Source: Presto Research; Compiled by: Tao Zhu, Golden Finance

Abstract

Driven by a tech-savvy population, South Korea's cryptocurrency market is characterized by intensive retail investment, resulting in unique phenomena such as the "Kimchi Premium" and the "IPO Boom".

The history of cryptocurrency in South Korea has been marked by significant regulatory developments, primarily focused on strengthening market integrity and investor protection.

However, despite high trading volumes and smooth regulatory progress, market builders still face challenges due to public perception of cryptocurrency and the lack of regulation in the field.

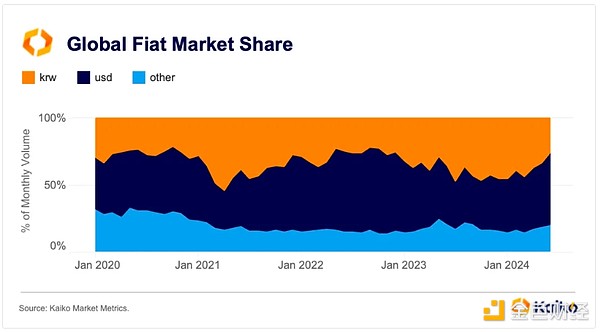

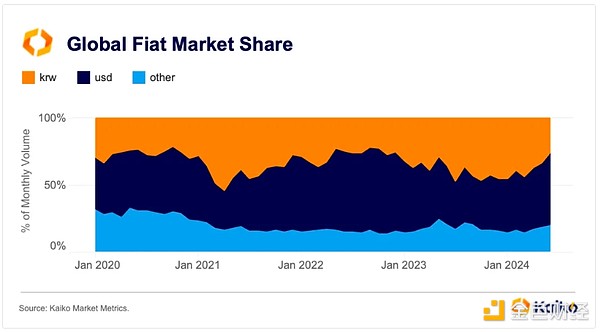

Figure 1: The Korean won has consistently ranked among the top two currencies in terms of global fiat currency trading volume.

Foreword

Thanks to its widespread internet access and tech-savvy population, South Korea has become a technological powerhouse, playing an important role in the global cryptocurrency sector. Characterized by its enthusiastic retail investor base, South Korea has exhibited unique market phenomena such as the "Kimchi Premium" and the "Listing Boom," reflecting the enthusiasm of South Korean citizens for cryptocurrency investments. However, these behaviors have also raised concerns among regulators and market observers, leading to the introduction of new regulations that are expected to affect the global cryptocurrency market.

In this research article, we (1) introduce the history of cryptocurrency in South Korea, (2) examine the current state of the industry, especially the aforementioned phenomena and new regulations, and (3) explore some of the major players in the domestic market.

History of Cryptocurrency in South Korea

~2017:

Prior to 2017, cryptocurrency was not mainstream in South Korea, in line with global trends. Some notable events include Korbit becoming the first cryptocurrency exchange in South Korea in 2013, followed by Bithumb in 2014.

2017:

Bull Run:2017 marked the beginning of South Korea’s cryptocurrency craze. The bull run attracted millions of retail investors, with Bithumb regularly ranking among the top exchanges in the world by daily trading volume, and the Kimchi premium (described later) reaching 30-40%.

ICO Ban:In September 2017, South Korea’s Financial Services Commission (FSC) announced a ban on all forms of initial coin offerings (ICOs) to protect investors and prevent potential financial scams and speculation. To this day, platforms such as CoinList remain banned in South Korea.

2018:

“Park Sang-gi Crisis”:In January 2018, Law Minister Park Sang-gi announced that the government was considering shutting down all cryptocurrency exchanges, triggering significant market turmoil and a sharp drop in Bitcoin prices.

Figure 2: $BTC price dropped sharply after his comments.

Real-name transactions: On January 30, 2018, the "real-name system" came into effect, requiring all cryptocurrency exchanges to cooperate with banks and provide real-name authentication accounts for transactions. This move is aimed at improving transparency and preventing money laundering.

2020/2021:

Amendment to the Special Financial Information Act:In March 2020, the National Assembly passed an amendment to the Act on Reporting and Use of Specified Financial Transaction Information (commonly known as the Special Financial Information Act or 특금법) to include regulation of cryptocurrency exchanges. The amendment requires all virtual asset service providers (VASPs) to register with the Financial Services Commission (FSC) and comply with anti-money laundering (AML) and know your customer (KYC) regulations. The law came into effect in March 2021.

After the law was enacted, only 29 of the 63 exchanges were successfully registered. Of these, only five exchanges (Upbit, Bithumb, Coinone, Korbit, and later Gopax) received ISMS certification and real-name accounts, and only they were allowed to operate the Korean won market.

The law also applies to foreign exchanges, forcing exchanges such as Binance to shut down Korean language support and P2P services. As of now, three principles apply: no support for the Korean won, no use of the Korean language, and no direct sales in Korean.

2022:

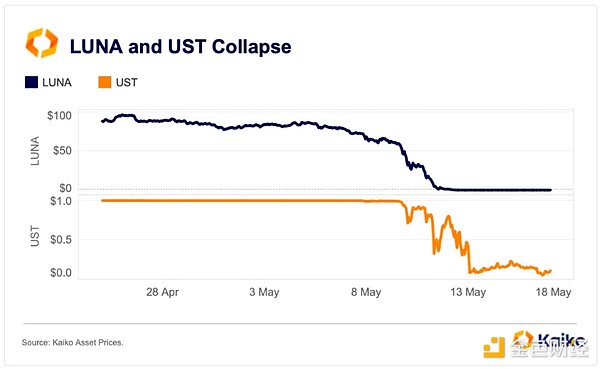

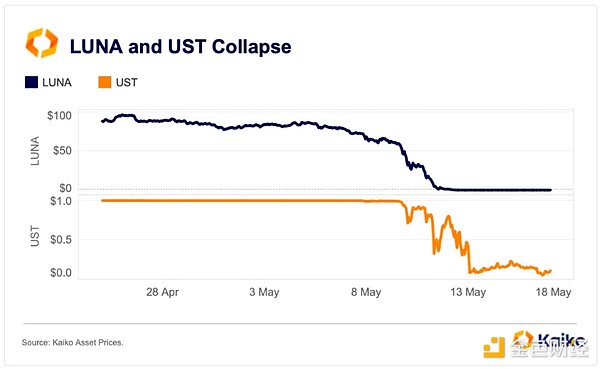

Terra Luna Collapse:In May 2022, the collapse of Terra (LUNA) and its stablecoin $UST caused major turmoil in the global cryptocurrency market. The event had a significant impact on the overall market, especially on the psychology of Korean investors. It also raised concerns about the stability and regulatory oversight of stablecoins. Given Terra’s close ties to South Korea, especially through Do Kwon and its ecosystem, this incident had a notable impact on the Korean cryptocurrency landscape.

Figure 3: Decline of the Terra ecosystem.

DAXA:The Digital Asset Exchange Alliance (DAXA) is formed by major Korean exchanges (Upbit, Bithumb, Coinone, Korbit, and Gopax) to strengthen cooperation and establish industry standards to better protect investors and market integrity.

Travel Rule:In line with FATF guidance, South Korea introduced the “Travel Rule” to increase transparency in cryptocurrency transactions and combat illicit activities.

2023/2024:

Haru Invest/Delio Bankruptcy:In 2023, two cryptocurrency digital asset management companies went bankrupt amid allegations of a Ponzi scheme. The event added to negative sentiment following the Luna debacle, highlighting regulatory gaps and investor protection issues amid allegations of mismanagement and financial irregularities.

Guidelines for Security Token Offerings (STOs):In February 2023, the Financial Services Commission announced guidelines for regulating security tokens under the Capital Markets Act. The guidelines focus on the principles for determining whether a token qualifies as a security and the regulations governing the offering and issuance of token securities.

Virtual Asset User Protection Law:Passed in June 2023, this bill aims to protect investors by imposing fines for price manipulation and other market abuses. It is the first phase of a comprehensive bill that aims to provide a comprehensive regulatory framework for digital assets.

