Author: Kyle Waters & Tanay Ved, researcher at Coin Metrics; Translation: Golden Finance xiaozou

This article adopts a data-driven perspective and reviews the important events that will affect the digital asset industry in 2023.

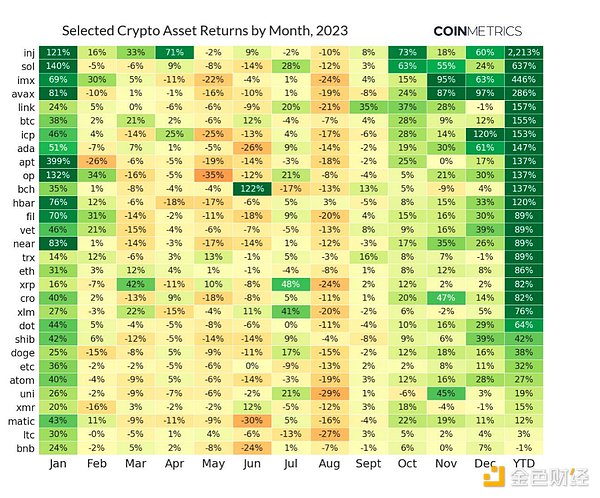

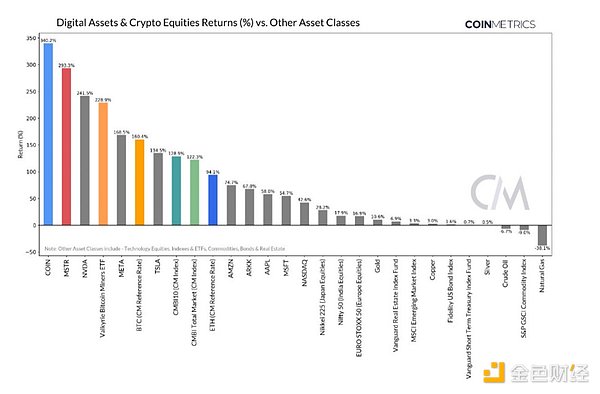

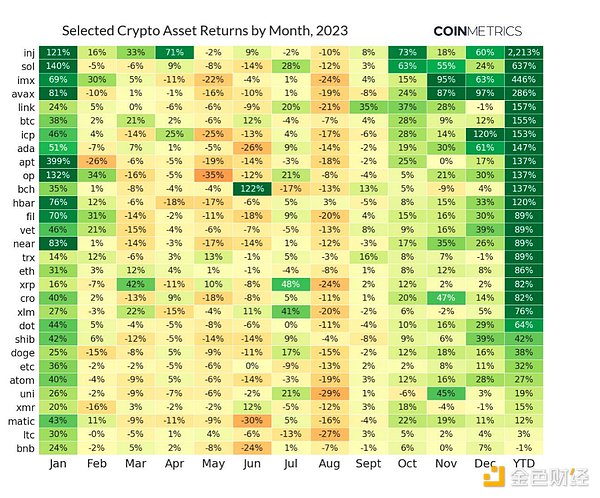

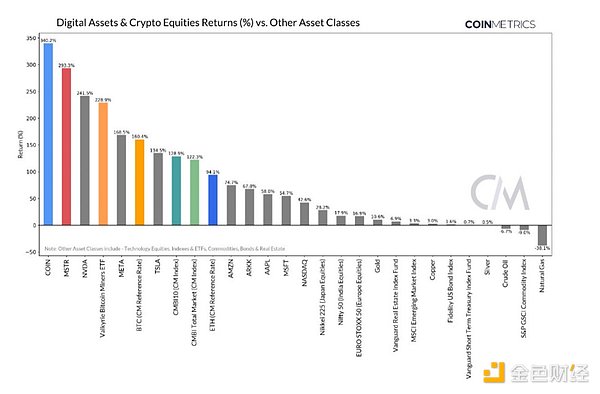

After a difficult 2022, 2023 has brought many positive developments to the entire ecosystem, such as the addition of new institutions and key technology upgrades etc. While the regulatory environment is arguably the most challenging ever, particularly in the United States, rounds of confrontation should force some of the outstanding issues to become clearer. The period of monetary tightening appears to be coming to an end, with both cryptocurrencies and stocks experiencing surges in 2023, with many digital assets more than doubling, including Bitcoin (BTC), which rose 150% in 2023. The table below shows the performance of all assets in datonomyTM with a market capitalization of over US$1 billion.

p>

Q1: Choke

In early 2023, after the collapse of FTX Under the gloom, the digital asset market quickly improved, with Bitcoin climbing from $16,000 to $23,000 in January. This growth will set the pace for the entire year. More and more people are starting to think that the worst is over and that FTX’s downfall as a centralized entity has not tarnished the core principles and potential that impacted public blockchain technology.

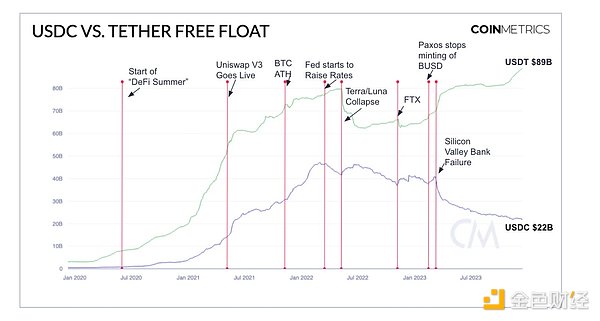

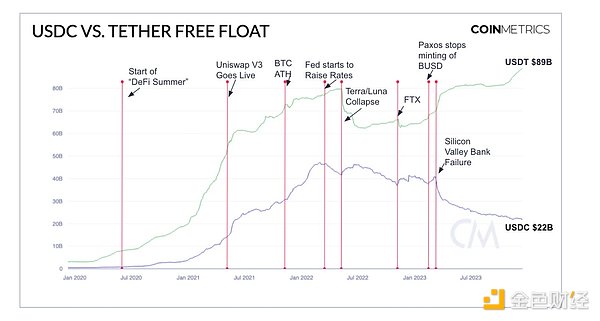

However, a series of events in early 2023 also gave birth to a theme that attracted much attention this year: escalating regulatory pressure in the United States. A series of enforcement actions in the first quarter attracted the attention of the digital asset industry. For example, the U.S. Securities and Exchange Commission issued a Wells notice to stablecoin operator Paxos regarding the Binance stablecoin BUSD, which resulted in the suspension of BUSD. BUSD supply plummeted from a peak of $16 billion to $1 billion during the year, losing $4 billion within a week of the announcement. Forcing BUSD to cease issuance marks the beginning of broader action by U.S. regulators to curb offshore exchange giant Binance. Binance is the world’s largest exchange by spot trading volume. In March of that year, the U.S. Commodity Futures Trading Commission (CFTC) announced civil enforcement against Binance and its founder Changpeng Zhao (CZ) for multiple regulatory violations.

Onshore operators are also subject to new regulatory scrutiny. Many have been facing increasing pressure since the first quarter. Banking regulators have issued special Formal guidance documents classify cryptocurrencies and cryptocurrency clients as banking system risks, with some in the industry even dubbing these actions “Operational Bottleneck 2.0” — arguably a coordinated, government-led effort to impede the U.S. The development of the digital asset industry.

Looking at the macroeconomic environment, banks are beginning to face a common but disturbing situation: in an environment of rapidly rising interest rates, U.S. Treasury bonds have depreciated, and those most affected Is the tech-friendly Silicon Valley Bank (SVB). SVB declared bankruptcy after a bank run in March, which not only raised concerns about the health of the U.S. banking industry but also tested the stability of the USDC stablecoin, where Circle holds $3.3 billion in reserves. The price of USDC fell briefly, but thanks to Federal Deposit Insurance, the price returned to the $1 peg.

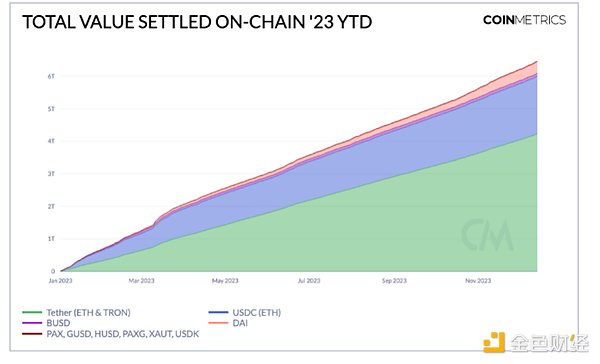

This turmoil has led to a reshuffle of the more than $100 billion stablecoin market, triggering a significant shift from USDC to offshore-issued Tether (USDT) . This also marks a growing divergence between Tether and USDC, a trend that will continue throughout 2023. The banking crisis further impacted crypto asset liquidity, disrupting real-time payment systems such as Silvergate Exchange Network and Signature Bank’s Signet, as both crypto banks were also shut down.

p>

Despite the many challenges, BTC and ETH experienced an immediate rebound following the SVB crisis. The core characteristics of digital bearer assets like Bitcoin – ease of self-custody, lack of intermediaries and on-chain transparency – are becoming more apparent than ever, in line with the October 2008 financial crisis that led to Satoshi Nakamoto’s Nakamoto’s initial sentiment when he launched Bitcoin resonated.

This momentum continued into the second quarter, triggering a resonance among institutions that began to express greater affirmation and appreciation for Bitcoin's unique qualities.

Q2: The arrival of 9 trillions of dollars

The U.S. market has been seeking a spot Bitcoin ETF since 2013, and the U.S. Securities and Exchange Commission (SEC) has consistently rejected proposals to introduce spot ETF products to the U.S. financial market. The significance of spot ETFs is that they promise to provide investors with a familiar and potentially more tax-efficient way to incorporate Bitcoin into their brokerage accounts and investment portfolios. The outsized influence of the first gold ETFs in the early 2000s, such as the well-known GLD, is what many would like to see in a Bitcoin spot ETF. Although the U.S. Securities and Exchange Commission (SEC) has given the green light to futures-backed Bitcoin ETFs in 2021, these products are not suitable for long-term holding due to significant tracking errors in spot prices over time, in addition to There are high fees and taxable distributions.

But in June this year, things changed quickly. BlackRock, the world's largest asset management company with more than 9 trillion US dollars in assets under management, announced on June 6 On March 15, I applied to establish the iShares Bitcoin Trust. The move immediately injected new legitimacy into efforts surrounding ETFs, with BlackRock CEO Larry Fink acknowledging that Bitcoin is a global asset that can “transcend any single currency.” Following BlackRock’s bold step, previous applicants such as Fidelity, WisdomTree, Bitwise, VanEck, Invesco, Valkyrie and ARK have also rejoined the competition, once again igniting the craze for Bitcoin spot ETFs. Demonstrating growing institutional interest in Bitcoin and recognition of its potential role in diversifying investment portfolios.

Coinbase and BlackRock have reached an important partnership. As the custodian selected by BlackRock for ETF applications, Coinbase has become a key crypto-native ally. , but in June this year, the U.S. Securities and Exchange Commission (SEC) also filed a landmark lawsuit against this leading U.S. exchange. The SEC accused Coinbase of operating as an unregistered securities exchange and labeling various assets, including SOL, MATIC, and ADA, as purported securities. The move brings into focus a long-running industry debate over the distinction between crypto securities and commodities. In response, Coinbase moved quickly to refute the accusations, and the industry is now bracing for an outcome that could significantly impact the future trajectory of the U.S. digital asset industry.

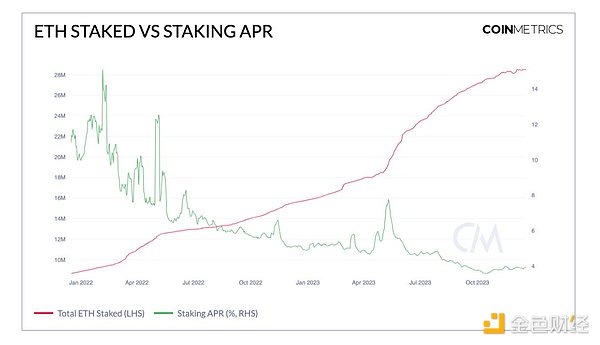

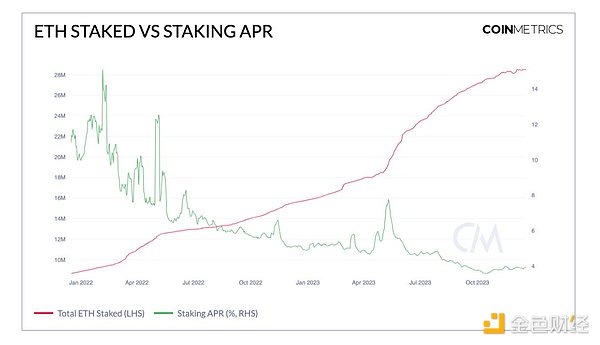

Despite a series of external events, both good and bad, the industry continues to move forward in 2023, advancing key planned upgrades. In April, Ethereum completed the “Shapella” hard fork, activating the withdrawal function for staked ETH and validators’ accumulated staking rewards. The upgrade successfully eliminated the previous liquidity risk associated with staking and immediately attracted a new surge in staking deposits, a trend that will continue throughout much of 2023. Although the current staking APR annual interest rate hovers around 4%, the amount of ETH pledged has reached 28 million, which is slightly less than a quarter of the entire ETH supply.

p>

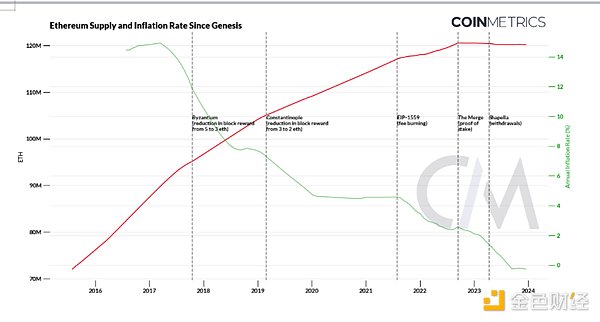

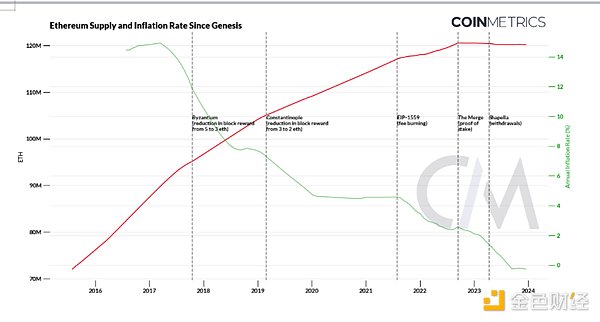

The upgrade provides much-needed assurance to Ethereum validators staking ETH on Ethereum’s years-long journey from a proof-of-work to a proof-of-stake system. The final phase of the project was completed, primarily via the Ethereum merge, without any issues. Ethereum’s issuance dropped by 90% after the merger, and 2023 was the first full year of declining Ethereum supply, even accounting for fee burning.

p>

Q3: Judgment in the Ripple case

The shift in the second half of 2023 has an intensifying trend, with major legal victories achieved in the second half and the re-entry of financial institutions to counter the regulatory pressures of the previous months.

It is worth noting that Ripple has achieved a landmark victory in the protracted legal battle with the U.S. Securities and Exchange Commission. On July 13, the Federal District Court issued a partial summary judgment, finding that the exchange’s secondary sales of XRP did not constitute securities transactions. This ruling not only upheld Ripple, but also set a precedent that challenged the SEC's classification method of digital assets, causing huge repercussions throughout the industry and affecting the regulatory treatment of other digital assets accused of being securities.

p>

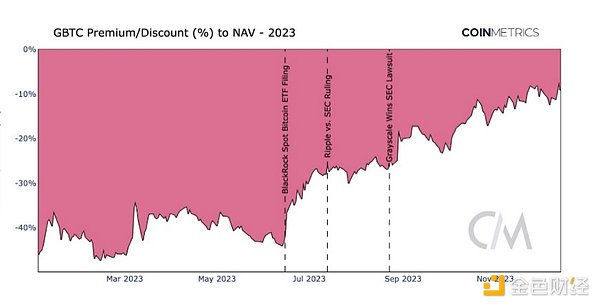

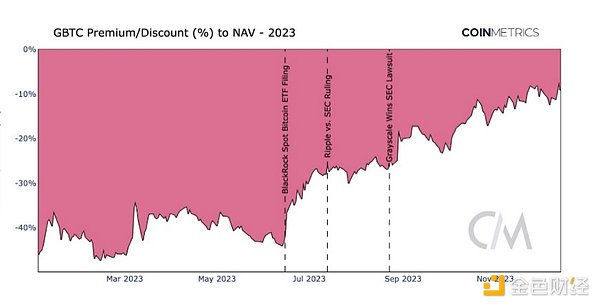

Concurrent with this legal watershed was Grayscale's victory against the SEC, marking another important turning point. The incident focused on Grayscale’s attempt to convert its Bitcoin Trust (GBTC) into a spot Bitcoin ETF, but the SEC initially rejected the application. However, on August 29, the appeals court overturned this decision, arguing that the rejection was “arbitrary” and reflected the SEC’s inconsistent treatment of similar products, especially given the existence of Bitcoin futures ETFs. The victory gave a huge boost to market expectations for the launch of a Bitcoin spot ETF, sentiment evident in the narrowing of Bitcoin’s discount to its net asset value (NAV) from 40% to 10%.

These regulatory milestones reflect the SEC’s softening approach to cryptocurrency regulation, paving the way for wider access and maturation of cryptocurrencies. . At the same time, this shift also highlights the need for greater regulatory clarity, especially as a more dynamic offshore regulatory environment drives activity in markets such as the UAE, Hong Kong, the EU and the UK.

p>

The launch of new products has also increased market excitement, especially stimulating lively discussions about stablecoins, which is a key theme throughout 2023. Payment giants such as PayPal and Visa have also joined the fray, with the former launching PayPal USD (PYUSD) on the Ethereum blockchain and the latter launching a stablecoin settlement scheme. The launch of FedNow, the Federal Reserve’s instant payment system, has also reignited discussions around its potential impact on the current stablecoin landscape and the direction of the central bank’s digital currency plan.

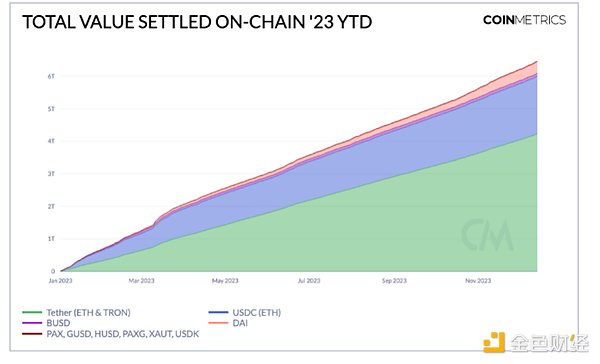

However, FedNow’s domestic business emphasizes the value proposition of stablecoins, which serve as a global medium of exchange, facilitate cross-border payments, and connect on-chain and off-chain Lower the economy. This tangible influence is clearly visible in the chart above, where the settlement volumes of USDT and USDC, the largest fiat-backed stablecoins, are US$4.2 trillion and US$1.7 trillion respectively. These developments, along with new entrants such as protocol-native stablecoins and interest-bearing stablecoins, depict the growing diversity and evolving role of stablecoins in the broader financial ecosystem.

Outside of the stablecoin space, the launch of Coinbase’s L2 network Base has attracted significant attention and triggered a wave of emerging application activity on the platform. This marks a key step in the development of L2 solutions (especially in the context of Ethereum’s upcoming EIP-4844 upgrade) aimed at enhancing the network’s scalability. Although tightening financial conditions and industry-specific events like the smart contract breach experienced by Curve Finance created additional challenges, the third quarter laid an important foundation for future growth.

Q4: Ready to take off

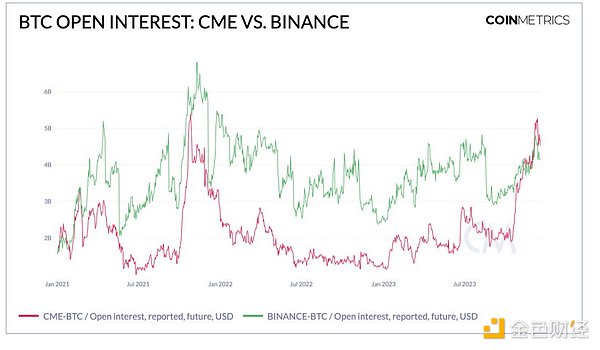

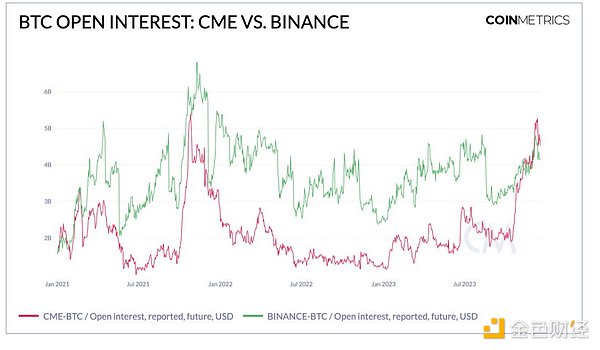

Recovery of the digital asset market As the fourth quarter unfolded, Bitcoin surged over 50%, signaling a recovery in market sentiment and valuations. The rally has been driven by rising institutional interest, as evidenced by the near-record level of open interest (over $5 billion) in Bitcoin futures at the Chicago Mercantile Exchange (CME), which is among the institutions participating traders’ favorite trading place. This provides clearer evidence of the evolving Bitcoin market structure as investors actively prepare for Bitcoin spot ETFs and the next Bitcoin halving. Spot trading volumes rose to yearly highs amid a surge in activity in derivatives markets. Supply trends have also reinforced bullish expectations, with free-floating supply reaching its lowest level since March 2017, with just 30% of Bitcoin in circulation over the past year, reflecting a determined and strong holder base.

p>

This rally has expanded beyond Bitcoin in a cyclical manner, boosting other areas of the crypto ecosystem. Grayscale trust products have seen significant reductions in discounts, with premiums on products such as GSOL and GLINK reaching 869% and 250% respectively in November in some cases. Alt L1 blockchains have also experienced a strong recovery, with Solana (SOL) standing out as it emerged from its previous FTX affiliation. An active community, growing application ecosystem, and infrastructure on the network strengthen Solana's credibility as an L1 platform and spark the debate around monolithic blockchains among a growing number of modular blockchains and L2 networks. discussion. This surge isn't just limited to valuations. On-chain activity has also rebounded, with fee markets rising on both the Bitcoin and Ethereum networks, while stablecoin supply has risen after a period of decline, signaling signs of a return to liquidity.

The trial ended with the conviction of Sam Bankman Fried, bringing an end to one of the industry's most tumultuous periods. Meanwhile, Binance’s settlement involves a $4 billion fine and the ouster of Changpeng Zhao (CZ), ending the long-running allegations surrounding the largest exchange. Another important announcement that went unnoticed was the Financial Accounting Standards Board’s (FASB) changes to crypto accounting standards. This change will allow companies that hold digital assets on their balance sheets to determine the assets at “fair value” rather than treating them as intangible assets, thereby reducing the friction these companies currently face while incentivizing greater ownership. For example, this would allow Microstrategy (MSTR), a publicly traded company with a holding of over 17,500 Bitcoin, to realize a profit or loss by measurement period on its balance sheet.

Together, these developments end a chapter of uncertainty that has shrouded the industry, paving the way for a more mature and optimistic future for cryptoassets.

p>

Digital asset markets have been grappling with significant macroeconomic challenges amid a decade of high inflation, financial austerity and rising geopolitical tensions. However, stakeholders have become adept at navigating these complexities, leading to the growth of new areas such as tokenized Treasuries and real-world assets (RWA). When we review the returns of major asset classes in the investable field in 2023, we will find that the advantages of digital assets are very obvious. Crypto-related stocks and digital assets have performed well, with Coinbase (COIN) being a major beneficiary of the market rebound. Macroeconomic trends are likely to change in the coming months, and the digital asset industry will enter a stage of maturity and expansion.

Xu Lin

Xu Lin