Source: Research Report

1. Perfect Prophecy

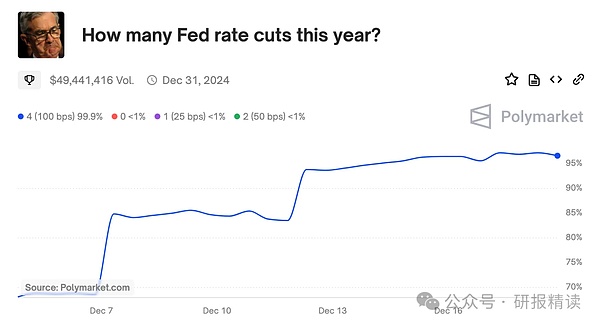

On December 18, 2024, Federal Reserve Chairman Powell announced another 25 basis point rate cut. For Polymarket users, this result was a foregone conclusion two weeks ago - on this prediction platform where money is voted, the probability of a rate cut has been stable at more than 95% since December 13.

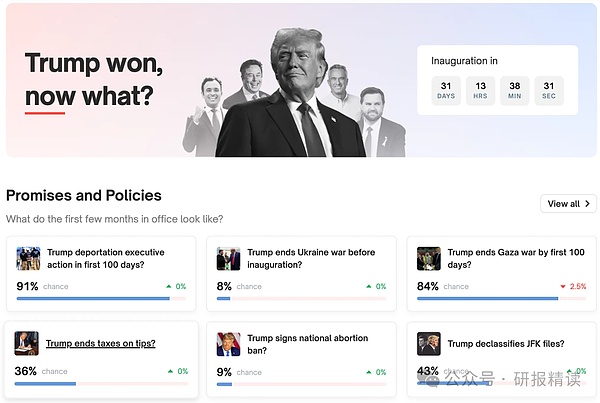

What really made Polymarket stand out this year was this year's US election. When traditional media and authoritative polls were still hesitant, Polymarket gave a clear signal that Trump had won the election, nearly six hours earlier than the Associated Press officially announced.

A mysterious French trader, known as the "Trump Whale" by the media, reaped a staggering $85 million in revenue by accurately betting on Trump's victory on Polymarket.

From the Federal Reserve's decision to the presidential election, from geopolitical conflicts to corporate mergers and acquisitions, the accuracy of predictions on Polymarket continues to refresh people's understanding of the limits of prediction. A thought-provoking phenomenon emerges: Why is voting with money always more accurate than traditional prediction methods?

Second, why is betting more accurate than polls?

On the eve of the 2024 election, authoritative polls by The New York Times and Siena College showed that the Democratic Party has an advantage in seven key swing states. Harris beat Trump with a narrow lead of 48% to 47%, and maintained a lead in four states: Nevada, North Carolina, Wisconsin and Georgia. However, the final election results were completely the opposite.

In sharp contrast to this is Polymarket's prediction. On this platform, Trump's winning rate has always been far ahead. Why is there such a big contrast? What is reflected behind this is the essential difference in prediction methods.

1. Limitations of traditional polls

Traditional polls face several fundamental challenges:

The first is "distorted statements". In a highly polarized political atmosphere, many voters tend to give "politically correct" answers rather than their true inner thoughts.

The second is the "sample representativeness" problem. In the era of smartphones, fewer and fewer people are willing to answer unfamiliar poll calls, and those who do answer are often underrepresented.

There is also the problem of "lack of depth". Telephone polls are usually time-limited and it is difficult to gain an in-depth understanding of voters' true attitudes and possible behavioral changes.

Finally, there is "static bias". Traditional polls are like taking static photos, and it is difficult to capture the dynamic changes in the election situation.

2. The victory of research depth

In contrast, the reason why the predictions on Polymarket are more accurate is that the participants have invested a lot of research energy.

Take the "Trump Whale" team as an example. They sent field research teams to visit swing states, deeply analyzed historical election data and population changes, and even studied detailed factors such as weather and traffic that affect voter turnout. They built complex prediction models and constantly adjusted them based on new information.

In prediction markets like Polymarket, we have seen a revolutionary shift in the way predictions are made: in-depth research replaces surface judgments, and systematic analysis replaces intuitive predictions.

As a senior participant said: "This is not gambling, but doing the most serious research. When you are ready to make important predictions, you will invest more energy than ordinary people can imagine to find the truth."

3. Why is the prediction market like Polymarket more accurate than traditional gambling?

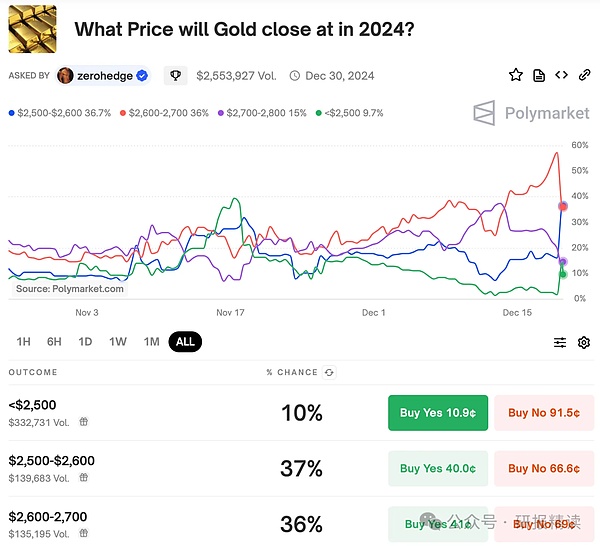

Polymarket looks like a prediction gambling website, but its essence is an information market. Here, major events happening in the world are transformed into simple yes or no questions: "Will the Fed cut interest rates this time?" "Can Trump win the election?"

Users can use virtual currency to buy "yes" or "no" shares. For example, in the election prediction, if you think Trump will win, buy "yes" shares. If Trump really wins, these shares will become $1, otherwise they will become $0. The real-time price of the share reflects the current market's expected probability of this event.

Why is Polymarket more accurate than traditional gambling? This stems from three key designs:

The first is the question design. Each predicted event must have a clear judgment standard and there must be no ambiguity. For example, the answer to the question "Will the Federal Reserve cut interest rates by 25 basis points in December?" can only be "yes" or "no", and there will be no third possibility.

The second is the market mechanism. Anyone can buy or sell shares at any time, and the price is determined by supply and demand. It's like a small stock market, where new information is immediately reflected in the price. When someone has important information, they will quickly buy or sell, pushing the price closer to the true probability.

Finally, and most importantly, there is the market maker mechanism. Market makers create market depth by continuously providing two-way quotes.

What is market depth? Imagine a pool of water. The deeper it is, the smaller the splash caused by throwing a stone into the pool. In the market, depth means the ability to withstand large transactions without causing drastic price fluctuations.

Why is market depth so important? Imagine a situation without market makers: a researcher finds that market expectations deviate from the actual probability through in-depth analysis. But when he wants to establish a large position, he may find that there are few counterparties and he has to pay higher and higher prices to buy enough shares. In this case, even if the judgment is correct, it is difficult to make a profit, and the enthusiasm for doing research will be hit.

With market makers, the situation is different. Market makers are always ready to buy at a price slightly below the market price and sell at a price slightly above the market price. Researchers can quickly establish large positions without significantly affecting market prices. Such a mechanism allows forecasters who invest a lot of resources and conduct in-depth research to fully utilize their information advantages.

Take the "Trump whale" for example. According to insiders, his team includes election data experts, poll analysts, social media researchers, and even weather forecast experts. Because they know that in the US election, rainy days often affect voters' enthusiasm for voting. It is the sufficient market depth that makes this in-depth research worthwhile.

This forms a virtuous circle: market makers provide depth, depth makes research valuable, more people are willing to invest energy in research, predictions become more accurate, the market attracts more participants, and market makers can provide better depth. This institutional design turns complex predictions into simple buying and selling behaviors, but it drives the most rigorous research behind the buying and selling. Participants are not gambling, but using professional knowledge and systematic analysis to find the truth.

In essence, Polymarket is more accurate than traditional gambling because it creates an ecosystem that perfectly unifies "pursuit of truth" and "pursuit of profit":

This is fundamentally different from traditional gambling. In traditional gambling, the dealer earns the difference by setting odds, and the player is essentially betting against the dealer. In Polymarket, market makers only earn a very small difference between buying and selling, and the real profit comes from accurate predictions of the future. This makes the goal of the entire market consistent: to find the truth.

It is this mechanism design that makes Polymarket an information market that can continuously produce accurate predictions, not just a gambling platform.

Fourth, the philosophical foundation of the prediction market - Hayek and Robin Hanson

The design of the prediction market is not accidental. It is deeply rooted in the theoretical insights of two thinkers: Hayek's "theory of knowledge dispersion" and Robin Hanson's "prediction market theory".

Hayek put forward a key point in his famous work "The Use of Knowledge in Society": In a complex society, knowledge is always scattered in everyone's hands. No individual or institution can obtain complete information. For example, to predict the results of an election, no matter how powerful a single analyst is, it is impossible to fully understand the specific conditions of all constituencies, the voting tendencies of each community, the impact of weather on voting, and so on.

So, how to integrate this scattered knowledge? Hayek believes that the price mechanism is the most effective way. In the market, everyone trades based on the local information they have, and the price will automatically integrate this scattered information to form a comprehensive signal.

Robin Hanson further developed this idea. He proposed that we can create a special market for any predictable event. In this market, the price represents the probability of the event. This is the theoretical basis of the prediction market.

Hanson particularly emphasized the importance of "real money". When people trade with real money, they are forced to take their judgment seriously. You may express your opinions casually on the Internet, but when you have to bet with real money, you will be more cautious. This is why the prediction market is more accurate than polls or expert predictions - because it allows people to "put money where your mouth is".

More deeply, the prediction market solves an old epistemological problem: how to get as close to the truth as possible without a "God's perspective"? The answer is: through the market mechanism, scattered knowledge, different opinions, and various information sources are woven into a huge cognitive network. Every transaction is a signal, and the price is the final synthesis of these signals.