2024+:

Virtual Asset User Protection Law:The aforementioned bill will be implemented on July 19, 2024. While this phase focuses on user protection and preventing abusive trading, the second phase will likely focus on market entry and operations for virtual asset service providers. However, discussions on the second phase have not even begun, and considering that the first phase took 20 months to pass, it may take longer to see what will be included and the timeline.

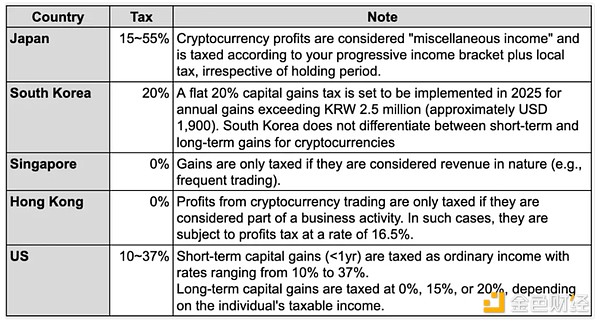

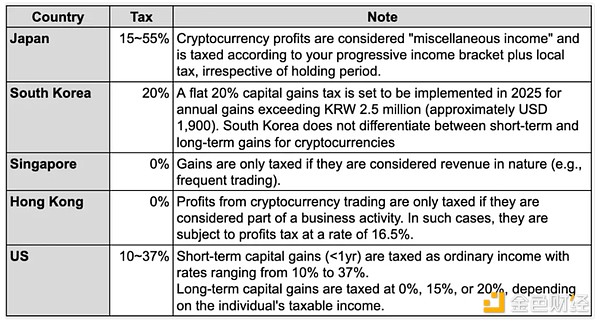

Crypto Taxation:Crypto taxation in South Korea has been a key issue during the election season. The implementation of cryptocurrency taxation has been repeatedly postponed since 2022 as part of the government’s efforts to woo voters ahead of the general election. As of today, a uniform 20% capital gains tax will be imposed on annual gains exceeding 2.5 million won (about $1,900) starting in 2025.

Figure 4: Cryptocurrency taxes by country.

Virtual Asset User Protection Law

As listing on a Korean exchange has become an important milestone for crypto projects, there has been a lot of interest in the guidelines and regulations that govern the listing process. Currently, there are no clear regulations on the listing and delisting of cryptocurrencies on Korean exchanges. The only existing guidelines come from DAXA, a consortium of five major Korean exchanges, which provided an initial framework for new listings in March 2023. However, the guidelines have been criticized for lack of clarity, so DAXA is revising the guidelines under the supervision of regulators to further refine them. This will be implemented under the Virtual Asset User Protection Act, which is expected to be a major step forward for Korean regulation and everyone should pay attention.

Virtual Asset User Protection Act (가상자산이용자보호법)

Scheduled to take effect on July 19, 2024, the Virtual Asset User Protection Act focuses on investor activities on exchanges, including:

Protecting customer deposits

Strengthening custodian responsibilities

Monitoring suspicious transactions

Insider trading

Listing/Delisting Guidelines

Under the supervision of the FSC/FSS, DAXA plans to implement “Best Practices for Compliance with the Virtual Asset User Protection Act” after the implementation of the Virtual Asset User Protection Act. The guidelines contain listing and delisting standards and are currently accepting industry feedback. The listing review criteria include nine requirements, which are reviewed quarterly and cover four main areas:

Failure to disclose material information related to virtual assets, or repeated and arbitrary changes without justifiable reasons.

Failure to verify the main wallet information of the issuer and operator.

Unexplained or unsolvable security incidents occurred in virtual assets, wallets or distributed ledgers.

The source code of the distributed ledger intrinsic token smart contract was not verified, and the important event function was improperly set.

Supporting virtual asset transactions that may be used for illegal activities or violate current regulations.

