Jessy, Golden Finance

Known as the largest airdrop of Ethereum Layer2, the airdrop of zkSync's token ZK has finally landed. Although the lucky users who received the airdrop said "this is the largest airdrop I have received so far in my career", many users, active communities, and project parties said they did not receive the airdrop.

Users who meet the zkSync airdrop criteria account for roughly 10% of the total number of interactions. According to statistics, there are about 6 million on-chain interactive users of zkSync, and about 690,000 people received airdrops, of which the highest can get 100,000 ZK, and the lowest can get 917 ZK. At present, according to the over-the-counter price, the price of a ZK token is about 0.4U.

Not only is the proportion of airdrops small, but users have also questioned the fairness of airdrops through various signs, and the founding team's rat warehouse and other issues. Users who were used to the PUA of the project also realized in the zkSync airdrop event that the airdrop dream was about to end.

On-chain asset value and time account for a high weight

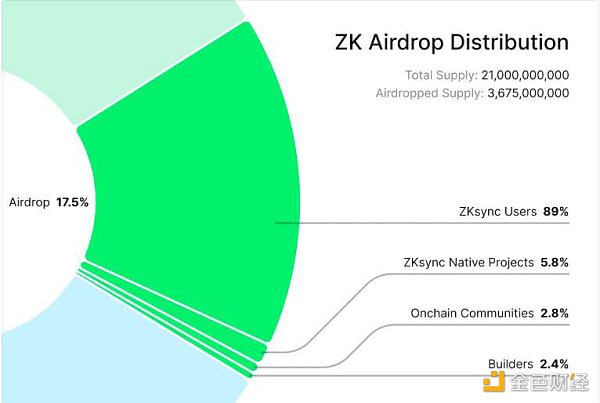

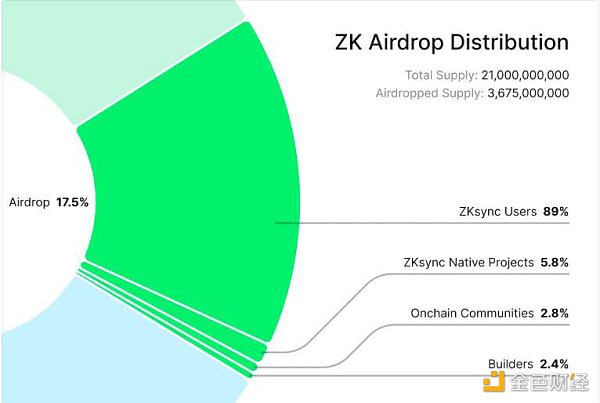

According to official news, 17.5% of the total number of ZK tokens will be used for airdrops. Among them, 89% are distributed to individual users, who are people who have traded on zkSync and reached the activity threshold. Another 11% are awarded to ecological contributors, which refers to individuals, developers, researchers, communities and companies who have contributed to the ZKsync ecosystem and protocol through development, publicity or education.

The snapshot date distributed to ordinary users is 00:00:00 UTC on March 24, 2024. In terms of rules, 7 rules are set to screen users. At least one rule must be met to enter the next stage of screening. The rules for the initial screening are as follows:

1. Interact with at least 10 non-token smart contracts on ZKsync Era. (Eligible contracts must have at least 30 days of active time)

2. Payers who have used at least 5 transactions on ZKsync Era.

3. Traded at least 10 different ERC-20 tokens on the ZKsync Era DEX.

4. Provided any amount of liquidity to DEXs and lending protocols tracked on ZKsync Era.

5. Provided any amount of liquidity to DEXs and lending protocols tracked on ZKsync Era.

6. Been active on ZKsync Lite for more than 3 months before the ZKsync Era mainnet.

7. Donated to Gitcoin through rounds on ZKsync Lite.

After the initial screening, the second step will be to count the number of users' on-chain assets, mainly based on the amount sent to ZKsync Era and the length of time these crypto assets stay in the wallet. The wallet balance and assets in the DeFi protocol are all included in the calculation, of which the weight of assets in DeFi is twice the wallet balance, and the total number of days calculated is 366 days before the snapshot date.

In the third step, each eligible address will be weighted multiplied according to the amount of on-chain behavior. The following are activities that are officially considered to have a high contribution to the ecosystem

1. Save one of the following ZKsync native NFT collections in the snapshot: Dudiez, Hue, Moody Mights, Webears, ZKPENGZ, zkSkulls or zkVeggies.

2.Hold at least $50 of one of the following ZKsync native ERC-20 tokens at the time of the snapshot: AAI, HOLD, KOI, MEOW, MUTE, RF, ZF, ZORRO.

3.Smart contract wallet created through ZKsync Era native account abstraction.

4.Hold at least 50% of the ARB/OP/ENS airdrop for more than 90 days after claiming.

5.Interact with eligible Ethereum smart contracts at least twice in the first 1,000 addresses. Eligible contracts are contracts that spend at least 100 ETH in transaction fees

After this step, each address will be allocated tokens, and the address must meet the minimum requirement of 450 ZK and the maximum of 100,000 ZK. Tokens of addresses with less than 450 ZK will be recycled back to the pool. Excess tokens of addresses with more than 100,000 ZK will also be recycled back to the pool. These tokens will then be redistributed to bring the minimum allocation to 917 ZK.

After passing the first three steps of screening, the official will conduct a witch detection on qualified addresses. There are two criteria for the detection. One is that the exchange deposit address is repeated. If two addresses send encrypted assets to the same deposit address, they are likely to be judged as witches. The second is to detect the source of funds, that is, the address correlation. If multiple addresses have transfers and other correlations, they are likely to be judged as witches.

Through the setting of the above rules, we can find that ZKsync regards on-chain interactions and on-chain asset value and time as heavier weights in the setting of airdrop rules.

According to the rules, there is actually nothing particularly wrong with ZKsync's airdrop rules this time. From the perspective of the rules, at most the rules are more stringent, and there are fewer users who meet the requirements.

Just this point alone, it is actually difficult to suffer large-scale criticism. The fundamental reason why the airdrop distribution of ZKsync was widely questioned and complained about this time is that in the process of airdrop distribution, the official did not seem to strictly follow the above rules to reward users, and even new wallets that had not done any interaction appeared, which was suspected to be the project party's insider trading. There are also some teams with real projects on its chain, that is, ecological contributors, who said that they did not receive airdrops.

A large number of zero-transaction accounts received airdrops

The NFT exchange Element on ZKsync failed to receive airdrops. Its official X account said in response to comments, "As the largest NFT trading market on zkSync, we did not receive any airdrops. Are you kidding?"

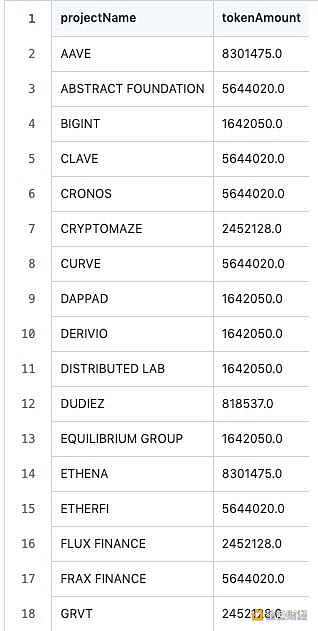

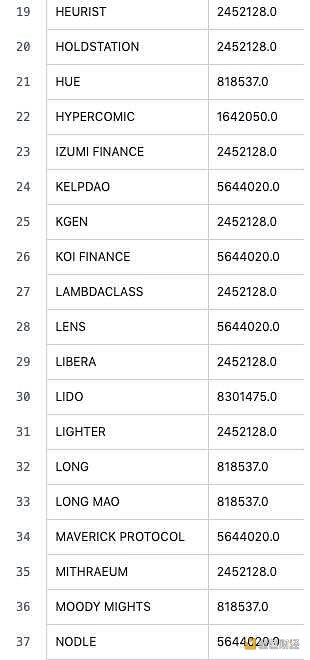

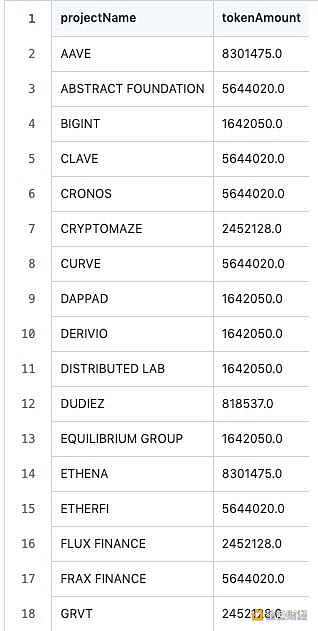

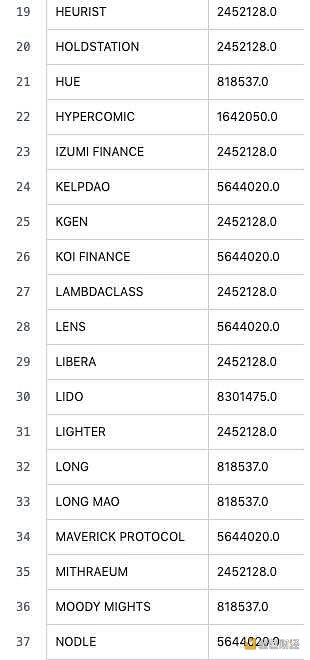

According to the results announced by ZKsync, a total of 67 on-chain projects received airdrops, with varying amounts. The specific situation is as follows:

A netizen summarized the airdrops received by 67 projects on the zkSync chain and found that some of them included shell projects and projects with insider trading by the project owners.

For example, the AAVE project was not listed on zkSync, but it was given 8 million tokens. The ABSTRACT FOUNDATION project received more than 5 million tokens, but its official website and X account could not be found. It is highly suspected that it was the insider trading of the project owner. In response to the doubts about the ABSTRACT FOUNDATION project receiving airdrops, the ZKsync ecological DEX zkSwap Finance came out to clarify the facts. The address belongs to zkSwap and is the project development token allocated by ZKsync. zkSwap emphasized that this part of the tokens will be used to develop the protocol and community.

However, this explanation did not quell the users' doubts. In the eyes of users, the project owner seemed to have released a batch of its own accounts to obtain airdrops.

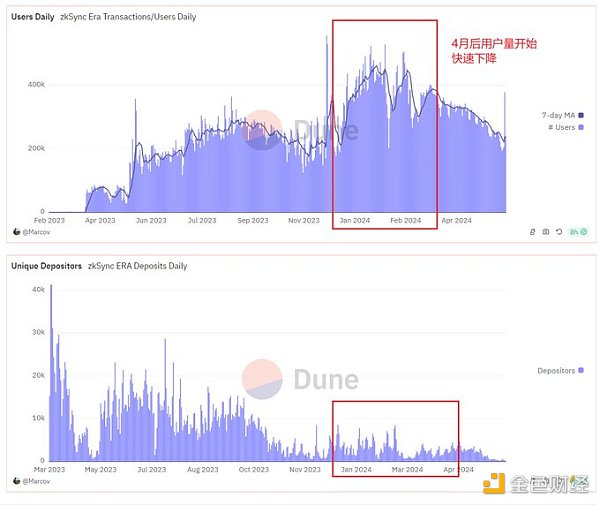

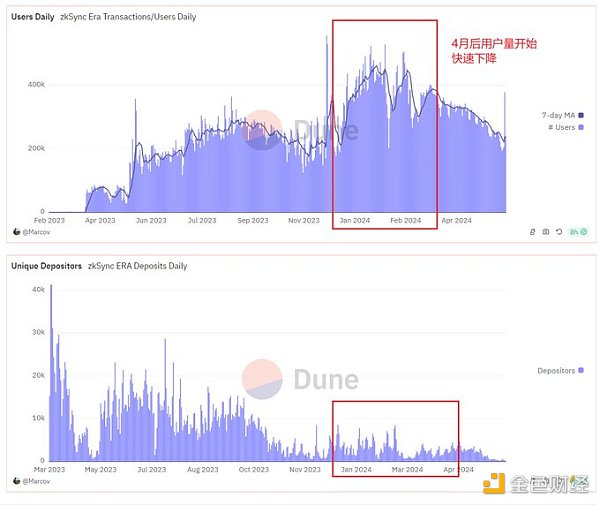

X user @riyuexiaochu also did some data analysis, saying that ZKsync used a large number of insider trading to harvest, "Evidence 1: In the three months before the airdrop, the number of user addresses nearly doubled.

Normal users will regard the cross-chain bridge as a must-do task. However, during this event, the number of users doubled, and the number of deposits was half of the previous one. The final published rules do not require the statistics of cross-chain amounts. This shows that these addresses not only mastered the airdrop time, but were also very familiar with the rules.

Evidence 2: It is not enough for the project party to use insider trading to increase activity, and it also directly sent it to the address with 0 transfers."

The lowest number of tokens is 917, the highest is 160495, the maximum and minimum difference is 159578, and the gap is 175 times. Most addresses get relatively low numbers of tokens.

Another point that is questioned is whether zkSync's anti-witch is really effective? Is it really effective against witches? Or is it filtering out real users on this ground?

According to a post by witch hunter Artemis on the X platform, a witch user who participated in the Arbitrum airdrop and made a profit of $4.2 million is still eligible to receive nearly 1,000,000 ZK tokens with his more than 3,000 wallet addresses.

According to Artemis' further digging, some rat warehouses obtained more than 2 million ZK tokens by depositing the same Ethereum funds on the same day, and each wallet received an average of 15,000 ZK tokens. More importantly, almost all accounts are marked on the witch list of @LayerZero_Labs.

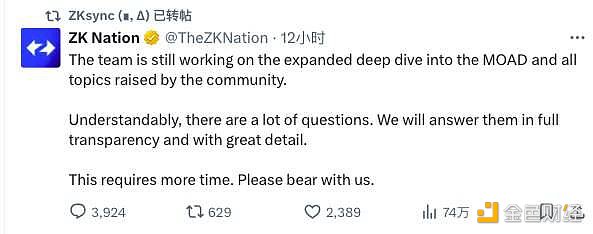

In response to the above questions, zkSync officially replied, "The team is still working on in-depth research on all issues raised by MOAD and the community. Understandably, everyone has a lot of questions. We will answer these questions in a completely transparent and detailed manner. This will take more time. Please be patient."

The community is very dissatisfied with the official response that does not directly address the problem. In the process of airdrops, users are actually used to PUA, and even acquiesce to the "unspoken rules" such as the team's mouse warehouse. But zkSync's PUA this time seems to be a warning to everyone that the more you acquiesce, the more rampant the project parties will become. The rights that should belong to the users will be eroded inch by inch by the project owners as they give in.

ZeZheng

ZeZheng