Altcoin ETFs are no longer popular.

Compared with the excitement in the market during the approval process of Bitcoin and Ethereum spot ETFs, the market sentiment brought by altcoin ETFs can only be described as negligible. But five months ago, the market was still immersed in the bright prospects of the policy bull market. Wall Street institutions with a keen sense of smell came to the altcoin market, pushing a round of price increases in altcoins. XRP and SOL were the first to bear the brunt and became the new concept coins of Wall Street under favorable supervision.

But now, the altcoin ETF has receded, approval news has been heard frequently, and capital institutions have also flocked to it, but market attention has gradually decreased.

As for the reason, the current altcoin ETF can only be blamed for not being born in a good time.

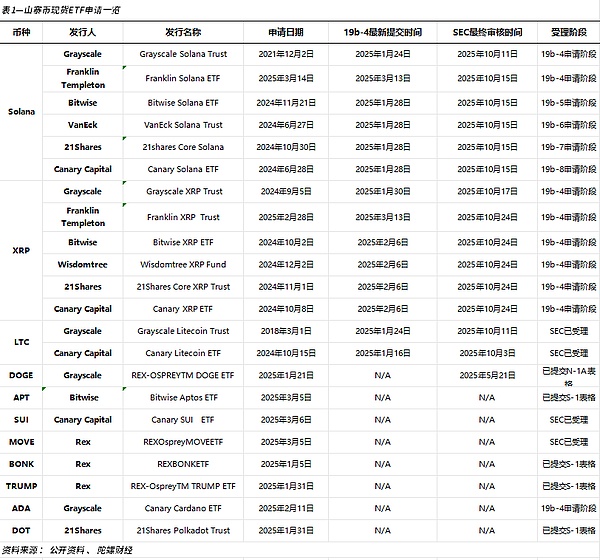

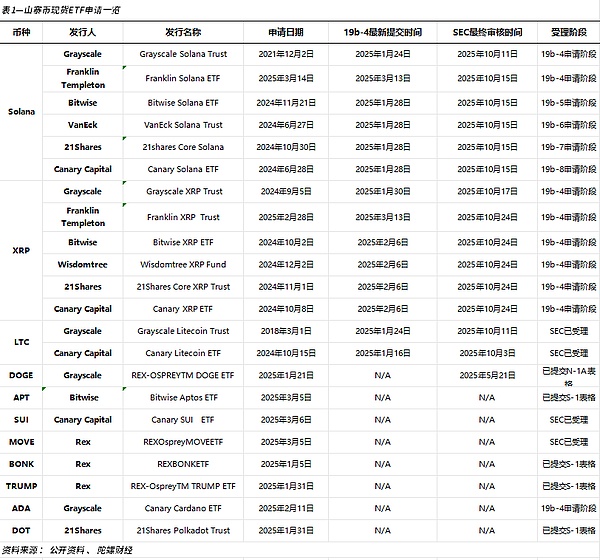

Since Trump announced the strategic reserve of cryptocurrencies, although it did not cause a significant price fluctuation, capital institutions have set their sights on the new market - altcoins. Looking at the altcoin ETFs today, the team is gradually growing. On March 6, a new ETF application was submitted again. In addition to Canary submitting the S-1 application for the AXL ETF, Bitwise also applied for the APT ETF, and VanEck also confirmed that it will launch the Avalanche ETF. So far, more than 7 institutions have applied for ETFs involving 11 major currencies, covering SOL, DOGE, LTC, SUI, XRP, APT, MOVE, HBAR, BONK, TRUMP, and ADA.

From the perspective of applicants, SOL, which is known as the "killer" of Ethereum, and XRP, which has abundant local resources, are the currencies with the most applicants. Both have gathered 6 issuers, reflecting the continued optimism of institutions for these two currencies. Among them, Franklin Templeton, Grayscale, Bitwise, VanEck, 21Shares and Canary Capital have applied for SOL ETF, while Franklin Templeton, Grayscale, Bitwise, Canary Capital, 21Shares and Wisdomtree have applied for XRP ETF. In addition to the above currencies, LTC and DOGE have two issuers respectively, while other currencies are mostly applied for by only a single institution.

In fact, from the perspective of altcoin ETFs alone, the selected currencies have become increasingly extensive, and even quite chaotic. In addition to the slightly larger SOL, XRP, LTC, ADA, and DOGE, public chain currencies are emerging in an endless stream, and even the long-dormant DOT has been selected by 21Shares. In the context of MEME rampant, BONK and TRUMP, which are regarded as strong dealers, also appeared in the ETF application form of Rex Shares.

Although there are many currencies, in terms of the probability of approval, the more high-profile the currency is, the greater the problem. The previous soft requirement of having a futures contract on CME seems to have been untied with the relaxation of supervision, but the securities attributes and the lawsuits in the case cannot be resolved in one day. After the approval of Ethereum ETF, SOL is the most popular currency among altcoins, and the application time is relatively early. According to records, VanEck and 21Shares submitted 19b-4 documents as early as June last year, but due to the securities attributes of SOL itself, the approval has never been achieved. In August last year, the 19b-4 documents of VanEck and 21Shares were removed from COBE, and in December last year, with the last bit of pride, former SEC Chairman Gary Gensler notified at least two SOL spot ETF applicants that the 19b-4 documents were rejected. Until now, the SEC has only announced that it has accepted all SOL ETF spot applications submitted by issuers.

XRP and SOL are basically the same. Ripple's lawsuit is like a foot wrap. After more than four years, it has not been put down, so that Ripple CEO continues to donate political donations to Trump and Congress, hoping to obtain litigation exemptions and continue to expand XRP's influence. The simple and crude donation did bring benefits to XRP. Although it is in the same SEC approval stage as SOL, Ripple's business in the US market has grown significantly. According to its CEO, Ripple signed more US transactions in the last six weeks of 2024 than the total of the previous six months, and has concentrated 75% of new jobs in the United States.

As for other altcoins, the probability of approval is slightly limited at the moment when the leaders have not yet obtained approval, but there are two exceptions, one is LTC and the other is DOGE. Both have no historical burden of securities, and the other is that they are both commodities. There is no negative impact from the regulatory perspective, and the obstacles are relatively small. Especially LTC, which is a public chain using POW, consistent with the mechanism of BTC. Although its scale is only US$7.7 billion, it is also quite deep in the market. DOGE is the leader among MEMEs and has become a cultural symbol. With the support of Musk, the probability of approval will naturally increase. Because of the above reasons, Eric Balchunas, senior ETF analyst at Bloomberg, has previously predicted that the Litecoin ETF has the highest probability of being listed before the end of this year, reaching 90%, higher than Dogecoin (75%), Solana (70%) and XRP products (65%).

From the approval progress, most ETFs are in the stage of being accepted but not yet approved. Combing the entire approval process, the issuer will first submit the S-1/S-3 form to the SEC, and then the dealer where the ETF is located determined by the issuer will submit the 19b-4 form. According to the rules, the SEC usually publishes the 19b-4 document in the Federal Register after accepting it, and opens a 21-day public comment period. During this period, the SEC can postpone, negotiate and review multiple times, but the time period shall not exceed 240 days.

From the most recent approval point of view, on March 12, the US SEC documents showed that the US Securities and Exchange Commission postponed the approval of multiple spot cryptocurrency ETF applications, including Grayscale Spot Cardano ETF, Canary Spot XRP ETF, Canary Spot Solana ETF, Canary Spot Litecoin ETF and VanEck Spot Solana ETF. Of course, judging from the altcoin ETF alone, the SEC's postponement of the ETF is foreseeable. The core reason is that after the previous generation of iron-blooded supervision, Trump's nominee for the new SEC Chairman Paul Atkins has not yet been confirmed by Congress. The leader is not here yet, and the regulations cannot be implemented. It can only be suspended through postponement. From the usual point of view, the leadership team takes more than 2 months from nomination to taking office. The market expects that the new chairman will make his debut in March.