Any virtual asset related to the above eight items is considered non-compliant and should not be listed. In addition, the financial authorities have introduced a ninth qualitative review standard, including the following:

The ability, social reputation, and past operating history of the entities involved in issuance, operation, and development.

Disclosure of significant information related to virtual assets.

The overall issuance and circulation plan, changes in the operating plan, and the transparency and reasons for the changes.

Whether the access control settings for functions related to important events of the token smart contract are appropriate.

These evolving guidelines are intended to provide a structured and secure environment for cryptocurrency trading in South Korea, resolve current ambiguity, and enhance market integrity.

So where are we now?

Retail Mania

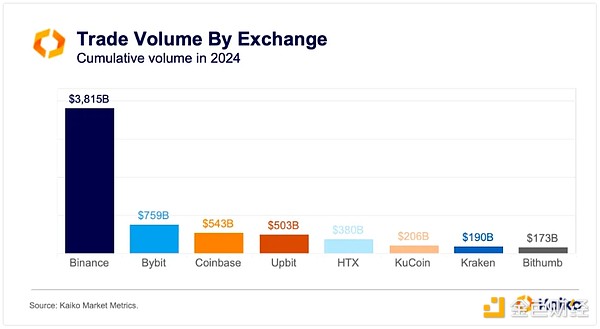

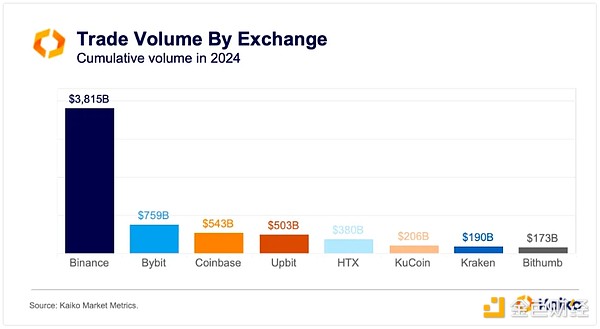

South Korea’s retail mania can be attributed to cultural factors such as widespread technology adoption due to fast internet speeds, a risk-taking culture, and a mono-ethnic society where trends evolve quickly. As a result, South Korea has been one of the largest markets in the cryptocurrency space since 2017, with its exchanges becoming key platforms for projects to get listed. Even today, Upbit consistently ranks among the top five exchanges by average trading volume and is often second only to Binance. This is particularly surprising considering that Korean exchanges are limited to Korean residents, unlike exchanges such as Binance, Coinbase, and HTX that have a wider audience.

Figure 5: Upbit ranks second in average trading volume.

Recently, cryptocurrency trading volume in South Korea has surpassed that of KOSDAQ and KOSPI. The surge in trading volume highlights how deeply cryptocurrencies are integrated into the country's financial landscape. The strong interest in cryptocurrencies has led to some interesting market phenomena: the Kimchi Premium and the listing boom.

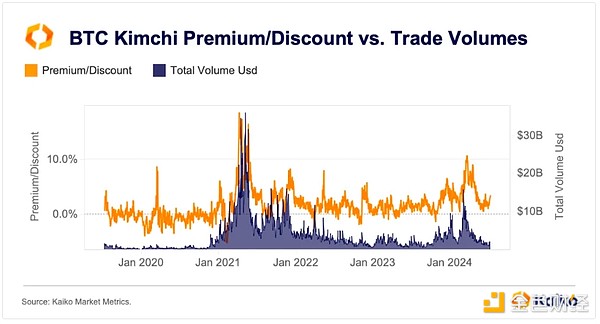

Kimchi Premium

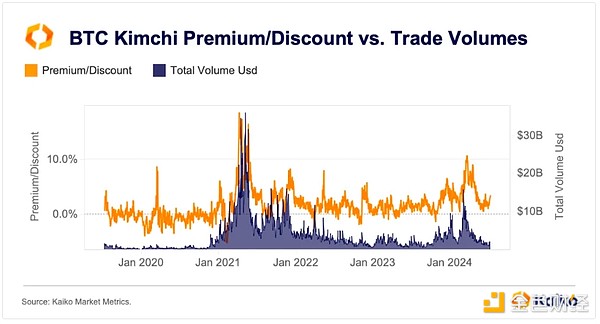

The Kimchi Premium refers to the price difference between cryptocurrencies on Korean exchanges and global exchanges. Due to regulatory challenges that hinder arbitrage, there is usually a 2-3% premium, which means that cryptocurrencies on Korean exchanges are traded at a higher price. However, during particularly bullish market periods such as April, this premium can spike to around 14%.

Figure 6: Kimchi premium spikes during bull markets with high trading volume.

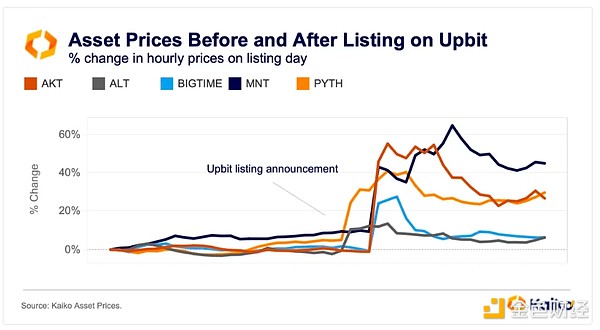

Listing Pump

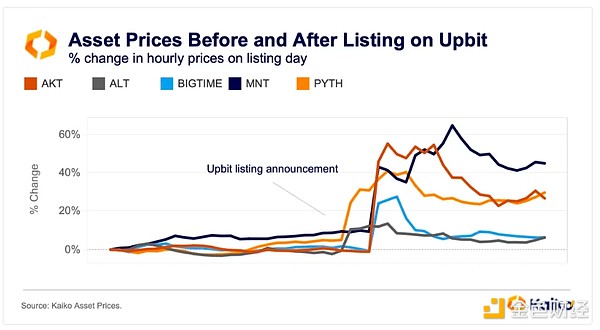

Another interesting phenomenon is the listing pump, which occurs when Upbit or Bithumb announces a project is listed. Depending on factors such as market capitalization, liquidity, and availability of perpetual contracts, the price of newly listed cryptocurrencies can surge immediately after the announcement. While listing on a South Korean exchange does enhance liquidity and is often viewed as fundamentally positive, the resulting price surge is often short-lived and tends to be a one-off event rather than a sustainable trend.

Figure 7: Asset price rises following Upbit’s listing announcement.

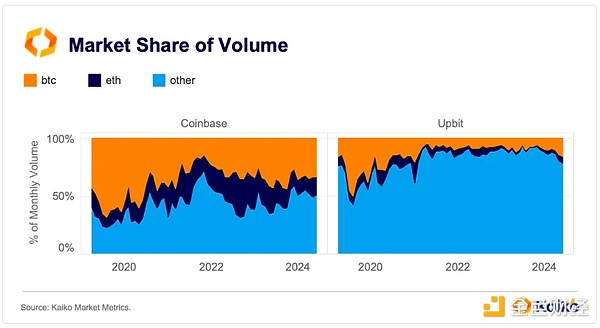

Despite progress in regulating exchanges and protecting investors, the outlook for South Korean Web3 operators and builders is in stark contrast. Currently, no significant local South Korean projects are in the top 100 by market cap, which is surprising given the popularity of the asset class. The main inhibitors appear to be public attitudes toward cryptocurrencies and regulatory uncertainty surrounding Web3 projects.

While cryptocurrency is popular in South Korea, it is often viewed as a form of gambling rather than a long-term investment in Web3 technology. Erratic market behavior such as listing/delisting pumps (e.g., price surges around token delisting announcements) reinforces this perception, and as a result, the market's focus remains on short-term speculation rather than long-term investments based on Web 3 fundamentals. In addition, the collapse of LUNA in May 2022 has exacerbated public negative sentiment towards cryptocurrencies, leading to intense media scrutiny of all crypto projects operating in South Korea. Furthermore, despite the genuine enthusiasm of the South Korean public, these projects have become a target for politicians, creating challenges for the country's sustainable development.

