From ancient times to the present, shells, chips, cash, deposits, electronic wallets, etc. are all carriers or forms of expression of currency. These carriers and forms of expression are constantly changing in line with the times, just like the digital currency form derived from blockchain technology in the digital economy era today, and the Web3 payment ecosystem built on it.

The most important thing is to understand that the essential attributes (value scale) and core functions (medium of exchange) of currency are unchanged.

The birth of programmable payment, programmable currency and special currency is also aimed at further highlighting the essential attributes of currency, strengthening its core functions, improving currency operation efficiency, reducing operating costs, strictly controlling risks, and giving full play to the positive role of currency in promoting exchange transactions and economic and social development through digital currency and blockchain technology.

Therefore, this article aims to clarify the concepts of programmable payments, programmable money and purpose-bound money by sorting out and compiling the article JPM: Understanding Programmable Payments, Programmable Money and Purpose-Bound Money, and further promote the application and implementation of Web3 payments.

Below, Enjoy:

As the world moves towards a more digital and technologically advanced future, the landscape of financial transactions is evolving rapidly. Continuous technological advances (including the use of blockchain platforms and smart contracts) are making money and payments more "intelligent", such as embedding the logic and conditions of payments into digital currencies. These concepts are completely changing our view of money and financial transactions, providing unique advantages and capabilities in the digital economy.

There are many ways to achieve programmability in digital currencies. A recent technical white paper on Purpose Bound Money (PBM) released by the Monetary Authority of Singapore (MAS) divides it into the following categories:

Programmable Payments: Payments are automatically executed once a predefined set of conditions are met

Programmable Money: Rules are embedded in the value storage itself to define or restrict its use

Purpose-Bound Money: At the protocol level, the conditions for the use of the underlying digital money (Digital Money) and the rules for transfer are specified.

The following will go through examples of different business models for better understanding.

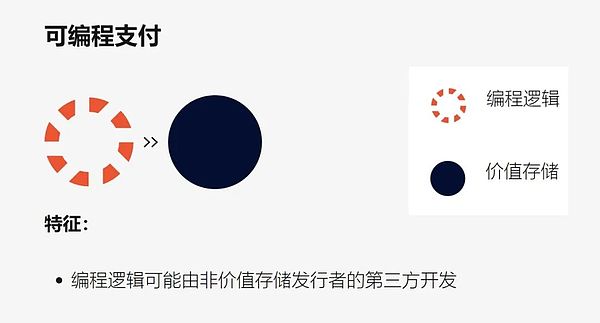

1.Programmable Payments

Most use cases for programmability fall into the category of programmable payments. A common example is conditional payments, which are payments executed when conditions are met. In the traditional world, a postdated check can be considered a conditional payment, where the check becomes effective on or after the value date and is valid for a predetermined period. The attached conditions are evaluated before the check becomes effective. In the digital world, programmable payments are often implemented through blockchain technology, where smart contracts automatically execute payments or actions when certain conditions are met.

A clear and direct use case for programmable payments is automated financial management. Clear financial instructions can help treasurers achieve account target balances and clear funds that exceed the target balance. Programmable payments can also implement more complex logic, evaluating multiple account balances in different currencies and foreign exchange rates, and then transferring funds in the most optimal manner. Paired with the real-time 24/7 payment capabilities of the JPM Coin System, treasurers will be able to use programmable payments to assist in financial management, moving from a cash forecasting model to an instant cash management model that can be programmatically responded to changing real-world conditions instantly.

Conditional payments can also make transactions more secure without the expensive operational overhead associated with escrow arrangements. For example, a buyer can hold funds and only release them to a seller after receiving the goods. There are many options for achieving this, such as using data from a trusted third-party logistics provider at the point where the buyer confirms receipt of the goods, or even by using Internet of Things (IoT) devices that track location to indicate when the goods are delivered to a specific geographic location.

