Written by: AIMan@黄金财经

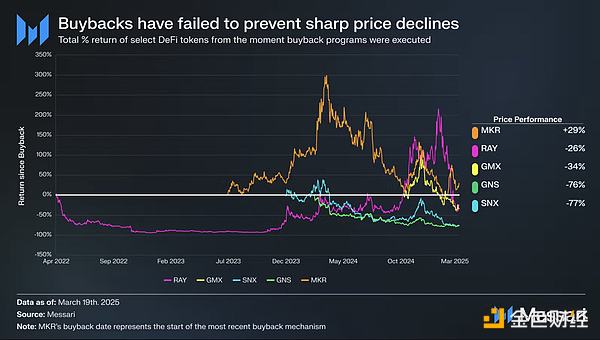

Messari analyst DeFi MONK found that repurchases could not prevent a sharp drop in token prices.

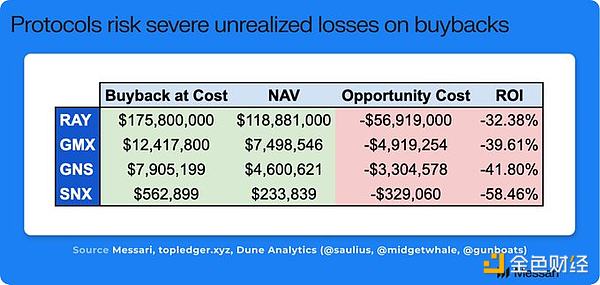

DeFi MONK further analyzed the repurchase data and price performance of RAY, GMX, GNS and SNX. RAY, GMX, GNS and SNX have repurchased millions of tokens through programs, and the value of these tokens is now much lower than the value at the time of repurchase.

DeFi MONK then analyzed the paradox that cannot prevent the token from being inherent:

1. The price has nothing to do with the buyback, and the price is driven by revenue growth and narrative.

2. When revenue is strong and the price is good, the project party will eventually spend more cash reserves to buy back tokens at unfavorable prices.

3. When prices and revenues are bad and cash is needed to invest in innovation and restructuring, the project party lacks excess capital to do so. Worse, the project party is suffering huge unrealized losses because the net asset value of the repurchase is now far below the cost.

Buyback is a bad capital allocation. The mindset should be to either achieve growth at all costs, or distribute real value to holders in a stable/primary form (see veAERO or BananaGun).

Catherine

Catherine