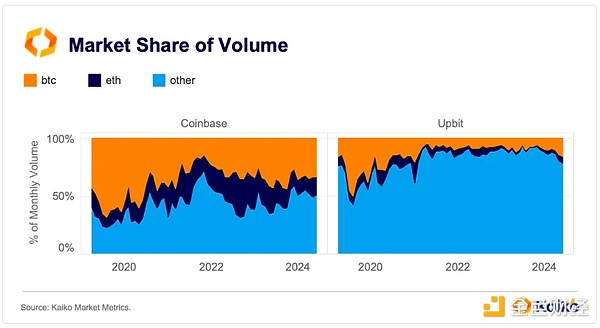

Figure 8: South Koreans prefer altcoins over major currencies.

Unclear regulations also add to the complexity. Although government officials are actively developing a regulatory framework, existing regulations focus primarily on investor protection, with little attention paid to supporting innovation and nurturing the industry. For example, the Virtual Asset Service Provider (VASP) license requirement only applies to exchanges, wallets, and custodians, while the initial phase of the Virtual Asset User Protection Act mainly addresses the operational aspects of exchanges. In addition, South Korea's ban on P2E games often leads to complex results, with top global Web2 game studios setting up operations in South Korea to access local talent, but ultimately serving offshore markets. This regulatory ambiguity and delays have forced many South Korean developers to relocate their operations to more favorable jurisdictions such as Singapore, stifling local innovation despite the country's technological capabilities.

