Author: Mike Kremer, Data Engineer at Messari; Compiler: 0xjs@黄金财经

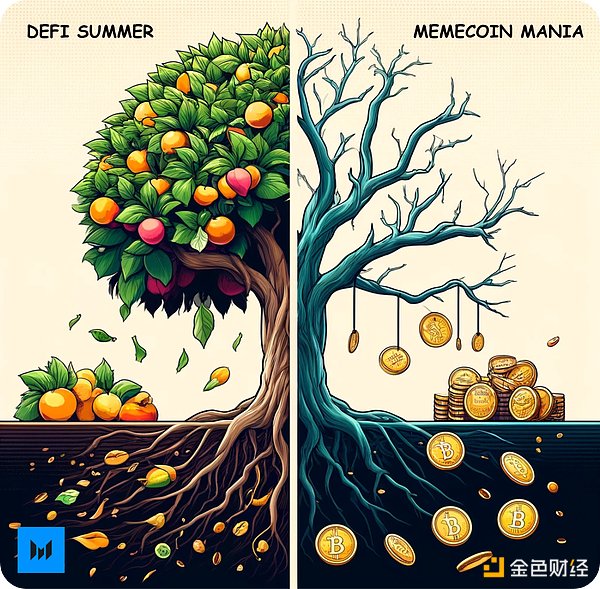

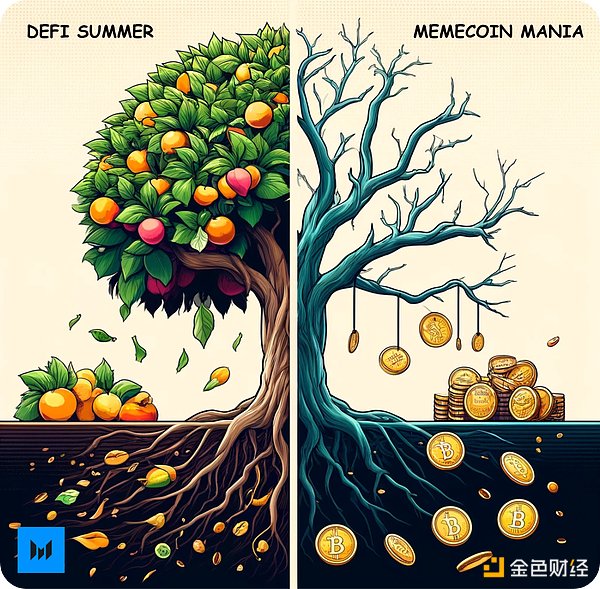

The meme coin craze may be the most predatory crypto phenomenon since the ICO boom. Unlike past cycles, where tokens were often backed by real projects with tangible value, the rise of meme coins marks a shift to a more destructive dynamic. To understand this, let’s compare the value flows during DeFi Summer to what we see today.

During DeFi Summer, projects such as Uniswap Labs launched protocols that provided real utility to the crypto economy.

Users who participate in these platforms are often rewarded with tokens — tokens that represent a portion of the value created by the protocol. When the speculative frenzy subsides, these tokens still have underlying value because they are tied to fully functional, valuable services.

Contrast this with the meme coin trend.

Here, insiders or cartels create tokens like supercumrocket69, hype them up, and trick retail investors into bidding up these “revolutionary” new assets. Once the price rises, the insiders dump their holdings, effectively extracting wealth from retail participants and leaving behind tokens with no real value or utility. The entire process is a zero-sum game, where value is not only redistributed, but destroyed.

The impact on retail investors is obvious. Look at projects like Friend.Tech and Ore Supply.

Despite implementing a distribution mechanism that favors retail investors - FRIEND is fully airdropped to its community, ORE is mined using a fair CPU-based algorithm - the price of both tokens has depreciated significantly.

This suggests that retail buyers have been ruthlessly ripped off by memecoins and no longer have the capital to support the market caps of more genuine projects. Meanwhile, memecoin is being sustained at best by questionable market activity and the naivety of retail investors.

The sad truth is that while speculative bubbles have always been a part of the cryptocurrency space, they have previously left some residual value in the form of legitimate projects. The memecoin bubble, however, is purely speculative and is draining value from the ecosystem, leaving retail investors worse off than before.

Disclosure: The author of this article has suffered massive losses on FRIEND and is now also suffering massive losses holding and mining ORE. This article was inspired by the loss of wealth and general frustration among memecoin sellers and buyers.

JinseFinance

JinseFinance