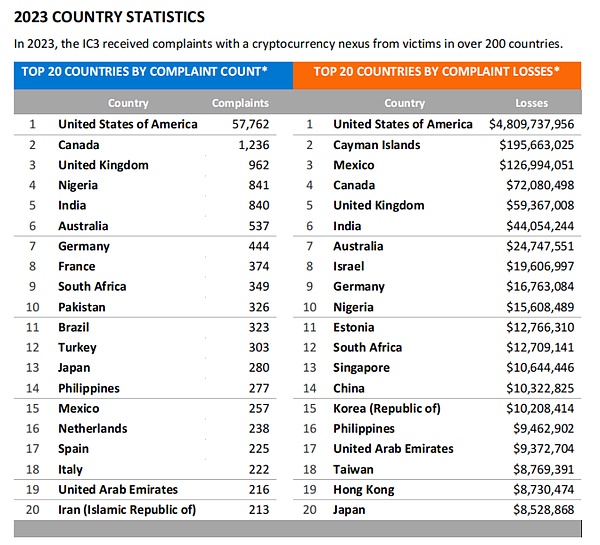

3. By country/region:

Countries/regions with the most complaints: United States (57,762 cases), Canada (1,236 cases)

Countries/regions with the most losses: United States (US$4.809 billion), Cayman Islands (US$196 million)

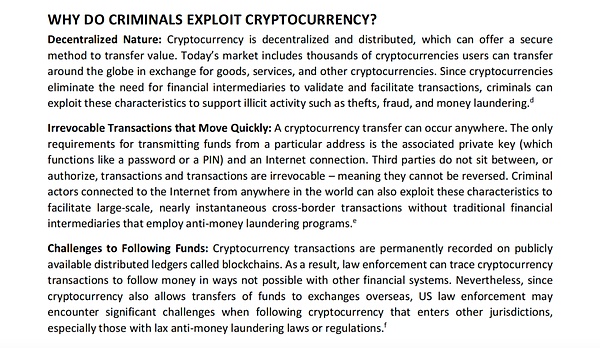

Key Point 2: Why Criminals Use Cryptocurrency

1. Decentralized Features:The decentralized and distributed features of cryptocurrency make it a secure means of value transfer, where users can transfer cryptocurrency globally in exchange for goods, services and other cryptocurrencies. Therefore, criminals use these features to conduct illegal activities such as theft, fraud and money laundering.

2. Transaction Irreversibility:Cryptocurrency transfers/transactions can be conducted anywhere, and transactions are irreversible, allowing criminals to conduct cross-border transactions quickly and on a large scale without being subject to the anti-money laundering measures of traditional financial institutions.

3. Challenges in Tracking Funds:Although blockchain provides a public distributed ledger that allows law enforcement to track funds, there are still many difficulties in tracking cryptocurrencies that are transferred "cross-border". Therefore, SlowMist believes that it is necessary to rely on international cooperation to achieve effective law enforcement. For details, please review the viewpoint | International cooperation in law enforcement will become a major trend in combating cryptocurrency crimes.

Key Point 3: Focus on the Types of Cryptocurrency Crimes in 2023

1. Investment Fraud

Investment fraud is the largest type of crime in cryptocurrency-related losses in 2023, accounting for about 71% of total losses, an increase of 53% from 2022 (US$2.57 billion). The most common type of trust-based cryptocurrency investment fraud in 2023 is:

Scam: Scammers use dating apps, social media, social networking sites or encrypted communication apps to find targets and spend weeks or even months building trust with their targets. Once trust is established, the scammers introduce topics about cryptocurrency investment, such as claiming to have some expertise or knowing experts who can help potential investors make money, and induce victims to invest by showing fake profits. The scammers allow victims to withdraw a small amount of funds in the early stage to get a taste of the sweetness and make victims trust the fraudulent platform more. When the victim tries to withdraw the principal and the so-called profits, they are told that they need to pay fees or taxes. However, even if the victim pays the mandatory fees or taxes, the fraudulent platform will not return any funds.

Labor trafficking: Scammers post fake job advertisements on social media and online employment websites, mainly targeting Asian people. Once job seekers arrive at the corresponding location, the scammers usually confiscate the job seekers' passports and travel documents and force them to cooperate through violence or threats. These victims are told that they must pay various fees, such as transportation fees and document processing fees, which means that the victims are heavily in debt from the beginning. They then have to work to repay the debt while also trying to pay for food and accommodation. Scammers use victims' mounting debt and fear of local law enforcement as an additional means of control.

In addition to trust-based cryptocurrency investment fraud, there are many other variations of cryptocurrency-related investment fraud:

Liquidity Mining Scams:Liquidity mining schemes are an investment strategy in the cryptocurrency space. In legitimate liquidity mining operations, investors put cryptocurrencies into liquidity pools in order to provide liquidity required for transactions and receive a portion of transaction fees in return. However, scammers often exploit people's interest in cryptocurrencies to commit fraud. Scammers generally gain the trust of victims (usually investors holding USDT or ETH) and lure them into participating in fake liquidity mining schemes by offering high daily returns of 1% to 3%. Scammers will eventually convince victims to transfer cryptocurrencies to so-called liquidity mining platforms, which are actually scam platforms and it is difficult to recover the money once transferred. Previously, we explained this type of scam in the Web3 Security Beginner's Guide to Avoiding Pitfalls | Fake Mining Pool Scams. Readers can click on the link to learn more.

Play and Earn (P2E) Games: Scammers promote fake game applications they create as games that can make money and provide financial rewards to players. Scammers contact potential targets online and establish relationships with them. Then, scammers introduce victims to games, saying that they can get cryptocurrency rewards by participating in certain activities (such as growing "crops" in animated farms). In order to participate in the game, scammers will guide victims to create a cryptocurrency wallet, purchase cryptocurrency, and join a specific game application, claiming that the more money deposited in the wallet, the more rewards they will get in the game. However, what the victim sees is actually accumulated fake rewards. When the victim no longer deposits funds into the wallet, the scammer will take the funds away. The scammer will also tell the victim that they can recover the funds by paying additional taxes or fees, but this is a bottomless pit. If users want to participate in such formal games, it is recommended to use a dedicated wallet. At the same time, regularly check the wallet for abnormal authorization using tools such as Revoke.Cash or Scam Sniffer, and cancel it in time if there is any.

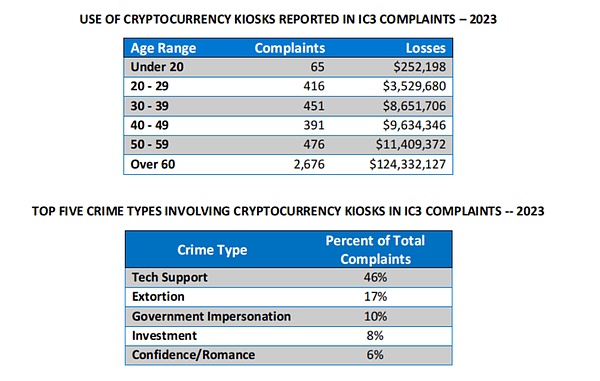

2. Cryptocurrency self-service kiosks

Cryptocurrency self-service kiosks are ATM-like devices or electronic terminals that users can use to exchange cash and cryptocurrencies. Typically, scammers provide victims with detailed instructions, including how to withdraw cash from banks, how to find self-service kiosks, and how to use self-service kiosks to deposit and remit money. This method has a higher degree of anonymity than depositing cash at financial institutions. In 2023, IC3 received more than 5,500 complaints about cryptocurrency kiosks, with losses exceeding $189 million.

3. Cryptocurrency Recovery Scams

Victims who have suffered losses from various scams may also be scammed a second time. Some fraudulent companies claim to provide cryptocurrency tracking services and promise to recover lost funds. They promote fraudulent cryptocurrency recovery services on social media and proactively contact victims who seek help online. These fraudulent companies will charge victims an upfront fee and then "disappear" or provide incomplete and inaccurate tracking reports and require victims to pay additional fees to recover funds. These fraudulent companies also claim to have connections with law enforcement or legal services to appear legitimate.

SlowMist would like to remind you that according to SlowMist’s experience, you need to report the theft/fraud as soon as possible. A technology company like SlowMist cannot retrieve user information or freeze accounts. Only law enforcement agencies can freeze accounts and retrieve funds under the compliance process of the exchange. However, if you are unfortunately stolen/fraudulent, you can submit a form to us. We can provide you with basic tracking assessment and fund flow analysis for free, and synchronize the verified hacker address to the InMist Threat Intelligence Cooperation Network for blacklisting. We will do our best to track and evaluate the stolen funds and analyze the fund flow, but the assessment results are for user reference only and are not used as a legal basis. Users not only need to follow the facts, but also comply with the regulatory policies and laws and regulations of their country. (Note: Submit the Chinese form to https://aml.slowmist.com/cn/recovery-funds.html, and submit the English form to https://aml.slowmist.com/recovery-funds.html)

Summary

This article interprets the "2023 Cryptocurrency Fraud Report" released by the Federal Bureau of Investigation (FBI), revealing the data of 2023 cryptocurrency-related complaints, how various criminals cleverly use the special properties of cryptocurrency to commit fraud, and the specific methods and types of crimes. Faced with increasingly complex and diverse cryptocurrency fraud methods, each of us needs to be vigilant and enhance our awareness and ability to prevent them. Only by distinguishing the true from the false, operating with caution, and always being skeptical can we effectively protect our property safety while enjoying the convenience and innovation brought by cryptocurrency.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance decrypt

decrypt Others

Others Coinlive

Coinlive  Cointelegraph

Cointelegraph