During the 2022 bull market, the asset price of LINK, the leading oracle project, rose from US$0.35 to US$53, an increase of 168 times, allowing many developers to see the potential of this track. Huge opportunities and business opportunities.

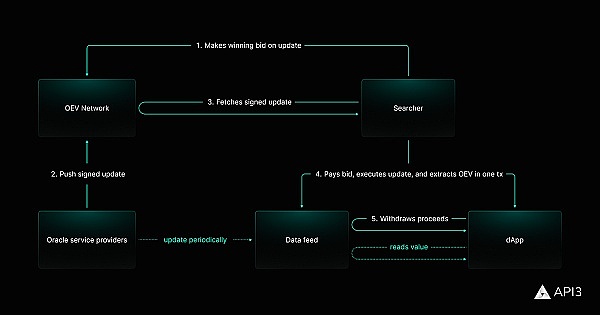

The bear market in 2024 seems to have come to an end, and another oracle project has begun to work. They intend to earn excess returns by solving the industry's pain points. Recently, the industry's representative oracle project API3 announced the launch of OEV Network supported by ZK-Rollup technology. OEV Network is a specialized order process auction platform that sells the right to perform specific data source updates to the highest bidder. The winning bidder pays a fee when performing data source updates, allowing Dapps to immediately receive revenue on their native chain.

The following will introduce this platform and its related important concepts, aiming to create opportunities for readers to grasp the value of the DeFi world.

First of all, clearly understand the concept of OEV, in order to understand what changes OEV Network will make to the DeFi data field

According to the official statement, OEV Network will be used to capture OEV generated by Dapps using API3 data sources on the chain. Therefore, before introducing what project OEV Network is, we need to first understand the concept of OEV.

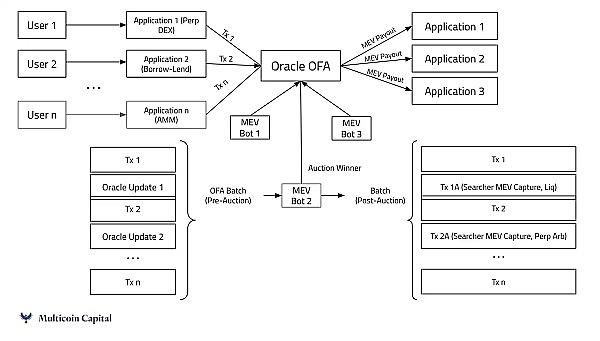

OEV stands for "Oracle Extractable Value", which is a proprietary concept proposed by API3. OEV is part of the miner's extractable value (MEV), focusing on Applications rely on oracle updates to exploit state inconsistencies. By bringing external data (such as market prices) onto the chain, oracles create opportunities for arbitrage and liquidation, thereby becoming part of the MEV life cycle.

Unlike MEV, which is independent of oracles, OEV relies on oracle updates to trigger value capture opportunities. For example, when the price on the centralized exchange changes, the MEV robot may choose to liquidate the underwater account on the lending agreement. This is a typical application scenario of OEV.

In the traditional MEV model, validators and stakers usually benefit, but this is often at the expense of users (such as liquidity providers). In contrast, OEV allows protocols and applications to capture and redistribute these profits, promoting user loyalty and enhancing the competitiveness of the protocol.

Put aside the complicated concepts, OEV is more friendly to liquidity providers, that is, the majority of ordinary users, and is more in line with the interests of ordinary people. Therefore, once this concept and gameplay were launched, it was undoubtedly more popular with the outside world.

Understand the workflow of OEV Network and discover a series of potential value opportunities

OEV Network is naturally more attractive in terms of profit mechanism, but for users, it is more convincing to have an in-depth understanding of what its mechanism is like. Next, I will introduce to you the specific workflow of OEV Network.

OEV (Oracle Extractable Value) represents a major innovation in value capture mechanisms in the DeFi field. The core of OEV is to exploit the inconsistency between on-chain and off-chain data to create opportunities for value capture. The working principle of this part can be divided into the following key points:

1. Arbitrage opportunities with inconsistent status: The emergence of OEV is based on a simple fact: on the chain The state of the application (such as price information) is sometimes inconsistent with the actual market state off-chain. The role of the oracle is to introduce these external data into the chain, but during the update process, this state inconsistency becomes an arbitrage opportunity.

2. Changing the role of the oracle: In the traditional MEV scenario, arbitrageurs make profits by reordering transactions. In the case of OEV, the data update of the oracle becomes the key to value capture. When an oracle updates new market data onto the chain, it provides applications with the opportunity to exploit differences in this information.

3. Automation and auction mechanism: In order to effectively capture OEV, API3 proposes an automated auction system. This system allows the right to update the oracle to be sold via auction to the highest bidder. This way, the winner of the auction not only performs updates to the data source, but also captures value from it.

4. Cross-chain operation and scalability: A distinctive feature of OEV is its cross-chain function. With the help of ZK-rollup technology, OEV Network is able to operate efficiently on various chains, thereby expanding the scope and potential of OEV capture.

5. Distribution and redistribution: The captured OEV not only brings benefits to verifiers and pledgers, but more importantly, it can be redistributed to participating protocols All parties, including users and liquidity providers. This distribution mechanism increases the appeal of DeFi protocols and improves users’ motivation to participate.

Through these mechanisms, OEV not only provides a new way of capturing value, but also increases the overall efficiency and fairness of the DeFi ecosystem. With the development and improvement of API3’s OEV Network, it is expected that OEV will play an increasingly important role in future DeFi applications.

The market for oracle data revenue distribution is vast, and revitalizing this track will help stimulate users' enthusiasm

The oracle project involves data clearing and processing in the Web3 world, especially the capture of the value of data information on the chain. This part actually has a huge market. But these services cover a variety of roles, from liquidation triggers to block producers, and third parties often exploit vulnerabilities in these services to extract maximum value from DeFi protocols.

As an example, Aave has liquidated $2 billion worth of positions over the past three years, with more than $100 million of that being used as liquidation bonuses. While liquidation is necessary, there is room for improvement in the distribution of value in this process.

In this regard, OEV Network can improve this series of problems to some extent, allowing the data distribution process to be optimized and improved, and further benefiting ordinary people. users, inspiring more people to build a more prosperous and stable DeFi world.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance TheBlock

TheBlock Others

Others Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist