"Please give me what I want, and you can get what you want."

Adam Smith first proposed the idea of division of labor and cooperation in "The Wealth of Nations", and systematically and comprehensively expounded on the improvement of the overall efficiency of the market by division of labor and cooperation.

The essence of modularization is division of labor and cooperation. A complete system can be divided into different replaceable modules. Different modules are independent, secure and scalable. At the same time, different modules can be combined to realize the operation of the entire system.

A free market will eventually move towards division of labor and cooperation, thereby driving a huge improvement in overall efficiency.

At present, modularization is one of the core narratives of the blockchain industry. Although the market's attention is not on this type of underlying infrastructure projects, the improvement of underlying infrastructure is an important force to promote the development of the industry.

This article will conduct an in-depth analysis of modular blockchains to fully understand the development history of modularization, the current market structure and future development direction.

1. What is modularization?

In fact, the development of modularization in the blockchain industry has a long history. We can review the development of the entire industry from a modular perspective.

The earliest Bitcoin chain was a complete system, with each module closely integrated to realize the currency capabilities of "Bitcoin" such as transfer and bookkeeping.

However, the main problem of the Bitcoin chain is that it is not scalable enough and cannot carry more usage scenarios. Therefore, Ethereum, known as the world computer, appeared.

It can be said that Ethereum is the modularization of Bitcoin, adding an execution module to the Bitcoin chain, namely EVM (Ethereum Virtual Machine).

The virtual machine is the execution environment of the program code. Bitcoin can only perform relatively simple operations such as transfers. If you want to run complex code, you need to introduce a virtual machine.

Therefore, various blockchain applications have emerged on the Ethereum chain, such as DeFi (decentralized finance), NFT (which can be understood as digital collections), SocialFi (decentralized social networking), GameFi (blockchain games), etc.

Later, the performance of Ethereum could not meet the growing needs of various application scenarios, and various Layer2 networks appeared, that is, the modularization of Ethereum, which transferred the execution module of Ethereum to the outside of the chain, thereby achieving capacity expansion in disguise.

The so-called Layer2, called the second layer in Chinese, is to build another layer of network on the basis of the Ethereum chain, transfer a large amount of calculations to this network, and then transmit the calculation results back to Ethereum, thereby reducing the amount of calculation of Ethereum and improving the speed of Ethereum.

After the execution layer of Ethereum was modularized, with the emergence of various Layer2, Ethereum was further modularized and split into four layers as a whole:

Execution layer: mainly responsible for processing transactions and executing smart contracts; (analogous to a ball game, playing according to the rules of the game)

Settlement layer: verify the status of the execution layer and resolve disputes, complete the final settlement of transactions, ensure that the transfer and record of assets are permanently stored on the blockchain, and determine the final state of the blockchain; (solve problems arising in the game)

Data layer: usually includes functions such as data storage, transmission and verification to ensure the transparency and trust of the blockchain network; (live broadcast or recording of the game)

Consensus layer: verify transactions and create new blocks through a specific consensus algorithm to achieve consistency of data and transactions in the network; (ensure that everyone has the same understanding of the result of the same game)

This can be compared to the development of the computer industry.

The earliest was Apple's all-in-one computer. After the emergence of Microsoft's Windows system, many assembled computers appeared on the market. You can buy high configurations for each component and finally assemble it into a high-performance computer.

In the blockchain world, if a chain wants cheap storage, it can use an independent data availability layer, similar to an external hard drive, with large storage space, cheap and easy to use. Except for the data layer, each module is pluggable and flexible to assemble.

However, after the emergence of assembled computers, they did not completely replace all-in-one computers like Apple.

Because many users do not care about or have no energy to study various configurations, they just want a good computer. The all-in-one machine can make the various components work together best, which maximizes the efficiency of each part, and provides a better experience than a higher-configured assembled machine. For example, Solana, one of the mainstream public chains of Layer1, is a typical "all-in-one machine" with no modularization but extremely high performance, and many popular projects have been born on it.

So we can see the significant advantages and implicit disadvantages of modularization.

Advantages:

Decentralization: By separating the data layer, the hardware requirements for nodes are reduced, thereby increasing the number of nodes, and increasing the degree of network decentralization without introducing additional trust assumptions;

Simplify chain deployment: By utilizing modular design, the startup cost of new blockchains and the development cost of designing architectures are reduced;

Improve chain performance: The performance of each module has been greatly improved. For Ethereum, it is to achieve Ethereum expansion;

Promote ecological prosperity: Each module undertakes different functions and ensures overall security;

Improve user experience: For example, reduce the difficulty of use and reduce transaction fees

Disadvantages:

2. Analysis of key projects

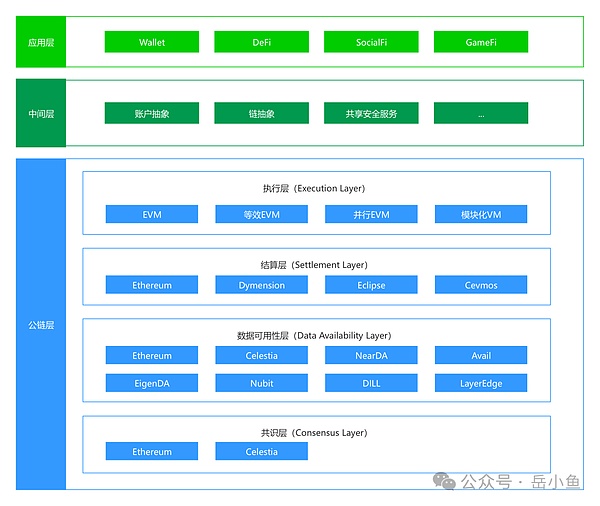

From a global perspective, the whole can be divided into three layers,

Application layer:

Various DApp applications (decentralized applications) built on the blockchain

Currently includes several major categories, including Wallet (wallet, portal to the Web3 world), DeFi (decentralized finance), NFT (can be understood as digital collections), SocialFi (decentralized social), GameFi (blockchain games), etc.

Middle layer:

If the application layer interacts directly with the blockchain, the performance and user experience will be greatly restricted by the characteristics of blockchain technology, especially now that there are many blockchains on the market, each with different technical architectures, system characteristics, etc., which greatly affects the difficulty of application development and user experience.

In order to improve the user experience and the difficulty of application development, such a middle layer has emerged, which connects various blockchains horizontally and encapsulates the characteristics of blockchains, providing various technical middleware for application development, including account abstraction (that is, the user's account can be programmed to expand various complex functions), chain abstraction (that is, after the chain is abstracted, the user side does not need to perceive the differences between the chains, and can directly use each chain based on their own intentions), etc.

Public chain layer:

Execution layer: divided into EVM (Ethereum virtual machine), equivalent EVM (virtual machine compatible with EVM), parallel EVM (EVM that supports parallel transactions), modular VM (non-EVM type virtual machine)

Settlement layer: In addition to being able to settle on Ethereum, the current main settlement modular project is Dymension;

Data layer: also called the data availability layer, this layer has the most projects, because the cost of data storage accounts for the bulk of transaction fees, so there is a strong demand in the market to obtain cheap and easy-to-use storage modules. Ethereum's own storage is too expensive. The leader in modular projects is Celestia, and the head projects in the Bitcoin ecosystem are mainly Nubit;

Next, let's analyze three key projects in detail, Celestia, Dymension, and AltLayer.

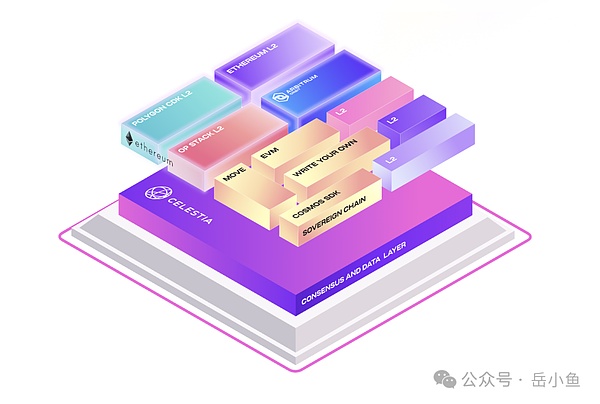

2.1 Celestia

Basic Introduction

As the first project to propose the concept of modular blockchain, Celestia can be said to be a pioneer in the modular track, especially after its coin price exploded, it attracted the attention of the market, thus opening up the ceiling of the entire track.

Build a scalable data availability layer to achieve the next generation of scalable blockchain architecture - modular blockchain, designed to make it easy for anyone to deploy their own blockchain with minimal overhead.

Operation mechanism

Data availability sampling

Celestia does not handle the validity of transactions, nor does it execute transactions. It only packages, sorts and broadcasts transactions, and all transaction validity rules are enforced by the client's Rollup node (that is, the decoupling of the consensus layer and the execution layer is achieved)

Data verification method: Abstractly speaking, block data can be divided into square matrices (for example, 8x8), and additional "check" rows and columns are added to the original data through encoding to form a larger square matrix (for example, 16x16). By randomly sampling part of the data within this large matrix and verifying its accuracy, the integrity and availability of the overall data can be ensured. Even if part of the data is lost or damaged, the entire data can still be restored using the checksum data.

Sovereign Rollup

Transaction verification method: The main difference between sovereign Rollup and smart contract Rollup (such as Optimism, Arbitrum, zkSync, etc.) is the transaction verification method. In smart contract Rollup, transactions are verified by smart contracts deployed on Ethereum. In sovereign Rollup, the Rollup node itself is responsible for verifying transactions

Upgrade method:

For smart contract Rollup, the upgrade depends on the smart contract of the settlement layer. To upgrade Rollup, the smart contract needs to be modified. This may require multiple signatures to control who can initiate updates to the smart contract. Although it is common for a team to control the upgrade of multi-signatures, it is also feasible to control multi-signatures through governance. Because smart contracts are located in the settlement layer, they are subject to the social consensus of the settlement layer.

Sovereign Rollup is upgraded through a fork similar to the Layer 1 blockchain. After a new software version is released, nodes can choose to update their software to the latest version. If the nodes do not agree to the upgrade, they can continue to use the old software. Such an option allows those who run nodes in the community to decide whether to accept the new changes, and even if most nodes are upgraded, they cannot be forced to accept the upgrade. This feature makes the sovereign Rollup a truly "sovereign" Rollup.

Quantum Gravity Bridge (QGB)

acts as a bridge between Celestia and Ethereum (or other EVM L1 chains), enabling data and asset transfer between the two networks

By introducing the concept of Celestium (EVM L2 Rollup), Celestia is used to achieve data availability, while Ethereum is selected as the settlement layer. This achieves the full use of the advantages of both networks, namely Celestia's scalability and data availability, and Ethereum's security and decentralization.

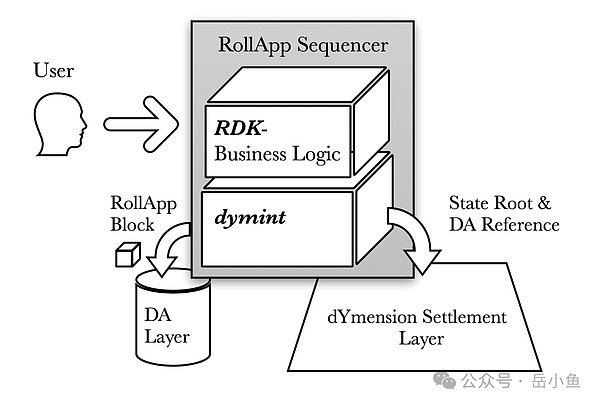

2.2 Dymension

Basic Introduction

Dymension is a sovereign Rollup built on Cosmos, aiming to make the development of RollApp (a blockchain focused on custom applications) easy through Dymension Chain (settlement layer), RDK (RollApp Development Kit) and IRC (Inter-Rollup Communication).

The core feature of Dymension is the modularization of the settlement layer, but at the same time it provides RaaS (Rollup as a service) capabilities, which is a competitor to AltLayer.

Operation mechanism

Front-end→RollApps; RollApp is a combination of Rollup and App. It is a high-performance modular blockchain dedicated to specific applications on Dymension, built using the Dymension RollApp Development Kit (called RDK).

Back-end→Dymension Hub; Dymension Hub is built using Cosmos SDK. As a settlement layer, it uses IBC for secure message transmission between Dymension RollApps.

Database→Data Availability Network; The Data Availability Network is decentralized and keeps data for a short time.

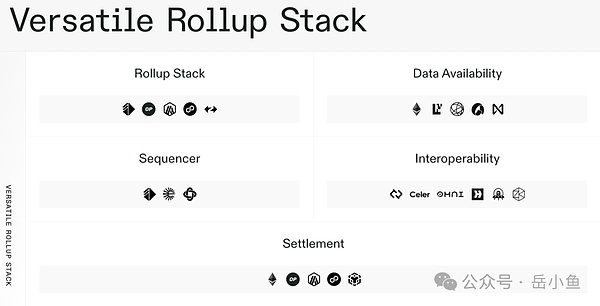

2.3 AltLayer

Basic Introduction

A Lego-style modular RaaS (Rollup as a Service) chain issuance platform: spanning the two concepts of modularity and Restaking

You can quickly build a fast and scalable Rollup protected by Layer 1, tailored for applications, which not only allows developers to use it, but also allows people with almost no coding experience to complete a customized Rollup in 2 minutes with just a few clicks

Operation Mechanism

One-click chain issuance capability (based on OP Stack, Arbitrum Orbit, zkSync ZK Stack, Polygon CDK)

Re-staking service (based on EigenLayer)

Third-party DA (based on Celestia, EigenDA, Avail)

Third-party sorter (based on Espresso, Radius)

3. Modular future narrative

There are three main directions for modular future narrative: further deepening of Ethereum modularization, expansion of Cosmos ecosystem, and rise of Bitcoin ecosystem.

Modularization started with Ethereum and matured in Ethereum, but there are two ecosystems that cannot be ignored: one is Cosmos and the other is BTC.

The emergence of Cosmos is to solve the cross-chain problem and build a multi-chain ecosystem. Chains based on Cosmos technology components can share security and facilitate cross-chain.

In achieving this goal, Cosmos has built a one-click chain-issuing capability with a very high degree of modularity. It has been developed for many years. Currently, many well-known projects come from the Cosmos ecosystem, such as Celestia and Dymension mentioned above, as well as the popular BTC pledge project Babylon.

As the founding chain of the blockchain industry, BTC is also the public chain with the largest market value, nearly three times the market value of Ethereum. Therefore, the Bitcoin ecosystem is also very imaginative and is currently booming. Many technologies that have been verified in Ethereum are directly used in the Bitcoin ecosystem.

Further deepening of the Ethereum module

Data availability layer: This layer is the module with the most projects and the track with the most intense competition. The current leader is Celestia, but Celestia faces many challenges. First, after the launch of EIP-4844 on the Ethereum mainnet, Rollup data can be stored in the form of Blob, and the data storage fee is greatly reduced. External DAs such as Celestia no longer have cost advantages. In addition, Celestia has many strong challengers, including NearDA of Near, an L1 blockchain whose consensus network already has credibility, and EigenDA launched by EigenLayer, a leading re-staking project.

Middleware layer: Now and in the future, there are multiple chains, and users and liquidity are separated. In order to provide users with a better experience at the application layer, many middleware services have emerged. The current popular concepts are account abstraction (that is, the user's account can be programmed to expand various complex functions) and chain abstraction (that is, after the chain is abstracted, the user side does not need to perceive the differences between the chains, and directly use each chain based on their own intentions).

RaaS: One-click Layer2 release, integrating various modular underlying services, providing developers with enterprise-level services for quickly building Layer2, lowering the development threshold, which means that in the future, Layer2 will not compete on technology, but on ecology, operations, and application layer services.

ZK technology: Zero-knowledge proof technology has two uses in blockchain. One is to verify the correctness of calculations, which can be verified faster without recalculation, and the other is to protect privacy, only providing ZK proofs without revealing original information. At present, it is mainly used in Layer2 to verify the correctness of calculations, and the future direction is mainly to ZK virtual machines. In the Ethereum roadmap, ZK is the core of the Verge stage, introducing SNARK into L1 EVM, and various Layer2s are also integrating ZK technology. Ethereum founder Vitalik once said: "In 10 years, all Rollups will be ZK."

Expansion of the Cosmos Ecosystem

After the Luna crash in 2022, the Cosmos ecosystem was hit hard, but after a round of bear market development, we can see that the Cosmos ecosystem is not dead, but many pioneering projects have emerged, including Celestia, a pioneer in the data availability layer, and Dymension, a pioneer in the settlement layer.

The Cosmos ecosystem adopts a multi-chain architecture, which can support multiple independent blockchains to coexist and interact with each other, and has strong interoperability.

The Cosmos chain adopts a modular design, allowing developers to choose and combine different modules to build their own application chains, providing developers with great autonomy and flexibility.

Cosmos also faces many problems, including the high cost of building and maintaining application chains, the lack of a revenue model for the Cosmos Hub, and the unsustainable economic model. These are all problems that need to be solved in the future.

The rise of Bitcoin ecology:

Since the emergence of the Ordinals protocol, the market has begun to pay great attention to the Bitcoin ecology. In the past year, there has been an inscription boom, a BTC L2 boom, and a Bitcoin re-staking boom.

There are two main directions for the development of the Bitcoin ecology. One is to expand based on the inherent characteristics of Bitcoin technology, and the other is to be compatible with EVM and open up the liquidity of the Bitcoin and Ethereum ecosystems.

Ethereum is the modularization of Bitcoin, and it can even be said to be a test network. Therefore, many of the more mature technologies in Ethereum can be directly used in the Bitcoin ecosystem. At present, many modular projects have emerged, such as the data availability project Nubit, Layer2 projects Merlin, BitLayer, etc., and the Bitcoin shared security service project (re-staking) Babylon, etc.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Joy

Joy JinseFinance

JinseFinance Bitcoinworld

Bitcoinworld decrypt

decrypt Cointelegraph

Cointelegraph