MicroStrategy, a tech company, recently announced a $500 million private offering of convertible senior notes to bolster its Bitcoin holdings. The notes, set to mature on March 15, 2031, will be unsecured senior obligations and will accrue interest biannually starting from September 15, 2024.

MicroStrategy has decided to conduct a new private placement of convertible senior notes worth $500 million

MicroStrategy's decision to embark on a new private offering of convertible senior notes valued at $500 million underscores its commitment to strategically increasing its Bitcoin holdings. With this infusion of capital, MicroStrategy aims to solidify its position as a significant player in the cryptocurrency market, capitalizing on the potential for long-term value appreciation and diversification benefits offered by Bitcoin. The company's proactive approach to leveraging convertible senior notes reflects its confidence in the enduring value proposition of Bitcoin as a store of value and hedge against inflation. By allocating the proceeds from the offering towards expanding its Bitcoin holdings, MicroStrategy demonstrates its conviction in the transformative potential of digital assets and its dedication to maximizing shareholder value through prudent capital allocation strategies.

Bitcoin Acquisition Strategy

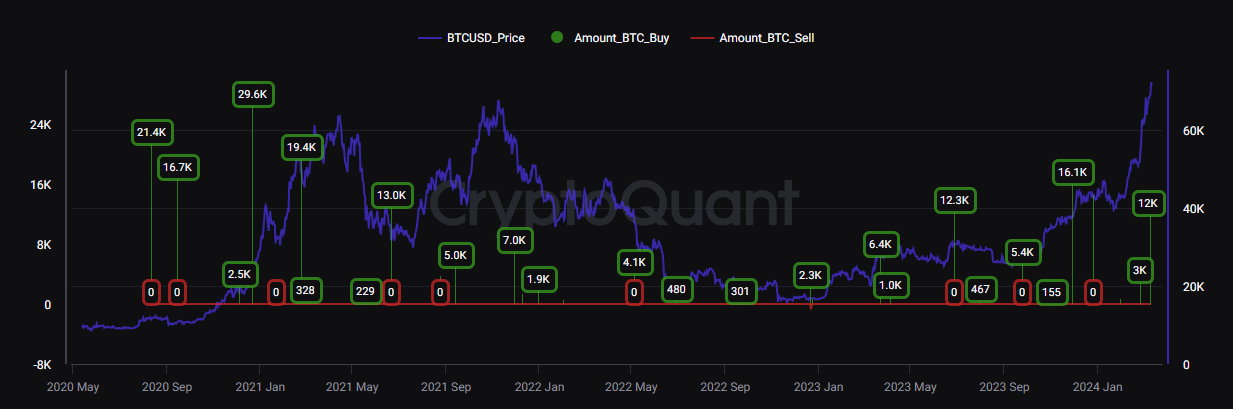

Less than a week prior to this announcement, MicroStrategy, led by Bitcoin advocate Michael Saylor, acquired 12,000 BTC at an average price of $68,477, marking its first Bitcoin purchase above $60,000. The company now holds 205,000 BTC, averaging at $33,706 per coin, surpassing the Bitcoin holdings of any US spot BTC exchange-traded funds (ETFs).

CryptoQuant reveals that the company's unrealized gains on its $14.6 billion bitcoin reserves exceed $7.7 billion

MicroStrategy's strategic approach has proven successful, as evidenced by the data platform CryptoQuant's revelation of the company's unrealized profits exceeding $7.7 billion on its $14.6 billion Bitcoin reserves. Since November of the previous year, the company has been consistently acquiring Bitcoin, accumulating a total of 37,755 BTC. This sustained accumulation strategy has not only bolstered MicroStrategy's position as a significant holder of Bitcoin but has also yielded substantial returns on its investment, showcasing the effectiveness of its long-term approach to digital asset management. As Bitcoin continues to gain mainstream acceptance and recognition as a store of value, MicroStrategy's proactive stance in accumulating significant quantities of the cryptocurrency positions it favorably to capitalize on future market opportunities and further enhance shareholder value.

Potential Future Gains

If Bitcoin reaches $100,000 by mid-2025 as predicted, MicroStrategy's unrealized profits from its BTC holdings could exceed $13.5 billion, resulting in a remarkable return on investment of 197% within five years.

Anais

Anais