. This could ultimately manifest as downward pressure on inflation.

This leads to rate cuts. This puts downward pressure on the dollar.

Over the medium term, we believe these dynamics should be supportive of risk assets/cryptocurrencies.

Credit Market

Data: FRED

Credit spreads continue to be historically low, suggesting that investors require low compensation for additional units of risk.

This could mean two things: 1) Market complacency and mispricing of risk. Or 2) Market participants are optimistic about the economy and the Fed and fiscal policy are accommodative.

We think it is the latter.

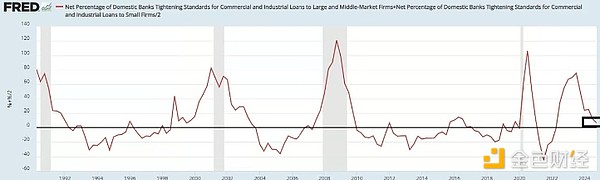

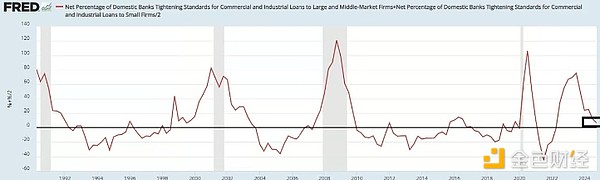

Next, let's look at the trend of bank lending.

Data: Fred Database

The share of banks tightening their lending standards has been declining since its peak at the end of 23. Ideally, this KPI would remain stable as the Fed cuts rates.

That being said, historically we have seen a negative correlation between rate cuts and the share of banks tightening their lending standards. Why? Rate cuts tend to herald an economic slowdown or recession - making it harder for banks to lend.

View on Credit Markets

No signs of stress. At least not yet.

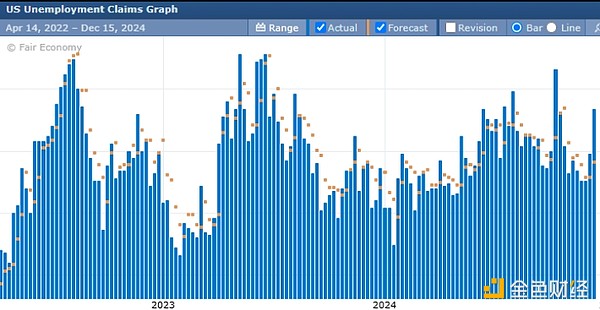

Labor Market

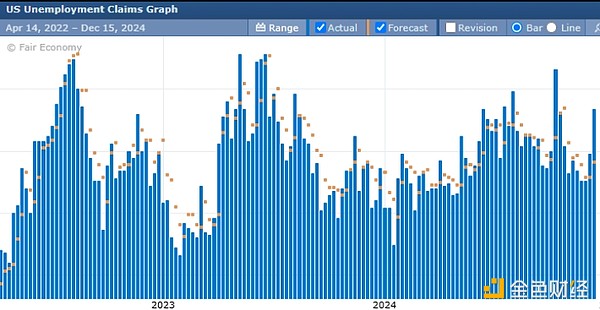

The unemployment rate rose to 4.2% in November (from 4.1%). Below we can see the recent rise in unemployment claims.

Data: Forex Factory

We believe that the weakness in the labor market has the full attention of the Fed at this point. The continued rise in unemployment claims data tells us that it is becoming increasingly difficult for those who are out of work to find work.

This is another sign of slowing/normalizing growth. That being said, the stock market is still at all-time highs. Corporate profits are strong. That's what keeps the labor market intact.

But my sense is that the Fed is watching this like a hawk. After all, the SAM rule was already triggered in July.

View on the labor market

It is softening. But not fast. We expect the Fed to (try to) get ahead of weaker data (since they already cut rates by 50bps in September after the July SAM data).

Treasury and Fiscal Spending

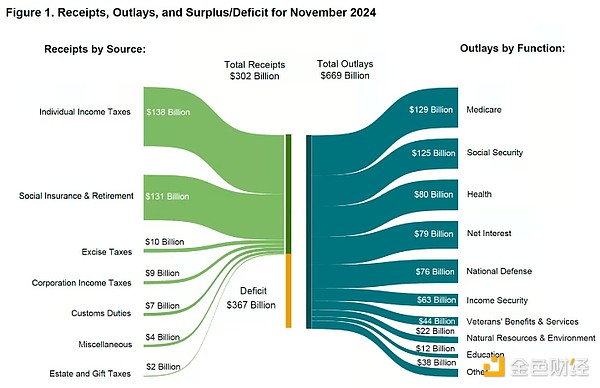

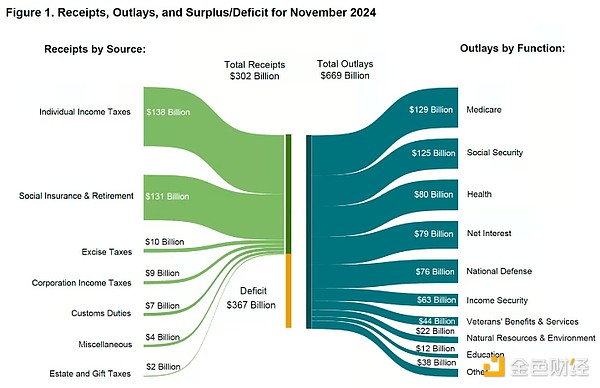

Data: U.S. Treasury

The U.S. government has spent $1.83 trillion more than it has collected in taxes this year. In November alone, it spent more than twice as much as it took in.

The $1.83 trillion that has been printed and pushed into the economy/Americans’ hands has been the primary driver of financial markets this year (and, we think, inflation).

And now. Trump is coming. We also have a new agency called "DOGE", the Department of Government Efficiency, headed by Elon Musk.

Some think that excessive spending will be reduced as a result. Maybe. But which departments will be cut? Medicare/Social Security? Military? Interest?

That's 65% of the budget - that seems untouchable.

Meanwhile, the Treasury has to refinance over 1/3 of its debt next year. We don't think they can do that with higher interest rates.

Views on Treasury/Fiscal Spending

We think it's unlikely that there will be big cuts in fiscal spending in the short term. DOGE might cut $10 billion in spending. But it won't change things in a material way. It'll take some time.

Meanwhile, the Treasury needs to refinance 1/3 of all outstanding debt next year. We think they will do that with lower interest rates.

Combining these views, We are positive on the outlook for risk assets/cryptocurrencies.

Federal Reserve Policy

The next FOMC meeting is on December 18th, and the market is currently pricing in a 97% chance of a rate cut. We think this could also give the green light for easing in China.

Why?

We think China wants to continue with its easing policy. But when the Fed doesn't cut rates, it's hard for them to do so because the RMB will depreciate against the dollar, making Chinese imports more expensive.

Views on Fed Policy

Rate hikes seem unlikely in the near term. A December rate cut is all but certain, with market pricing pausing at 76% in January. There is no FOMC meeting in February.

So the next policy decision is not until March. We think the labor market is now likely to show more signs of slack, and the Fed is likely to cut rates further in mid- to late-2025 - ultimately by around 3.5%.

Will rate cuts increase inflation? We don't think so - it's a non-consensus view. In fact, we think rate hikes are causing inflation (and other fiscal spending) to rise.

Why?

Because interest payments are now over $1 trillion. That money is printed and passed on to Americans holding bonds, and it appears that money is being pumped back into the economy. Of course, rising rates haven't caused banks to stop lending (see chart above).

So, we think that as the Fed cuts rates, inflation could fall (assuming oil prices stay low and we don’t see further increases in fiscal spending). Remember, we had 10 years of zero interest rates with low inflation. Japan had 0% interest rates for 30 years with low inflation.

Trump Policies

The market knows what a Trump presidency will bring:

Lower taxes. This should boost corporate profits and could lead to higher stock prices. It could also lead to greater income inequality and larger deficits. More deficits = more dollars in the hands of Americans.

Tariffs/“America First”. This could lead to higher domestic prices. We think AI/automation could actually offset this to some extent.

Deregulation. This is good for business as it could lead to higher profits in the energy, tech, and financial sectors.

Stronger borders. This could lead to labor shortages and higher wages (inflation).

Views on Trump’s Policies

We think Trump is generally good for business, free markets, and asset prices. The trade-off is that we could see some inflationary impulses. That’s where things get interesting because if inflation returns, the Fed will look to pause rate hikes or tighten monetary policy.

Of course, we think Trump will try to impose his will on Jerome Powell. Ultimately, we think Trump wants to boost the economy and inflate away some of the debt over the next four years. This means inflation would have to exceed nominal interest rates, which is not the case today.

Finally, given Trump’s support for the digital asset industry (and the incoming SEC Chairman), we think cryptocurrencies will benefit from his administration.

Not to mention the potential for favorable regulations from Congress in the coming years and the potential for a strategic reserve of Bitcoin.

Views on Trump’s Policies

We believe that a Trump administration would be favorable to cryptocurrencies from a market and regulatory perspective.

China

Dan Tapiero (one of my favorite macro investors) says China is currently experiencing deflation (negative real interest rates).

China’s negative interest rates dampen U.S. inflation concerns. This allows the dollar to strengthen (as we are seeing today).

A U.S. rate cut could lead to a Chinese rate cut as well.

Ultimately, it leads to more global liquidity.

Speaking of global liquidity.

Global Liquidity

Given that 1/3 of US debt needs to be refinanced next year, we think the Fed may have to step in as a buyer of last resort (QE).

Lower US rates will allow China and Europe to ease conditions in some coordinated way.

We think this will lead to ample liquidity/collateral within financial markets - with crypto/risk assets being one of the biggest beneficiaries.

These dynamics are consistent with year 4 of the crypto cycle - the most volatile up cycle in history.

Summary

Growth is slowing.

This leads to labor market turmoil (something the Fed is watching).

This leads to rate cuts (as we are seeing today).

This allows China and Europe to ease conditions without sacrificing currency/imports.

This leads to favorable liquidity conditions for risk assets.

This is what we see going forward.

Add fiscal spending, the incoming Trump administration, and year 4 of the crypto cycle, and you can predict explosive bull market conditions in 2025 (expect volatility).

Of course, we will continue to monitor the market and keep you updated from an on-chain data + macroeconomic perspective.

After all, if you don’t understand the macroeconomic situation, you don’t understand your crypto.

Wilfred

Wilfred