Author: Alice Liu, Forbes; Translator: Felix, PANews

Despite the hype surrounding a potential crypto boom during the "Trump era," Bitcoin has lagged behind almost all major asset classes. Looking back at Bitcoin's performance so far in 2025, 2025 can be described as a "disappointing year."

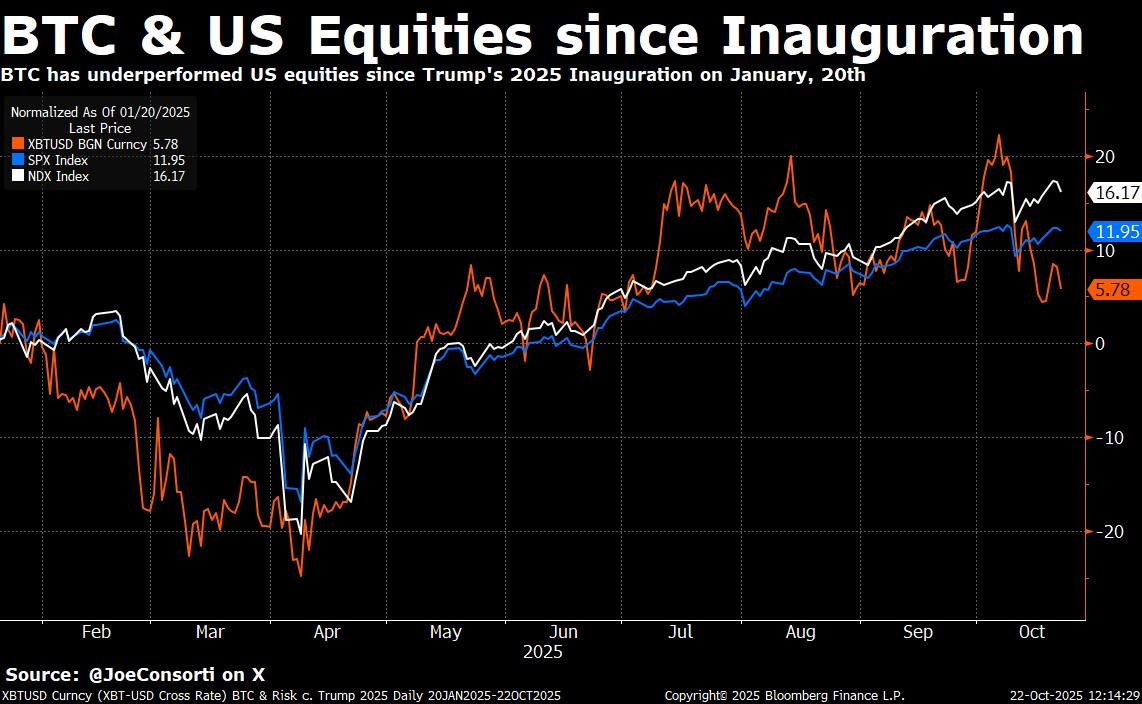

Since the US presidential inauguration in January of this year, Bitcoin's return has been only around 5.8%, while the Nasdaq and S&P 500 have both achieved double-digit gains, and even classic safe-haven assets like gold have significantly outperformed Bitcoin.

Investors hoping for a boost from the "Trump trade" are now facing a harsh reality: unfavorable macroeconomic conditions, fund rotation into AI stocks, and profit-taking by long-term investors have limited Bitcoin's upside potential for most of the year.

Since Trump's inauguration on January 20: Bitcoin has risen 5.78%, the S&P 500 has risen 11.95%, and the Nasdaq has risen 16.17%. Source: X

The $100,000 resistance level

The key question everyone is asking is: Why can't Bitcoin break through?

Simply put, $100,000 has become a psychological profit zone.

On-chain data shows that whenever Bitcoin breaks through this price level, selling by long-term holders increases significantly. These holders include early adopters, whales, and long-term staunch supporters; they are not panic selling, but rather reducing risk and shifting funds to other high-performing sectors, such as AI and tech stocks. Every time Bitcoin breaks $100,000, it triggers a wave of selling: this is not panic, but profit-taking. This creates structural selling pressure, making it difficult for Bitcoin's price to maintain new highs. Weak Demand and Market Structure Another reason for the market downturn is weak demand. Bitcoin is currently trading below the cost base for short-term holders: approximately $106,100 (as of October 30th), and is struggling to maintain above $110,000, which can be considered the 0.85 support level. This is important because historically, when Bitcoin fails to hold this range, it often foreshadows a larger pullback—potentially down to $97,000, the price level where the $0.75 support is located. This pattern has been seen for the third time in the current cycle: a strong rally, exhaustion of demand, followed by a prolonged period of consolidation. In short, the market needs a reset. There is no large-scale inflow of new funds at present. Retail sentiment is weak. Institutional investors are also cautious. Without new demand, each rally will fade faster.