Major players in the Korean cryptocurrency market

Exchanges

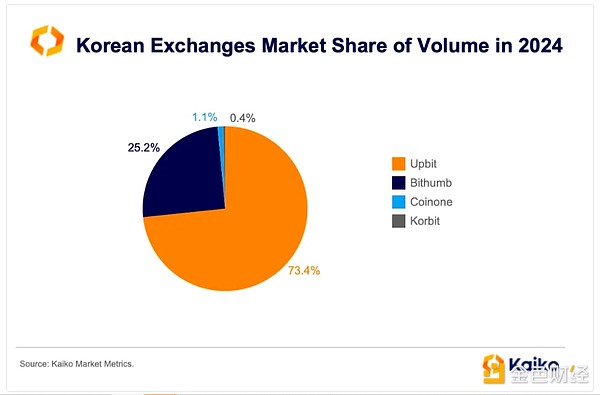

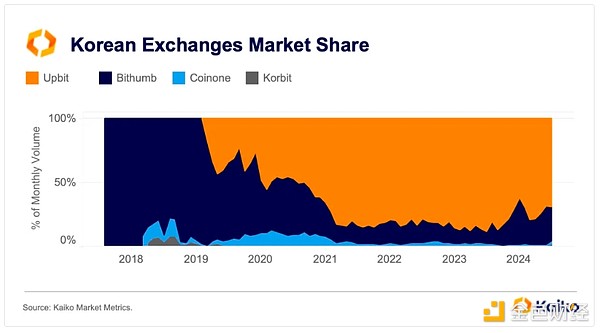

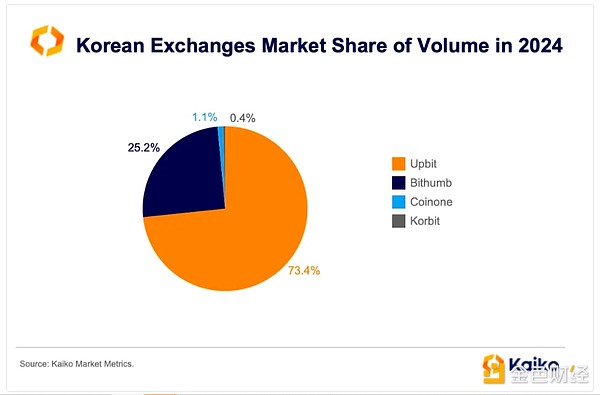

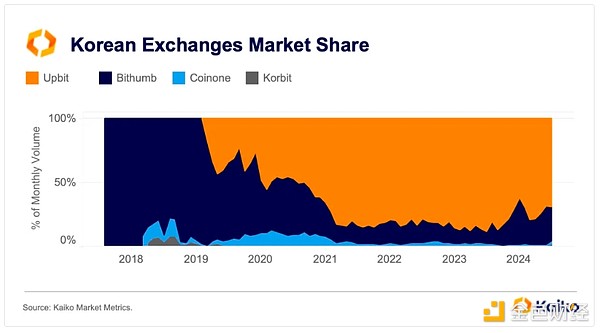

Although there is no clear regulation, cryptocurrency futures trading is not allowed in principle in Korea due to restrictions by the Financial Services Commission (FSC). As a result, the Korean cryptocurrency market is dominated by five major spot exchanges: Upbit, Bithumb, Coinone, Korbit, and Gopax. These exchanges have a considerable market share, with Upbit and Bithumb accounting for nearly 96% of the total trading volume.

Figure 9: Korean exchange market share as of today.

Upbit: Dunamu-owned Upbit is undoubtedly the number one cryptocurrency exchange in South Korea. Dunamu also operates the stock trading platform Luniverse (a Web3 product) and even has businesses such as a secondary monitoring platform. Dunamu is currently valued at around $2.5 billion in the OTC market and reports sales of $2.7 billion in 2023. Today, Upbit offers the KRW/BTC/USDT pair, with the majority of its trading volume coming from the KRW market.

Bithumb:While Bithumb’s governance structure has been unclear, the exchange is currently valued at approximately $289 million in the OTC market and has announced plans for an IPO in 2025. Bithumb held the number one position in the exchange market until 2020, when it lost a significant amount of market share to Upbit. Nevertheless, Bithumb has recently regained market share with its aggressive fee policy and continues to exert significant influence, as often evidenced by exchanges’ “listing boom.”

Figure 10: Korean exchange market share history shows that Bithumb once held the number one position until 2020.

Coinone: Coinone has a market share of 1.1% and is the first exchange in South Korea to list Ethereum.

Gopax: Binance acquired a 72.26% majority stake in Gopax, a strategic move to enter the Korean market. However, the process is still subject to government approval due to regulatory uncertainties.

Korbit: Korbit has a market share of 0.4% and is the oldest cryptocurrency exchange in South Korea.

Projects

i) Kaia

Born out of the merger of Klaytn and Finschia, Kaia is a new Layer-1 project led by South Korean tech giants Kakao (Klaytn) and Naver's Line (Finschia). The merger aims to integrate their respective blockchain platforms into a unified system named after the Greek word for "and", which symbolizes connection. The project is scheduled to launch by the end of this year and will become the main Layer-1 blockchain in South Korea. The merger is also one of the few M&A cases in the crypto industry to date and is worth paying attention to.

ii) Delabs

South Korea has always been a leader in the Web2 gaming field, with major companies such as Nexon, Netmarble, NCSOFT, and Krafton dominating the global market. As a result, there are naturally a lot of ongoing attempts in the P2E (Play-to-Earn) space, with people from major game studios, and even entire studios themselves, entering the Web3 space, such as Wemade and Nexon. South Korean game studio Delabs Games, a subsidiary of 4:33 Games, is also part of this trend. Founded by former Nexon head Joon Mo Kwon, Delabs Games is making its mark in the Web3 space.

Summary

South Korea's cryptocurrency market presents complex retail investment and regulatory challenges. Despite the country's large, tech-savvy population, the lack of significant homegrown blockchain projects highlights persistent regulatory and public perception barriers. The upcoming Virtual Asset User Protection Act marks a step toward addressing these issues, aiming to improve market integrity and provide clearer operating guidelines. However, for South Korea to truly leverage its technological prowess and market enthusiasm, it will need to foster an environment conducive to blockchain innovation, overcome negative public sentiment, and ensure a balanced regulatory framework that encourages long-term investment in Web3 businesses and enables sustainable growth. This balanced approach is critical to South Korea's efforts to establish itself as a global leader in the growing crypto space.

Edmund

Edmund