Author: Tom Mitchelhill, CoinTelegraph; Compiler: Baishui, Golden Finance

As the LIBRA memecoin issuance continues to cause controversy, Pump.fun founder called for new protections for token issuance platforms.

In a post to X on February 18, the anonymous Pump.fun founder Alon said he was "disgusted" by the "inside scam" LIBRA memecoin issuance, which was briefly shared by Argentine President Javier Milei and accused by some of being an elaborate scam.

LIBRA was launched on February 15, and Argentine President Miley designated it as the country's official token.

However, several wallets quickly withdrew more than $107 million in one-sided liquidity from the token's liquidity pool, and Miley deleted the tweet supporting the token, causing the token's market value to evaporate by $4.4 billion in just 6 hours.

However, Alon defended his platform, saying it was created to prevent insiders from controlling token issuance.

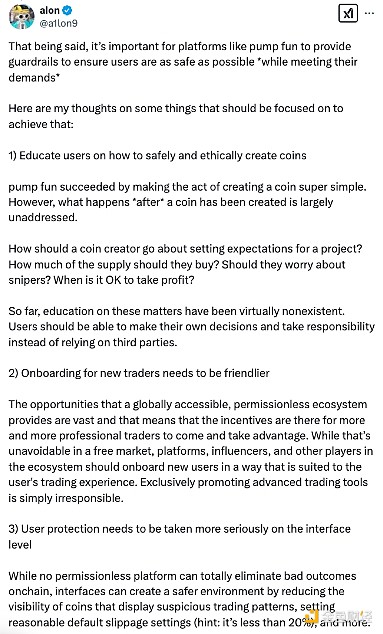

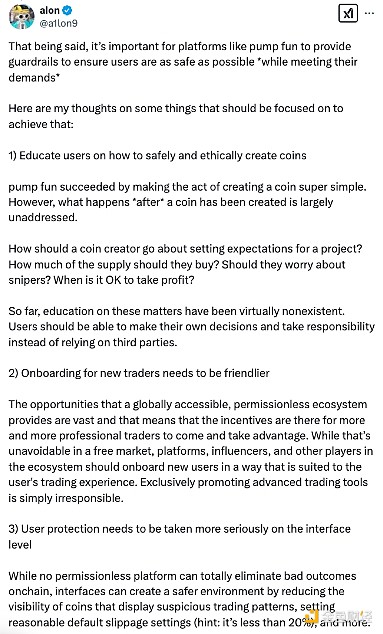

He has since called on token issuance platforms to provide protections to "ensure users are as safe as possible while meeting their needs."

Alon said priorities should include educating users on how to create tokens safely and ethically, making entry "more friendly" for new traders, and ensuring user safety by reducing the visibility of tokens that show suspicious trading patterns or ownership structures.

Meteora co-founder resigns

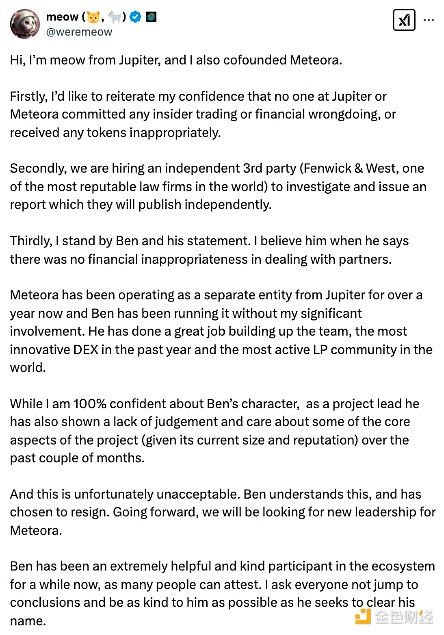

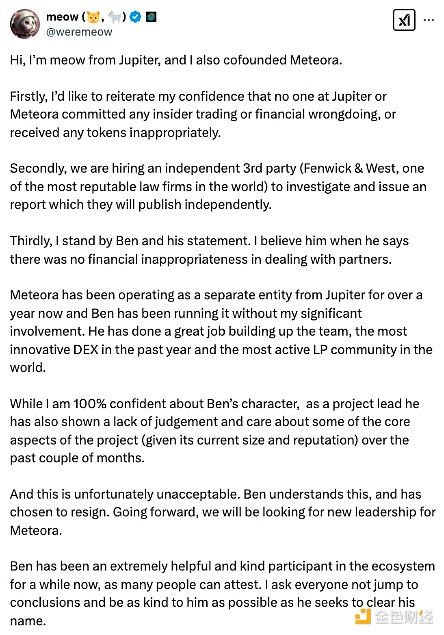

Meanwhile, Meteora co-founder and Jupiter founder Meow sent a post to X on February 18, saying that Meteora co-founder Ben Chow has resigned from Meteora.

Meow said the resignation was related to Chow's "lack of judgment and caution" on certain core aspects of the project in the past few months, but did not elaborate further.

While some commentators have accused the Meteora team of colluding with Kelsier Ventures’ Hayden Davis (the man behind the LIBRA token), Meow claims that neither Meteora nor Jupiter were involved in any wrongdoing:

“I would like to reiterate my confidence that neither Jupiter nor Meteora have engaged in any insider trading or financial wrongdoing, or received any tokens inappropriately.”

In an earlier X statement on Feb. 17, Chow also denied that Meteora had any insider activity surrounding the LIBRA launch.

Chow said he and the Meteora team never “privately” received or managed tokens, nor were they informed of “off-chain transactions.”

“In order to maintain a high level of confidentiality, very few people at Meteora have access to any release information,” Chow said.

“Neither I nor the Meteora team compromised the launch of $LIBRA by leaking information, and we did not purchase, receive, or manage any tokens.”

He said the relationship between Meteora and LIBRA deployer Davis “is not exclusive or unique in any way.”

Following the LIBRA scandal, Meow also announced that he would hire the law firm Fenwick and West to investigate the situation and issue an independent report. Fenwick and West is currently facing a lawsuit alleging that the law firm was “directly involved” in helping FTX obfuscate its relationship with Alameda Research in 2022.

Anais

Anais