Author: Paul Veradittakit, Partner at Pantera Capital; Translator: 0xjs@黄金财经

Introduction

Blackbird is perhaps one of the most unique applications in the consumer blockchain space. In an era when many of the leading projects in this space are focused on building new infrastructure and developer tools, Blackbird stands out as a consumer-facing application with the potential to bring cryptocurrency into the everyday lives of mainstream users.

In this article, we will explore how Blackbird seeks to make the "holy grail" of cryptocurrency adoption a reality. To do this, we will first discuss how Ben Leventhal's experience and unique insights into the restaurant industry inspired Blackbird to become a product. Next, we will explain how Blackbird works for end users and restaurant owners, and finally discuss how this represents a new paradigm for customer loyalty in restaurants and other fields.

Reinventing the Restaurant Experience

When we think of dining in with friends and family, the typical image that comes to mind is the “traditional” restaurant experience — in-person, sit-down service at an independently owned, neighborhood restaurant.

But as COVID-19 restrictions shuttered stores, food delivery platforms surged, and prices soared, mom-and-pop independent restaurants have been pushed to the brink. In 2023, about 4,500 more restaurants closed than opened, while sales at fast-food restaurants grew twice as fast as dine-in restaurants. Today, the trillion-dollar restaurant economy is increasingly shifting toward delivery-first, chain-first, and fast-food-first. In many ways, traditional dine-in restaurants are struggling in an economy that no longer works for them. Blackbird hopes to solve this problem and bring back the magic of the restaurant experience.

Blackbird was founded by Resy co-founder Ben Leventhal, who has a unique understanding of all the problems many independent restaurants face. He has been a serial entrepreneur in the restaurant technology space for the past 20 years. In 2005, Ben founded Eater, a restaurant discovery blog, transforming restaurant guides from outdated paper books to newer digital blogs, which he subsequently sold to Vox Media in 2013. In 2014, Ben went on to found Resy, a mobile-first reservation platform that is now synonymous with restaurant reservations. In 2019, he sold Resy to American Express, where he worked for several years, before founding Blackbird in 2023.

In many ways, Ben represents the founder that fits in with restaurant technology, with a product that has grown and matured just like our modern internet. If Eater is Ben's answer to Web 1.0 restaurants and Resy is his answer to Web 2.0 restaurants, then Blackbird is Ben's vision for Web 3.0 restaurant technology.

At every stage, Ben has been strengthening the digital relationship between restaurants and their customers. In Web 1.0, Eater allowed customers to connect with each other globally by providing a restaurant discovery platform. In Web 2.0, Resy not only let customers discover restaurants, but also let customers book restaurants and manage reservations, all in a mobile-first way. And in Web 3.0, Blackbird builds the last missing piece, allowing customers to build deeper connections with restaurants through a programmable digital loyalty system, bringing value to independent restaurant operators and making the restaurant experience magical.

How Blackbird Works

So, what exactly is Blackbird? How does it work? It is a very intuitive and simple app for the everyday consumer. You can download Blackbird from the App Store, create an account on the platform and link your credit card.

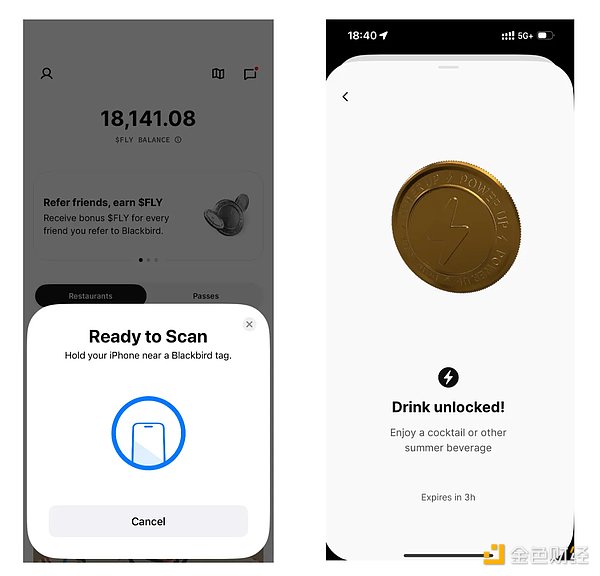

Blackbird check-in

When you visit a restaurant, you can open the Blackbird app and tap your phone to the Blackbird-labeled puck to earn FLY loyalty points for checking in. When you check in, Blackbird will tell you about all the special offers and discounts you can get in store, such as free drinks, merchandise, or surprise gifts from a variety of Blackbird-exclusive offers.

For example, some restaurants offer surprise gifts to returning customers, such as a free drink on the second visit, a dessert on the fifth visit, and an extra omakase set meal on the tenth visit. Other restaurants hold regular “Blackbird Specials,” such as free coffee every two weeks for Blackbird members. Still others participate in Blackbird’s pass programs, such as Blackbird’s Breakfast Club pass and Bar Blackbird Summer Pass, both of which are great deals for the end consumer.

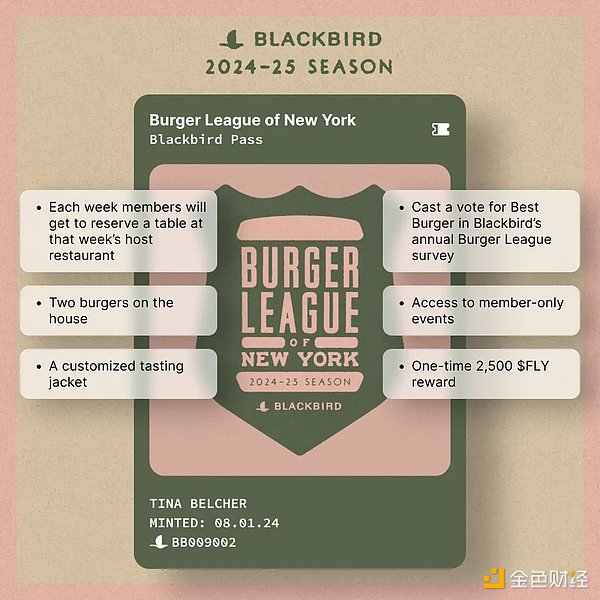

For example, Blackbird’s Breakfast Club costs $85, and cardholders can enjoy free coffee every morning for a whole year at 15 New York City locations. Similarly, the Blackbird Summer Pass costs $50, and customers can enjoy a free drink every day during happy hour at more than a dozen bars throughout the city. Most recently, Blackbird also launched the Blackbird Burger League Pass, a $250 pass that entitles cardholders to one free burger per week at nine different burger restaurants, and allows cardholders to vote for New York’s “Burger League Champion.”

Blackbird Burger League Pass.

This diverse selection of special offers, benefits, and experiences is a testament to Ben Leventhal’s unique approach to building both product and consumer experience. Blackbird has created a novel experience for everyday consumers while also giving restaurants the freedom to choose what to include in their Blackbird offers, trusting that restaurateurs know their business best.

As you sip your free coffee, chat with your barista, and glimpse customers in line downloading the app on the spot, you can’t help but realize that Blackbird has made the restaurant experience magical again. Blackbird achieves this magic by hiding the complexity of encryption from the average user and eliminating the nightmare of data tracking for Blackbird restaurateurs.

On the back end, restaurateurs pay an $89 monthly subscription fee to use Blackbird’s complex mechanisms for collecting guest profiles and tracking customer loyalty. Blackbird tracks four parts of customer data to form a comprehensive "guest portrait":

1. Personally identifiable information (PII), stored in the Blackbird Labs database to protect privacy

2. Understand the restaurant's check-in history based on on-chain transaction data

3. Customer value score, calculated by Blackbird

4. FLY points balance

These four components work together to enable restaurants to better understand who their customers are, so that restaurants can provide tailored experiences to reward and incentivize their most loyal customers. In addition, Blackbird uses FLY points to incentivize users to engage in behaviors that are beneficial to restaurants. For example, while data sharing is an optional feature of the Blackbird app, if users decide to share PII with restaurants, they will receive FLY rewards. In addition, if users use debit cards instead of credit cards to consume, they will also receive FLY rewards, so that restaurant owners can save credit card fees.

Blackbird leverages restaurants' existing technology stacks, such as the tablet clients that many restaurants use to coordinate reservations and check in customers. For example, Blackbird has introduced an SMS concierge service directly within the Blackbird app, enabling restaurants to interact with customers in real time, make reservations, and customize reservations to special requests. As a result, Blackbird provides restaurants with a low-cost, comprehensive toolkit that enables them to easily track and manage customer profiles, ultimately enabling a better customer experience.

Towards an on-chain loyalty framework

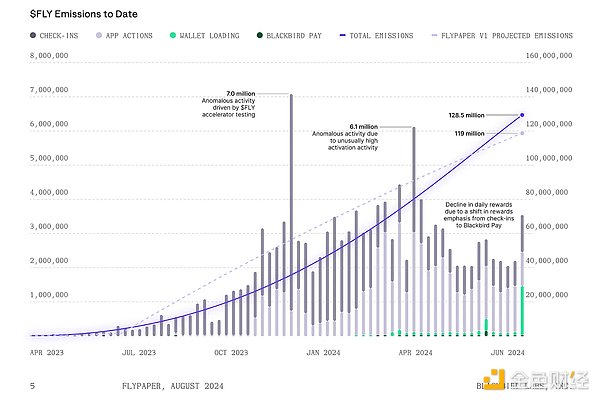

FLY issuance to date.

One of the most exciting aspects of Blackbird is that it is an app that can change consumer behavior every day. Through restaurant discovery, passes, and points, Blackbird lets users discover restaurants they wouldn’t otherwise know about, let alone dine there. In a Chinatown dotted with similar restaurants, for example, the lure of FLY loyalty points might steer customers toward certain restaurants, much like airline bonus miles incentivize customers to book with specific vendors.

But of course, collecting points is only one side of the loyalty equation; the real question with loyalty programs is how those points are spent.

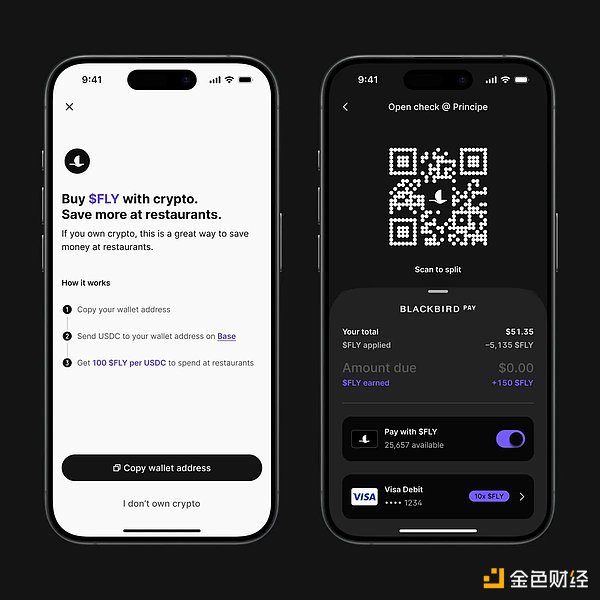

That’s where Blackbird’s recently launched Blackbird Pay system comes into play. Rather than simply offering free drinks and desserts as perks, Blackbird envisions a future where consumers can pay for the entire cost of their meal using their FLY points, with 1 FLY being worth 1 cent. In other words, FLY is more than just a loyalty program — it’s become a blueprint for a new crypto-based payment system.

Blackbird Pay UI.

In July 2024, Blackbird released the ability to purchase FLY points via USDC, which means that for any restaurant that accepts Blackbird Pay, users can now pay with their cryptocurrency balances by transferring USDC into the Blackbird app. The payment part of the app may explain why Blackbird was originally built on a cryptocurrency rail.

Indeed, if Blackbird was just a data collection app with a digital membership card and restaurant loyalty points, it wouldn’t necessarily need to be built on-chain. But Ben Leventhal’s vision for Blackbird goes far beyond this simple premise. Blackbird’s ultimate goal appears to be much broader, with FLY points being just one part of a flywheel of a new crypto payment network that both reduces costs and increases revenue for restaurants.

In this flywheel, Blackbird charges a processing fee of 2%, 50% lower than traditional payment processors, which can charge up to 4%. The lower processing fees attract more restaurants to join the Blackbird network, and restaurants can use benefits, rewards, and points to attract consumers. Once more consumers build brand loyalty to Blackbird restaurants, they will start to bring more FLY to the restaurants, which in turn attracts more restaurant adoption. As the Blackbird ecosystem matures, it has the potential to become a full-fledged crypto payment network that serves millions of mainstream consumers every day, just like American Express does today.

In a recent Flypaper update, Blackbird also hinted at a novel long-term vision for “Flynet,” a third-layer chain built on Base specifically for loyalty tools that serve this FLY payment network. In the proposed Flynet blockchain, Blackbird hopes to build open-source ecosystem applications, such as projects that facilitate consumer restaurant discovery, data visualization, and other third-party tools. As a consumer application, Blackbird can serve as a distribution gateway for all of these community-built loyalty tools, and Flynet could be Blackbird’s way to eventually build an inexpensive, open-source loyalty program that’s comparable to the expensive solutions built in-house by restaurant groups.

Indeed, the hidden power of building membership cards as ERC-721 NFTs and putting FLY on-chain is that it unlocks the programmability of these assets, allowing for endless composability between the real-world use cases of restaurant loyalty and the broader on-chain world.

Furthermore, while Ben Leventhal may be the perfect founder to apply this loyalty blueprint to the restaurant industry, Blackbird’s core insights into what loyalty means in web3 are applicable to a range of other industries as well. Loyalty programs are the backbone of many service-intensive, retail-oriented industries, such as hospitality, cosmetics, fashion, and travel.

Many verticals face the same problem as restaurants, where small and medium-sized independent providers cannot afford sophisticated loyalty tools to compete with large conglomerates. Blackbird’s loyalty framework, through the use of an intuitive “click to check-in” feature, may actually provide independent operators in all of these verticals with the tooling solution they need — a public, open-source, community-driven approach to customer loyalty that enhances the consumer experience.

Perhaps this is the novel on-chain loyalty blueprint Blackbird offers for web3, and what can finally bring crypto to the mainstream.

XingChi

XingChi

XingChi

XingChi Olive

Olive Cheng Yuan

Cheng Yuan CaptainX

CaptainX Others

Others Bitcoinist

Bitcoinist decrypt

decrypt Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist