Over the weekend, the US-China trade delegations held their fifth round of talks in Malaysia, making final preparations for the upcoming summit between the two heads of state at the end of the month. Previously, with both sides, especially the US, continuously signaling their desire for negotiations, and with improved short-term liquidity in US financial markets, the Nasdaq Composite Index has gradually stabilized and rebounded from two weeks of decline and volatility, reaching a record high after the release of US September CPI data on Friday. On Sunday, both sides announced a consensus on the "agreement framework," stimulating a collective rally in the BTC and crypto markets. The US-China trade conflict, short-term financial liquidity, and inflation data—three major market factors that had previously weighed on bullish sentiment—all improved, contributing to the US stock market reaching new all-time highs this week. However, BTC and the crypto market remained weak due to suppressed overall risk appetite and the constraints of historical cyclical trends. Although it rebounded weakly after finding support from the 200-day moving average and regained its position at the "Trump bottom," it has yet to return to a bull market. The crypto market remains lacking in hot spots, and altcoins remain weaker than BTC.

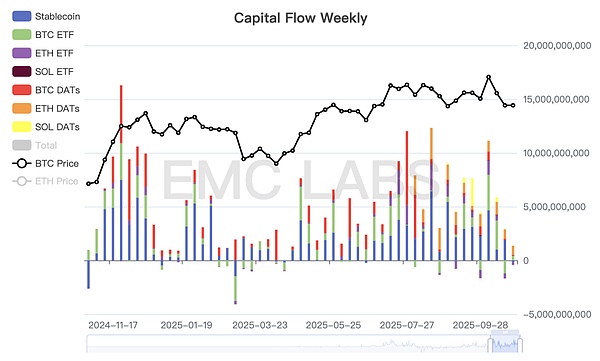

Capital inflows remain weak, making it difficult to offset the market pressure of long-term selling. It remains to be seen whether, with interest rate cuts and the easing of the US-China trade conflict, capital inflows can return to ample levels, reverse the downward trend, or even rewrite the old cyclical pattern.

Policies, Macro-financial and Economic Data

Two weeks ago, the US-China tariff war suddenly escalated, triggering renewed turbulence in global financial markets. Afterward, both sides, especially the US, continued to send signals of goodwill and eagerness to reach an agreement. The market gradually interpreted this as a "fight to promote talks" strategy, and the market subsequently stabilized. Over the weekend, delegations from both sides held their fifth round of talks in Malaysia. According to announcements from both sides on Sunday, over the two days, the two sides "held constructive discussions" and "reached preliminary consensus" on topics including export controls, reciprocal tariff extensions, fentanyl and drug control cooperation, further expanding trade, and measures related to Section 301 "shipping charges." The two sides will then proceed with internal approval procedures. The meeting between the leaders of the two countries at the end of the month is likely to take place as scheduled. Since the US government shutdown, the market has been struggling with a lack of economic and employment data. Finally, on October 24th, the first key data release—the Consumer Price Index—was released. The data showed a 3% year-on-year increase in the US CPI for September, below the 3.1% estimate and up from the previous reading of 2.9%. This means the Federal Reserve's October rate cut is nearly 100% certain, and expectations for a December rate cut on FedWatch have reached 91.1%. The continuation of the rate-cutting cycle has alleviated previous market concerns, and all three major stock indices hit record highs following the data release. Bitcoin also continued its weak rebound, but remains a long way from its all-time high. The US government shutdown has caused short-term liquidity problems. With Powell's statement that "the Fed will soon stop QT," the market's pressure has begun to ease. U.S. stocks AI and technology stocks have begun to release Q3 earnings reports. Tesla's earnings report fell short of expectations but still closed higher, indicating that the market is still optimistic about AI spending. Several leading companies will continue to release earnings reports next week, so keep a close eye on them. The US dollar index rebounded 0.39% this week, closing at 98.547, in a moderate state. After several weeks of short squeezes and rises, gold began to fall violently on Tuesday and has been in a weak state since then.

Crypto Market

In addition to the impact of the macro-financial market,

BTC and the crypto market are still subject to the influence of historical "cyclical laws."This week, exchanges still recorded an inflow of more than

130,000 BTC, a slight decrease from last week, but the net outflow shrank to 2,775 coins, the lowest in recent times. This demonstrates that the transition between old and new cycles significantly impacts the market. Long-term investors reduced their holdings by over 39,000 tokens. This sustained sell-off during a decline often occurs during the confirmation phase of a bull market transition to a bear market. At this point, the buying power of short-term investors is insufficient to absorb the selling pressure. In the new market structure, the main drivers of selling pressure, DATs and BTC Spot ETF channel funds, also performed weakly this week. According to eMerge Engine statistics, total inflows into the crypto market this week were only 943 million, the lowest in several months.

Weekly Statistics of Crypto Market Capital Inflows

The weak trading performance is driven by the "cyclical law" that we have recently emphasized, which suppresses market sentiment. A change in this state will either require bullish forces within the new structure to actively go long and absorb selling pressure amid rising global risk appetite, or a relentless sell-off by long and short positions to confirm a bear market. Technically, BTC stabilized above its 200-day moving average and the "Trump bottom" (between $90,000 and $110,000) this week and continued its weak rebound, achieving a 5.4% weekly gain. ETH, on the other hand, stabilized above its 120-day moving average. BTC Price Daily Chart: The continued liquidation of the contract market following the resurgence of US-China conflict has resulted in a loss of over US$20 billion in notional value. Recently, BTC has rebounded alongside the weakness of US stocks, but the total amount of open interest remains low, indicating that leveraged funds are unlikely to become a key driver of the rebound in the short term. Based on a multi-dimensional analysis, we believe that the behavior of DATs and BTC Spot ETF channel funds in the future market will remain the only two forces maintaining BTC's rebound and even returning to a bull market. Cycle Metrics According to eMerge Engine, the EMC BTC Cycle Metrics indicator is 0, indicating that it is in a transition period.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cointelegraph

Cointelegraph