Author: [email protected], data source: Footprint Analytics public chain research page

March, encryption The market is performing strongly, with Bitcoin hitting another all-time high. Ethereum prices have steadily climbed, while the Cancun upgrade has significantly reduced transaction costs. The Meme craze has swept across the Solana chain, and its powerful wealth creation effect has ignited market enthusiasm, and its influence has also spread to other public chains, such as Base.

AI, Meme, and TON are the main recent forces driving the mass adoption of blockchain. At the same time, public chains are sparing no effort to expand the Web3 game ecosystem, which, as a key driving force for the large-scale adoption of blockchain, is increasingly receiving market attention.

The data in this report comes from the public chain research page of Footprint Analytics. This page provides an easy-to-use dashboard containing the most critical statistics and indicators for understanding the public chain field, updated in real time.

Crypto Market Overview

Cryptocurrency markets performed strongly in March, driven by expectations of falling interest rates despite strong overall economic performance . This prospect adds to inflation concerns, making assets like Bitcoin and gold more attractive.

The AI industry has become the focus of the market. Nvidia released Blackwell GPU and GB200 super chip at the AI event GTC 2024, which not only ignited the enthusiasm of the US and global stock markets, but also aroused widespread attention in the cryptocurrency market and promoted The rise in the crypto AI sector.

In late March, Sam Bankman-Fried (SBF) was sentenced to 25 years in federal prison for fraud related to the November 2022 collapse of FTX exchange and Alameda Research. While the story of SBF and FTX may have come to an end, the crypto space still faces serious regulatory challenges. It is worth mentioning that at the end of the month, news broke that KuCoin is facing legal action from the U.S. Department of Justice and other departments. Subsequently, KuCoin faced massive fund outflows.

Public Chain Overview

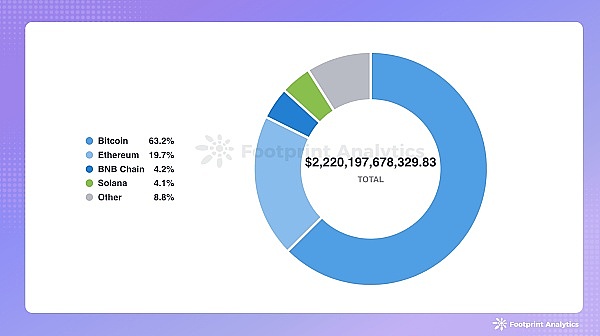

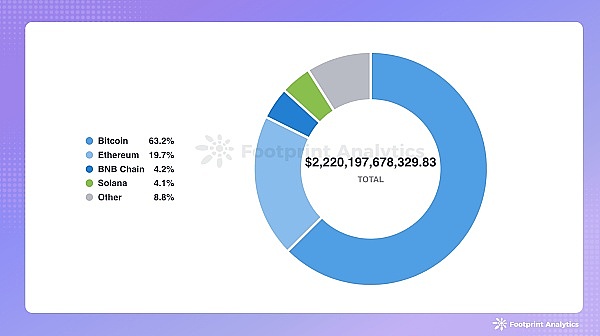

As March comes to an end, the total market value of public chain cryptocurrencies has climbed to US$2.2 trillion, an increase compared to February 15.8%. In this wave of growth, Bitcoin, Ethereum, BNB chain and Solana performed particularly well, with market shares of 63.2%, 19.7%, 4.2% and 4.1% respectively.

Data source: Market value share of public chain tokens - Footprint Analytics

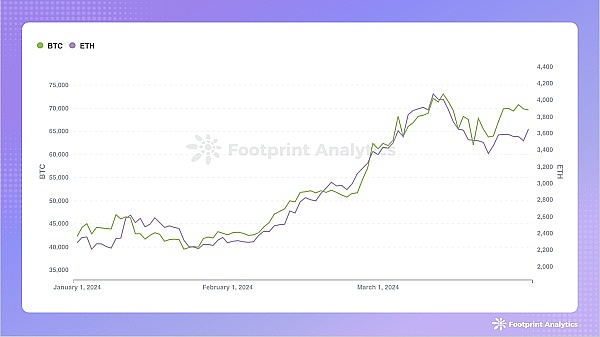

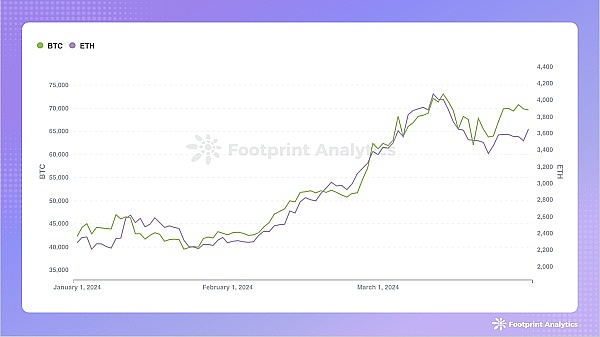

Bitcoin It has experienced significant ups and downs between "breakouts" and "waves". Starting the month at $61,213, it quickly surpassed the previous high of $69,000 and hit an all-time high of $73,068 on March 14. Although it fell back as much as 15.1% to $62,047 mid-month, it regained ground at the end of the month to close at $69,656.

Bitcoin’s price movements are closely related to the performance of the U.S. Bitcoin Spot ETF. The mid-month price pullback was largely driven by slowing inflows into Bitcoin spot ETFs and lower leverage by traditional traders. However, expectations for Bitcoin’s halving event in April have maintained its upward momentum.

Data source: Bitcoin and Ethereum Prices - Footprint Analytics

Comparison Down, Ethereum’s gains were relatively solid, starting at $3,344 and closing at $3,648. Ethereum, while slightly lagging behind Bitcoin, has maintained steady growth, in part because prospects for U.S. spot ETF approval appear unclear. The March 13 Ethereum Cancun upgrade was designed to reduce Ethereum’s transaction costs, thereby boosting activity within its ecosystem.

BNB and Solana both experienced significant token price growth, with gains of 48.8% and 56.0% respectively, driving their token market capitalization shares to increase by approximately 1% during the month.

Data source: Public chain token prices and market capitalization - Footprint Analytics

March , AI-related tokens have achieved significant growth. The news that Sam Altman has returned to the OpenAI board of directors after a firing and rehiring incident has had a positive impact on AI-related tokens. In addition, market expectations for the Nvidia GTC conference have further boosted the hype atmosphere, bringing benefits to projects announced to participate in the conference. Notably, the NEAR chain’s token price and market capitalization both surged by 84%.

The widespread popularity of AI applications has not only deepened the public's understanding of AI, but also made the concept of "AI + encryption" more popular and easier to understand and accept. The growing interest in AI concept tokens is further driving the widespread adoption of cryptocurrencies.

Meme has also played an important role in driving mass adoption in the crypto world. Recently, Solana has attracted attention due to the surge in Meme-related activities, with tokens such as $BOME and $SLERF rapidly rising in price, attracting active participation from a large number of community members. This phenomenon fully demonstrated the potential of Meme in quickly creating wealth and triggered widespread FOMO sentiment in the market. As an entry point that is easy to access and understand, Meme helps lower the threshold and attract more people to explore the Web3 field.

Memes

TON (The Open Network) and social applications closely related to it Telegram has had a significant impact in driving mass adoption. Notably, in March, Telegram announced the expansion of its advertising platform to nearly a hundred new countries. The move, a key component of Telegram’s monetization strategy, allows public channel owners to earn up to 50% of advertising revenue, with all transactions conducted through TON. This move has greatly promoted TON’s on-chain activities. In March, Toncoin doubled in price and market cap, reaching all-time highs. Leveraging Telegram’s massive user base and seamless integration of dApps, TON simplifies access to Web3. Combined with Telegram’s powerful marketing capabilities, the TON ecosystem is expected to be a key force in driving mass adoption of blockchain.

TON Blockchain

At the end of March, the public chain TVL reached 8.13 billion US dollars, and Ethereum , Tron and BNB chains rank among the top three.

Data source: Public chain TVL ranking - Footprint Analytics

Solana’s TVL implementation Significant growth, reaching $3.59 billion, a figure that was double that of February. This growth has been driven largely by the meme craze, which has dramatically boosted online activity and attracted significant capital inflows. DeFi dApps on Solana, such as DEX aggregator Jupiter, have received extremely high levels of attention and user engagement.

Layer 2

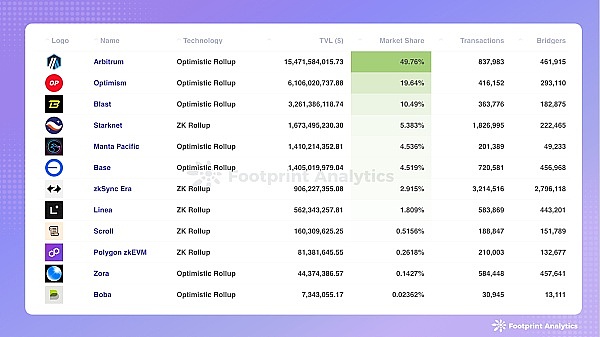

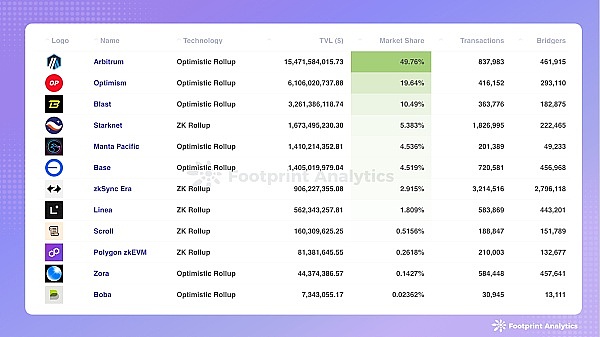

With the booming crypto market and the help of the Cancun upgrade, Ethereum Layer 2’s on-chain activity and TVL have both reached new heights. Among them, Arbitrum One and Optimism performed particularly well, with TVL increasing by 26.4% and 7.2% respectively, and together accounting for approximately 70% of the market share.

Base’s TVL grew by 87.3%, while active users (wallets) also grew by 29.6%, mainly due to the traction of meme coins like $DEGEN. In addition, Coinbase’s launch of smart wallets has further boosted the activity of its ecosystem. This smart wallet leverages Account Abstraction (AA) technology to greatly enhance Base’s user acquisition capabilities by simplifying the user registration process through Touch ID or Google Account integration.

Data source: Ethereum Layer 2 Overview - Footprint Analytics

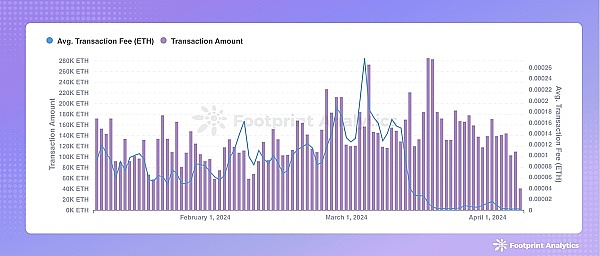

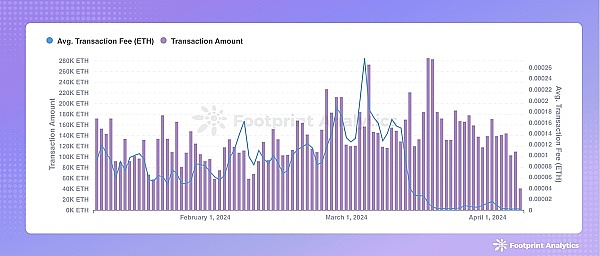

Complete on Ethereum After the upgrade, Cancun saw a significant drop in average transaction fees on its Layer 2 network. Among them, Arbitrum and Starknet on-chain transaction costs have been reduced by more than 95%. This significantly reduced fee marks the official entry of the Ethereum ecosystem into the “penny era.”

Data source: Arbitrum average daily number of transactions and average daily single transaction fee - Footprint Analytics

The discussion on Layer 3 is becoming increasingly fierce, and people from all walks of life have expressed their opinions. Polygon Labs CEO Marc Boiron recently questioned the need for Layer 3 and explained why Polygon decided not to develop Layer 3. At the same time, Vitalik Buterin, the co-founder of Ethereum, also expressed his opinion. He pointed out that Layer 3 networks are not mainly used for expansion; instead, their main purpose is to provide "customized functions" for Layer 2 to enhance its performance.

Blockchain Games

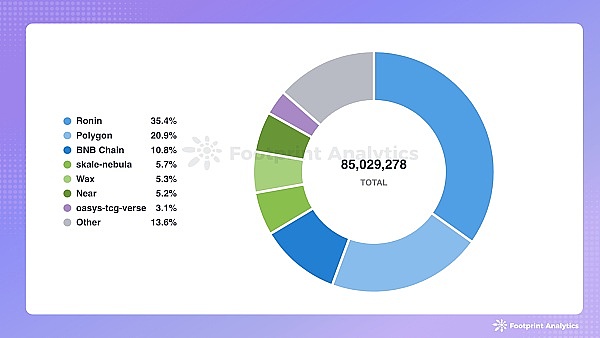

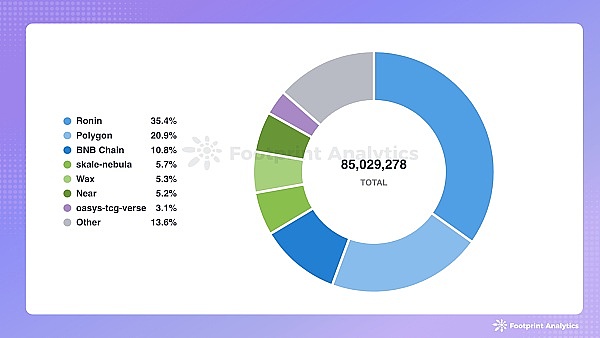

In March, game player rankings showed that Ronin, Polygon and BNB chains were the platforms with the largest number of active players, accounting for 35.4% respectively. %, 20.9% and 10.8% market share. It is worth mentioning that Ronin and Polygon further consolidated their leading positions, with their market shares increasing by 6.3% and 7.8% respectively compared to February.

Data source: Proportion of active game players on public chains - Footprint Analytics

In terms of transaction volume ranking, Ethereum, Ronin and BNB chains dominate. In March, Ronin’s trading volume reached $81.7 million, a 35.1% month-on-month increase, while the BNB chain saw a 13% decline. With less than 10 games under its belt, Ronin is growing its market share aggressively. As Ronin continues to add new games, its growth potential is expected to increase further.

Competition in the public chain field is becoming increasingly fierce, and major public chains have increased investment and are committed to promoting the prosperity of the Web3 game ecosystem.

The Arbitrum Foundation has announced a proposal to distribute $200 million in ARB tokens over two years to support gaming projects on its blockchain. Of this amount, $160 million ARB will be allocated to game publishers and developers, while the remaining funds are planned to be used to improve infrastructure. This proposal requires approval from the Arbitrum DAO.

At the same time, the Starknet Foundation is also taking active actions and has established a dedicated gaming committee to promote the development of the Starknet gaming ecosystem. The committee plans to distribute 50 million $STRK tokens to support committee-endorsed gaming projects, specifically those that incentivize game development and player participation.

You can read the blockchain gaming monthly report from Footprint Analytics to learn more about gaming industry dynamics: "Web3 Gaming Report March 2024: Market Trends and Investment Dynamics".

Public chain investment and financing situation

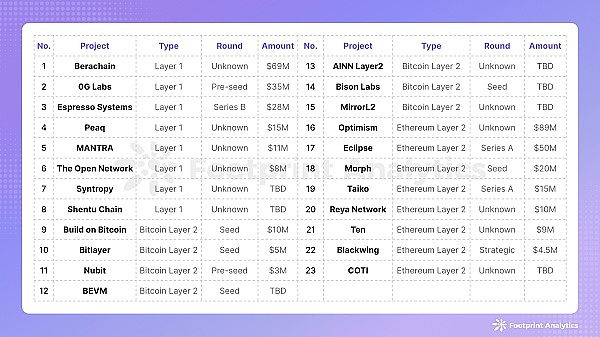

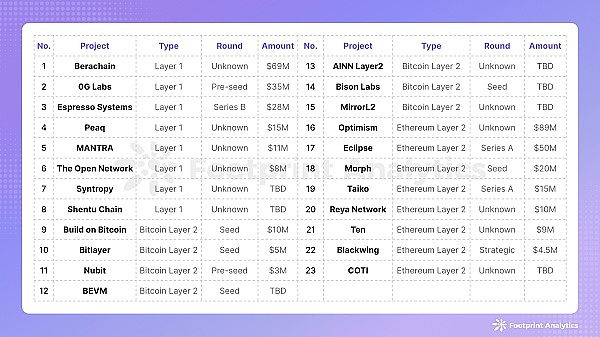

In March, the public chain field ushered in significant growth momentum, with a total of 23 financing events, with a total of Investment amount reached US$380 million, an increase of 160.2% compared with February. In this round of investment boom, Optimism, Berachain and Eclipse performed particularly well, receiving huge funding support of US$89 million, US$69 million and US$50 million respectively.

Public chain financing events in March 2024 (data source: crypto-fundraising.info)

Among these 23 financing events, the distribution of funds showed a "three-legged" trend: 8 of them involved Layer 1, 7 focused on Bitcoin Layer 2, and the other 8 focused on Ethereum Layer 2. Although the highest disclosed investment amount in Bitcoin Layer 2 is only $10 million, the Bitcoin ecosystem has gained more and more attention.

Token sales are becoming a popular way to obtain investment and financing.

Recently, Berachain, which successfully completed financing through a token sale, has reached a valuation of US$1.5 billion, successfully joining the ranks of unicorns. This Cosmos-based and EVM-compatible platform focuses on DeFi transactions and plans to launch its mainnet in the second quarter of 2024.

The Optimism Foundation also announced a private token sale, selling approximately 19.5 million OP tokens. The sale was sourced from a pool of unallocated OP tokens, totaling nearly $89 million at current market value. The tokens were acquired by an undisclosed buyer and will be subject to a two-year lock-up period.

Key news

With the craze of Meme coins, Solana on Google Search volume surged, reaching a peak of 100.

The Blast mainnet was officially launched on March 1.

Bitcoin Layer 2 project BEVM announced its mainnet release plan.

CyberConnect announces the launch of Cyber, the Ethereum Layer 2 network.

Mysten Labs uses the technical prototype "Pilotfish" on Sui to prove the feasibility of linear scaling of the blockchain.

Google already supports searching for Bitcoin, Arbitrum, Avalanche, Optimism, Polygon and Fantom on-chain wallet addresses.

BNB chain launched the “Rollup as a Service” (RaaS) solution.

JinseFinance

JinseFinance