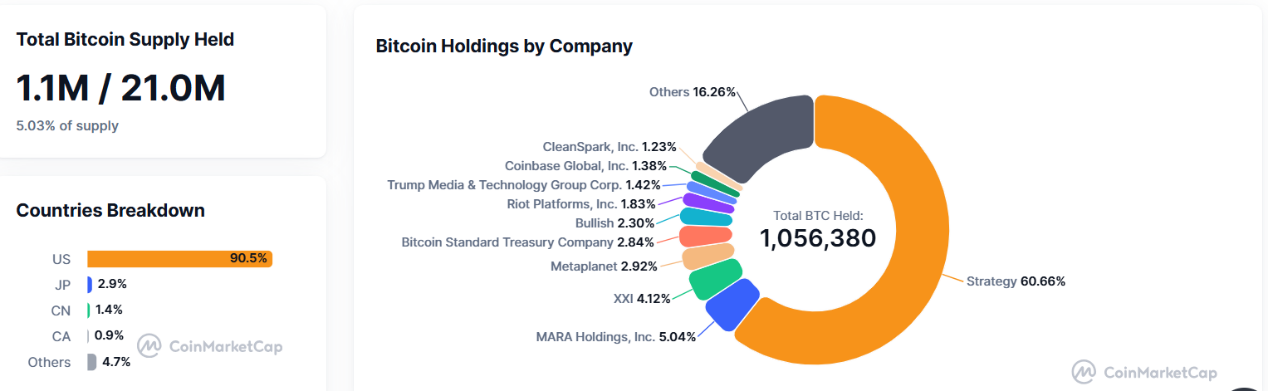

Currently, listed companies hold more than 5% of the total Bitcoin supply. Data source: CoinMarketCap

Miners and Macroeconomic Factors

In addition, miners and macroeconomic factors have brought double pressure.

First, let's talk about miners: After the Bitcoin halving, miners' profit margins were squeezed. Many miners had to sell some of their holdings to pay for operating costs. Coupled with the rise in US real yields earlier this year, this caused miners to turn from net buyers to net sellers.

However, from a macro perspective, the lower-than-expected September Consumer Price Index (CPI) offered some relief, mainly due to easing housing inflation. This provides the Federal Reserve with room to cut interest rates in October and December, an expectation largely priced into the market. If this easing cycle materializes, it could boost risk sentiment by the end of the fourth quarter. However, this positive factor has not yet translated into Bitcoin's strength: liquidity remains tight, and funds are still chasing high-beta AI stocks (PANews note: a financial indicator reflecting the performance of highly volatile stock markets) rather than crypto assets. Options Boom and Market Evolution A major structural change this year has emerged in the derivatives sector. Bitcoin options open interest has reached a record high and continues to grow. This is actually a positive sign of a maturing market. This has also changed investor behavior. Instead of directly selling spot Bitcoin, they are using options to hedge risk or bet on volatility. This has reduced the pressure of direct selling in the spot market, but it has also amplified short-term volatility. Now, every significant move triggers hedging by traders, further exacerbating intraday price fluctuations. We are currently entering a new phase where price movements are more influenced by derivatives positions than by long-term convictions. This indicates that Bitcoin has become a fully financialized macro asset. Where is the market currently in this cycle? Overall, it appears to be a consolidation phase at the end of a cycle. Long-term holders are reducing risk, miners are selling, short-term buyers are at a loss, and derivatives dominate. This combination typically leads to prolonged consolidation before the next major market move. Historically, Bitcoin thrives during cyclical resets—weak hands exit, strong hands rebuild positions, and macro liquidity eventually returns. We are currently in a rebuilding phase. The crypto market is in a rebuilding phase. Data source: CoinMarketCap. So what's next? The $97,000 to $100,000 range will be crucial. If Bitcoin can hold this range during the two Fed meetings, the outlook for early 2026 will look optimistic—especially if interest rate cuts and fiscal expansion begin to reignite risk appetite. However, if this support level breaks, we could see a capitulation sell-off before the next rally—similar to the corrections of 2019 and mid-2022. The key point is: this is not a crash, but a recalibration. Bitcoin's poor performance this year is not due to fundamentals, but rather to fund rotation and natural volatility in mature asset classes. Once the macroeconomic environment turns favorable again, Bitcoin is poised to once again become the preferred high-beta safe-haven asset in the global market.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  Cointelegraph

Cointelegraph