This method relies neither on the authority of a single expert nor on the consensus of the majority, but on a market mechanism that can constantly correct itself. When new information emerges, those who get it first or are best at analyzing it will act quickly, pushing prices in a more accurate direction.

From this perspective, the prediction market is not only a trading platform, but also a cognitive tool and a social technological innovation. It shows a new way to get the truth: not through authoritative judgment, but through the wisdom of the market; not through centralized computing, but through distributed collaboration.

This is why the prediction market is considered revolutionary. It can not only predict election results, but also change the way we understand the world.

V. The arrival of the "fifth power" and the "information finance" era

If traditional media is the "fourth power", then the prediction market is becoming a new social force - the "fifth power". It does not influence society through speech, but conveys the truth through price signals. This power is not only reshaping the way we obtain and verify information, but also bringing unprecedented information equality.

In traditional financial markets, institutional investors usually have access to more and faster information than retail investors. But in a prediction market like Polymarket, everyone can see the same probability numbers in real time and can perceive the market's expectations for the future at the first time. This transparency makes the prediction market a unique source of information.

More and more traders and research institutions are paying attention to Polymarket, not for betting and profit, but as an important source of information. When they need to assess the possibility of a major event, the price of the prediction market is often the most intuitive and reliable reference. This phenomenon confirms that the prediction market is evolving from a simple trading platform to a core information infrastructure.

Imagine this scenario: when a major news comes out, people will not only pay attention to media reports, but also immediately check the prices in the prediction market. For example, during the Russian-Ukrainian war, when news of fierce fighting came from a city, the price changes in the relevant prediction market often reflected the truth of the situation faster and more accurately than news reports.

This information equality has a far-reaching impact. Traditionally, prediction and analysis are often monopolized by a few elites: political analysis needs to rely on think tank reports, economic forecasts depend on investment bank research, and election situations have to wait for polling agencies to announce them. But now, anyone can directly "see" the probability of the future through prediction markets.

This change is reshaping the entire information ecosystem. For example, mainstream financial media such as Bloomberg and Reuters have begun to regularly quote Polymarket's forecast data. Some hedge funds incorporate price changes in prediction markets into their risk assessment models. Some policy researchers even suggest that governments should refer to prediction market signals when formulating important policies.

What's more interesting is that prediction markets are forming a new "collective wisdom display". When experts in a particular field discover new information, they often express their judgments through transactions in prediction markets. These professional insights are promptly and accurately transmitted to all market participants through price mechanisms. This is like a never-resting "truth conference" that constantly gathers and updates the best human cognition of the future.

More importantly, prediction markets are giving birth to a whole new field: "information finance". In this field, information is no longer just for reading and dissemination, but an asset that can be priced, traded and invested. Accurate predictions can bring benefits, and wrong judgments can lead to losses. This has created an unprecedented information ecology:

First, it has changed the incentive mechanism for information production. Traditional media make profits by clicks, which often leads to "clickbait" and emotional reports. But in the prediction market, only accurate information can bring benefits. Individuals or teams who are good at collecting and analyzing information can get rewards through predictions.

Second, it provides a new information verification mechanism. In the era of social media, false information is rampant, but it is difficult to quickly judge the truth. In the prediction market, the value of each piece of information is immediately reflected in the price. If someone spreads false news, the insider will immediately correct the price through trading and make a profit.

Third, it is forming a new professional group: information traders. Just like some people make a living by trading stock futures, there may be more and more people specializing in information prediction and trading in the future. They will establish professional research teams, use advanced analytical tools, and manage various forecast positions like managing investment portfolios.

Looking to the future, prediction markets may penetrate into all areas of society. Companies may use it to predict product sales, governments may use it to evaluate policy effects, and scientific research institutions may use it to predict research breakthroughs. Every important social issue may have a corresponding prediction market, and prices will reflect changes in collective cognition in real time.

This development also brings new challenges. How to prevent the market from being manipulated? How to balance the efficiency of information transactions and social fairness? How to deal with the moral risks that may be brought about by prediction markets? These are all issues that need to be seriously considered.

In this world full of uncertainty, prediction markets are becoming a "public display screen" of real probabilities. It allows each of us to have equal access to information about the future, no longer subject to the limitations of traditional information channels. This democratization of information not only improves society's predictive ability, but also makes decision-making more transparent and rational.

In the future, when we look back on this era, we may find that the real revolutionary nature of the prediction market does not lie in how accurately it can predict the future, but in that it allows everyone to participate equally in the process of discovering the truth. This is the most profound meaning of the "fifth power".

This is the era of "information finance": a new world where prices are used to discover the truth and markets are used to achieve equality. In this world, the most valuable wealth is not money, but accurate cognition; the most important ability is not to predict the future, but to constantly correct one's own judgment; the most precious progress is not technological innovation, but the democratization of information. Those who can capture the truth in the ocean of information will become the winners of this era.

References: This article refers to an episode of the podcast "Literature and Science Blossoms" on Xiaoyuzhou, "Polymarket and Prediction Markets: Let Data Bet, Let Truth Speak", as well as other news content

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance