Author: Mlixy; Source: W3C DAO

Bitcoin eats gold

On March 12, MicroStrategy Executive Chairman Michael Saylor said on CNBC on Monday that his company announced the purchase of an additional 12,000 Bitcoins (BTC) and that cryptocurrencies will become more valuable than gold in the future. assets. "

Saylor said that Bitcoin is definitely at least digital gold, and it will eat up gold. It has all the advantages of gold without any of its flaws. .

He also expects Bitcoin to attract funds moving away from other risk assets, including the large-cap S&P 500 ETF (SPDR S&P 500 ETF), Bitcoin will start to appear in other funds, similar to BlackRock's plan to acquire a spot Bitcoin ETF in its Global Allocation Fund.

Saylor reminded that the upcoming Bitcoin halving in April will reduce the cryptocurrency's block rewards by 50%, which means that only 450 new Bitcoins will enter the market every day, compared with the current 900, "For To meet investor demand, the price of Bitcoin will have to adjust. ”

Previously, on November 11, 2023, Michael Saylor believed that the demand for BTC may increase 10 times by the end of 2024. “I think the next 12 months are going to be an important period. Because the demand (monthly) should double or triple, or maybe 10 times, anywhere from 2 to 10 times. But the supply available for sale in April will be reduced by half. Therefore, miners will no longer receive $1 billion in Bitcoin per month, but $500 million.”

MicroStrategy makes a fortune strong>

On March 11, MicroStrategy acquired 12,000 Bitcoins for $821.7 million in cash.

SEC filings show that between February 26, 2024 and March 10, 2024, MicroStrategy used $781.1 million in offering proceeds and $40.6 million in excess cash to acquire approximately 12,000 Bitcoins for approximately $821.7 million in cash.

The average price per Bitcoin, including fees and expenses, is approximately $68,477. As of March 10, 2024, MicroStrategy and its subsidiaries held a total of approximately 205,000 Bitcoins, which were purchased for a total of approximately $6.91 billion, withan average purchase price of approximately $33,706 per Bitcoin , including fees and expenses.

Market data shows that since MicroStrategy began buying Bitcoin, the company’s stock price has soared more than 1,000%, and its market value increased to approximately US$25.7 billion.

On the same day, MicroStrategy completed an issuance of 0.625% convertible senior notes worth US$800 million with a term of 2030.

The company used the net proceeds from the offering to purchase more Bitcoin. The bond offering was completed on March 8, 2024 and includes an additional $100 million of bonds issued subject to a purchase option exercised in full by first-time purchasers. The bonds will pay interest on March 15 and September 15 of each year until the start of September 2024.

Back on February 29, Michael Saylor’s personal wealth increased by approximately $700 million after his company’s stock and Bitcoin prices rose for three consecutive days. MicroStrategy shares rose 10% on Wednesday, taking their three-day gain to 40%. The vast majority of the company's value comes from its Bitcoin holdings. Saylor is MicroStrategy's largest investor, holding a 12% stake in the company.

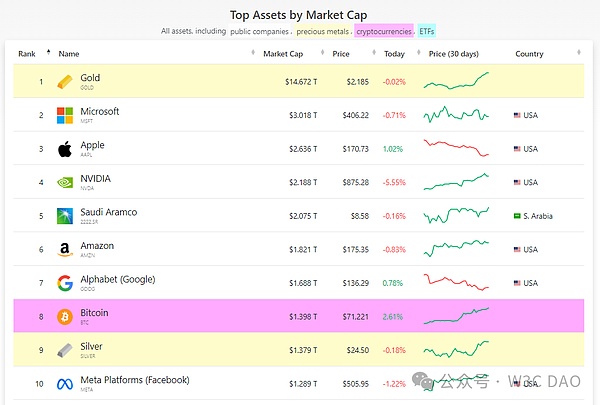

Bitcoin has surpassed silver

On March 11, according to CMC According to data, the market value of Bitcoin has risen to US$1.398 trillion, surpassing silver (US$1.379 trillion) and becoming the eighth largest asset in the world by market value.

A few days ago, Grayscale released a report and believed the same , Bitcoin is a macro asset that competes with the U.S. dollar and physical gold, two traditional “store of value” assets.

Grayscale said that for some investors, Bitcoin may have advantages over physical gold. For example, it is easy to carry: Bitcoin can be used anywhere in the world as long as the holder has access to the Internet and a private key. In Grayscale’s view, the rise in demand for Bitcoin mainly comes from investors’ concerns about the mid-term prospects of the US dollar and seeking an alternative “store of value” asset. Notably, physical gold prices also hit a new high in U.S. dollar terms on Tuesday.

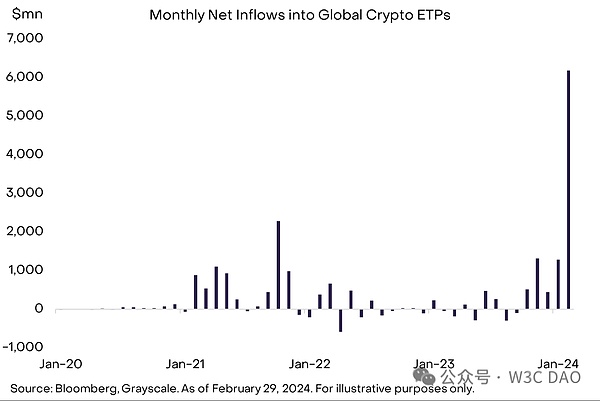

In addition, it is worth noting that since spot U.S.-listed gold ETFs have seen net outflows since the launch of the Bitcoin ETF, perhaps signaling a shift by investors from one “store of value” asset to another.

Written at the end

In a recent interview, MicroStrategy’s Michael Saylor announced a massive investment in Bitcoin , and predicts that this digital currency will surpass gold and become a more valuable asset.

Saylor emphasized the advantages of Bitcoin and expected it to attract funds from traditional risk assets. He also pointed to the upcoming Bitcoin halving event and a potential significant increase in demand for Bitcoin.

MicroStrategy’s Bitcoin investment has significantly increased its market value, and Saylor’s personal wealth has also increased as a result.

Bitcoin’s market value has surpassed that of silver, becoming the eighth most valuable asset in the world and is regarded as a potential macro asset.

Looking ahead, Bitcoin is likely to continue to strengthen its market position as a "store of value" asset, despite the challenges it faces from regulation and market volatility.

JinseFinance

JinseFinance

JinseFinance

JinseFinance XingChi

XingChi JinseFinance

JinseFinance Bernice

Bernice JinseFinance

JinseFinance JinseFinance

JinseFinance Jasper

Jasper Coindesk

Coindesk Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph