Coinbase: L2 Innovation and the Future Development of the Ethereum Ecosystem

Clarify the basic demand drivers of Ethereum and sort out the narrative logic behind it.

JinseFinance

JinseFinance

Author: Revelo Intel Translation: Shan Oppa, Golden Finance

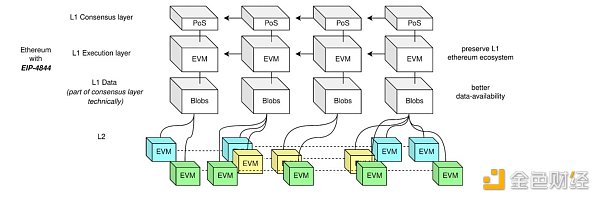

Ethereum’s scalability roadmap increasingly focuses on Rollup solutions, and With continued adoption and the anticipated EIP-4844, Ethereum layer 2 (L2) solutions are gaining lasting importance.

However, evaluating L2 solutions is far from simple. Unlike L1 networks like Ethereum, which have clear revenue streams from transaction fees and clear fees from token issuance, Layer 2 solutions pose unique valuation challenges.

This report explores the complexities of evaluating Ethereum Layer 2 solutions and provides insights into the economic factors underpinning their value propositions.

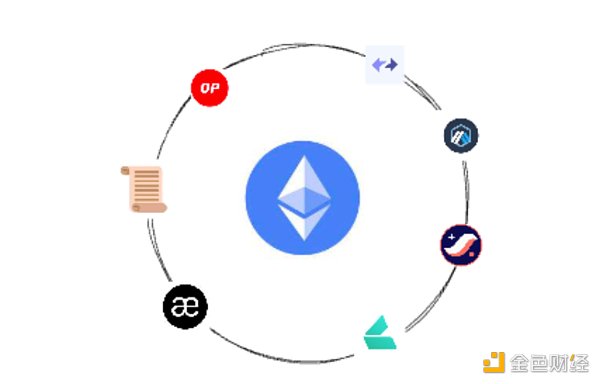

The recent progress made in the world of Rollup solutions is certainly impressive. Since the launch of Rollups in 2018, an influx of talent and research has resulted in significant improvements. These include Ethereum Virtual Machine (EVM ) equivalent rollups, implementation of fraud and validity proof-based bridges, breakthroughs in bulk data compression, and the introduction of the rollup software development kit (SDK). Notably, various rollup solutions such as Optimism, Arbitrum, Base, zkSync, and StarkNet have entered the market, fostering a thriving ecosystem that leaves alternative L1s vulnerable and exposed as the battle for market share intensifies status.

While current adoption rates have met expectations and proven the feasibility of attracting the next generation of users, the growth trajectory for Layer 2 solutions (L2) will Accelerate in the coming months. With the emergence of EIP-4844 and the launch of new chains such as Scroll, Linea and Base, L2 is now in the spotlight.

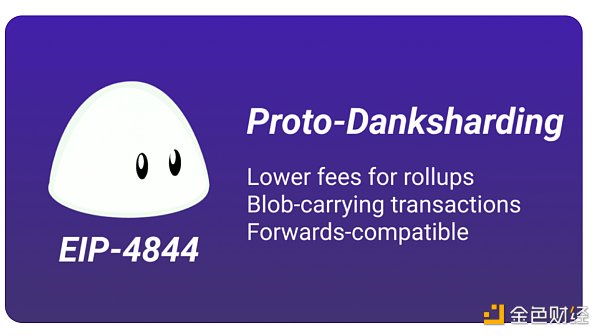

The upcoming Dencun upgrade brings A notable feature is EIP-4844, also known as Proto-Danksharding, which marks a significant reduction in the operational costs associated with aggregation. While the specific specifications for Danksharding continue to evolve, EIP-4844 paves the way for a seamless transition of the Ethereum protocol architecture to accommodate future Danksharding implementations.