The same concept applies to digital financial assets. With digital financial assets, proof of delivery will be digital. Funds can only be held and released after the digital asset is successfully delivered. This is a form of "money for goods" settlement that minimizes settlement risk by synchronizing the transfer of funds and assets.

2.Programmable Money

Programmable money goes a step further and embeds the rule logic directly into the value storage itself. These rules or logic for the use of money introduce a whole new level of control and security for money.

Unlike programmable payments, programmable money is self-contained and contains both programming logic and value storage. This means that when programmable money is transferred, it carries the rules and logic with it.

The rigidity of limiting rules to the value itself may limit the use cases of programmable money. These rules need to be limited to specific scenarios rather than general applications.

3. Purpose-Bound Money

Purpose-Bound Money (PBM) provides the flexibility to customize rules based on specific use cases, while also ensuring that the rules are closely integrated with the underlying value. Technically, it can be seen as wrapping the rules around the value token, creating a new transferable token that contains the rules and the underlying value.

This provides both the flexibility of programmable payments, which can build different token containers for different scenarios or use cases, and the certainty of programmable money, with the rules bound to the underlying value storage in this new transferable token.

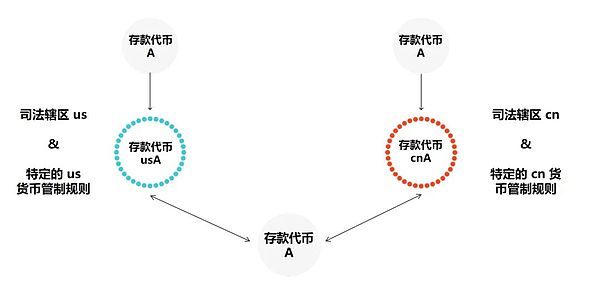

PBMs are most useful when specific rules need to be applied in a unified and universally applicable scenario. Suppose a bank issues a deposit token that can be held by customers of other partner banks, thereby enabling global circulation. In this case, let's assume there are 10 jurisdictions and 10 partner banks. Each jurisdiction has its own set of rules, such as currency controls and sanctions lists. Similarly, each partner bank has its own set of rules, such as different control mechanisms or even reward mechanisms.

These rules cannot be implemented through "programmable payments" because the flow of money is an inherent property of money, not a one-time condition. Although it is possible to implement it through "programmable money", it may not be practical from a governance and technical perspective. From a governance perspective, the original issuing bank needs to integrate 100 permutations (10 banks X 10 jurisdictions) of rules, implement all of these rules, and regularly maintain and update these rules. From a technical perspective, implementing these rules will incur high operational costs.

Through the PBM approach, the original bank will first issue a deposit token A with basic general rules. When entering the cn specific jurisdiction, the additional rules of the specific jurisdiction will wrap the deposit token to form cnA, and when the cnA deposit token leaves the specific jurisdiction, it will be unwrapped and turned back into a deposit token A. Within the cn specific jurisdiction, all transfers are subject to the same rules and are carried out by cnA tokens consisting of the basic deposit token A and the cn specific jurisdiction rules.

Partner banks can further formulate their own bank-specific rules to transfer money for customers within a specific jurisdiction, thereby generating tokens that comply with all the rules of the partner bank and its jurisdiction.

The following figure represents the movement of deposit tokens between different jurisdictions and the different jurisdiction-specific rules surrounding it.

IV. Conclusion

The concept of PBM changes our view of programmable rules and their specific practical implementation methods. With the widespread use of digital currency, it creates new possibilities for how we can manage rules more effectively and provides more effective ways to support different innovative use cases.

Programmable payments, programmable currencies, and dedicated currencies are reshaping the traditional monetary system, providing greater flexibility, automation, and controllability for financial transactions. These concepts will drive innovation, efficiency, and security in the digital economy, propel us into a new era of finance, and change the way we have long viewed and used currency.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex Ledgerinsights

Ledgerinsights Medium

Medium Coindesk

Coindesk