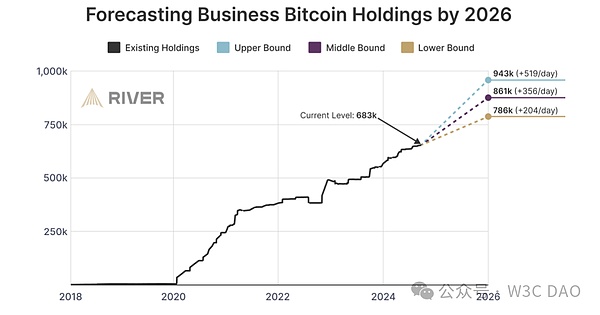

A new report from Bitcoin technology and financial services company River predicts that some US companies will increase their investment in Bitcoin (BTC) in the next 18 months.

US companies enter the market

It is reported that about 10% of US companies are expected to convert 1.5% of their treasury reserves (about $10.35 billion) into Bitcoin in the next year and a half.

Analysts at River also pointed out that traditional corporate financial strategies rely on cash and other short-term cash equivalents, which have poor value storage capabilities. To this end, River's analysis states:

"These investments can generate modest returns close to the federal funds rate, currently over 5%. However, even these short-term investments tend to fail to outperform inflation, which reduces the value of Treasury bonds."

The report notes that inflationary erosion has also caused Apple (currently worth $1 trillion) to lose $15 billion in bond holdings over the past 10 years.

MicroStrategy's Corporate Finance Strategy

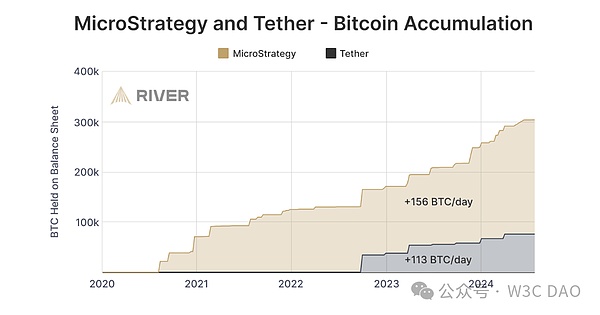

The analyst's prediction suggests that the corporate finance strategy popularized by MicroStrategy founder Michael Saylor will be adopted by more and more people.

In June 2024, MicroStrategy completed the sale of an additional $800 million in senior convertible note debt at an interest rate of 2.25%, with a maturity date of 2032. MicroStrategy used corporate debt funds to purchase an additional 11,931 BTC.

Seller defines Bitcoin as an asset that can guarantee "economic immortality" for businesses and companies because Bitcoin has a limited supply and does not have the counterparty risk inherent in other means of storing value such as real estate or stocks.

MicroStrategy's second-quarter financial report showed that it currently holds 226,500 BTC, which was worth about $14.7 billion at the time.

US banks enter the market

Previously, US banking giant Wells Fargo disclosed its investment in multiple Bitcoin ETFs, making it the latest major financial institution to join the cryptocurrency field.

Documents filed with the U.S. Securities and Exchange Commission (SEC) show that the bank has purchased shares of Grayscale's GBTC spot Bitcoin exchange-traded fund (ETF) and also holds shares in Bitcoin Depot Inc., a Bitcoin ATM provider.

But the exposure is small, with Wells Fargo investing $141,817 in GBTC and less than $1,200 in ProShares. Bitcoin Depot’s exposure is just $99.

Not only that, BNP Paribas and Bank of New York Mellon have also invested heavily in Bitcoin ETFs. This shows that despite the small exposure, the investment trend of traditional financial institutions is still growing.

Surpassing Warren Buffett – A New Era in Corporate Finance?

Saylor’s BTC financial strategy has allowed MicroStrategy to outperform Warren Buffett’s investment company Berkshire Hathaway. Since adopting the Bitcoin financial strategy, MicroStrategy has risen by more than 1,000%. In comparison, Berkshire Hathaway's stock price has risen 104.75% during the same period.

Buffett refuses to add Bitcoin to his portfolio or recommend it as a hedge against fiat inflation.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex Bernice

Bernice JinseFinance

JinseFinance Kikyo

Kikyo Beincrypto

Beincrypto Others

Others Catherine

Catherine Bitcoinist

Bitcoinist