Although the approval process has been ups and downs, from the perspective of existing supervision, the probability of approval is undoubtedly increasing. Even SOL and XRP, which are still under litigation, have been included in the US digital asset strategic reserve. Although this point has no direct connection with whether it is approved or not, it can also indirectly reflect that the above-mentioned currencies are expected to be freed from the SEC's restrictions.

However, judging from the market performance, the narrative of the altcoin ETF does not seem to work.

Back to five months ago, in November last year, institutions set off a wave of altcoin ETF applications, and the first batch of coins such as SOL, XRP, LTC, and HBAR rose rapidly. In one month, XRP rose from $0.5 to $2.9, and successfully reached $3.4 on January 16 this year. SOL also follows a similar trajectory, rising from $160 to $264, and rising to $295 on January 19.

In November, due to the general rise of altcoins, the long-dry market was like a rain of blessings. The slogan "Altcoin season is coming" brought a glimmer of hope to the firm holders. But the dream was soon shattered. In February, all altcoins continued to fall, and the news of altcoin ETFs could no longer drive the market. Regardless of the progress of approval, the price of the currency was moving in a downward direction.

Has the ETF narrative failed? In fact, it may not be, otherwise many holders would not keep a close eye on ETF data, but it is strange that today's ETFs are not born in a good time. From the current financial market, the narrative of a single sector is difficult to sustain, and the world is betting on whether the United States will decline. The more vigorously Trump's tariff stick dances with geopolitics, the greater the macro uncertainty, the greater the possibility of inflation, and the theory of US recession will come uninvited. At this point, even the government cannot guarantee a recession. In addition to Trump's mysterious statement that "it is uncertain whether there will be a recession", the US Treasury Secretary also responded positively today that "there is no guarantee that the US economy will not fall into recession", which is a state of scraping the bone to heal the wound.

Under this panic, Bitcoin has shown a downward trend and continues to fluctuate around $80,000-83,000. ETH has started a defense battle at the $1,900 point. SOL has fallen to $128, and the market is at the junction of bulls and bears. In a market with insufficient liquidity, it is not easy to have an independent market. ETFs are still in the approval period and have not been substantially approved. The expectations brought are not enough to change the trend and can only serve as a forward factor to support the bottom of the price.

It is worth noting that even if the ETF is passed, the actual purchasing power is questionable. At present, the total net inflow of Ethereum spot ETF is only 2.5 billion US dollars, which is enough to prove that the market propaganda that "billions of dollars will flow in after the altcoin is passed" is not credible. Even if it is credible, it is not a one-day Rome. After all, in theory, the market value of the altcoins that have applied for ETFs is much smaller than that of Ethereum. The largest market value of XRP is 135.4 billion US dollars, while the market value of Ethereum has reached 229.1 billion US dollars.

On the other hand, the entry of Wall Street capital is not entirely a good thing, and the transfer of pricing power is inevitable. Taking Bitcoin as an example, the continuous decline in Bitcoin prices is also due to the reduction of spot ETFs. The latest data shows that the US spot Bitcoin ETF has reduced its Bitcoin holdings by 4.76% since February 6, 2025. From January 1 to February 6, these funds added about 56,802.86 bitcoins to their balance sheets, but in the past 35 days, holdings have decreased by 55,348.00 bitcoins.

Of course, for altcoins, narrative is far more important than pricing power. Institutions can bring in real money and silver flows, and holders can only expect institutions to treat them differently and fall into a love-hate relationship with capital. For most currencies, through ETFs, one foot has stepped into Wall Street, and connected with Wall Street, and it is one step closer to obtaining the label of "Made in the USA", and even the chance of being included in the reserves through operations will increase. At least during Trump's four-year term, it can live better than other altcoins.

Joy

Joy