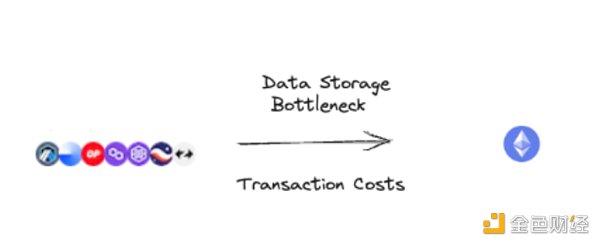

Current Rollup implementations face two main challenges. First, there is a data storage bottleneck, as L2 processes millions of transactions per day, aggregates these transactions, and submits transaction proofs to Ethereum. Second, there are transaction costs associated with transferring transaction data from L2 to Ethereum.

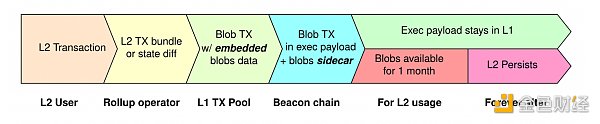

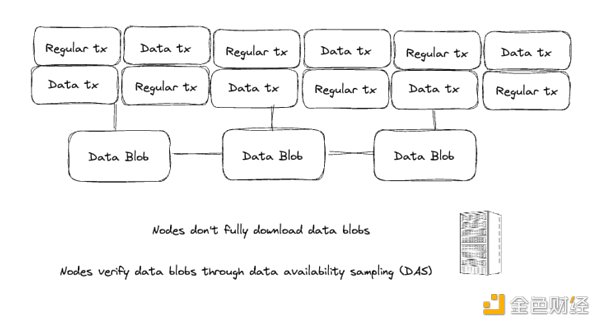

The core of EIP-4844 is the concept of "Blob", which represents a binary large object. Essentially, a blob is a block of data linked to a transaction, unlike a regular transaction. These blobs are stored exclusively on the Beacon Chain and incur minimal gas fees. They can add more data to Ethereum blocks without increasing the block size. Simply put, leveraging blobs can increase the amount of data stored by nearly 10 times compared to the average block size.

The main purpose of Blobs is to significantly reduce data availability (DA) costs, especially for aggregated Layer 1 (L1) publishing. Unlike the traditional approach where all rollup data resides in Ethereum’s calldata space, blobs provide an efficient and cost-effective alternative. Since the consensus layer manages blob storage, blob transactions place no additional requirements on validators. Additionally, blob data is automatically deleted within the recommended 30 to 60 days, which is in line with Ethereum’s scalability goals, rather than indefinite data storage.

Before the implementation of EIP-4844, L1 release costs accounted for more than 90% of the total costs of Rollup. Going forward, EIP-4844 introduces the concept of “data gas,” a new fee category for blob transactions. This separates the cost of publishing L2 data to Ethereum from the standard gas price. With dynamic pricing based on blob demand and supply, L2 can significantly reduce costs when submitting data to Ethereum, with potential cost reductions of up to 16x or a staggering 90% compared to current gas fees.

“'Blobs’ are like blocks of data that allow Ethereum to run more efficiently. They are stored separately, do not disturb validators, and are used when Disappear when needed. This means lower costs and more data space, making Ethereum faster and cheaper."

To understand the importance of EIP -4844, it is crucial to understand Rollups' business model. The upgrade has resulted in significant cost reductions, while revenue is expected to remain stable or increase as on-chain activity increases.

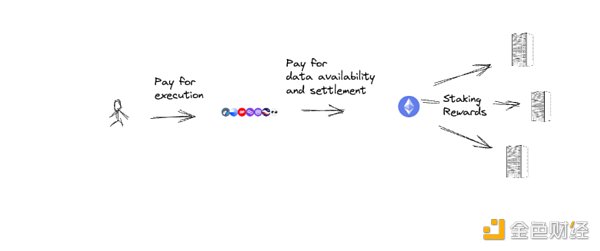

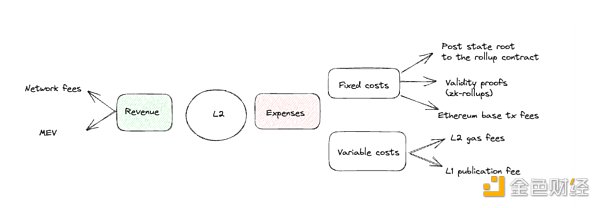

In order to fully understand the impact of EIP -4844 on the aggregate economic model, it is necessary to dissect its revenue streams. Rollup’s revenue comes from network fees and miner extractable value (MEV), a source of capital currently controlled by centralized orderers who monopolize MEV.

In terms of costs, aggregation will encounter fixed expenses and variable expenses. Fixed costs come from operations such as publishing the state root to the Rollup smart contract, proof of validity in the case of ZK rollup, and Ethereum’s base transaction fees. Variable costs include L2 gas fees and L1 publishing fees required to store batches of data on Ethereum.

EIP -4844 introduces a dynamic fee system for Blobs, in which fees are determined by Blob supply and demand, independent of block space requirements, which is different from traditional fees. The models are different. Therefore, the fee market of Ethereum after EIP -4844 includes two dimensions:

Based on EIP ;-1559 Regular Transaction Fee Market: This dimension retains the established regular transaction EIP -1559 fee market with its own unique dynamics, including base and priority fees consistent with EIP -1559 principles.

Blob fee market: The second dimension introduces the blob fee market, where fees are determined entirely by current blob supply and demand. This creates a separate ecosystem from the regular transaction fee market, ensuring that Blob fees are not affected by fluctuations in block space demand.

Analysis of the EIP -4844 fee market reveals several noteworthy results:

As the number of application chains and generalized L2 increases, the demand for Blobs is expected to gradually increase. EIP-4844's price discovery mechanism may cause data gas prices to increase in the event that demand exceeds the blob target.

Data gas costs are expected to grow exponentially as demand surges. If blob demand exceeds target levels, the cost of data gas will experience rapid and exponential growth, potentially increasing more than tenfold in a matter of hours. Once blob demand reaches the target price, the data gas price will begin to increase exponentially every 12 seconds.

EIP -4844 is a game changer for how Rollups make and spend money. With dynamic blob fees, one part of the fee market follows regular rules, while another part adjusts itself based on blob supply and demand. As blob demand grows, so does the cost of gas.

With specific applications As the number of chains increases, the business model of Rollups as a Service becomes more and more important. For example, Ethereum Layer 2 has clear advantages compared to specific application chains on platforms such as Cosmos, mainly due to the emergence of RaaS solutions.

A key reason for this advantage is the reduction in infrastructure overhead. In the context of Ethereum Layer 2, this process is significantly simplified thanks to RaaS solutions. These services simplify the deployment, maintenance, and management of custom rollups, effectively solving the technical difficulties that developers often encounter when developing mainnets. Therefore, RaaS enables developers to focus on application layer development, thereby increasing their overall productivity.

RaaS also offers a significant degree of customization. Not only do developers have the freedom to choose their preferred protocol for the execution environment, settlement layer, and data availability layer, but they also gain flexibility in key aspects such as sequencer structure, network fees, token economics, and overall network design. This adaptability ensures that RaaS can be customized to meet the specific needs and goals of various projects, enhancing the versatility of Ethereum Layer 2 solutions.

We can distinguish two main types of services:

SDK (Software Development Kit): These are used as development frameworks for Rollup deployments and include well-known options such as OP Stack, Arbitrum Orbit for L3s, Celestia Rollkit and Dymension RollApp Development Kit (RDK).

Codeless rollup deployment services: These services are designed for simplicity and can be deployed without deep coding expertise Summary. Solutions such as Eclipse, Cartesi, Constellation, Alt Layer, Saga, and Conduit fall into this category. They lower the barrier to entry for developers and organizations interested in leveraging Rollup technology.

We can also include a third category of shared Sequencer sets that can provide multiple aggregation services at the same time, such as Flashbots' Suave Or Espresso.

While the current market landscape may show little demand for custom Rollup creation, it is widely expected that as macroeconomic conditions improve and product As the market fit becomes clearer, RaaS may lead to hundreds to thousands of rollups.

RaaS makes developers’ lives easier, faster, and more flexible. This gives them more time to prioritize and focus on the application's core logic and business model.

Optimism, Arbitrum The success of Rollup solutions such as , Mantle, and zkSync is indisputable. However, when it comes to the investment perspective of Rollup governance tokens such as $OP or $ARB, a nuanced picture emerges.

In traditional financial markets, shareholders Enjoy a range of rights, including dividends, voting rights and claims on assets, which provide the stock with intrinsic value, making it an attractive investment. On the other hand, tokens that merely represent governance power lack such guarantees beyond voting on governance proposals. Since Sequencer revenue generated from transaction fees does not flow to token holders, the growth of the network does not necessarily translate into an increase in token value. This raises legitimate questions about the value proposition of Rollup tokens.

While governance rights have inherent value, especially in Layer 2 solutions where token holders have significant influence (such as Optimism’s RPGF and Arbitrum’s STIP), but because there are no dividends or other income streams, they become a different form of investment.

In today's high interest rate environment, assets that do not provide a real yield may be less attractive, especially for conservative investors. Rising interest rates increase the cost of funds, making the opportunity cost of holding non-yielding assets more significant. Against this backdrop, despite the growth potential of Rollup tokens, ETH with its stable stake returns may be a more attractive option for risk-averse investors.

In the financial market, the value of a company is not only Tied to profits or dividends. For example, growth stocks are valued based on their long-term growth potential and reinvestment strategies. Investing in Rollup governance tokens can also be similar to investing in non-dividend growth stocks.

Historically, companies like Amazon have chosen not to pay dividends, instead reinvesting profits in expansion and innovation. Investors in such companies are not necessarily looking for immediate returns through dividends; instead, they anticipate long-term growth and appreciation in value.

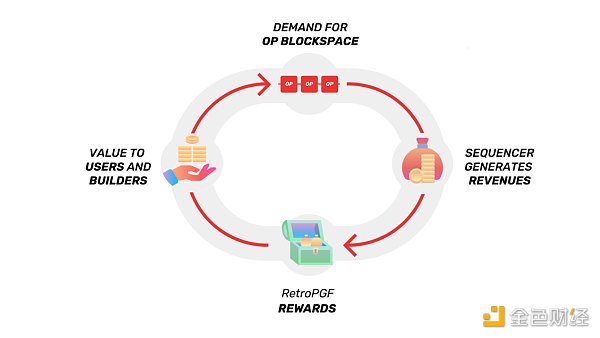

In the case of Optimism and $OP tokens, there is a clear commitment to reinvest the proceeds into the growth of the ecosystem, thus promoting its native dApp , sequencer revenue and RPGF A virtuous cycle of increased demand. In addition, with the emergence of plans such as Hyperchain, the bandwidth of OP Stack continues to expand, eventually forming a strong moat that is difficult to ignore due to network effects.

The Layer 2 (L2) landscape is evolving into a highly competitive domains, and the implicit expectations of airdrops can significantly affect user behavior within any given L2. However, it is important to recognize that the valuation of a particular L2 is intrinsically linked to the value of Layer 1 (L1), with network effects being the differentiating factor.

This connection becomes apparent when we examine the currently aggregated features. They charge gas fees in ETH and have to pay data availability fees to Ethereum in ETH. Essentially, these aggregates lack the ability to enforce their own monetary policy; Ethereum dictates how much they must pay to the underlying chain.

Therefore, L2 does not have a significant monetary premium. However, the way L2 tokens are currently traded does not always align with this reality. However, as long as they can build strong ecosystems and cultivate network effects, these secondary entities have the potential to become sovereign entities in the future, and the market may seek to anticipate and seize this opportunity.

Airdrops will definitely affect user behavior. But here’s the twist: L2’s value is closely tied to Ethereum (L1). L2 charges and pays in ETH, so they don’t have their own funding rules.

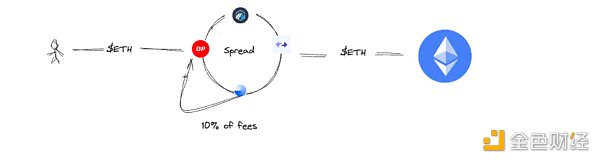

In this context, it is clear that the current L2 operates as a spread business: they charge the end user a fee and retain it A portion of the fee covers Ethereum’s settlement and data availability costs. Owning the associated governance token is effectively equivalent to holding a portion of the spread generated by L2.

Things get more interesting when multiple instances can be created, as is the case with Optimism. In this case, the spread generated by these instances can flow back to token holders. Take Base, for example, which allocates 10% of its fees to Optimism.

This model unlocks greater potential for L2 asset scalability, pioneering the sharing of a portion of fees with the Treasury as part of an implicit licensing agreement precedent. This dynamic not only adds depth to the L2 ecosystem, but also strengthens the value proposition of the L2 token as it evolves and adapts within the competitive landscape.

The current transaction price of Ethereum is approximately US$195 billion, and it is expected that its The value will rise in tandem with the growth of the Rollup built on top of it. Additionally, the launch of Rollups as a Service (RaaS) is expected to bring about a surge in both general and application-specific Rollups entering the market.

But while we can expect the base layer to increase in value, L2's trading beta is generally higher compared to ETH. Additionally, investors may view their tokens as a bet on the entire ecosystem. We recommend using this approach with caution, as individual projects don't think twice about migrating their codebases and users to the latest and most popular L2 at any given moment.

In addition, L2 is positioned to attract more users, thus increasing the value flowing back to Ethereum. This dynamic may follow a power law distribution, albeit to a smaller extent than that observed in liquid staking. Therefore, one can reverse the view and argue that ETH is an actual index that investors might prefer to own. As more L2s enter the market, and dApps end up spread across multiple L2s, choosing the winning chain becomes more complex. Still, no matter who the eventual winner is, $ETH holders and Ethereum validators will benefit.

The value of Ethereum will rise as Rollups grow, and Rollups as a Service (RaaS) will bring a wave of Rollups to the market.

The volatility of L2 is different from that of ETH, and projects can quickly switch between L2.

L2 will attract more users, benefiting ETH holders and validators, but pick the winners in L2 But it's tricky.

Finally, holding ETH is probably the safest bet.

The era of L1 rotation trade seems to be a thing of the past. As Layer 2 (L2) solutions effectively address Ethereum’s scalability challenges, questioning the value proposition of alternative Layer 1 (L1) blockchains (e.g. Near, Avalanche, Solana, Fantom, etc.) is warranted.

A key differentiator is the ease of bootstrapping Total Value Locked ( TVL ). L2 enjoys an advantage in this regard because users and developers are already familiar with the tools available on Ethereum. They can take advantage of reduced transaction costs simply by bridging assets to the L2 chain. In essence, TVL, originally on Ethereum, was simply seeking a more cost-effective trading environment.

However, it is important to recognize that alternative L1s still serve a specific purpose and offer unique capabilities that may appeal to certain use cases.

Diverse ecosystem: Alternative L1 cultivates its own ecosystem, Often with unique communities, projects, and innovations. These ecosystems may cater to niche markets or specific industries.

Professional features: Some L1s prioritize features such as high throughput, low latency, or specific consensus mechanisms. These properties may make them more suitable for certain applications, such as high-frequency trading or gaming.

Diversification: From an investment perspective, diversification across different levels can reduce risk. While Ethereum remains dominant, other L1s may offer diversification opportunities. For example, betting on Solana could be a way to counter EVM dominance (imagine a scenario where zero-day vulnerabilities are discovered in EVM).

The surviving L1s will be those that bring unique value to the ecosystem (Solana, Monad, etc.). Providing EVM-compatible chains and low gas fees is no longer enough. This may seem obvious now, but in the past there have been many examples of EVM-compatible chains with lower Gas costs reaching huge valuations. Take Moonriver, an EVM-compatible chain on Kusama (Polkadot’s canary chain) as an example. The chain reached an all-time high of $494 in the fourth quarter of 2021 and is currently trading at $4.

L2 reduces the need for L1 rotation transactions. While alternative L1 blockchains still have unique uses, L2s have an advantage in terms of TVL because they offer familiar tools and lower transaction costs.

However, a diverse ecosystem, specialized capabilities, and diversity can make alternative L1s useful for specific use cases and risk mitigation attraction.

Surviving L1 will bring unique value beyond EVM compatibility and lower gas costs

Traditional The valuation method is more suitable for L1, with transaction fees as revenue and token issuance as expenses. L2 poses unique challenges to valuation.

Although cryptocurrencies and stocks are structurally different, the basic investment logic still applies - invest with long-term growth potential of assets may also be an attractive strategy.

L2 operates by capturing the spread, a model that is reinforced when implicit revenue sharing agreements are formed with other chains, For example, Base allocates 10% of its fees to the Optimism treasury.

$ETH can be considered an "index" asset, while L2 functions like a personal "stock pick." Regardless of which L2 is the most active, both $ETH holders and Ethereum validators will benefit from increased rollup activity.

A way to look at this issue The approach is that EIP4844 will significantly reduce the cost of L2 while its revenue will grow over time. The difference between the two is the profit margin on those L2s. As spreads widen, so does the likelihood that they will decide to start sharing those profits with token holders. If you're willing to wait for the pieces of the puzzle to fall into place, running the logic ahead of time is a reasonable approach.

As we chart a course for the future of Rollup governance tokens like $OP or $ARB, it’s clear that the landscape is ready for transformation. The rise of EIP4844, ERC4337, and the emergence of RaaS featuring SDK and codeless deployment services are about to usher in a wave of Rollup adoption.

This wave of adoption may see rollups in the thousands or even tens of thousands. However, investors are divided on the value of these governance tokens. On the one hand, challenges such as the lack of traditional value capture mechanisms and the impact of a high interest rate environment may limit the potential upside of Rollup tokens. On the other hand, some investors may liken these tokens to non-dividend growth stocks like Google, Amazon, and Tesla, recognizing their potential to achieve higher valuations driven by long-term growth prospects.

As we venture into a more competitive environment, it is critical to remain adaptable given the evolving dynamics and unique characteristics of the Rollup governance token.

Clarify the basic demand drivers of Ethereum and sort out the narrative logic behind it.

JinseFinance

JinseFinanceLayer 2, ETH, VanEck: Ethereum L2 market value estimation in 2030 Golden Finance, evaluates 5 key areas of Ethereum Layer 2.

JinseFinance

JinseFinanceOptimism is an Ethereum-compatible Layer 2 project that hopes to solve Ethereum’s scalability issues while functioning similarly to the Ethereum blockchain.

JinseFinance

JinseFinanceIn the long run, I think the future of Ethereum will be a combination of "L1 blockchain + L2 system equivalent to L1 trustless" (hereinafter referred to as "L1+L2"), especially when ZK Rollup solves the problem of general intelligence After contract platform technology.

JinseFinance

JinseFinanceThis article explores the importance of solving cross-chain liquidity issues and the three main approaches to achieving seamless liquidity transfers and the concept of a fast finality layer.

JinseFinance

JinseFinanceThe competition in Alt L1 has become fierce. Near has launched a DA solution and Sui’s TVL has been rising. Only Ethereum is still unhurriedly upgrading its main network. Two major competition points have emerged in L2: parallel EVM and decentralized sequencer.

JinseFinance

JinseFinanceIn an article published by Bankless on December 22, Bankless guest author Viktor Bunin discussed and predicted the future of Ethereum and L2.

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinanceIn this article, we will show what sidechains and L2 solutions are and how they can help with scalability.

Ftftx

Ftftx