Steadyly occupying the leading position in stablecoin transactions, innovating the second layer of Bitcoin to help ecological prosperity and development

Project name: TRON

Token: TRX

Current market value: 116 100 million U.S. dollars

6-month estimated market value: 15.6 billion U.S. dollars

Room for upside: 35 %

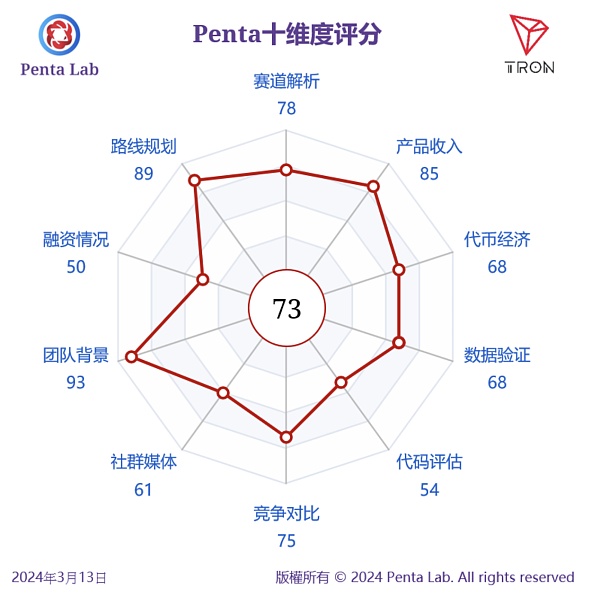

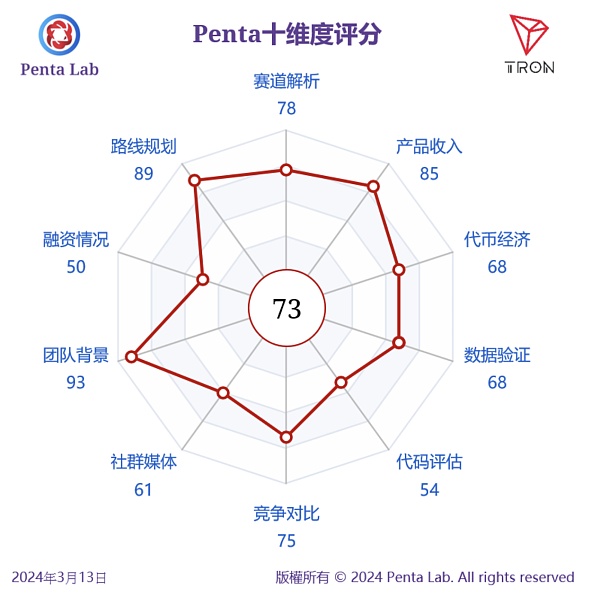

Penta ten-dimensional score: 73

Data as of: March 13, 2024

Download the complete research report https://t.me/pentalabio

Official website: pentalab .io

TRON dominates the stablecoin online trading market. CoinMarketCap data shows that as of December 31, 2023, the total market value of the global stablecoin market was approximately $130 billion, accounting for 7% of the total market value of cryptocurrencies. In December 2023, Tether Treasury issued an additional US$1 billion of USDT stablecoins on the Tron blockchain. The USDT circulating on the TRON chain exceeded 48.8 billion, accounting for 53% of the total USDT circulation, and the number of its holding accounts Up to 35 million. TRON version of USDT has become a mainstream stable currency used by users around the world. Not only that, the other two centralized stablecoins USDC and TUSD circulating on the TRON chain also performed well. At the end of 2023, the TRON version of USDC’s circulation exceeded US$270 million; while the TRON version of TUSD’s circulation exceeded US$1.87 billion, accounting for 77% of the total circulation of TUSD. TRON's multiple stablecoin indicators rank at the forefront of global blockchains, including weekly active addresses, weekly transaction volume, etc., consolidating TRON's dominant position in the stablecoin field.

Just Network provides a rich financial ecosystem integrating multiple DeFi protocols. This platform hosts various DeFi protocols in TRON and highly integrates them to form a robust ecosystem, representing the next generation of DeFi solutions. It includes the USDJ stablecoin-based Just Stable, the lending platform JustLend DAO and the cross-chain bridge Just Cryptos. Through stUSDT, Just Network implements support for real-world assets and collaborates with RWA DAO to manage the RWA DAO platform. As of March 13, 2024, TRON's total locked value (TVL) reached US$25.2 billion, of which JustLend DAO accounted for US$8.1 billion, Just Cryptos accounted for US$796 million, and TRX Staking Governance accounted for US$592 million, which together accounted for TRON's total TVL 37.6%. Just Network relies on the high performance of the TRON network to provide low fees and a good transaction experience.

TRON is about to launch an innovative second-layer solution for Bitcoin, dedicated to improving interoperability and utility. This plan aims to connect the tokens in the TRON network with the Bitcoin network. It is expected to enable the stablecoin market with a market value of more than 55 billion US dollars to access the Bitcoin network and inject more financial vitality into Bitcoin. The solution’s roadmap is divided into three phases, including the application of cross-chain technology, cooperation with the Bitcoin Layer 2 protocol, and Layer 2 solutions that integrate TRON, BitTorrent (BTTC) and the Bitcoin network. These collaborations will allow TRON users to participate in re-staking activities on major Bitcoin Layer 2 networks and support the development of the Bitcoin Layer 2 ecosystem with TRON’s diverse asset portfolio. At the same time, this will retain the speed and low fee advantages of POS systems and ensure integration with the POW and UTXO security of BTC L2.

Valuation: We use the total value locked (TVL) to value the protocol on the TRON chain. We use the total value locked (TVL) ) to measure the value of stablecoins (TVC). On the one hand, the float-to-TVC ratio has averaged about 1.45x since March 2021, while the current ratio of 1.12x is in line with the historical average. On the other hand, the float market cap to TVC ratio has averaged around 0.13x since June 2023, and the current ratio is 0.14x, which is comparable to the average since June 2023. TRON’s current TVL annual growth rate is 130%, while TVC’s annual growth rate is 46%. Assuming growth rates of 50% and 20% respectively over the next six months, we can forecast TVL to reach $15.6 billion and TVC to reach $98.5 billion. Meanwhile, assuming current valuation levels of 1.12x and 0.14x, the market capitalization in six months is expected to be $17.4 billion and $13.8 billion, respectively. Taking the average of the two, we get a six-month target market cap of $15.6 billion, which is about 35% higher than the current market cap.

Main risks: Market competition intensifies, and the development of the second layer of Bitcoin is less than expected.

JinseFinance

JinseFinance